Editor’s note: Seeking Alpha is proud to welcome Samuel Pezzetta as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

ngkaki

Dropbox (NASDAQ:DBX) is a company that managed to develop and grow a business model with recurring revenue, producing strong free cash flows and turning profitable for the first time in 2021. Assuming a 15% rate of return on investment, I arrive at a fair value of $25-$26 for the stock (more on that consideration in the valuation section). The company started out as one of the first cloud storage providers for individuals in 2007. Today it offers solutions at different price points for individuals, families and teams.

Over the last few years specifically, the company has evolved from offering pure cloud storage solutions to offering a place where individuals and teams can collaborate, keep files in sync, and organize their work. The company just recently acquired HelloSign (an e-signature and document workflow platform), DocSend (a platform for secure document sharing and advanced analytics), and Command E (a universal search engine). The company is planning on growing paying users both organically and through acquisitions of companies that fit well in Dropbox’s environment of products and services. This has panned out well so far and is reflected in the company’s financials (e.g., revenue growth and paying users growth).

Industry overview

Dropbox operates in a growing and cash flow-positive industry, fueled by long-term tailwinds such as the trends of increasing distributed work and a growing share of freelance workers. The sectors in which Dropbox operates (cloud storage, content collaboration, and e-signing of documents) are all expected to grow in the coming years.

The core market for Dropbox by revenue is the cloud storage market. Here, profitability was not as important over the last few years, as the main goal for each company in the industry was to grab market share by offering products at low prices. In addition, companies were continuously investing in infrastructure and equipment to keep up with user growth and deliver the best user experience. Nevertheless, profitability is becoming more and more important for these companies, as investors demand to be rewarded for their investments in actual net earnings.

Competitive pressure for Dropbox comes from well-established technology companies, such as Google (GOOG)(GOOGL) and Microsoft (MSFT), that can offer their products and services at lower prices due to greater financial resources available. Competitive pressure also comes from a smaller company named Box (BOX), which I found to be the most similar to Dropbox in terms of its product offerings and in terms of its size (i.e., market capitalization).

Even though the solutions offered by these competing companies are slightly more accessible for the average individual (i.e., cheaper), Dropbox is constantly adding new and innovative features to their products and services so that they maintain an edge over their competitors in terms of what they can offer to their users. According to online reviews and research about the different cloud storage products that are available for individuals, I found that Dropbox seems to be among the top players with its products having average ratings of 4+ out of 5 stars. Customers praise the user-friendliness, simplicity, security and seamless integration with third-party apps.

Box, Microsoft, and Google entered the cloud storage market in 2005, 2007, and 2012, respectively, and are therefore not new competitors for Dropbox. With Microsoft and Google being much larger companies that can put more financial resources behind the development of their products (and operate at a net loss for an extended period), and with Box offering cheaper solutions, Dropbox has managed to build a moat around its products and established itself as a viable competitor, consistently growing registered and paying users over the years. This goes to show that Dropbox has a sticky business model and that customers are likely to keep using its products, even though competitors can offer similar products for cheaper prices. In the following section, we are going to look at some features of Dropbox’s business and what makes it stand out among others.

Key differences vs. other services

The Dropbox platform has some traits and specials that are not too prevalent in other platforms. So, what makes it so unique?

- Open ecosystem (third-party ecosystem): Dropbox works across all devices and operating systems; integration with partners such as Microsoft, Zoom (ZM), Slack, BetterCloud, Atlassian (TEAM) and Google; integration of apps from various creators (API calls).

- Intuitive and user-friendly design: user-centric design and bottom-up adoption.

- Lean business model, low spending on advertising and natural bottom-up adoption of users.

- Security and reliability are a top priority: custom-built infrastructure for high data durability; multiple layers of protection.

- Continued innovation: development of new features through in-house R&D or acquisitions of other companies.

Key highlights of the business

Dropbox had 700 million registered users in 2021. The actual number of unique users is most likely lower due to multiple registrations (applying a margin of safety of 50%, I assume that there are 350 million unique registered users). Of these only 15.48 million were paying users in 2020 and 16.79 million in 2021 (increase of 8.5% YoY). The growth rate of paying users over times slowed down until 2020 but now seems to have reached a plateau, accelerating slightly in 2021. For revenue to continue growing, the company needs to keep paying users growing – but it can also be achieved through an increase in spending per user over time. For example, there are customers upgrading to more expensive subscriptions, and adapting prices of paid plans – Dropbox has recently increased prices of their teams’ plans and said that they are seeing lower than expected churn rates.

Here’s a look at paying users over time:

|

Year |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Paying users in millions |

6.5 |

8.81 |

11 |

12.7 |

14.3 |

15.48 |

16.79 |

|

Annual growth rates |

– |

35.54% |

24.86% |

15.45% |

12.60% |

8.25% |

8.46% |

|

CAGR |

17.14% |

||||||

There was the introduction in 2020 of a virtual first workforce where remote work became the primary choice for all employees. In the short term this should result in more streamlined and profitable business operations due to a decrease of needed office spaces (the company took a one-time impairment of $398.2 million for unused office space it had invested in prior to the announcement of the shift).

There’s also the acquisition of smaller companies whose products integrate well into the business environment of Dropbox. Alongside the natural innovation of the core business, this helps expand the product offerings and to deliver even better solutions for users’ problems. In 2019 the company acquired HelloSign (company facilitating e-signature of documents) for $230 million in cash, and in 2021 they acquired DocSend (company managing document workflows) for $165 million in cash.

There’s also the multi-class structure of common stock: Dropbox’s common stock is split into two classes of shares with specific voting rights associated with them (Class A common stock – one vote per share – and class B – ten votes per share). The plan is for no new issuance of class B common shares and slow conversion to class A common stock. The founder and CEO Drew Houston holds most of the voting power of the company. The multi-class structure of common shares has two important consequences that investors must keep in mind.

First is the ineligibility for inclusion in the S&P 500, S&P MidCap 400 and S&P SmallCap indices – therefore, some institutional investors might not be allowed to invest in Dropbox. Investors who passively track these indices will also not invest in Dropbox, which might depress the price of the stock compared to its competitors.

Second, due to the unequal division of voting right toward Class B common shares, which are mostly owned by insiders (in addition to anti-takeover provisions of the state of incorporation, Delaware), Dropbox is unlikely to be taken over by other companies. A takeover by a bigger company is only likely to happen if it would be something that insiders are in favor of.

Here’s a look at the authorized stock repurchase program:

- $600 million for 2020 (purchased: 20.2 million shares for $397.5 million – avg. purchase price of $19.68/share)

- $1.3 billion for 2021 (purchased: 41.1 million shares for $1,058.6 million – avg. purchase price of $25.57/share)

The company is currently not paying a dividend and does not intend to do so in the foreseeable future. There’s also no customer concentration – no customer accounted for more than 1% of revenue.

Key financials

Let’s now have a look at the company’s financials:

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

TTM |

|

|

Revenue growth % |

39.91 |

31.01 |

25.74 |

19.37 |

15.21 |

12.75 |

– |

|

|

Revenue (USD Mil) |

603 |

844 |

1,106 |

1,392 |

1,661 |

1,914 |

2,158 |

2,251 |

|

Gross Margin % |

32.5 |

53.8 |

66.7 |

71.6 |

75.3 |

78.3 |

79.4 |

80.2 |

|

Operating Income (USD Mil) |

-306 |

-194 |

-114 |

-494 |

-81 |

121 |

306 |

343 |

|

Operating Margin % |

-50.7 |

-22.9 |

-10.3 |

-35.5 |

-4.8 |

6.3 |

14.2 |

15.2 |

|

Net Income (USD Mil) |

-325 |

-210 |

-112 |

-484 |

-53 |

-256 |

336 |

342 |

|

Earnings per Share (USD) |

-0.91 |

-0.59 |

-0.28 |

-1.35 |

-0.13 |

-0.62 |

0.85 |

– |

|

Dividends |

– |

– |

– |

– |

– |

– |

– |

– |

|

Payout Ratio % |

– |

– |

– |

– |

– |

– |

– |

– |

|

Shares (Mil) |

359 |

359 |

393 |

359 |

412 |

414 |

396 |

– |

|

Operating Cash Flow (USD Mil) |

15 |

252 |

330 |

425 |

529 |

570 |

730 |

746 |

|

Capital Expenditures (USD Mil) |

-83 |

-124 |

-26 |

-66 |

-138 |

-80 |

-29 |

-33 |

|

Free Cash Flow (USD Mil) |

-69 |

129 |

304 |

359 |

390 |

491 |

701 |

713 |

|

Free Cash Flow Per Share |

– |

– |

– |

0.81 |

0.77 |

1.18 |

1.81 |

– |

|

Working Capital (USD Mil) |

– |

-222 |

-220 |

372 |

228 |

139 |

674 |

– |

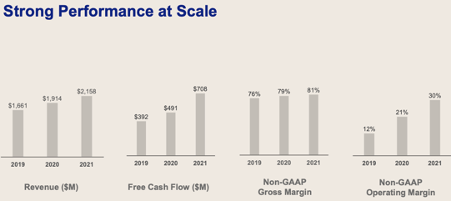

Revenue growth is slowing over time and will reach around $2.3 billion for FY 2022. Gross margins have steadily improved year after year, showing signs that management can grow revenues faster than costs increase. Revenue is recognized ratably over the contractual term: Customers are billed upfront once they sign up for a paid plan; this revenue is initially recognized as deferred revenue and ratably recognized over the course of subscription term (yearly or monthly). This type of revenue recognition smooths out business cycles in revenue, but makes it difficult to recognize for example a sharp increase in new customers on paid plans.

The results would not show up immediately in quarterly revenue numbers but be smoothened out over time and the difference would be only seen in a year-to-year comparison. If we want to be on the lookout for strong increases or decreases in paying users, we need to look at deferred revenue changes over time ($611 mln in 2020, $672 mln in 2021).

The net profit amounted to $335.8 million for 2021, compared to a net loss of (-$256.3) million for the prior year 2020. This included a one-time impairment charge of $398.2 million for office spaces due to the shift to a virtual first workforce. Without it, the company would have recorded approximately $121 million in net profits.

Free cash flow has increased to $701 million for the year 2021, driven by an increase in cash provided by operating activities and a decrease in capital expenditures (fewer expenses for office spaces). Dropbox also has a revolving credit facility where it can borrow up to $500 million at a time (decreased from $725 million in 2020 – meaning that the company does not expect to borrow as much in the future and rely more on its cash position to fund operations). As of Dec. 31, 2021, the company had $52.2 million in letters of credit.

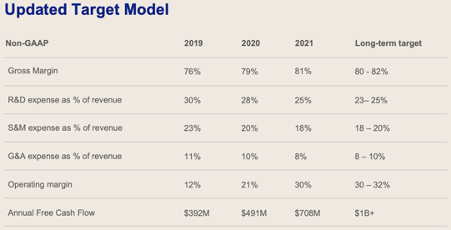

Financial targets for the business

Dropbox’s financial strategy for the “long term” (2024) is ambitious. But given the most recent results from FY 2021, the long-term goals seem achievable (some goals have already been met, such as targets for non-GAAP gross margin and non-GAAP operating margin).

As we can see from the following figures from Dropbox’s investor presentation, the company expects to generate $1+ billion in free cash flow by 2024. As of 2021, the company achieved $708 million in FCF (compared to $491 million for 2020 – 44% YoY growth). Whether as fast of a growth rate in FCF is sustainable or not in the coming years remains to be seen. Personally, I doubt it – I think that the growth in FCF will come down to more sustainable levels in the high single-digit to low double-digit range.

Dropbox’ Longterm Financial Targets (Investor Presentation August 2022) Dropbox’ updated Target Model (Investor Presentation August 2022) Selected financial metrics – trend over time (Investor Presentation August 2022)

The long-term target for gross margins (80%-82%) has already been achieved in 2021. According to the estimates, it seems to remain stable for 2022.

Estimations for operating margins differ depending on the use of GAAP or non-GAAP measures. I prefer to stay conservative and use GAAP measures, as I view stock-based compensation expenses and other “non-recurring” expenses, such as depreciation and amortization, as real costs to the business and its owners. GAAP operating margins have steadily improved and turned positive in 2020 (14.2% in FY 2021).

Risk factors for the business

Enough about the positives – let’s look at the risks that Dropbox is facing. One important risk factor for the business is the increasing debt, where the share-buyback programs play a significant role. While share repurchases can in general return value to shareholders in form of a so-called “buyback-yield” (i.e., ownership in the company for investors grows when shares are retired), they can also destroy value when the price paid for the shares is above the intrinsic value of the company or when shares are repurchased with debt.

The first was not the case for the company’s buyback program so far. However, in early 2021 Dropbox’s management issued convertible senior debt of around $1.3 billion to pay for the share repurchases (and other business expenses like hedging of said notes). These senior notes will give investors the chance to convert them into ordinary shares once a certain stock price is hit. Given that at the beginning of 2021 Dropbox had already around $1.7 billion in cash on its balance sheet, I think the move was not in the best interest of shareholders who are holding the stock for the long term. Buying back shares with debt is financial engineering to make metrics, like earnings and cash flows per share, look better in the short term. In the long term, however, in my opinion this approach is detrimental for shareholders as the conversion of these notes to ordinary shares will lead to dilution for all remaining shareholders.

Another risk factor for the company is whether it can maintain and grow profitability (measured by GAAP net profits). This is important as the value of a business in the long run is closely related to its profitability, and as the increasing amount of debt has to be serviced/paid back with net profits.

Valuation summary

Here I will analyze how valuable Dropbox is to potential shareholders, and what types of returns we can expect in future years from an investment. Given that the company just turned profitable in 2021, I derive the intrinsic value for the business from its cash flows and not from net earnings. This section is inspired by the book Modern Value Investing by Sven Carlin, PhD. It follows a multi-step approach for reaching a valuation for the business, considering quantitative metrics as well as qualitative ones. Taken together, the 24 steps outlined in the book (not applicable to all stocks) should give a good overview of the price a company is worth paying for.

The following table sums up the key points of the analysis process where the steps from the book were applied to the company in question:

|

Tool |

Value/Notes |

Tool |

Value/Notes |

|

|

#1 Using a range of values |

$30-$35 |

#14 Analyzing the quality/integrity of the management |

Mostly positive about management (negative about buying back shares with debt) |

|

|

#2 Net Present Value calculation |

(-$1.47) to (-$10.23) |

#15 Potential activist involvement can be considered a margin of safety |

No activist involvement |

|

|

#3 Liquidation value |

(-$2.33) |

#17 & #18 Analyze the cyclicality of a sector |

No cyclicality for the business |

|

|

#4 Stock Market Price |

Undervalued compared to competing business |

#19 Look for future catalysts |

Increase in GAAP-net profits over the coming years |

|

|

#6 Measuring Intrinsic Value |

$25.7 |

#20 Avoid secular declining sectors |

Growing sectors in which the company operates; tailwinds |

|

|

#10 Net cash per share |

$(-4.21) -> risk factor |

#21 Looking at significant insider activity |

More selling than buying -> negative |

|

|

#12 Determining a business moat |

|

#23 Determining market sentiment |

Neutral for large-caps; Pessimistic for mid-caps; Pessimistic for small-caps; pessimistic-neutral market sentiment for Dropbox |

|

|

#13 Use what none of the great investors had before 1998 – Google |

Competition/alternative products |

– |

– |

|

The company represents a favorable investment opportunity when buying the stock below intrinsic value (there were multiple opportunities over time to buy shares of the company where the stock price traded below intrinsic value). It’s important to keep an eye on how profitability and debt evolves over the coming quarters/years.

Conclusion

Dropbox is a company that has a phenomenal business model and is offering valuable services to its customers, as seen by the continued user growth and revenue growth. According to my analysis, the fair value of Dropbox is around $25-$26/share for an investor expecting a long-term return on free cash flow of 15%. There is no cash that would add additional value to the company. Furthermore, given the low to non-existent cyclicality, the strong brand name and reputation, the growing industries in which Dropbox is operating, and the current state in which the company is in, an investor can feel fairly safe investing when the stock trades below intrinsic value.

However, an important thing to keep in mind the coming quarters/years is how profitability and the debt of the company will evolve. If the company is not able to maintain and grow GAAP net profits over time, the stock price could go sideways for a long time. That’s because, in the long term, profitability is going to command the valuation of the stock. In addition, the company must maintain profitability in order to be able to pay back its debt over time.

Be the first to comment