Darren McCollester

Thesis

DraftKings Inc.’s (NASDAQ:DKNG) post-earnings tumble last week has met with a robust recovery as the Fed’s rate hikes could be potentially nearing their end, as October CPI’s print came in well below the consensus estimates.

As such, unprofitable growth stocks like DKNG have received a brief respite (at least for now) from the bears looking to cover their positions after battering DKNG. We also updated investors in our previous article to be cautious about adding DKNG, as the reward/risk ratio wasn’t attractive.

Accordingly, DKNG significantly underperformed the market through its lows last week, even though management telegraphed a decent path toward adjusted EBITDA breakeven by FY24.

We like the pullback toward its November lows, as it has significantly de-risked DKNG’s execution risks. However, Wall Street analysts remain tentative over the company’s execution through the recession, as consumers could further pull back their spending.

Of course, we would have preferred if DKNG hadn’t staged a 15% bounce today in response to a better-than-expected CPI print. But, we think the setup remains constructive, proffering investors a relatively appealing entry zone to add exposure.

Revising from Hold to Speculative Buy with a price target (PT) of $17 (implying a potential upside of 30%).

DKNG Has A Viable Path Toward Adjusted EBITDA Profitability

DraftKings outperformed its previous Q3 revenue and adjusted EBITDA guidance markedly. Therefore, we believe the company guided conservatively in Q2, given the macro headwinds.

Accordingly, management highlighted they have yet to glean any material deterioration in its operating performance that could impact its revenue visibility moving ahead.

As such, management raised its FY22 revenue and adjusted EBITDA guidance to reflect its confidence in executing through the cycle.

Therefore, the massive selloff last week was pretty surprising. Notwithstanding, the market appeared to have de-rated DKNG as its FY23 adjusted EBITDA guidance wasn’t in line with the previous consensus estimates.

However, CEO Jason Robins highlighted that DraftKings would have outperformed the previous Street consensus (FY23 adjusted EBITDA: -$419M) if it relied on its previous modeling of not including new states. Robins articulated:

One of the things, I think, that is very different this year and this quarter, I should say, is that we guided with new states in. We’ve never done that before. If you take out those states, we’re guiding to under $400 million [adjusted EBITDA] loss in 2023. So I think that at least some of the analyst numbers out there that might be a more apples-to-apples comparison versus the guide we just provided, which was for the first time, including several new states. (DraftKings FQ3’22 earnings call)

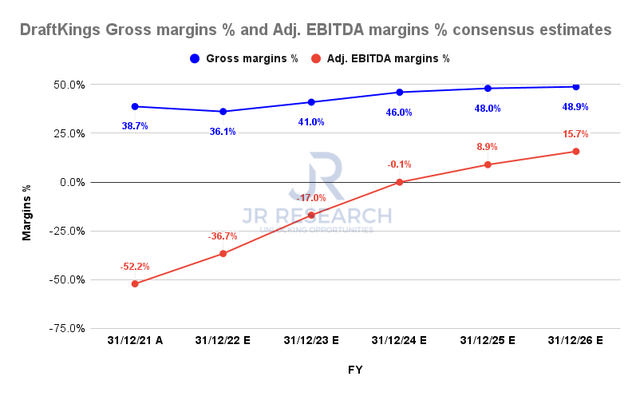

DraftKings Gross margins % and Adj. EBITDA margins % consensus estimates (S&P Cap IQ)

Accordingly, based on management’s revised outlook, DraftKings is expected to post an adjusted EBITDA margin of -17% in FY23 compared to the previous -14.8% margin estimates.

As such, Wall Street also took down the margin estimates through FY26 to reflect a slightly slower path toward profitability. Hence, the massive de-rating last week was likely in response to an outlook that had not been anticipated.

Notwithstanding, we believe the battering has also helped to relieve the uncertainties as DKNG neared its July lows. We are confident those lows should hold as DraftKings continues to gain operating leverage as it shifts more of its spending toward national advertising.

Is DKNG Stock A Buy, Sell, Or Hold?

DKNG last traded at an FY26 EBITDA multiple of 6.9x. Therefore, the market still expects DraftKings to execute well against its peers, given their median NTM multiple of 7.7x.

Therefore, it’s easy to understand why the market is sensitive to structural changes to DraftKings’ road to profitability, as it could significantly impact its valuation.

Hence, it’s clear that DKNG still has an embedded growth premium, behooving the company to continue executing well through FY26. Any unforeseen guidance revision could face a brutal digestion by the market to de-risk its execution risks.

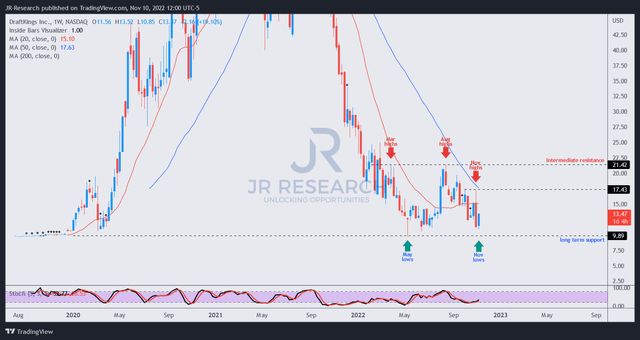

DKNG price chart (weekly) (TradingView)

DKNG bulls have attempted to batter the sellers this week, as buyers anticipate a Fed pivot/pause could be near. However, DKNG remains in a medium-term downtrend but should continue to find robust support along its May lows.

Hence, we believe the current entry zone is reasonable. However, investors can consider waiting for a pullback, given today’s sharp reversal.

Revising from Hold to Speculative Buy.

Be the first to comment