Armand Burger/E+ via Getty Images

Investment Thesis

Doximity (NYSE:DOCS) is a cloud-based platform solution that allows US physicians to be more productive while caring for their patients. As I note throughout the analysis, Doximity’s free cash flow margins leave most other businesses in the dust.

According to my estimates, after adjusting for stock-based compensation, out of every $1 of revenues, 26 cents drop to the floor as clean free cash flows.

The business simply gushes free cash flow. And management believes that the stock is undervalued and has sought to repurchase 1% of the company over the coming year.

My Background With Doximity

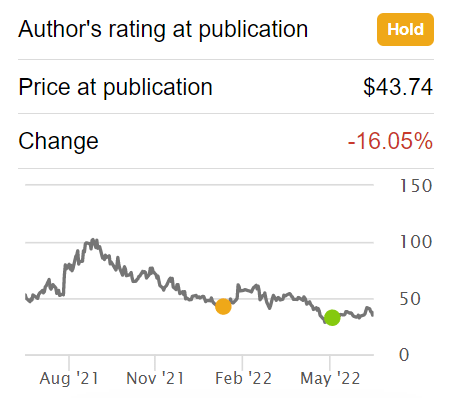

Author’s coverage

When I first appraised Doximity I recognized its strong free cash flows, yet I was put off by its valuation. As such, I asserted a hold rating on the stock. Indeed, I was on the fence and felt it was a coin toss how it would perform.

Later on, I changed my stance, and I upgraded Doximity to a buy rating. I said,

I’m now reversing this call and sticking a buy rating on it. There’s a lot here to like about this company, particularly at this valuation.

Given that the stock has moved up 25% since my last article, I believe this tells me that the stock has stopped selling off. And this is particularly important because as you know, nearly all US indices are down in the past month or so, particularly the Nasdaq (QQQ)

Hence, given this backdrop, together with SaaS stocks generally selling off, and the tech index more broadly, I believe that a second look at Doximity is warranted.

Indeed, it’s with a buy rating that I now continue.

Doximity’s Revenue Growth Rates Slow Down

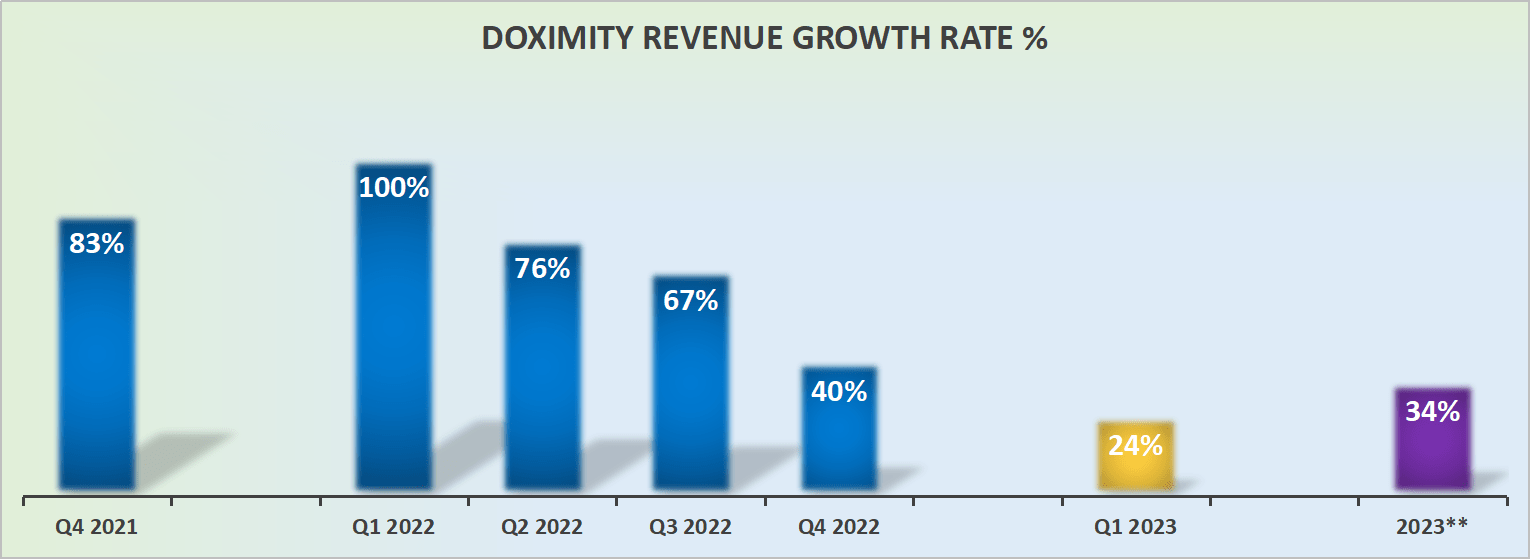

Doximity’s revenue growth rates

This is the unavoidable truth. Doximity’s fastest growth rates are now in the rearview mirror. Could Doximity grow by 40% in fiscal 2023? Perhaps. Perhaps it even ends up growing by 45% y/y in fiscal 2023.

Yet, even at 45% y/y growth, that would still be more than 2,000 basis points deceleration from fiscal 2022.

That’s not to say that Doximity’s prospects are saturating. They are not. But it does imply that its hyper-growth days appear to be behind itself.

Doximity’s Near-Term Prospects

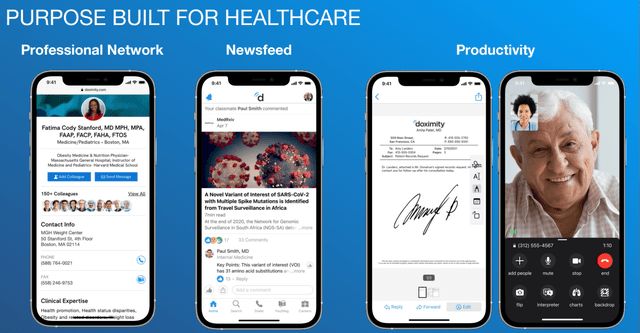

Doximity describes itself as creating proximity for doctors. It’s a leading business for U.S. medical professionals.

It’s a highly specialized cloud-based platform. In fact, from the investor perspective, it’s not all that different from the likes of Veeva (VEEV), a cloud-based software solution for the life sciences industry. This high level of specialization leads both companies to simply ooze free cash flows.

Moving on back to Doximity, it provides a platform that allows clients to connect with physicians while allowing physicians to be more productive.

Some investors, including Doximity themselves, have described Doximity as LinkedIn (MSFT) for doctors. The ability to work alongside doctors rather than being an invasive part of their work schedule.

Doximity allows physicians to connect with their colleagues, search for new job paths, and stay up to date with the latest medical research.

However, over time, Doximity has moved further down the path of how to facilitate communication with other physicians, rather than simply being a ”glory wall” where physicians display all their credentials for the world to see.

Doximity notes that it has very high ROI numbers. And it’s easy to see why they are essentially charging a fee to connect up with doctors in a highly targeted manner.

Hence, with all that in mind, let’s now dig into the crown jewel of this investment.

Crown Jewel: Profitability Profile

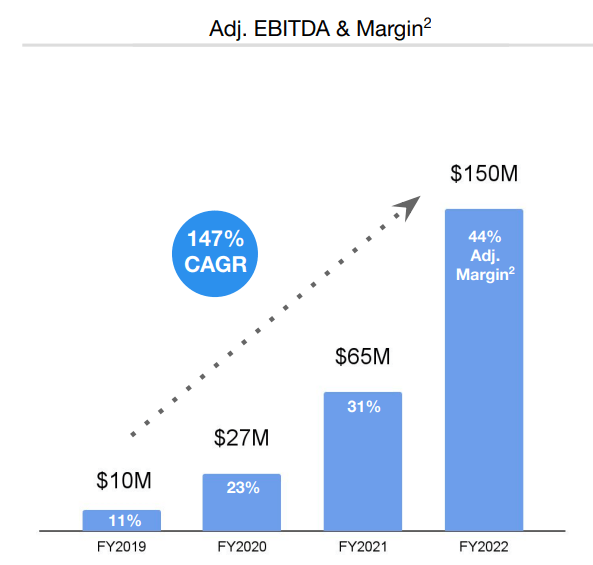

Doximity Q4 2022

The graphic above speaks for itself. You have a business that is reporting eye-watering profit margins. Furthermore, looking ahead to fiscal 2023, similarly, Doximity presently points to EBITDA margins of 43%.

Given that we could probably assume that Doximity is lowballing estimates, that means that the business’ profitability is likely to match fiscal 2022.

Digging further into its profitability profile, we can see that out of its $150 million of EBITDA for fiscal 2022, only $31 million was stock-based compensation.

Meanwhile, the business doesn’t have much in the way of capex or capitalization of intangibles.

As a reference point, from a ”cleaned-out” free cash flow perspective, where we adjust for stock-based compensation as a cash expense, Doximity is already reporting 26% free cash flow margins. Despite reporting attractive growth rates.

DOCS Stock Valuation – Priced at 54x Clean Free Cash Flows

If we assume that over the coming twelve months Doximity’s free cash flows, adjusted for stock-based compensation as a cash expense, grows by approximately 40% that would see Doximity’s cleaned free cash flow reach approximately $130 million.

That would put the stock priced at 54x this year’s clean free cash flow.

I will not argue that this is a particularly cheap valuation. It’s far from the bargain basement. But there again, very high-quality companies rarely go into the bargain basement.

What’s more, management evidently believes that the business as Doximity has sought to repurchase $70 million worth of equity or approximately 1% of its market cap being returned back to shareholders over the next twelve months.

Put another way, the repurchase program will fully offset the dilution associated with its stock-based compensation.

The Bottom Line

Very few businesses would have an IPO and be immediately cash flow generative. Fewer, still, would look to repurchase shares in the second year as a public company. This is a testament to Doximity’s ability to make sustainable and robust free cash flows.

Despite my enthusiasm for Doximity, I will not detract from the fact that Doximity is not cheaply valued. Yes, it’s a very high-quality business, and that always supports a high valuation.

But its valuation is far from the bargain basement, that’s the reality of this investment. Investors are not likely to go very wrong from buying now and holding on tight over the next couple of years.

Be the first to comment