The Good Brigade

….Right now, the home building space is really fascinating. The price of companies seems to be remarkably low, almost certainly because of concerns over the impact that economic conditions might have on demand for housing. Naturally, these concerns make sense and investors should not expect the recent performance achieved by these companies to represent a new normal for them. Having said that, there could be some players in the space that, even if they do see a pullback in fundamental performance, could still make for attractive long-term opportunities. One interesting player that warrants attention is Dream Finders Homes (NASDAQ:DFH). Management has done incredibly well to grow the company’s top and bottom lines in recent years. Having said that, shares do look to be a bit pricey compared to similar firms. And on top of that, the company is demonstrating some weakness in demand. Long term, I fully suspect that the company will be just fine. But given the wide range of opportunities out there, I do think a more appropriate rating for the business would be ‘hold’ for now.

A fast-growing home builder

According to the management team at Dream Finders Homes, the company specializes in designing, building, and selling homes in high-growth markets. Examples of where it operates include Charlotte, Raleigh, Jacksonville, Orlando, Denver, Washington DC, Austin, Dallas, and Houston. For the most part, the company focuses on single-family properties that cater to either the entry-level, first-time move-up, and second-time move-up home buyers out there. In addition, the company provides other services such as the offering of title insurance and mortgage banking solutions three joint venture that it has called Jet Home Loans.

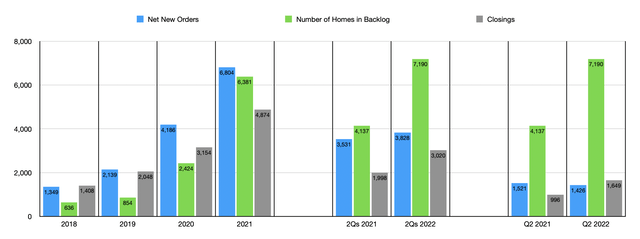

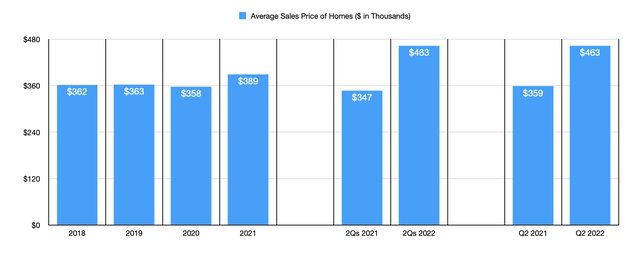

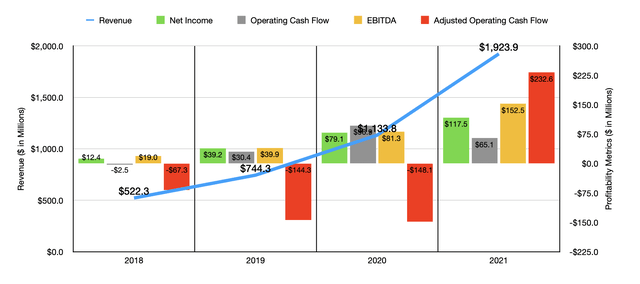

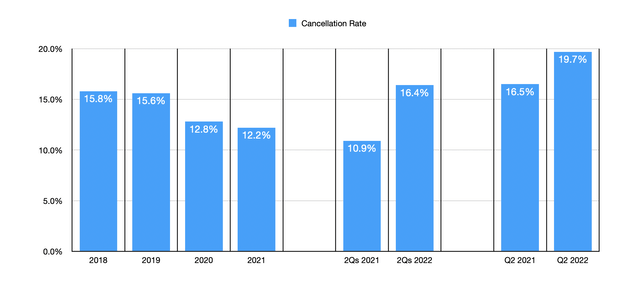

Fundamentally speaking, Dream Finders Homes has done incredibly well in recent years. Revenue with the company grew from $522.3 million in 2018 to $1.92 billion in 2021. This increase was driven by a couple of factors. First and foremost, the company saw the number of homes closed skyrocket from 1,408 to 4,874. And second, the company saw the average price of a home closing increase from $361,860 to $389,094. On top of this, the company also has some strong catalysts in its favor. The number of net new orders that the company has increased in recent years, climbing from 1,349 in 2018 to an impressive 6,804 last year. This outpacing of new orders relative to closings was instrumental in the backlog the company has, with that number soaring from 636 properties to 6,381. Also during this time, the cancellation rate of homes in its backlog decreased, dropping from 15.8% to 12.2%.

Author – SEC EDGAR Data Author – SEC EDGAR Data

With this rise in revenue, we have also seen a nice increase in profitability. Net income method business rose from $12.4 million in 2018 to $117.5 million last year. Of course, other profitability metrics also followed suit. Between 2018 and 2020, operating cash flow went from negative $2.5 million to positive $96.9 million. Then, in 2021, it dropped to $65.1 million. If, however, we were to adjust for changes in working capital, the trend would be consistent, with the metric rising from $27.5 million in 2018 to $94 million in 2020 before popping up to $161.9 million last year. Meanwhile, EBITDA also improved, jumping from $38.1 million to $201.5 million in the past four years.

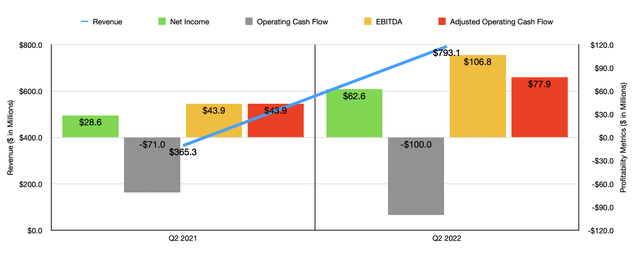

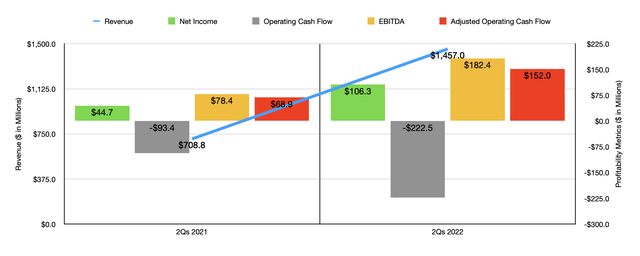

Although the picture so far has been positive, we are seeing some mixed results this year. First, let’s start with the good news. Revenue at the company continues to expand, with sales in the first half of the year hitting $1.46 billion. That’s over double the $708.8 million generated in the first half of the 2021 fiscal year. This came as the number of home closings rose from 3,020 to 1,998 for a year-over-year increase of 51.2%. The improvement was particularly strong in the second quarter alone, with closings climbing by 65.6% year over year. During this time frame, the average price of a home sold also rose, increasing from $347,261 to $463,318. All of this brought with it an increase in backlog from 4,137 homes to 7,190. And on top of that, the company also enjoyed a rise in profitability. That income jumped from $44.7 million in the first half of 2021 to $106.3 million the same time this year. Operating cash flow did worsen, declining from negative $93.4 million to negative $222.5 million. But if we adjust for changes in working capital, it would have risen from $68.9 million to $152 million. Meanwhile, EBITDA for the company also expanded, rising from $78.4 million to $182.4 million.

Unfortunately, not everything has been great for the company. Although revenue, backlog, and profitability, are all rising, there are signs of weakness showing. Consider a performance in the second quarter of this year. The number of net new orders came in low at just 1,426 properties. This compares to the 1,521 the company booked just one year earlier. But perhaps even bigger than this would be the number of cancellations the company is experiencing. In the first half of the year, cancellations totaled 16.4%. That compares to the 10.9% that it was just one year earlier. The cancellation rate has continued to climb, hitting 19.7% in the second quarter of this year compared to the 16.5% that it was just one year earlier. This makes sense when you consider the impact that rising interest rates and inflation should have on the home buying experience. It also suggests that investors should be wary moving forward.

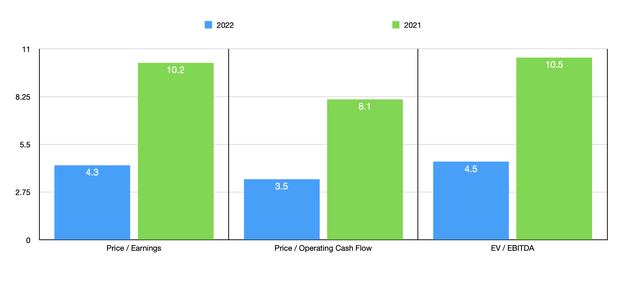

Despite these troubles, management still expects to end this year with no fewer than 7,000 closings. Beyond that, however, the company has not really provided any guidance for the year. If we annualize results experienced in the first half of the year, however, we should anticipate net income of $279.4 million. Adjusted operating cash flow should come in at $343.2 million, while EBITDA should total about $468.8 million. Using these figures, shares of the company look incredibly cheap. The price-to-earnings multiple would be 4.3. The price to adjusted operating cash flow multiple is even lower at 3.5, while the EV to EBITDA multiples should come in at 4.5.

To put this pricing into perspective, we need only consider how shares are priced using 2021’s results. In this case, the price to earnings multiple should come in at 10.2. The price to adjusted operating cash flow multiple should be 8.1, while the EV to EBITDA multiple should come in around 10.5. As part of my analysis, I also decided to compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 2.7 to a high of 5.6. This is based on 2021 figures, not forward figures. In this case, Dream Finders Homes was the most expensive of the group. The same held true when it came to the EV to EBITDA multiple, with ranges of between 3.6 and 6.8. When it comes to the price to operating cash flow approach, only two of the five comparable firms had positive results. These were 12.5 and 18.5, respectively. At least in this case, our prospect was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Dream Finders Homes | 10.2 | 8.1 | 10.5 |

| M/I Homes (MHO) | 3.3 | N/A | 3.6 |

| Green Brick Partners (GRBK) | 5.6 | 18.5 | 5.4 |

| Century Communities (CCS) | 3.2 | N/A | 3.8 |

| Beazer Homes (BZH) | 2.7 | N/A | 6.8 |

| Tri Pointe Homes (TPH) | 4.0 | 12.5 | 4.2 |

Takeaway

Right now, I understand that the market is concerned about what the future might hold for housing demand and prices. In truth, Dream Finders Homes and other firms like it will probably experience some pain. The key is to find a high-quality player that can weather the storm, that has a nice long-term outlook, and that is trading cheap not only on an absolute basis but relative to similar players. Although I think that Dream Finders Homes is definitely a great company, I do think that there are cheaper players in this space for investors to buy into. Doing this could result in lower losses in the event that investors are wrong, while the upside could be even greater if the market turns around sooner than anticipated. But for investors who are completely married to the idea of Dream Finders Homes, I do not think the long-term picture’s anything but good.

Be the first to comment