Scott Olson

There’s always an exception that proves the rule.

DraftKings (NASDAQ:DKNG) reports earnings tomorrow, August 5th. Despite a rising interest-rate environment, an economy which now technically meets the operational definition of a recession, and fierce industry-wide competition, DraftKings looks like it might defy the rule that a recession spurs flight to value and slams growth stocks. The question is whether this short-term expected strength can endure over time.

Prior Articles’ Work

I first analyzed DraftKings about four months ago, though that article itself was a follow-up to an earlier one on fuboTV (FUBO) which analyzed much the same issues in the gambling industry. After arguing that revenue was likely to be far lower than expected in the first piece, my initial article on DraftKings proper reassessed and found that it probably would secure much higher revenues than I originally anticipated… but the chances that net profit would rise by anywhere near as much were far lower.

I still think I’m right about that, but it doesn’t change the fact that in the short-term, at least, DraftKings’s prospects are looking increasingly brighter.

The Word On The Street

Wall Street sentiment reflects this recent strength. Despite DraftKings considerable long-term challenges, in the short-term market analysts are surprisingly bullish, especially considering that interest rate hikes aren’t expected to stop – yet – and growth stocks like DraftKings are usually hit hardest by such things.

Although DraftKings is expected to report a decline in quarterly earnings Y/Y, from $0.76 per share in the red to $0.85, its revenue growth is expected to remain strong, at 47% Y/Y. The average Street price target is over $25 per share.

There are a few factors that are driving most analysts towards a brighter expectation of DraftKings’s prospects.

DraftKings Superior Stock Performance

First, there is the recent trading pattern. I’m generally focused on long-term fundamentals and usually don’t even bother with short-term trends or trading patterns, but in DraftKings’s case the pattern is unmistakable, and really quite impressive.

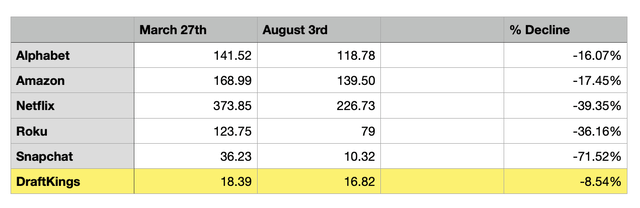

Since I wrote my last article on the stock on March 27, DraftKings stock has fallen 8.54% almost exactly matching the overall market decline of 8.5%. But as I mentioned earlier, DraftKings is a hypergrowth stock, trading cash for market share as Netflix (NFLX) did for years before becoming an established streaming leader. Companies like that should be absolutely reamed by interest rate hikes that make the cash they’re losing today much more expensive to reclaim down the road.

Seen in this context of rising rates, DraftKings feat of moving nearly in lockstep with the broader market actually suggests that selling may have been overdone and buyers are now sufficient in number to support the stock.

Consider the fates of some other tech/growth stocks since that same date:

DraftKings Superior Performance (Seeking Alpha)

DraftKings is not only matching the broader market, it is outperforming most of the biggest names in digital. It’s one thing to be outperforming streaming-focused stocks like Roku (ROKU) and even Netflix, quite another for behemoths like Alphabet (GOOG) and Amazon (AMZN) to be wishing they had your stock performance over the last four months when you haven’t turned a dollar of profit yet and still even aren’t allowed into about a dozen states or so.

Home Base Is A Home Run

Another factor is the ongoing legalization of sports gambling across the US. Unlike the higher revenue prospects, this isn’t really such a surprise; no one expected the legalization trend to run in any direction but one after the Supreme Court ruling in 2018. But even so, each time a state makes legalization official, it provides a little boost to the market by taking a little bit of the lingering uncertainty out of the picture.

The latest is Massachusetts, which legalized sports betting a few days ago, a particularly sweet victory for DraftKings since it is headquartered in Boston. And unlike some states that take months or even years to issue actual licenses to match legislation, word is that licensed Massachusetts operations could actually be up and running in a matter of weeks.

The new bill imposes a tax of 15% on retail, in-person bets and a slightly higher 20% on digital/mobile betting. Like most states, Massachusetts is prohibiting the placing of bets on its own in-state sporting events – funnily enough, New Hampshire and Massachusetts citizens have to place bets on games in their state in each other’s gambling systems – and imposing a 21-year age minimum. Up to seven operators have been authorized, each of which will pay a one-time fee in addition to the ongoing taxes.

State Taxation

When I discussed the long-term prospects of DraftKings a few months ago, one of the foundational assumptions I used that got a lot of pushback was my decision to pencil in the newly enacted 51% tax rate in New York City as the long-term normal for states. Massachusetts will only charge a 15% tax on in-person betting, with a 20% rate on digital transactions. Is my number too high?

Maybe. Then again, maybe not.

How Taxing Are Taxes?

Consider New England as a whole, more broadly. Maine and Connecticut charge even lower tax rates than Massachusetts does, probably what drove Massachusetts lawmakers to fear an outflow of gambling to those states and set a low rate. Vermont hasn’t passed a legalization bill yet but when it does it will probably be in the same neighborhood.

And yet New York State, the source of my original estimate and not that much further away, maintains its 51% rate and is seeing record-breaking revenues, with little to no suggestion of regulatory arbitrage by consumers. New York has generated more gambling “handle,” – bets placed instead of revenue which is the sports books take of the bets – in five months than Connecticut has generated in almost a year.

And while we could chalk that up to Connecticut’s much smaller size, New York is hobbled itself by the fact that so far all of its in-person betting is taking place at upstate casinos, limiting penetration somewhat in New York City. Anyway, the sheer size of the disparity – $267 million tax revenues since January, compared to $7.3 million in Connecticut since October 2021 – is still much larger at almost 27x than the population difference between the two states at 5.5x. Per-person, New York State is generating almost 5x more tax revenue than Connecticut with a tax rate 4x as high. This suggests per-person betting is still larger in New York State than Connecticut.

And all this before New York City is really fully penetrated.

The Siren Call Of Easy Money

Not all of New England is in on the low-rate plan, either. New Hampshire actually gave DraftKings an effective monopoly on state gambling – not officially, but only one license of the authorized five has been issued. That may be because the legalization bill which passed in 2019 provides for a gradually lowering rate as the number of authorized operators increases. Even just adding a second operator drops the tax rate to 21%? But the tax rate for a single-operator, state sponsored monopoly? 51%.

It should come, therefore, as a surprise to no one that the governor of New Hampshire recently blasted Massachusetts’s new law and indicated that he thought a DraftKings monopoly worked well for the state – “if there’s a problem I can get on the phone and talk to ’em” as he put it, while apparently a problem in Massachusetts would leave regulators with too many phone numbers to handle? – and intimated he intended to preserve a single-operator system for the foreseeable future.

I mean, if your gambling operation had already generated more tax revenue in 30 months than it was projected to generate in 60 months, wouldn’t you? By the way, Rhode Island is charging that same 51% as well. And they didn’t even give DraftKings a monopoly for its trouble.

What’s In A Name?

The other main obstacle I’ve feared with DraftKings’s road to profitability is the ‘integrity fee’ sports leagues have repeatedly lobbied for legislatures to force sports books to pay them. So far, they haven’t had much success – Massachusetts had one in a 2020 bill that didn’t pass but doesn’t have one in this bill. Most other states have not granted them, either.

However, it may be a little too soon to take my estimated league takes from sportsbooks out of the math. Some of the states that have legalized gambling have imposed ‘mandatory data’ rules that require sportsbooks to use only official league data in settling bets. The leagues are allowed to charge a fee for that data.

And the sportsbooks themselves have already decided that they need the leagues marketing heft to reach their customers. After all, by definition the leagues own viewership is the perfect advertising channel. Leagues are already charging a hefty premium for such marketing partnerships.

If such deals and mandates spread, the difference between ‘data fees’ and ‘marketing fees’ versus ‘integrity fees’ is likely to be more a matter of semantics than economics.

Long-Term Projections

It seems very likely to me that legalization will continue, probably spreading to nearly all 50 states within the next 18 months at most. Even so, we shouldn’t overstate the significance of this. Legalization is something which is increasingly already priced into the stock. The bear case against DraftKings never was that legalization was suddenly going to turn around and start running in reverse.

For most of the market, the issue is the massive cash burn of gaining market share in this new, competitive industry with low barriers to entry. For me, it’s more the asymmetrical power relationships with the industry’s two key partners. Even when the sports gambling industry does well, I am less convinced that sports gambling companies will.

More alarming for DraftKings’s long-term prospects than the fact that some states are charging high tax rates is how little they seem to be suffering for doing so. If bettors will not travel from upstate New York to Connecticut to turn a 51% tax into a sub-15% tax, it seems unlikely that higher revenues will hurt high-tax states in any significant way; which in turn suggests that over time it will be low-tax states rising to match high-tax ones, not the other way around.

Other Investments

The factors I have identified can be applied to just about anyone else planning to launch a sportsbook, including fuboTV, Fox Corporation (FOX) which holds a stake in FanDuel, and Disney (DIS) which is increasingly open to integrating betting into its flagship ESPN channel. While inflation is eating away at everyone’s profit, there is no indication yet that any of these players are backing off their plans to penetrate the new and growing sports betting market.

Investment Summary

I see definite short-term momentum for DraftKings. To be sure, a truly awful earnings report tomorrow could still torpedo the stock, but there’s been little sign from industry indicators that we should expect one. And the stock’s ability to hold up under considerable pressure on growth stocks – Snapchat (SNAP) in particular is down over 70% – suggests that at least for now, the bottom is well and truly in.

Long-term, I am far less bullish. The temporarily lower tax rates in certain jurisdictions and lack of any express integrity fees so far do not convince me that the long-term thesis of rent-seeking behavior by state legislatures and sports leagues is wrong. That’s especially true if, as New York’s experience so far would seem to indicate, there is little penalty from consumers for the higher rates.

Because I don’t want to try to time when short-term bullishness will turn long-term bearish, I am maintaining my Hold rating despite DraftKings’s improving short-term prospects.

Be the first to comment