Kuzmik_A/iStock via Getty Images

Over the past several months, we have seen a surge in the number of people seeking to raise their incomes. This makes a great deal of sense as price of necessities such as energy and food has risen substantially over the past year. This situation has forced many people to take on second jobs or begin to perform odd jobs in order to generate the extra income that they need to feed and support themselves and their families. Fortunately, as investors, we have other methods available to us to boost our incomes. One of the best of these methods is investing in a closed-end fund that specializes in the generation of income. These funds enjoy the benefit of professional management along with the ability to employ certain strategies that boost the yield of the portfolio beyond that possessed by any of the underlying assets. In this article, we will look at the DoubleLine Income Solutions Fund (NYSE:DSL), which is one fund that investors can utilize for this purpose. This fund boasts a jaw-dropping 11.01% yield at the current price, which will certainly appeal to any income-focused investor. I have discussed this fund before but as more than a year has passed since that time, obviously a great many things have changed. This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund’s finances.

About The Fund

According to the fund’s webpage, the DoubleLine Income Solutions Fund has the stated objective of providing its investors with a high level of current income. This is hardly surprising since the name of the fund implies that it will be attempting to produce income that it can pass through to the shareholders. As is the case with most income-focused closed-end funds, this one is primarily attempting to achieve its objective by investing in fixed-income securities, although the fund’s webpage implies that it may invest in equity securities as well:

“The fund will seek to achieve its investment objectives by investing in a portfolio of investments selected for their potential to provide high current income, growth of capital, or both. The Fund may invest in debt securities and other income-producing investments anywhere in the world, including emerging markets.”

As I have pointed out in various previous articles, fixed-income securities are typically quite limited in the amount of capital appreciation they can provide. This is because these investments do not benefit if the issuing company grows and prospers. After all, a company will not pay its creditors a larger amount of money just because its profits went up. These securities instead trade based on interest rates. As interest rates increase, the price of fixed-income securities declines and vice versa. This is because newly issued securities will have higher yields than existing securities in a rising rate environment so the price of the existing securities must decline in order for them to deliver the same yield that an investor could obtain by purchasing a brand-new security with similar characteristics. The reverse is also true as fixed-income security prices will rise when interest rates decline, which would allow for capital gains. However, there is a limit to how low interest rates can actually go. After all, nobody will ever buy a security with a negative yield unless forced to by a government or other authority. Thus, the capital gains that can be garnered from any fixed-income security are limited.

This characteristic of fixed-income prices declining when interest rates rise shows up in the fund’s performance. The DoubleLine Income Solutions Fund is down 26.35% year-to-date:

As disappointing as this is, it is highly likely to continue going forward. After all, inflation has not yet been tamed. After all, the November CPI report showed a month-over-month inflation rate of 0.4%, which translates into 5% annually. That is significantly above the Federal Reserve’s target rate so it seems likely that the central bank will keep increasing rates until inflation falls further. Jerome Powell suggested as much in the remarks that he gave at the Brookings Institution a few days ago. Thus, fixed-income prices will likely be under pressure for quite some time.

With that said, the DoubleLine Income Solutions Fund does not invest exclusively in American securities. In fact, only 44.51% of the fund’s assets are from American issuers. As such, the policies of the Federal Reserve are not the only central bank policies that matter to this fund. We could very easily see a situation in which one country is raising rates and another is not. In fact, Japan has not increased its interest rate so far this year. The European Central Bank, for its part, has not increased them nearly as far as the Federal Reserve. This is important because securities from issuers in those countries will respond based on the policies of their own central banks, not based on the Federal Reserve’s policies. Thus, some of the securities held by the fund are going to hold up better in the current rising rate environment than others. Unfortunately, this has not helped its performance much year-to-date as the fund has underperformed both the U.S. Aggregate Bond Index (AGG) and the World Bond Index (BNDW). One possible reason for this is the fund’s use of leverage, which we will discuss later in this article.

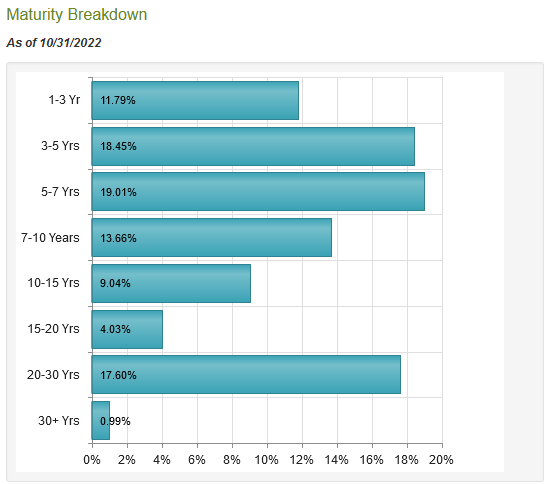

One of the characteristics of fixed-income securities is that they are fully repaid at maturity. This is true for bonds at least since preferred stocks have no maturity date. As a result, the closer the bond’s maturity date, the safer it is. This shows up in the bond’s pricing when interest rates change. A bond with a maturity far into the future will move more in response to interest rates than a bond that matures in the next year or two. This could be both a blessing and a curse since the long-term bond will deliver higher gains when interest rates fall but it will also deliver higher losses when interest rates rise, as they are today. As such, it is nice to see that the fund is invested in bonds of multiple maturities, although it is somewhat weighted towards short-term bonds:

CEF Connect

As we can see, 49.25% of the bonds in the fund’s portfolio mature in seven years or less. This is nice in the current monetary tightening cycle since it should help limit the fund’s losses from falling bond prices. The long-term bonds in the portfolio will typically have a higher yield-to-maturity, which helps to boost the fund’s income. With that said, given how interest rates are likely to keep rising for a while, I would not mind seeing the fund reduce its exposure to long-term bonds somewhat before it suffers more losses.

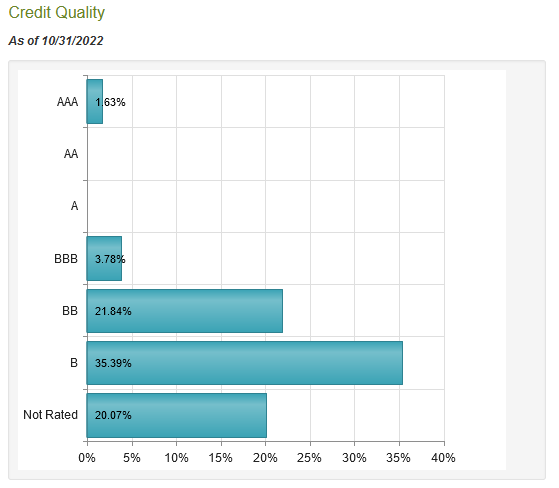

Another risk that we have to consider when investing in fixed-income securities is default risk. Fortunately, there are a few major rating agencies (S&P, Moody’s, and Fitch) that have done most of the heavy lifting for us in this area. These agencies grade most bonds with a letter-grade rating that theoretically tells us how likely the bond issuer is to default. Here is how the fund’s portfolio is composed as far as bond ratings:

CEF Connect

Anything rated BBB or higher is considered to be investment grade so we can clearly see that is a very small percentage of the fund’s portfolio. Indeed, most of the bonds here are rated BB or B, the two highest junk bond ratings. This is something that may be concerning to those investors that are concerned with principal preservation. This is because these bonds are widely believed to be at high risk of default. However, according to the official bond rating scale, issuers with these ratings have the sufficient financial capacity to cover their debt obligations barring some severe economic shock. Thus, the risk losses due to default here should be relatively low. In addition, the fund has 463 different holdings so even if one issuer does default, it should only have a minimal impact on the entire portfolio.

Leverage

As mentioned in the introduction, closed-end funds have the ability to use a variety of strategies that have the effect of increasing their portfolio yields. One of these strategies that are employed by the DoubleLine Income Solutions Fund is the use of leverage. Basically, the fund borrows money and uses those borrowed funds to purchase fixed-income securities. As long as the interest rate that the fund pays on the borrowed funds is lower than the yield that it receives on the purchased securities, this strategy works pretty well to boost the portfolio yield. However, the use of leverage is a double-edged sword since debt boosts both gains and losses. This is one reason why this fund has declined more than comparable bond index funds year-to-date. As such, we want to ensure that the fund does not employ too much leverage since this would expose us to too much risk. I do not generally like to see a fund’s leverage above a third as a percentage of its assets for this reason. The DoubleLine Income Solutions Fund has a leverage ratio of 33.65% as of the time of writing so it is right about at that level. As such, it appears that this one has a pretty good balance between risk and reward.

Distribution Analysis

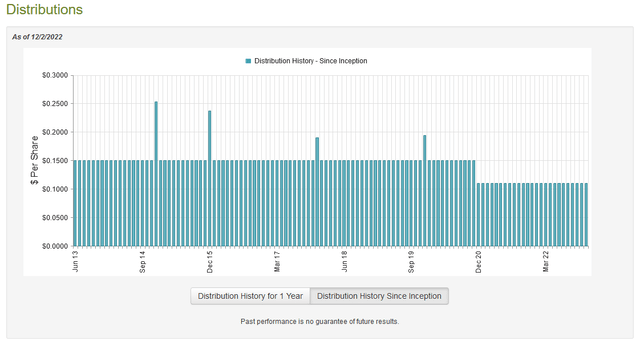

As stated earlier in the article, the primary objective of the DoubleLine Income Solutions Fund is to provide its investors with a high level of current income. The fund seeks to accomplish this by investing in a leveraged portfolio of high-yielding fixed-income assets such as junk bonds. As such, we might assume that the fund would have a very high yield. This is certainly the case as it currently pays out a monthly distribution of $0.11 per share ($1.32 per share annually), which gives it an 11.01% yield at the current price. This is one of the highest yields available in the closed-end fund space, which could signify that the market does not expect the fund to maintain its current distribution. However, the fund has been remarkably consistent over the years as it has only changed its distribution once in its twelve-year history:

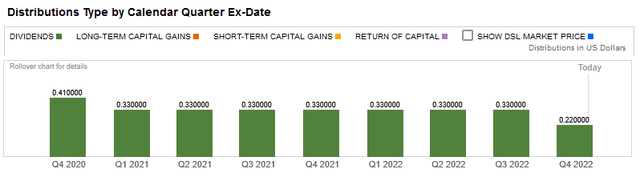

This general consistency is something that is likely to appeal to anyone that is seeking a source of income to use to pay their bills and otherwise finance their lifestyles. Another thing that will appeal to the same group of people is that the fund’s distributions are entirely classified as dividend income as opposed to a return of capital or capital gains:

The reason that this is nice is that dividend income is by far the most sustainable form of distribution that a closed-end fund can make. After all, a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. A capital gains distribution may not be repeatable during all periods, which could be relevant today given that fixed-income prices are falling all over the world due to rising interest rates. However, as I have pointed out in the past, it is possible for these distributions to be misclassified. As such, it is important that we investigate exactly how the fund is financing these distributions so that we can figure out how sustainable they are likely to be.

Fortunately, we have a very recent report that we can consult for this purpose. The DoubleLine Income Solutions Fund’s most recent financial report corresponds to the full-year period ending September 30, 2022. As such, it will provide us with fairly good insight into how well the fund has handled the steep increase in interest rates that has been going on since March, although it will of course not include any data about the past two months. During the full-year period, the DoubleLine Income Solutions Fund received $183,883,174 in interest and $6,228 in dividends from the investments in its portfolio. This works out to a total of $183,889,402 over the period. The fund paid its expenses out of this amount, which left it with $149,787,677 available for shareholders. This was, however, not enough to cover the $176,556,509 that the fund actually paid out in distributions. Thus, it does not appear that all of the distributions were actually dividends, despite what the chart above claims. The fund did have about $26 million of income above what it paid out last year though so if we add that to the fund’s current-year income, it does get pretty close to the amount that was actually paid out.

The fund does have other methods that it can use to generate the income that it needs to cover the distribution, however. The most used of these is capital gains but as we can guess from the performance of the bond market lately, the fund generally failed in this task. The fund reported net realized losses of $27,909,681 million and suffered from another $582,510,041 net unrealized losses. Overall, the fund’s asset base declined by $637,188,554 over the period once we account for all inflows and outflows. This is disappointing since it is a sign that the distribution may not be sustainable. With that said though, the fund did manage to grow its asset base by $215,720,298 last year but that is not enough to fully make up the difference. The fund does get reasonably close to covering its distributions if we look at its net investment income over the two-year period but the losses from rising interest rates are going to make it increasingly difficult for the fund to continue paying out the current distribution. It may end up having to cut it a bit to bring the distributions down in line with net investment income in the near future.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the DoubleLine Income Solutions Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total value of the fund’s assets minus any outstanding debt. This is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to buy shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing the fund’s assets for less than they are worth. That is fortunately the case with the DoubleLine Income Solutions Fund today. As of December 2, 2022 (the most recent date for which data is available as of the time of writing), the fund had a net asset value of $12.18 per share but the shares currently trade for $11.85 per share. This gives the shares a 2.71% discount to net asset value at the current price. This is reasonable but the shares have traded with a 5.45% discount on average over the past month so a more attractive price might present itself in the near future.

Conclusion

In conclusion, the DoubleLine Income Solutions Fund looks like a decent choice as far as fixed-income closed-end funds go right now. The fund boasts a great deal of international diversity as well as wide exposure to bonds of various maturities and ratings. The biggest risk here is that interest rates will likely continue to rise over the next several months, which will apply a great deal of pressure to the price. The fund’s distribution might also not be sustainable, although it is getting pretty close so any cut will likely be a reasonably small one. Overall, we could certainly do worse here.

Be the first to comment