Drew Angerer

Investment Thesis

Dropbox’s (NASDAQ:DBX) recent quarterly results were in line with expectations. Their core business is growing along with their software ecosystem. The company is also starting to take measures to increase its per-user revenue. But increased taxes and higher stock-based compensation are hurting GAAP profitability.

I’m still bullish on the stock, and I believe there’s further upside here.

User Growth Continues Higher

Dropbox continued to grow its paying user base during the quarter. The company added about 280,000 new customers during the quarter, an almost 8% increase year over year. This is similar to its quarterly average user adds over the past two years. Revenue was in line with expectations.

These are solid results, although they’re not especially exciting. We’ve seen a slight slowdown in the economy over the last few months. It’s promising that Dropbox is still able to recruit new paying customers in this environment.

Management is also taking measures to increase product usage by their customers. They see this as a way to reduce churn. On their earnings call, they explained this plan.

In addition to UX improvements, we’re seeing increased adoption of multiple Dropbox features among our paid users. And we’re discovering that customers that leverage multiple capabilities retain at higher rates than those who do not. For example, there are millions of paid individual users using Dropbox Backup and these users retain at higher rates than those who haven’t turned on Backup. Similarly, we’re seeing early signals that customers who use Dropbox Passwords retain at higher levels than those who don’t.

Given this, in Q2, we rolled out Passwords to Teams users as part of our update to our Standard and Advanced plans and are already seeing strong early adoption… I’m pleased to see how we’re monetizing multiproduct adoption in the form of higher retention.

I think this is a smart strategy. Dropbox is improving its competitive advantage by expanding its ecosystem. Users are less likely to churn when they need to cancel multiple services. This can also drive adoption of paid features like DocSend and HelloSign. I see this as a way to build sustainable, consistent growth.

Can ARPU Trends Turn Around?

One area where Dropbox has been struggling is its per-user revenue numbers. New customer adds drove almost all of Dropbox’s top line growth.

This quarter, the company reported an ARPU of $133.34. This is up only 19 cents year over year and down sequentially. ARPU has been essentially flat since early 2021, while inflation was almost 13% over the same period. Part of these headwinds are due to foreign exchange rates. But I want to see Dropbox prove it has pricing power.

Management started increasing some product prices during the last quarter. The company boosted the price of its “standard” and “advanced” business plans by 20% a seat. This is the first price increase in five years. New customers were offered this price in June. Existing customers renewed at the higher rate starting in July.

This looks like a meaningful step in the right direction to improve top line growth. These increases affect roughly one third of Dropbox’s user base. These numbers should boost revenue going into the company’s next report.

Profitability Is Under Pressure

Dropbox’s top line growth is decent, but its profitability has been declining. The company’s expenses have been growing faster than revenues. Dropbox reported that its GAAP earnings were down almost 30% year over year. Part of this expense was driven by an increase in taxes. Changes to the R&D tax credit increased the company’s tax bill by almost six times year over year.

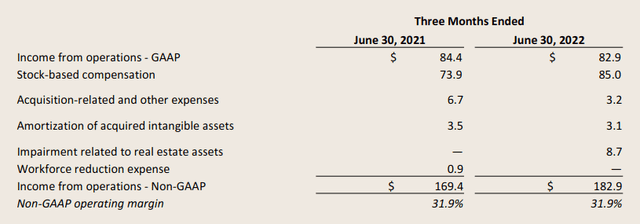

The gap between the company’s GAAP and non-GAAP margins is extremely high. The company reported that its GAAP profit was over 55% lower than its non-GAAP earnings. GAAP and non-GAAP operating profit reported a similar disparity.

Dropbox Q2 2022 Investor Presentation

A lot of this difference is because of high stock-based compensation. Stock-based compensation as a percentage of revenue grew from 14% to 15% year over year. Dropbox has offset dilution with share repurchases, but this eats into shareholder returns.

The Valuation Is Still Cheap

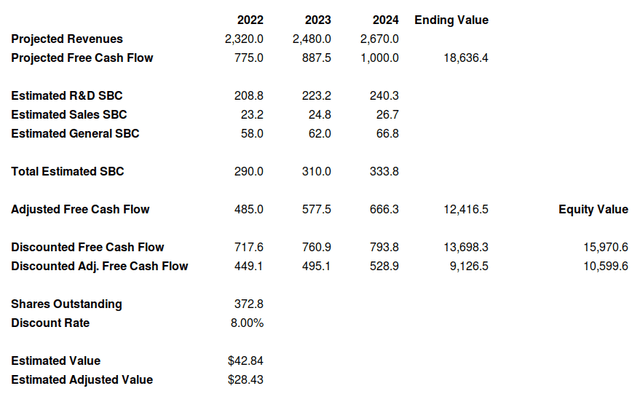

Dropbox’s long term financial models have largely remained unchanged. I’ve written that Dropbox’s valuation seems cheap, even accounting for stock-based compensation. My discounted cash flow model calculated a fair value of $28.43, indicating a potential upside of over 20%.

Created by author

I think that my thesis still holds true. The company is trading at an EV/FCF of 12 times. That becomes about 20 times after removing stock-based compensation from free cash flow. This is well within the range I’d be willing to pay for a company with this financial profile.

The company has been buying back more of its shares, repurchasing 8.9 million in the last quarter. At the current valuation, I think this is a good deal.

Final Verdict

Dropbox is still generating solid returns for shareholders. I’m glad that the company is taking measures to increase prices and offset inflation. Their stock-based compensation numbers are still a concern. I don’t consider it a major threat to the company.

Increased taxes and expenses may cause some short-term headwinds. But I still feel the company is on track to generate solid value for shareholders.

Be the first to comment