Justin Sullivan

The better-than-expected CPI print for October unleashed a rally in both equities and credits on Thursday (November 10), with the tech-heavy Nasdaq 100 index adding close to $1 trillion in market cap over the span of one session. Nvidia (NASDAQ:NVDA) was one of the biggest gainers, staging a 14% intra-day rally to outperform the broader PHLX Semiconductor Index (SOX).

Signs of easing financial conditions is currently a core driver of investors’ confidence, which is corroborated by the strong intra-day gains observed during Thursday’s session. Yet, the broader market climate remains fragile, as the Fed’s monetary policy tightening trajectory has yet to peak, with consumer slowdown only now becoming more prevalent.

And specific to Nvidia, the company also faces operating challenges from worsening geopolitical tensions, though its recent release of the A800 data center GPUs exclusive to the Chinese market in compliance with U.S. regulatory requirements is a step in the right direction. But renewed crypto contagion fears are now sparking fresh concerns on the near-term performance of Nvidia’s GPU segment, which is already reeling from a broader decline in global PC demand this year.

Regardless of the near-term macro and industry-specific headwinds though, Nvidia’s robust one-day gain on Thursday underscores the strength of investors’ confidence in the stock still, given the underlying business’ positive potential in benefitting from longer-term advances stemming from its massive market share across high-growth verticals spanning high-performance computing (“HPC”) to AI-driven innovations like self-driving vehicles and the metaverse. With market conditions still choppy in the months ahead, the Nvidia stock’s latest rally is likely to fizzle, creating more compelling entry opportunities than its current valuation.

Macro Overview

The Federal Reserve maintained a hawkish tone after raising 75 bps for the fourth time consecutively this year in November as inflation remains far from the desired 2% target. With the October inflation print coming in better-than-expected, market participants are becoming more optimistic that the worst of rapid price increases this year are now behind, playing favorably to desires for a more dovish monetary policy trajectory and improving financial conditions ahead.

October headline CPI came in at 7.7%, softer than the average consensus estimate of 7.9%, marking the “smallest annual advance since the start of the year”. Meanwhile, core inflation – which strips the impact of volatile food and energy prices – came in at 6.3%, which is also a welcome improvement from consensus calls for 6.5%. Equities rallied across the board in response to the softer-than-expected inflation print, as it points to early signs of a structural slowdown in pricing increases that the Federal Reserve has been looking for before considering easing its monetary policy tightening plans. The latest improvement in pricing increases is supportive of the Fed’s planned rate hike for 50 bps in December, marking possibly the first deceleration in the pace of tightening since June.

Yet, any possibility of a sustained rally on signs of easing inflation and a potential Fed pivot remains remote. At 7.7%, current price increases remain far removed from the Fed’s desired 2% target, which aligns with Fed Chair Jerome Powell’s commentary earlier this month that the terminal rate could end up being higher than previously anticipated as tightening continues into restrictive territory to ensure inflation is contained. The remarks were further reinforced by Dallas Fed President Lorie Logan on Thursday (November 10):

Today’s economic conditions are complex, but they can be summarized in five words: Inflation is much too high.

Not only is inflation far above the FOMC’s 2 percent target, but with aggregate demand continuing to outstrip supply, inflation has repeatedly come in higher than forecasters expected. This morning’s CPI [Consumer Price Index] data were a welcome relief, but there is still a long way to go.

Source: Federal Reserve Bank of Dallas

What this effectively means is that the demand environment for Nvidia will continue to weaken, weighing on its near-term fundamental prospects. The stock’s valuation outlook over coming months will also remain volatile to changes in interest rates, which place a direct impact on multiples that dictate the value of the underlying business’ future prospects.

Specifically, on the fundamental front, continued rate hikes and “much too high” inflation implies tightening financial conditions over coming months, especially as ongoing deterioration in consumer sentiment this year now becomes materialized into a real decline in consumer purchasing power. Average personal savings in the U.S. have declined from 3.5% in the second quarter to 3.1% in the third quarter, a far-cry from the “five-year pre-COVID average of [approximately] 7.7%”. Consumers are also increasing reliance on credit card debt to sustain spending as purchasing power declines in the face of surging inflation – consumer credit card debt is now approaching the “pre-pandemic peak of $916 billion in September”, while “real average hourly earnings decreased in October and were down 2.8% from a year earlier… falling each month since April 2021” after adjusting for inflation.

Specific to Nvidia, weakening consumer spending is largely reflected through significant underperformance in its consumer-centric Gaming segment during the fiscal second quarter. And conditions have likely remained muted or worsened in the fiscal third quarter, as global PC demand continued on a rapid decline while discretionary purchases of consumer electronics remained stagnated.

And on the commercial front, which was previously regarded as relatively recession-resistant compared to the consumer end-market, spending has become more conscious as well based on commentary during the latest third quarter earnings season. Even resilient corporate cloud investments are showing signs of a slowdown or delay amid growing macroeconomic uncertainties, risking weakness in data center investments over the near-term, which would impact the performance of Nvidia’s star segment.

And on the valuation front, continued rate hikes are bound to further weigh on multiples. The value of high growth companies like Nvidia, with much of their prospects still being “far out in the future” are becoming increasingly susceptible to heavy discounting as a result of rising capital costs. This circles back to our earlier mention that any rally in the Nvidia stock observed as a result of the latest October inflation print will likely fizzle, as the double-whammy of valuation and fundamental challenges continue to play out over coming months.

Implications of the A800 Data Center GPU

Moving on from broader market headwinds, Nvidia is also facing industry-specific challenges stemming from intensifying U.S.-China relations as of late. As discussed in detail in our previous coverage on the stock, the latest ban imposed by the U.S. government on exports of advanced semiconductor technologies to China further complexes the operating backdrop for chip makers like Nvidia, which is already reeling from unraveling demand this year. The company had previously reiterated that it does not expect a material impact on its business as a result of the newly imposed restrictions, though the implementation of said export ban could result in a $400 million headwind to fiscal third quarter results.

In the latest development, Nvidia has confirmed the production of A800 data center GPUs made exclusively for the Chinese market in response to U.S. regulatory requirements. The A800 chips will be a direct replacement for the A100 that has been effectively banned from being exported to China. The A800 chips, which are also based on Nvidia’s Ampere architecture, will include three variants offering the same specs as the A100 chips. However, the “NVIDIA NVLink” technology implemented, which enables “seamless, high-speed communication between every GPU” within a system to facilitate the compute demands of increasingly complex AI and HPC workloads, will be downgraded from the A100’s standard 600GBps to 400GBps for the A800. The A800 has received regulatory clearance from the U.S. for export to China, with the hardware’s processing speed non-programmable to exceed the 400GBps cap, and thereby “limiting their usefulness” in HPC applications to restrict China’s military advancements. However, the company has yet to provide any immediate reprieve to restricted sales of the upcoming H100 Grace data center CPUs to China as a result of the new rules, which also relies on next-generation NVLink technology capable of at least 1.5x higher performance than existing Ampere-based processors.

As analyzed in our previous coverage, we expect Nvidia’s base case 12-month PT to hover around $150 and bull case 12-month PT of $160 as a result of the newly imposed export restrictions in addition to looming macroeconomic challenges. And the recent relief brought by the introduction of the A800 chips exclusive to the Chinese market – the largest source of semiconductor demand – is viewed as a positive development to support the stock’s potential leap beyond the base case PT and approach towards the near-term bull case PT. This is further corroborated by the stock’s intra-day leap of as much as 4% to reach the $150-level on November 8th upon announcement of the A800 chip which began productions in the fiscal third quarter, which was organic to positive investors’ sentiment on the news and separate from any positive macro development.

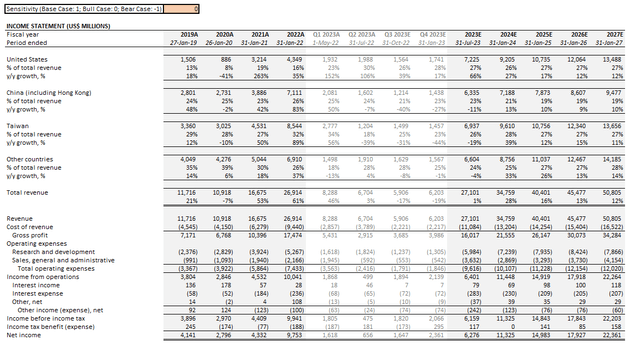

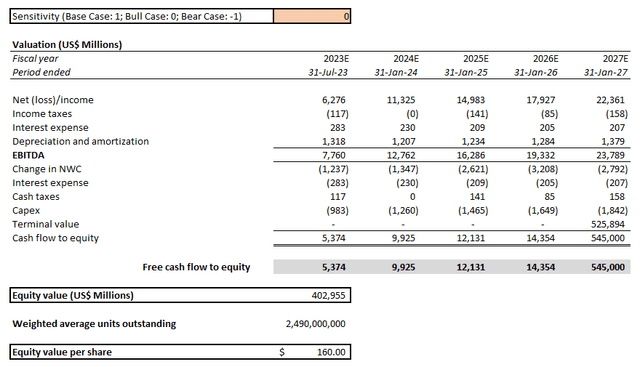

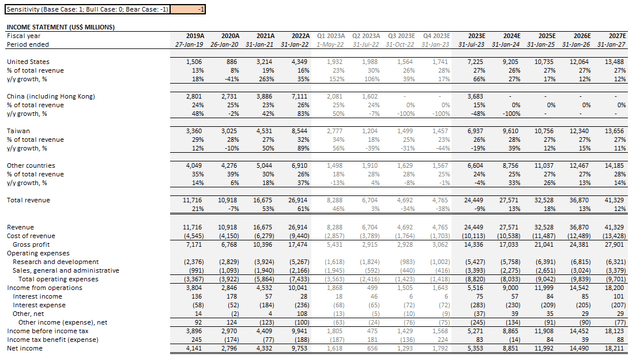

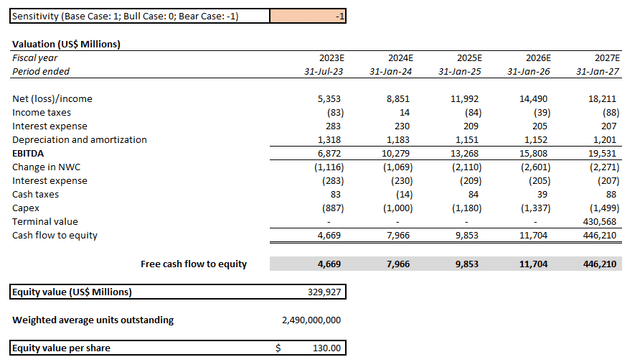

i. Bull Case Financial Forecast and Valuation Analysis:

Nvidia Bull Case Financial Forecast (Author) Nvidia Bull Case PT (Author)

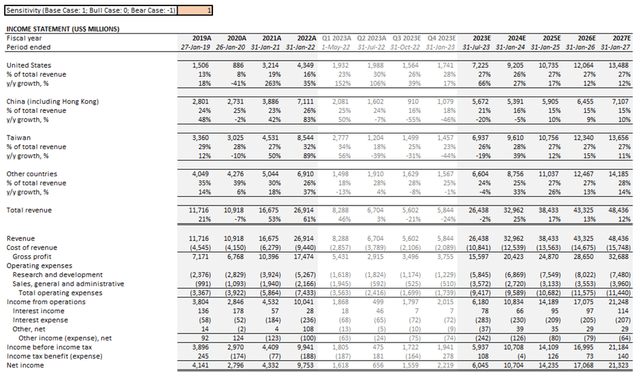

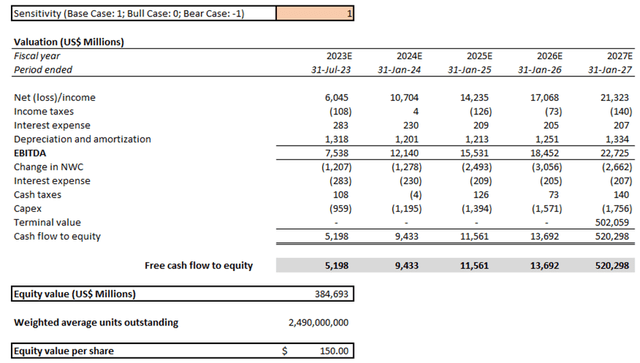

ii. Base Case Financial Forecast and Valuation Analysis:

Nvidia Base Case Financial Forecast (Author) Nvidia Base Case PT (Author)

iii. Bear Case Financial Forecast and Valuation Analysis:

Nvidia Bear Case Financial Forecast (Author) Nvidia Bear Case PT (Author)

However, the total elimination of Chinese demand for Nvidia’s best-selling A100 data center GPUs and H100 data center CPUs will remain an overhang on the company’s near-term fundamental performance. China is still the largest buyer of chips, and with Nvidia’s heavy reliance on HPC/data center sales to make-up for the near-term downturn in its consumer-centric segments, the company is still missing out on a chunk of market share that it would have otherwise been able to capitalize on if it were not for the newly imposed rules. Yet, we see the A800 as a positive development that will not only bring some partial relief to Nvidia’s near-term fundamental performance, but also an indicator of a potential equivalent for the company’s new foray in data center CPUs with its Hopper architecture. We see this as a probable implication for a potential clawback of revenue losses that were previously thought to be permanent due to the U.S.-imposed export curbs, which would be a plus to Nvidia’s near-term valuation prospects.

Nvidia_-_Forecasted_Financial_Information.pdf

Author’s Note: Please see here for further detail on key assumptions and methodology applied in the financial forecast and valuation analysis.

Implications of Crypto Contagion 2.0

As previously discussed, lingering crypto headwinds make another overhang that is harder to gauge on Nvidia’s near-term performance. Recall that a non-disclosed portion of Nvidia’s Gaming segment sales are driven by GPU demand from crypto mining, which has experienced a material slowdown this year following the Luna/Terra death spiral (UST-USD / LUNC-USD / LUNA-USD) in May and the Ethereum Merge (ETH-USD) that took place in September.

While cryptocurrencies saw some reprieve in prices in late October, earlier hopes of an emergence from the latest crypto winter have been stymied by the latest FTX wind-down. It has been a tumultuous week for crypto. The intensifying feud last weekend between Binance (BNB-USD) founder and CEO Changpeng “CZ” Zhao and FTX founder and CEO Sam Bankman-Fried following the former’s decision to liquidate its holdings in the latter’s FTT coins (FTT-USD) had rapidly turned into a liquidity crunch for FTX.com, which later turned into a potential bailout by Binance. And within 24 hours, the relief deal soured with Binance pulling out from the non-binding bailout agreement, and FTX facing bankruptcy risks. Contagion fears are also spreading like wild fire again, with BlockFi being the latest victim in the downward spiraling situation.

Cryptocurrencies have plummeted this week as a result of the latest drama unfolding in real-time within the digital assets industry. Even Thursday’s relief rally on the back of easing inflation signals failed to restore confidence in the risky asset, with Bitcoin prices dipping below $17,000 at one point. Many Bitcoin miners have already either sold their coins or mining equipment to raise cash needed to weather the protracted crypto winter, with some even halting expansion efforts as a pre-emptive measure against rising liquidity pressures:

Contagion risks in cryptocurrencies, following on from the FTX-Alameda collapse, will take a long time to work through and the market remains vulnerable…We’re going to see definite lower volumes because people are going to hold back at this moment in time.

Source: Bloomberg

While Nvidia’s latest release of the A800 chips and the broader market rally on signs of easing inflation this week have largely overshadowed potential contagion risks to demand for its gaming / crypto-mining GPUs, we see the latest crypto rout as a new bout of challenge on the chipmaker’s already-stagnate Gaming segment. As mentioned in the earlier section, Nvidia’s Gaming segment has already seen a significant decline in sales as a result of “softness in Europe related to the war in Ukraine and COVID lockdowns in China” that have been worsened by “lower units and lower ASPs” due to deteriorating macro conditions, and inadvertently, consumer demand. The latest crypto whiplash is likely to bring about further declines in crypto mining activity, thus adding to the Gaming segment’s near-term turmoil given an undisclosed portion of its sales are still linked to crypto mining demand.

In addition to a contagion impact from the recent crypto debacle on the Gaming segment’s sales, Nvidia also risks another write-off related to its inventory of crypto-mining processors, “CMP”. Although any related amount is not expected to place a material impact on its fundamental nor valuation prospects – for perspective, Nvidia had already reported a $1.32 billion CMP inventory write-down during the fiscal second quarter – it does not bode well for the company’s profit margins, nonetheless. This makes another near-term challenge to consider ahead of its upcoming fiscal third quarter earnings release, as investors’ preference shift towards profitability over growth ahead of an increasingly uncertain market climate.

Final Thoughts

As we have previously noted – when it rains, it pours for Nvidia. The near-term operating environment for the company remains a challenge, and the market backdrop for the stock’s near-term prospects continues to be turbulent. While the latest macro development pertaining to signs of easing inflation makes a positive point for valuation multiples, it is too soon to tell if the related rally is sustainable as price increases remain far out from the Fed’s 2% target. Continued Fed monetary policy tightening into restrictive territory to ensure inflation is under control for good means further deterioration in financial conditions ahead. And the recent easing observed in China’s stringent COVID Zero policies are also adding pressure to a tightening oil market – especially as the OPEC+ slashes production this month to prevent further price declines. With a potential return of demand from the world’s largest oil importer, the tightening oil market today is unlikely to handle such a sudden influx, adding to risks of a rebound in price pressures in the near-term, which corroborates continued hawkishness in the Fed’s policy agenda.

And while Nvidia’s recent introduction of the A800 is a step in the right direction to mitigate the impact of fraying U.S.-China relations, there is still work to be done to recoup the majority of lost revenues from other verticals as a result of the latest export restrictions. The latest crypto turmoil also brings renewed pressure on the company’s already-staggering Gaming segment.

Despite a cautious sentiment over Nvidia’s near-term outlook, the company remains well-positioned to capitalize on high-growth opportunities driven by secular demand across multiple verticals in which it specifically caters to over the longer-term. Nvidia’s offerings remain a critical backbone to almost every technology used across all daily life settings today and tomorrow, from HPC applications satisfying cloud-computing demand, to AI applications addressing nascent developments like autonomous mobility and the metaverse. The steadfast confidence in the company’s long-term bullishness is further evidenced by the Nvidia stock’s outsized gains on Thursday. Although further downturns in the stock are expected within the near-term to wipe-out its impressive intra-day gains observed this week, we view them as compelling risk-reward opportunities for longer-term upside potential ahead.

Be the first to comment