stockcam

Introduction

Unsurprisingly, Snap Inc (NYSE:SNAP) is yet again crashing after a quarterly report. In Q2, Snap missed on revenue ($1.11B vs. $1.13B est.) but beat on EPS (-$0.02 vs -$0.03 est.) and DAUs (347M vs 344M est.). While Snap’s Q2 numbers are mixed, a lack of guidance for Q3 is causing panic among investors. As per Snap’s management DAUs are likely to reach 360M by the end of Q3; however, revenue growth (so far in Q3) is flat y/y, i.e., Snap is not growing anymore. The adverse impact of platform policy changes, heightened competition, and a weak macro environment is clearly evident in Snap’s financial performance, and things may get worse before they get better. However, one must wonder if SNAP has a strong enough balance sheet to survive this crisis and get to the other end of this downturn.

SNAP Q2 Was A Horror Show, But DAU Growth Offered Some Consolation

Snap’s results have deservedly received a lot of bearish coverage in the media and on Seeking Alpha (find here), and so I won’t bother you with all the negatives from the report. While more pain is likely for Snap’s shareholders in upcoming months due to its premium valuation, I do see one positive in the report that nobody is talking about. Despite a rapid deceleration in revenue growth rate, Snapchat is still gaining users, with DAUs rising to 347M (up 18% y/y). For Q3, the company is projecting for DAUs to reach 360M (an addition of 13M DAUs). The problem with Snap is not user growth, its monetization, and in my view, this is a fixable problem. Now, will Snap be able to solve this issue? I don’t know; only time will tell. I do like the usage numbers for Spotlight (59% y/y growth) and the potential of Snap’s Maps as an Ad surface, along with Snap’s long-term potential in the emerging AR market.

Is Snap Profitable?

Under tough economic conditions, Snap’s valuation may normalize drastically over the coming months, potentially leading to a good long-term buying opportunity. With that being said, Snap’s ability to get to the promised land (i.e., becoming a free cash flow machine) is in serious doubt due to its continued lack of profitability and lingering business headwinds.

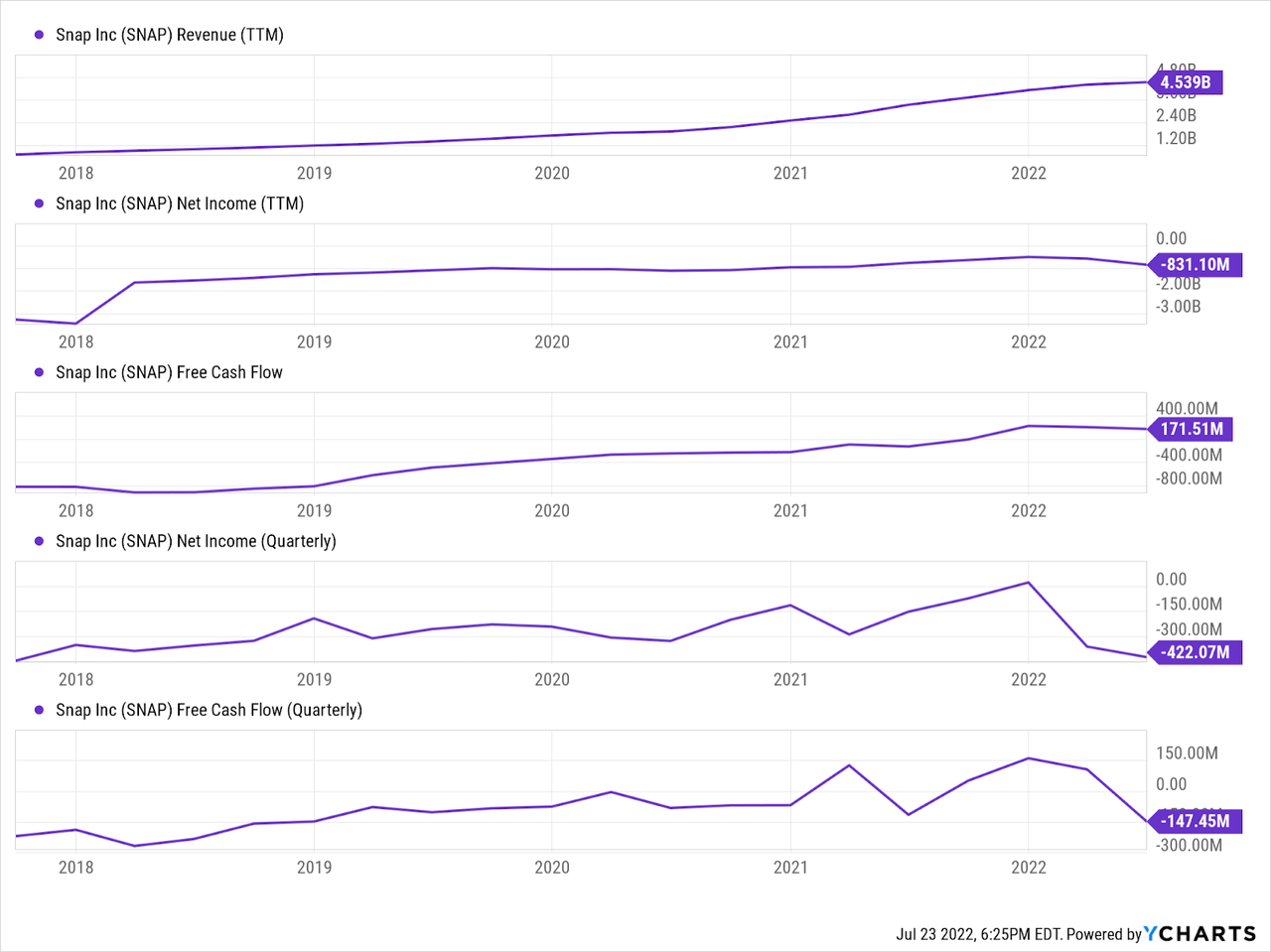

Over the last twelve months, Snap recorded revenue of $4.54B with a net loss of $831M. While most of these losses were a result of stock-based compensation, SNAP is clearly not profitable.

YCharts

Snap seemed to have turned a corner in late 2021 in regards to free cash flow generation; however, the company could once again be back to being a cash-burning furnace by the end of this year. While the FCF figure of -147M in Q2 is somewhat due to cyclicality, Snap is set to lose more money in upcoming quarters as sales growth falls off a cliff and expenses don’t. Snap’s management disclosed the possibility of transition expenses (layoffs), and it is only a matter of time before they need to scale back the excesses accumulated during the growth burst during the pandemic.

What Is Snap’s Debt?

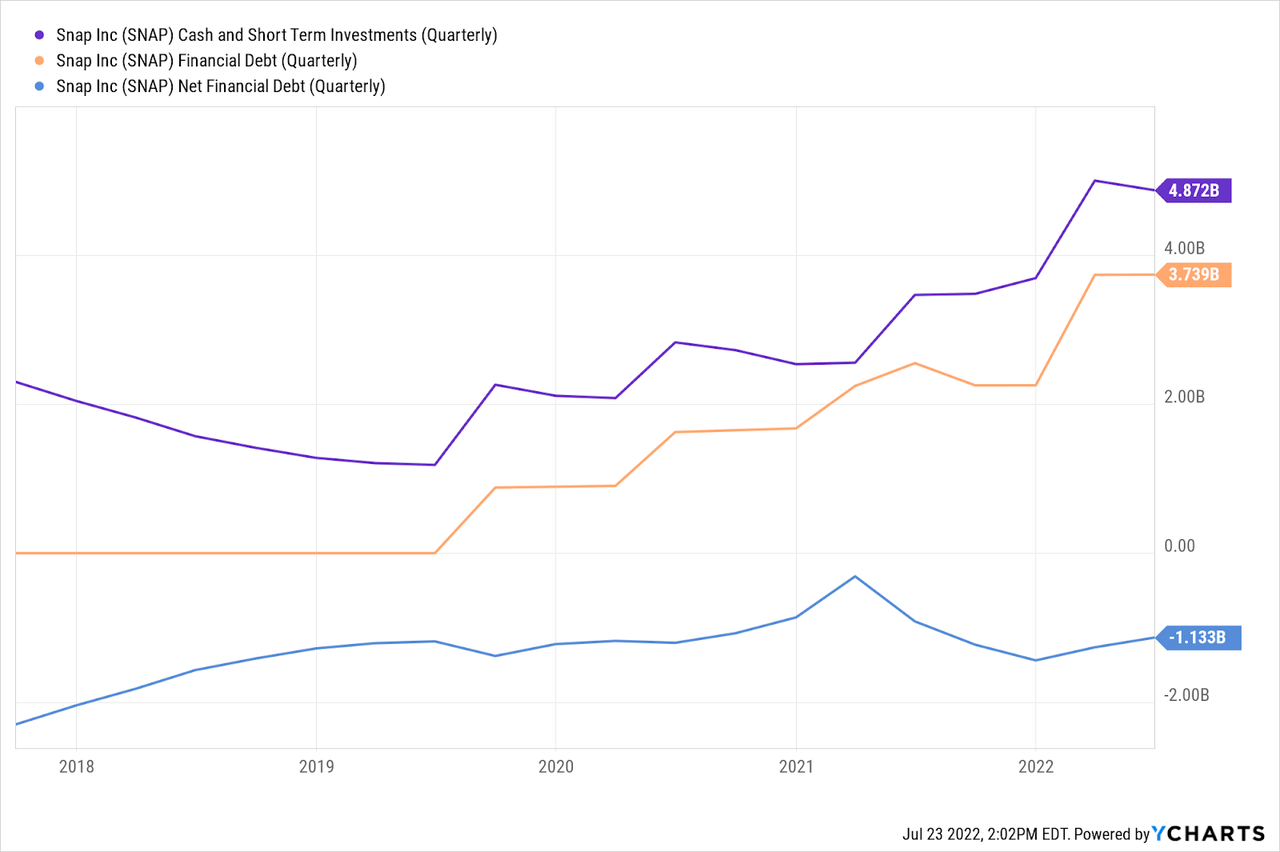

Nearly all of Snap’s investor material highlights its Cash & Short Term Investments of $4.87B to showcase the strength of its balance sheet; however, the company also carries a financial debt of $3.74B. Hence, Snap’s net cash is only ~$1.1B. I say “only” because SNAP is still not a free cash flow generative business.

YCharts

As we saw earlier, SNAP’s Q2 FCF came in at a negative $147M. I know these numbers look especially bad due to cyclicality in SNAP’s cash flows; however, with revenue growth slowing down faster than expense growth, SNAP could burn through a lot of cash over the coming quarters.

Is Snap’s Balance Sheet Strong?

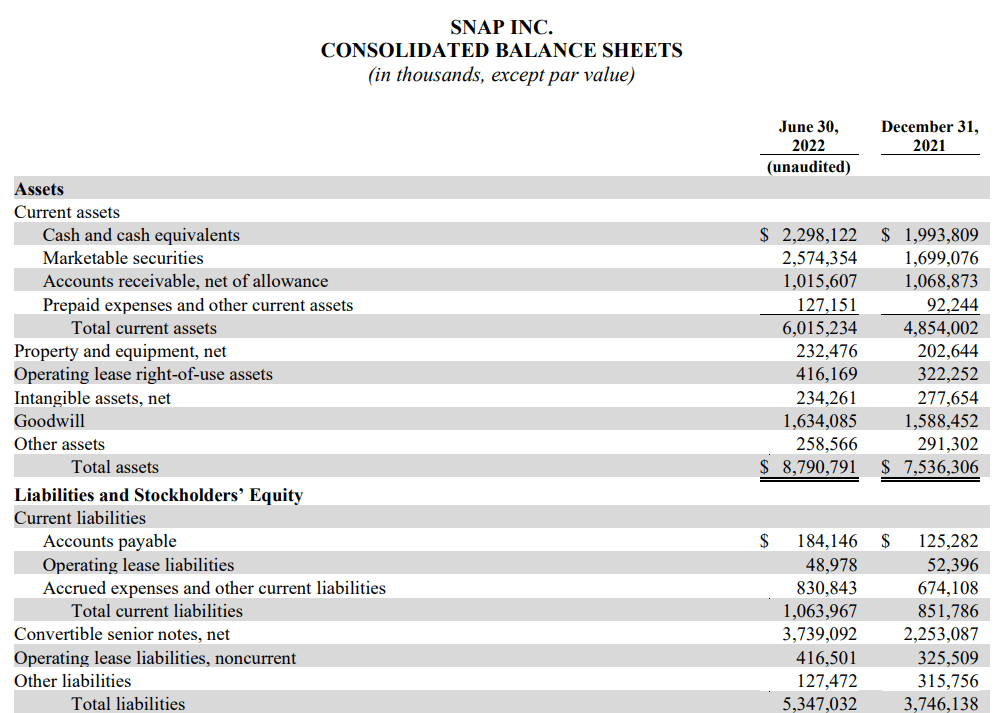

When we factor in Snap’s potential cash burn, its balance sheet starts to look mediocre despite a massive cash position. As revenue growth vanishes, Snap could lose tons of cash over coming quarters. Furthermore, Snap’s board has announced a $500M stock buyback program to limit the effect of stock-based compensation. And then, if we were to see layoffs at Snap, as warned in the investor letter, its balance sheet could deteriorate a lot over the coming quarters.

SNAP Q2 Earnings Press Release

With all of this being said, Snap’s $3.7B debt is convertible, and none of it is due until 2025. Hence, Snap has ample liquidity to ride out an economic downturn (if there’s one over the next couple of years). Overall, I think Snap has a big enough cash cushion to survive the ongoing crisis, but the company may need to tighten up its belt and get to FCF breakeven faster than planned.

Is SNAP Stock Fairly Valued?

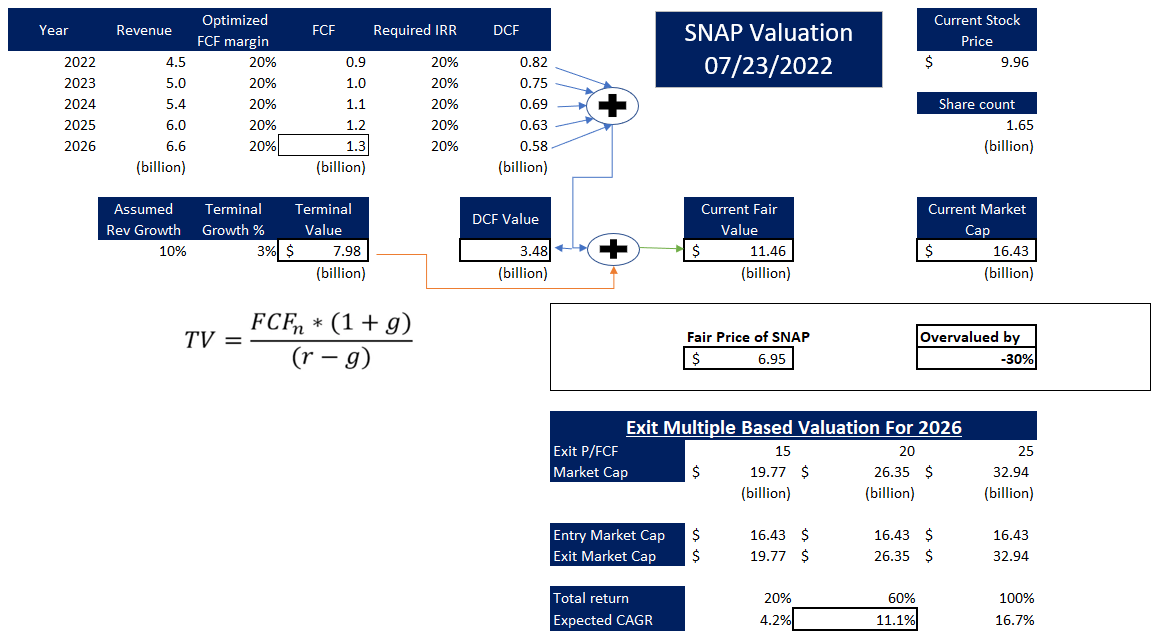

To find the fair value and expected return of Snap, we will use TQI’s Valuation model, which is a simplified discounted cash flow model, with the following assumptions:

|

2022E revenue (ultra-conservative estimate) |

$4.5B |

|

Forward 4.5-Yr Revenue Growth Rate (%) |

10% |

|

Terminal Growth Rate (%) |

3% |

|

Optimized FCF Margin (%) |

20% |

|

Discount Rate / Required IRR (%) |

15% |

|

Exit Multiple [P/FCF] |

15-25x |

Results:

TQI Valuation Model (tqig.org)

Despite assuming a re-acceleration in Snap’s growth to 10% per year (probably too conservative) and basing my valuation on an optimized FCF margin of 20% (a figure SNAP should be able to achieve long-term considering its gross margins of 60%+), Snap’s stock is still overvalued by ~30% [even after the 40% plunge last Friday]. From current levels, SNAP offers a potential CAGR return of just 11.1%, which falls short of our required IRR of 20% (raised from 15% in this case due to risks related to SNAP’s future growth and monetization). Since the expected returns for SNAP fall short of expectations, I rate it neutral (avoid) at current levels.

Concluding Thoughts

Even after a 40% plunge in its stock post-Q2 ER, SNAP remains overvalued by ~30%. In today’s note, we analyzed Snap’s balance sheet, which (for now) looks solid enough to see the company through to the other side of this economic downturn. While SNAP could effectively turn net cash neutral over the next 12-18 months as it burns cash amid a growth slowdown, none of the company’s $3.7B convertible debt is payable until 2025. This leaves ample time for the company to sort out its monetization issues and turn into a robust free cash flow machine (that a social media platform with 350M members must be). From a liquidity perspective, SNAP is in good condition; however, its balance sheet will continue to deteriorate over the near to medium term (especially if the company fails to tighten up its belt during a period of slower growth). The risk/reward on offer here is unattractive, and so, I rate SNAP neutral (avoid) at current levels.

Key Takeaway: I rate SNAP neutral (avoid) at current levels.

Housekeeping Note: I’ll soon be launching a Marketplace service on Seeking Alpha focused on generating long-term outperformance through financial engineering. For a limited period after launch, TQI memberships will be available at a heavily discounted legacy price. If you are interested in joining our community, stay tuned for more updates!

Be the first to comment