ngkaki

Though the market has pulled back in a dramatic way from tech stocks, the best move for long-term oriented investors is to double down on value-oriented software and internet names that have strong recurring revenue and established brands. It’s important to remember that software companies in particular sit on rich gross margin profiles that, at scale, can throw off large amounts of operating profit and cash flow.

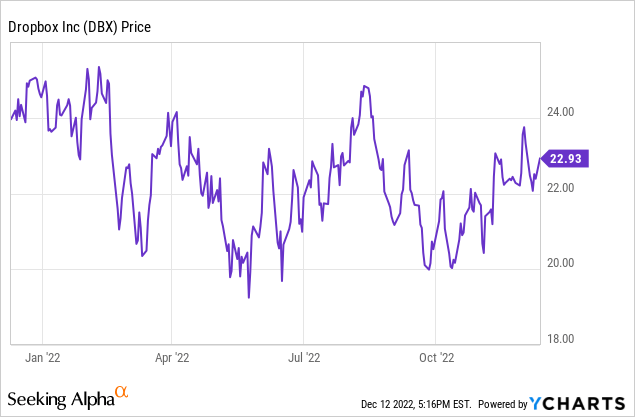

Dropbox (NASDAQ:DBX) is a solid-gold example of this. The file-sharing company has barely seen any impact from macro headwinds onto its top-line growth (and as a relatively mature software company that has seen growth level out in the high single digits, expectations for Dropbox aren’t tremendously high either; or does its valuation multiple require outstanding growth rates). Year to date, as investors have flocked to safety, Dropbox’s -8% decline vastly outperforms many software peers that are down 30-40% or more:

A vibrant bull case for Dropbox

Despite relative outperformance this year, I continue to hold onto Dropbox in my portfolio and remain bullish on the name. I think Dropbox trades at enviable cash flow multiples (one of the few names in the SaaS sector that can actually be valued based on bottom-line metrics), and its strong established presence among its customers (high ARR base) plus its continued product innovation make it a strong long-term hold.

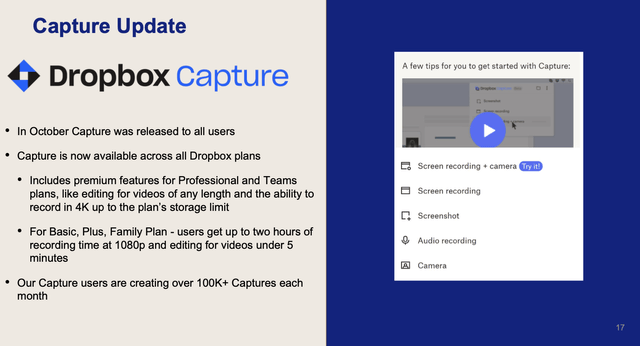

On the product front, in October Dropbox announced its latest product, Dropbox Capture. The product is intended to help remove the burden of quick check-in meetings that don’t require discussion, and instead have colleagues send each other pre-recorded videos / screen captures with annotations and highlights.

Dropbox Capture (Dropbox Q3 investor presentation)

As shown in the chart above, the product has caught on quickly with 100k+ Captures created monthly. I view this product as an upsell incentive, as it has limited recording time on the company’s individual user plans but is unlimited on the company’s higher-ARPU enterprise plans. Continued rollouts like these also help Dropbox to continue to hold ground against competitors like Box (BOX) and Google Drive, while also deepening its push into enterprise (which has long been more of Box’s forte).

Here’s a refresher on my full, long-term bull case for Dropbox:

- Dropbox isn’t just trading on a pie-in-the-sky future projection, but on real free cash flow today, singling out from other SaaS stocks in this risk-averse environment. Growth and paying premiums for growth stocks is out; value is in. The fact that Dropbox has routinely dangled a target of hitting $1 billion in annual FCF by FY24 while continuously raising operating margins quarter after quarter is a big draw for investors. Note that in FY21, Dropbox already hit north of $700 million in free cash flow, so I think it’s highly likely that this original $1 billion target gets replaced with something more aggressive.

- Consumer upsells. More and more freelancers have emerged from the pandemic, untethering themselves from a corporate lifestyle and building brands and businesses of their own. Tools like Dropbox have become necessary infrastructure, and one with very low barriers to entry and ease of setup. Accordingly, Dropbox has differentiated itself from Box by appealing to these professional solo acts and small businesses, which is reflected by Dropbox’s greater upsells to premium paid plans.

- Enterprise market opportunity. Dropbox’s traditional strength has always been in smaller/consumer users, though it has started ramping up its enterprise efforts lately (products like Capture add to the company’s enterprise resume). There’s still plenty of opportunities for Dropbox to take market share from Box here.

- E-signature opportunity. The addition of an enterprise tool like DocSend (acquired in 2021 and recently rebranded as Dropbox Sign) will further flex Dropbox’s muscles in the enterprise space, helping it catch up to its rival Box (the latter of which has long touted superior security capabilities). Like the rest of Dropbox’s product portfolio, Dropbox Sign has a range of plans and pricing for users of various budgets and levels of sophistication, giving it immediate cross-sell applicability to all segments of Dropbox’s customer base.

- Buyback boost. Earlier this year, Dropbox’s board approved another $1.2 billion in share buybacks, which is a great way for the company to capitalize recent share price declines. This authorization covers a whopping ~14% of Dropbox’s current market cap ($922 million of the original $1.2 billion remains unused, as of the end of Q3).

Stay long here: Dropbox will continue to have upside heading into 2023.

Q3 download

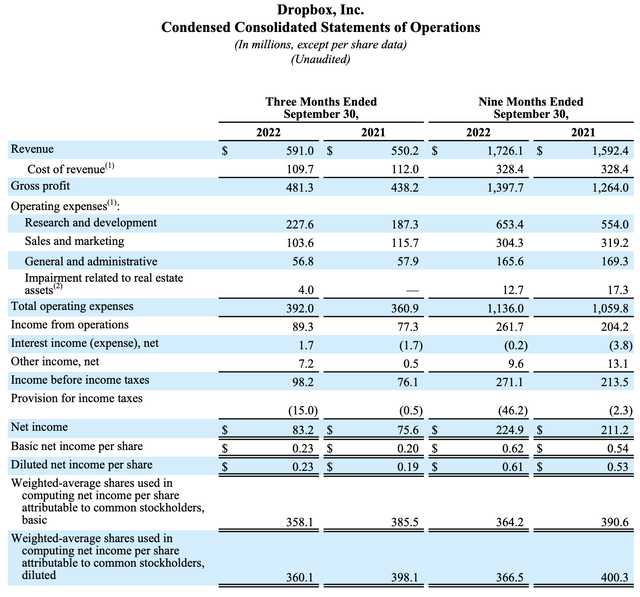

Let’s now dig into Dropbox’s latest quarterly results in greater detail. The Q3 earnings summary is shown below:

Dropbox Q3 results (Dropbox Q3 investor presentation)

Revenue in Q3 grew 7.4% y/y to $591.0 million, beating Wall Street’s expectations of $586.2 million (+6.5% y/y) by a one-point margin. There were two points of FX headwinds baked into Q3 results: on a constant currency basis, Dropbox’s revenue would have grown at 9.6% y/y.

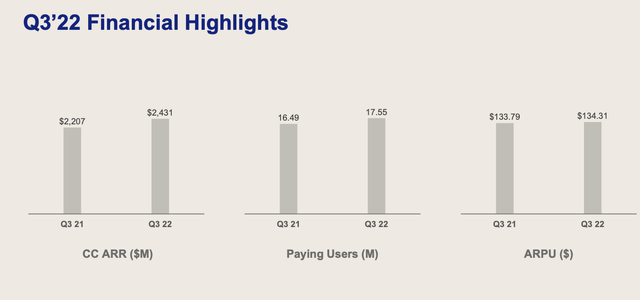

The company also continued to grow its ARR, up 10% y/y to $2.43 billion on a constant currency basis. We note that this covers a good chunk of next year’s consensus revenue expectation of $2.46 billion (data from Yahoo Finance). The company has also added approximately 1 million paid users y/y (and +180k net new paid customers since the end of Q2), while the continued upsell into premium and enterprise trends has driven a slight boost in ARPU to $134.31.

Dropbox Q3 user metrics (Dropbox Q3 investor presentation)

Management notes that in spite of macro headwinds, customer churn is down and retention is improving – a reflection of how deeply ingrained Dropbox becomes in enterprise processes, as well as the attractiveness of its expanding product portfolio. Per CEO Drew Houston’s qualitative remarks on the Q3 earnings call:

We delivered another strong quarter amidst an increasingly challenging macroeconomic backdrop. We saw strength from our teams plans driven by pricing and packaging changes, which we rolled out in June. And the strength was partially offset by some continued moderation in our document workflow businesses which I touched on last quarter, along with some recent softness with our Plus individual SKU, particularly in mobile […]

We delivered another strong quarter amidst an increasingly challenging macroeconomic backdrop. We saw strength from our teams plans driven by pricing and packaging changes, which we rolled out in June. And the strength was partially offset by some continued moderation in our document workflow businesses which I touched on last quarter, along with some recent softness with our Plus individual SKU, particularly in mobile.”

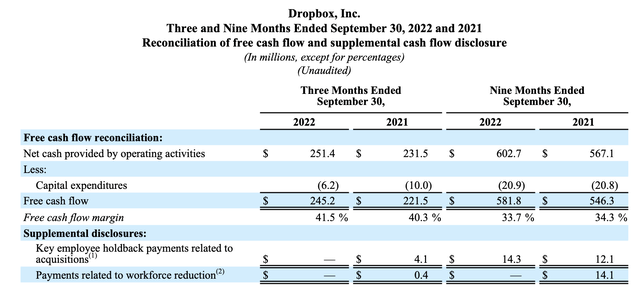

Dropbox’s main appeal (at least in my opinion), free cash flow, also saw an attractive 11% y/y increase to $245.2 million, representing 130bps of FCF margin leverage.

Dropbox FCF (Dropbox Q3 investor presentation)

The company benefited from two points of gross margin gains, driven by economies of scale on its cloud hosting infrastructure, partially offset by higher R&D costs due to a pull-forward in hiring that should moderate in go-forward quarters. Q3 pro forma operating margins of 31.6% also expanded two points year over year and exceeded internal company expectations by three points. This trend should continue as the company continues to focus on dampening hiring as well as shifting more of its workforce away from its costly headquarters city (San Francisco) and into cheaper locales.

Valuation and key takeaways

Dropbox slightly boosted its FCF range for the year to $770-$790 million (up $10 million on the low end of the range versus its prior outlook) against ~$2.32 billion in revenue, representing a 33.6% FCF margin at the midpoint.

If we assume this FCF margin holds through next year (a reasonable expectation, given that the company also just raised its gross margin guidance by 50bps to account for infrastructure efficiencies) against $2.46 billion of consensus revenue (+6% y/y), Dropbox’s free cash flow next year will land at ~$827 million.

At current share prices near $23, Dropbox trades at a market cap of $8.32 billion. After netting off the $1.45 billion of cash and $1.37 billion of debt on the company’s most recent balance sheet, the octane’s resulting enterprise value is $8.25 billion. This represents a 10.0x EV/FY23 estimated FCF multiple – which I think is a very safe valuation in a choppy market.

With generous free cash flow, a strong buyback program and solid ARR, keep riding the upside here.

Be the first to comment