Sundry Photography/iStock Editorial via Getty Images

Introduction: Why Did SNOW Drop In May?

Snowflake (NYSE:SNOW) is down ~47% from my previous article on the data cloud company. While I suggested an accumulation of Snowflake’s stock due to the potential for valuation compression, I did not see such a rapid decline. Despite robust business performance in Q1 FY2023, Snowflake’s stock has been sinking lower amidst a broad equity market sell-off. In 2022, high-multiple growth stocks have been undergoing a violent valuation reset as interest rates have surged higher. Unfortunately, Snowflake is not insulated from these market dynamics.

Here’s what I said about Snowflake back in April 2022:

Snowflake is one of the fastest-growing enterprise software companies in history. However, management’s guidance for a sharp deceleration in growth is causing a meltdown in the stock.

While Snowflake’s valuation has moderated a lot, it may go lower in the near term. If you are pondering a long-term investment, Snowflake is a fine buy here.

Snowflake’s (relatively high: >30x P/S) valuation could yet compress further in the near term. And so, I think starting a small position here and following up that purchase with a six to twelve-month DCA plan would make sense. Snowflake is a high-quality growth company that could make up ~3-4% of growth-focused portfolios, and it is now trading at a reasonable valuation. I would always buy a great company at a fair price, then a fair company at a great price. Hence, I am happy to start accumulating Snowflake in the $180s.

At current levels, Snowflake is a lot more attractive than when it was trading in the $180s. After reviewing Snowflake’s quarterly numbers and forward guidance, I can say with certainty that the business hasn’t changed materially in the last couple of months, i.e., the investment thesis is unaltered. Hence, I plan to add to my long position as per my original DCA plan.

In this note, we will analyze Snowflake’s Q1 FY2023 results and re-evaluate SNOW’s fair value and expected returns. Additionally, we will review some quantitative and technical data to gauge the near-term risk/reward of allocating capital to Snowflake at current levels. So, without further ado, let’s get started.

SNOW Q1 Highlights And Key Metrics

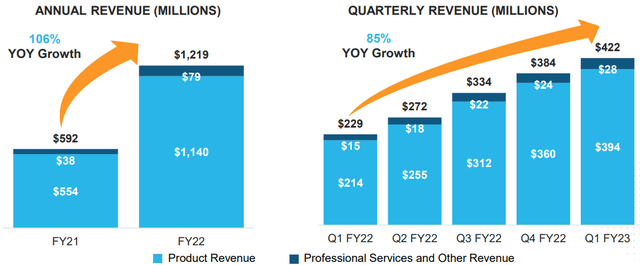

In Q1 FY2023, Snowflake’s revenue came in at $422M (up 85% y/y), with high-margin Product revenue reaching $394M (up 84% y/y). While these growth numbers were lower than what we have seen from Snowflake since its IPO, I can’t find many companies recording hypergrowth at such scale and margins.

Snowflake Q1 FY2023 Earnings Presentation

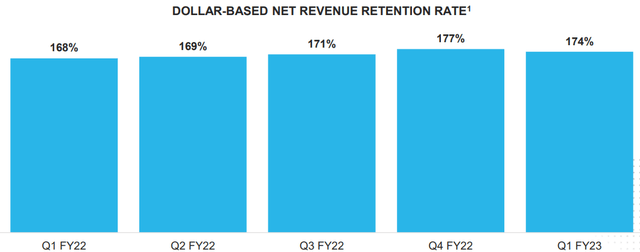

Frankly speaking, I am still astounded by Snowflake’s ultra-high net retention rates (174% in Q1) considering its consumption-based model. With strong customer acquisition and existing customers ramping up their usage of Snowflake’s data cloud for storage and compute solutions, Snowflake’s business momentum is looking robust.

Snowflake Q1 FY2023 Earnings Presentation

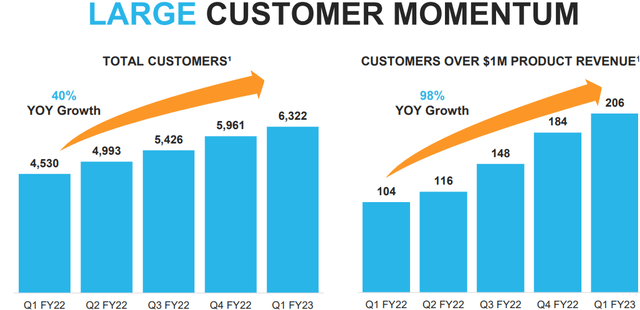

Snowflake Q1 FY2023 Earnings Presentation

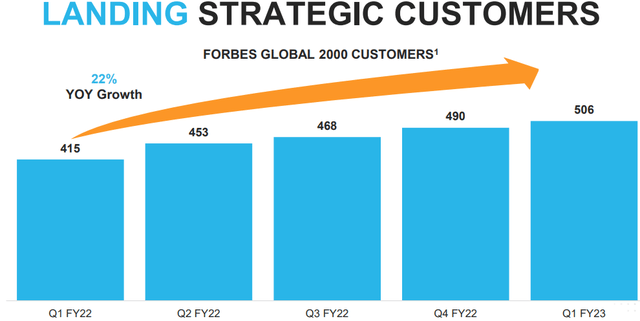

Snowflake Q1 FY2023 Earnings Presentation

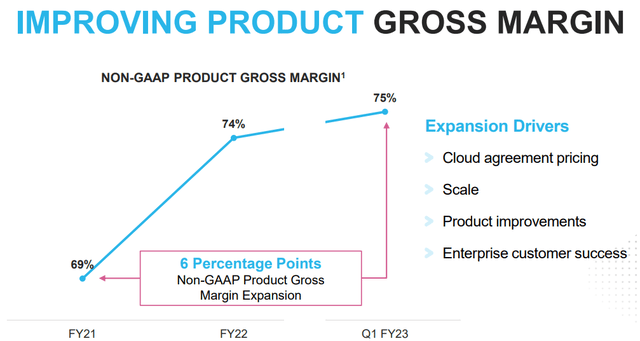

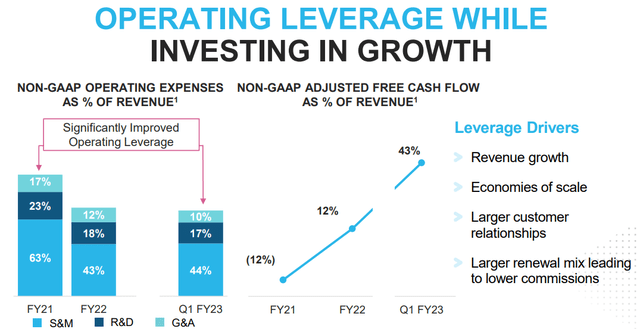

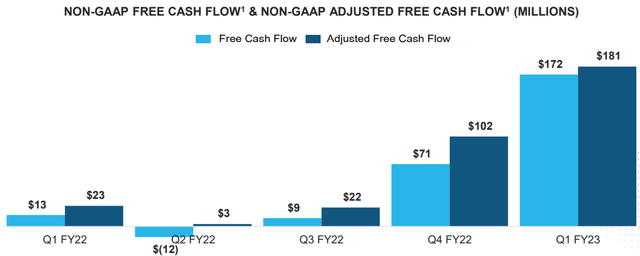

As Snowflake scales up, its margin profile is getting better and better. In Q1 FY2023, Snowflake’s non-GAAP Product gross margin rose to 75%, whilst non-GAAP adj. free cash flow margin reached 43% (boosted by billing cycle trends). My long-term (mature growth stage) FCF margin estimate for Snowflake stands at 35%, and I have received a lot of flak for this estimate; however, SNOW’s Q1 results show that this estimate is feasible.

Snowflake Q1 FY2023 Earnings Presentation

Snowflake Q1 FY2023 Earnings Presentation

While Snowflake is still unprofitable on a GAAP basis, it is already free cash flow generative (as evidenced by its non-GAAP results), which implies positive unit economics.

Snowflake Q1 FY2023 Earnings Presentation

A rapidly changing macroeconomic environment is creating fear with regards to Snowflake’s growth trajectory; however, Frank Slootman, in his recent interview with CNBC, said that –

The environment for Snowflake is not rocky, but rather subdued and normal. When I talk to customers, they are not falling off a cliff. Between the current supply chain issues and inflation, what Snowflake does is very much needed right now.

In my opinion, the secular growth trend in the cloud may slow down a little bit for a year or two if we go through a recession; however, cloud adoption will continue to rise for years to come (potentially decades) with only 15% of enterprise workloads on the cloud today. Hence, I expect Snowflake to maintain elevated growth rates throughout this decade.

What Is The Long-Term Prediction For Snowflake Stock?

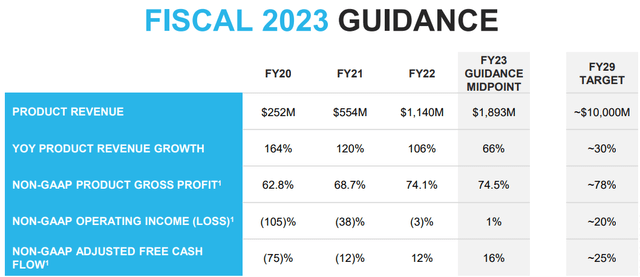

For FY2023, Snowflake’s management is guiding for product revenue to come in at $1.9B (y/y growth of 66%) and for gross margin to remain steady at 74-75%. Interestingly, Snowflake’s management finally increased their long-term FCF margin target to ~25% (from ~10%), removing some ridiculously sandbagged guidance.

Snowflake Q1 FY2023 Earnings Presentation

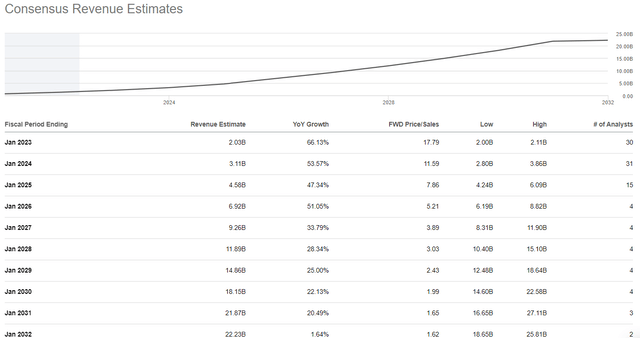

Seeking Alpha

While Snowflake’s management is guiding for product revenues to reach $10B in FY29, consensus analyst estimates call for $15B. Considering Snowflake’s addressable market, product roadmap, and competitive positioning, I think Snowflake will compound sales growth faster than management’s guidance and analyst estimates. For the next ten years, I project Snowflake to grow sales at ~35% CAGR (including organic and inorganic growth).

Is Snowflake Stock Undervalued?

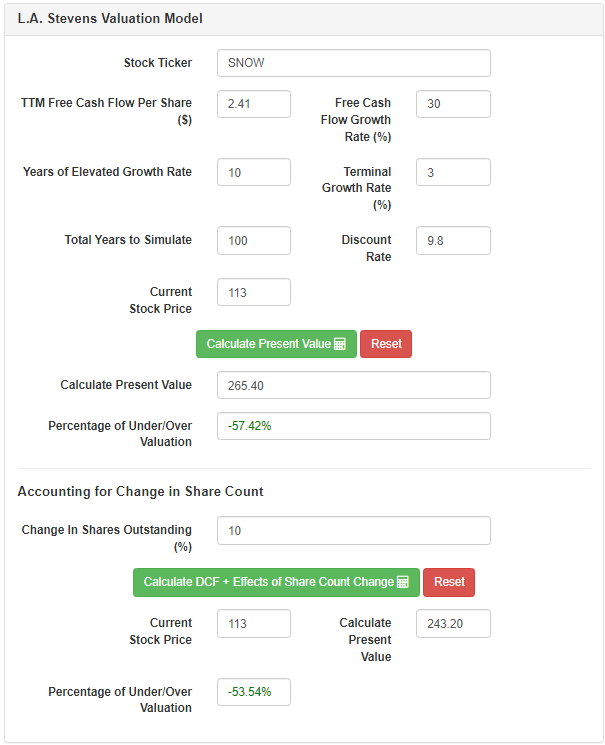

Snowflake’s growth story is just getting started with the rise of cloud computing set to continue over the coming decade. As per its management, Snowflake’s revenues will still be growing at 30% per year in 2028 (with faster growth numbers expected in the next 3-5 years). To implement an additional margin of safety in this investment, I will be using a CAGR growth estimate of 30% (down from 35% from my previous valuation) in today’s valuation exercise. For the next twelve months, I am now expecting product revenues of $2.5B. All other assumptions are unchanged. Let’s take a look at the results:

Assumptions:

|

Forward 12-month expected Product revenue [A] (our estimate) |

$2.5 billion |

|

Potential Free Cash Flow Margin [B] |

35% |

|

Average diluted shares outstanding [C] |

~363 million |

|

Free cash flow per share [ D = (A * B) / C ] |

$2.41 |

|

Free cash flow per share growth rate (conservative estimate) |

30% |

|

Terminal growth rate |

3% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

Results:

L.A. Stevens Valuation Model

L.A. Stevens Valuation Model

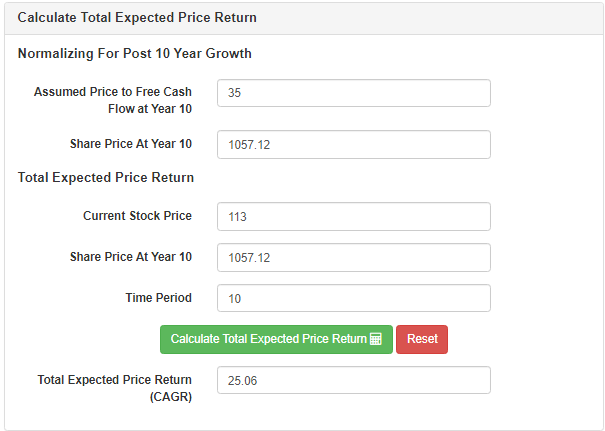

Even with conservative growth assumptions, Snowflake is worth ~$243 per share, i.e., it is currently undervalued by ~53.5%. By buying Snowflake at current levels, investors could expect to generate a CAGR return of ~25% over the next ten years. In my view, Snowflake offers a great long-term risk/reward for investors at $113 per share ($41B market cap).

Quantitative Data And Technical Charts

After topping in Nov-2021 (FED’s pivot), Snowflake’s stock has declined roughly ~71% in a short span of time. Currently, the stock remains stuck in a downward wedge pattern (bearish). Due to a short trading history, Snowflake’s stock has no support on its chart, and now that it has broken below its IPO price of $120, nobody knows how low Snowflake will go from here. With an RSI of 26.7, Snowflake’s stock is in oversold territory; however, I don’t see any signs of a trend reversal, not yet.

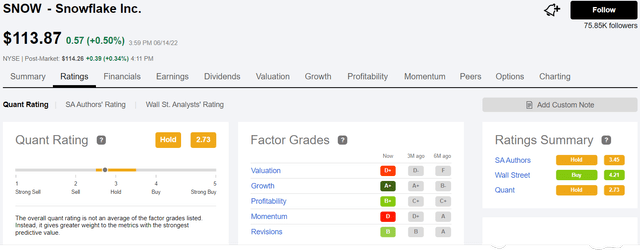

WeBull

According to Seeking Alpha’s Quant Rating system, Snowflake is rated as a hold at current levels. While Snowflake’s growth is best-in-class, and the company is showing improving profitability, Snowflake’s price momentum is slowing (as indicated by the Momentum rating dropping from “A” to “D-” in six months), and its valuation is still quite high (relative to its peers) as indicated by the “D+” Valuation rating. Overall, Snowflake’s factor grades are mixed.

WeBull

In a nutshell, Snowflake’s technical chart is bearish, and its quantitative factor rating is neutral. Hence, the near-term reward potential looks bleak. If you are looking for a short-term buy idea, I recommend avoiding Snowflake. With that being said, I am more interested in the long-term, and I hope you are too. Let’s conclude today’s discussion by answering this question: “Is Snowflake’s Stock A Buy, Sell, Or Hold Now?“

Concluding Thoughts

As we know, Snowflake is a free cash flow generative business (on a non-GAAP basis); however, the company still has negative earnings. Snowflake’s forward P/S multiple of ~16.4x is much higher than average P/S multiples commanded by cloud software stocks (~8-10x). Snowflake’s growth potential deserves a premium, but I don’t know how much. In the current market environment, Snowflake’s valuation may yet compress further. Due to the bearish technical setup and weak quantitative factor ratings, I am not going to buy a full position in this counter just yet (despite the massive decline in prices over the past couple of months). For now, I will continue the staggered accumulation of Snowflake’s shares per my initial DCA plan as the long-term risk/reward is very much favorable for bulls. At this point, we are buying lower than Mr. Warren Buffett, and that must count for something.

Key Takeaway: I rate Snowflake a buy at $113 per share.

Thank you for reading. Please feel free to share any questions, thoughts, or concerns in the comments section below.

Be the first to comment