Marcus Lindstrom

Introduction

In November of last year, I started keeping track of Dream Industrial REIT (OTC:DREUF), a Canada based REIT focusing on industrial and warehousing properties in North America and Europe.

DIR Investor Relations

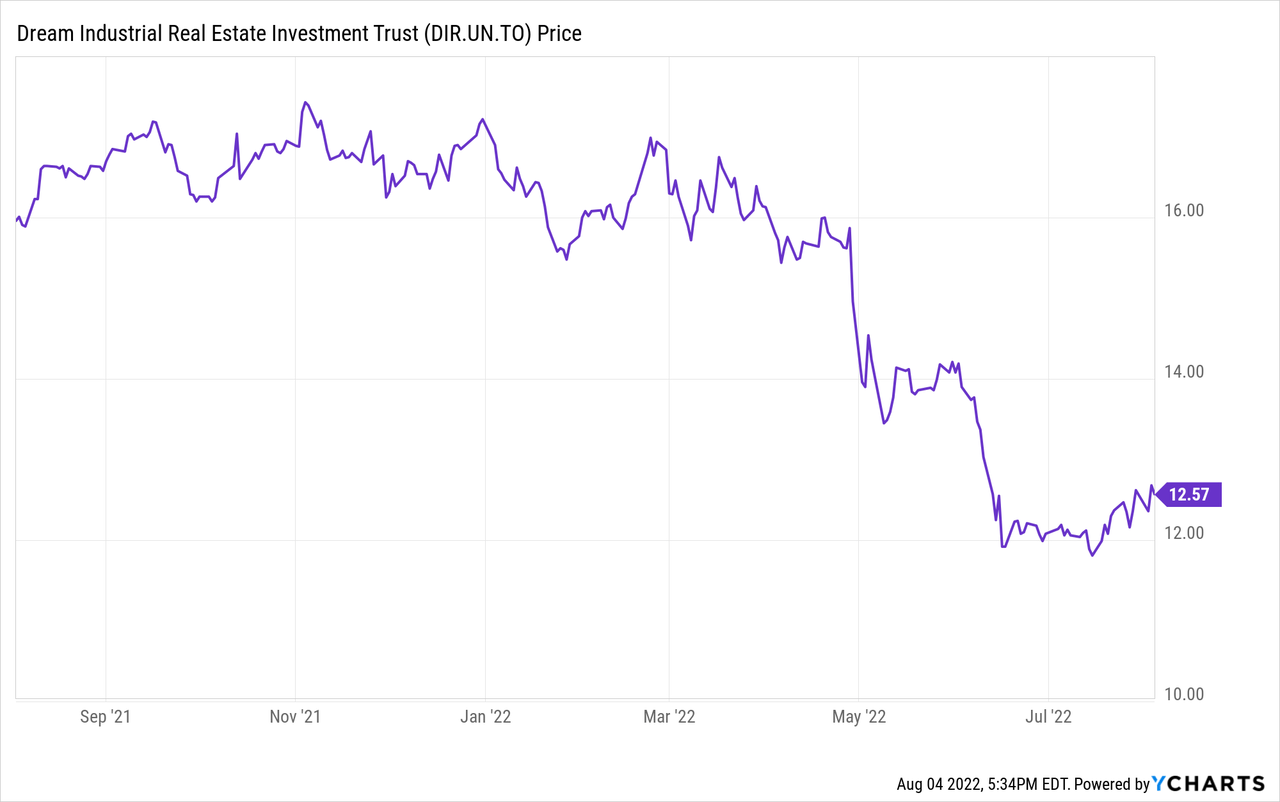

The share price has remained pretty stable until the rate hikes started and the shares can now be had at a 25% discount to last year’s price. Plenty of reasons to have another look to decide whether or not I should pull the trigger and go long.

Dream Industrial REIT has its main listing in Canada, where it’s trading with DIR.UN as its ticker symbol (some brokers use DIR-UN). The average daily volume in Canada is almost 700,000 shares, and that makes it the most liquid listing. DIR also reports its financial results in Canadian Dollar, so I will use the CAD as base currency throughout this article. There are currently approximately 273.5 million units outstanding including the Class B units which are a liability on the balance sheet but can be converted into stock, so it only makes sense to include these.

The second quarter was pretty robust

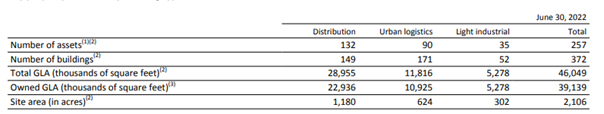

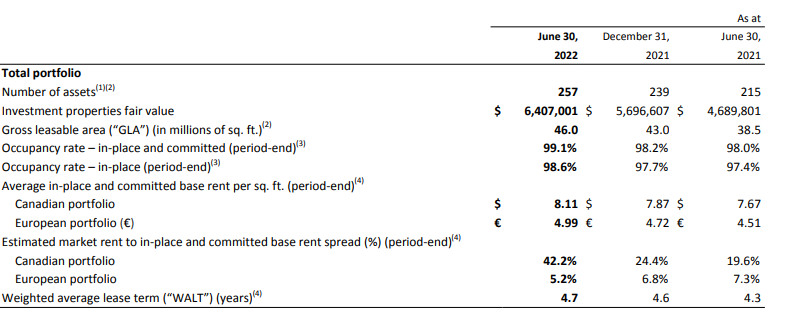

Over the past few quarters, Dream Industrial REIT has continued to grow its asset base. Compared to the end of Q2 2021, the total amount of assets has increased by approximately 20% to 257 assets. Meanwhile, the gross leasable area has increased from 38.5 million square ft. to 46 million square ft. And with an occupancy ratio of 98.6% (and even 99.1% if you include the committed agreements in place), DIR’s management team is executing very well. Another important element in the portfolio is the estimated rent spread, the difference between the market rent and the contractual rent.

DIR Investor Relations

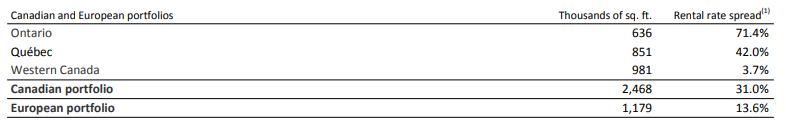

This indicates that -especially on the Canadian assets – lease renewals should happen at a higher monthly payment which will immediately benefit the FFO and AFFO per share.

DIR Investor Relations

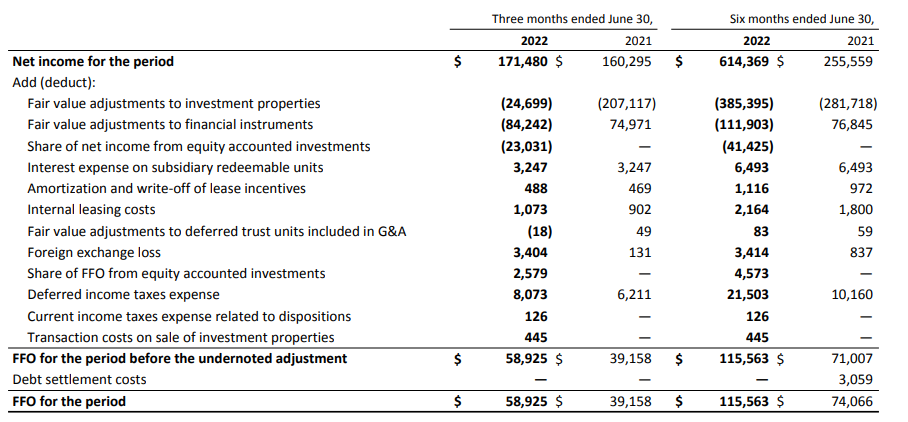

I won’t waste your time discussing the income statement as the FFO calculation is much more important for REITs. And Dream Industrial’s Q2 FFO was pretty strong at just under C$59M.

DIR Investor Relations

The FFO came in at C$0.215/share, which is roughly C$0.86 on an annual basis. That’s more than sufficient to cover the current monthly distribution of C$0.0583/share, which works out to be C$0.70 per year. At the current share price in the mid-C$12 range, the dividend yield is approximately 5.6% with a payout ratio of 79%. The distribution has not been updated in a while, and I don’t think we should expect a distribution hike anytime soon as Dream sees plenty of opportunity to redeploy the cash it is able to retain on its balance sheet. And as the rent spreads are materializing, the payout ratio will likely decrease even further as the FFO and FFO/share will increase.

Strong lease spreads and a very healthy balance sheet could bode well for the future

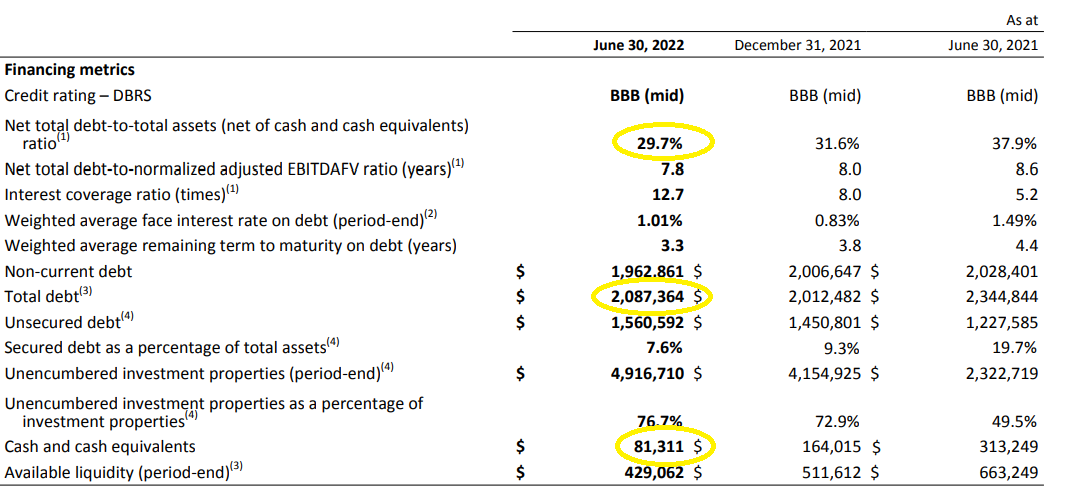

The strong lease spreads in Canada, as discussed earlier in this article, should provide a nice boost to the FFO and AFFO going forward. But Dream Industrial REIT has more elements working in its favor. The debt ratio, for instance. As of the end of June, the net debt to gross book value was approximately 29.7%.

DIR Investor Relations

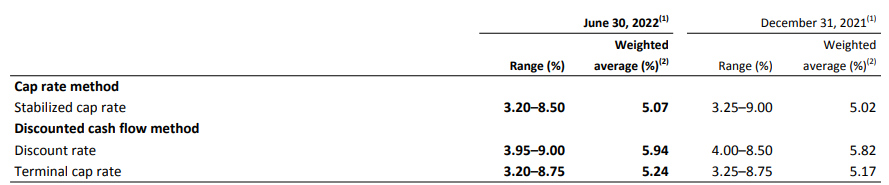

Of course, an important element to determine the debt ratio is knowing the cap rate the properties were valued at, and according to the quarterly report, the REIT used a 5.07% stabilized cap rate.

DIR Investor Relations

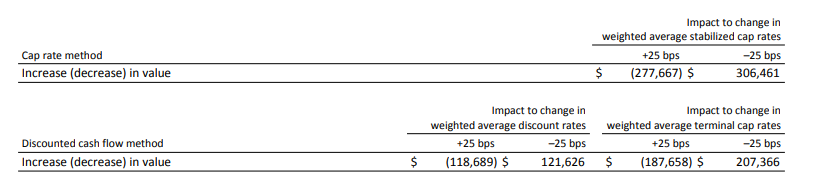

Fortunately, Dream also provided a clear sensitivity analysis. For every 25 bps the cap rate increases, the value of the assets decreases by C$278M. So for an increase in the cap rate to 6%, the value of the properties will likely decrease by approximately C$1.1B, keeping all other elements equal.

DIR Investor Relations

That would also mean the net debt ratio increases to 35.7% of the book value of the assets and while that would be inconvenient, an LTV ratio in the mid-30 range would still be excellent.

Another important element of keeping the payout ratio relatively low is the amount of cash DIR is retaining on its balance sheet. Although the LTV ratio is already low, the cash retained on the balance sheet helps to fund the development pipeline. At the current payout ratio (and excluding any impact from future expansions or rent spreads), DIR is retaining approximately C$40-50M per year.

DIR Investor Relations

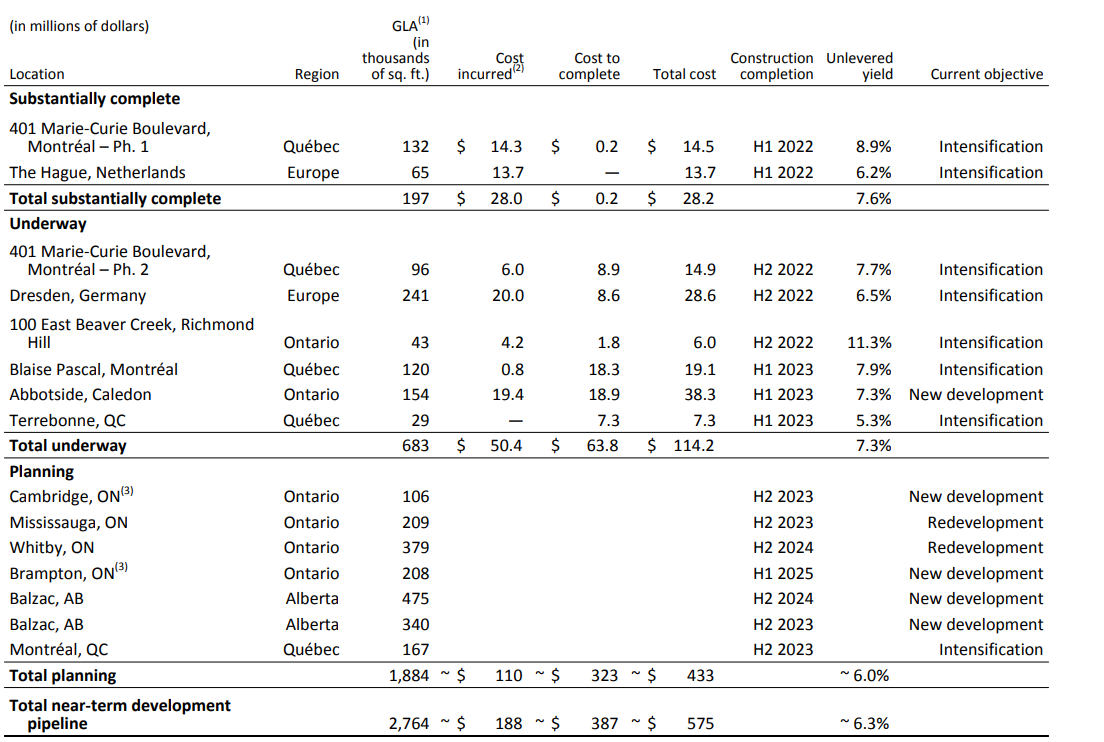

As you can see in the image above, DIR continues to invest in expanding its asset base. Two developments were completed in the first half of the year and these will contribute about C$3M on an annualized basis. In the next twelve months, DIR expects to complete an additional C$114M in expansion initiatives with a 7.3% yield (adding in excess of C$8M in rental income). Of the C$114M total price tag, only C$64M still has to be spent and this could (in theory) almost fully be covered by the FFO retained on the balance sheet.

There are more development projects in the pipeline with about C$433M in longer-term expansions and developments that will be completed over the course of the next three years. With an estimated yield of 6%, these developments could bring in an additional C$25M per year.

With a total cost to complete of C$387M over the next three years and considering the FFO will accelerate as new projects are starting to contribute during this three-year development pipeline plan, the C$150-160M in retained FFO will cover almost half the remaining cost to complete. This means the LTV ratio will likely remain unchanged at around 30% especially as the newly delivered assets may be revalued.

Investment thesis

Dream Industrial REIT has gotten cheaper in the past few months to a level which I would describe as ‘good value’. The official NAV/unit is C$16.64 which means the current unit price offers a 25% discount. And even if you would increase the cap rate to 6%, the stock is still trading at that more conservative NAV.

The distribution is safe and well-covered, so income investors should be satisfied with this. I am surprised to see the stock at the current levels as the share price is currently just 10% higher than in Q2 and Q3 2020 when the FFO/share was about 20% lower.

I currently have no position in Dream Industrial REIT but will likely go long in the near future.

Be the first to comment