akinbostanci

Thesis highlight

I recommend going long DoubleVerify (NYSE:DV) ($26.21 as of this writing). It is a leading player that rides on the strong tailwinds of digital advertising and has the support of several blue-chip customers. Despite the weak macroenvironment today, if one were to look over the longer term, I believe it should continue to grow at high levels for the foreseeable future on a CAGR basis. I expect it to generate $347m EBITDA in FY25, with a 24x forward EBITDA multiple resulting in $52/share of equity value (100% upside).

Company overview

DV provides a software solution for the digital advertising industry that checks to see if an ad has been shown to the right audience in the right place without any fraud or risk to the advertiser’s brand. Ad views are monitored by DV across the entire digital advertising ecosystem, including Walled Gardens and the Open Internet. DV gives clients instantaneous access to crucial metrics regarding the efficacy of their digital advertisements. Customers can then use DV’s data analytics to optimize their media strategies in real time by verifying their best-performing ads and content and to improve the overall efficiency of their digital advertising investments by not wasting money on blocked or fake ads.

DV reports in three segments:

- Advertisers Programmatic (50% of FY21 revenue): When advertisers purchase ad units through programmatic platforms

- Advertisers Direct (41% of FY21 revenue): Marketing clients who buy advertising directly from websites, digital IP owners, publishers, social media platforms, etc.

- Supply-side Customer (9% of FY 21 revenue): Customers who used DV’s data and analytics to validate the quality of their ad inventory.

Investments merits

Large and growing TAM

The advertising industry has shifted away from traditional advertising mediums and toward a proliferation of digital channels and platforms. Previously, digital advertisers had almost no accurate and efficient way of understanding how their digital advertising budget was spent by platforms or advertising space suppliers because they had to rely on inconsistent and self-reported data. In the face of rising threats such as ad fraud and objectionable content, advertisers are increasingly turning to third-party solutions to protect their brand equity and get the most out of their digital media budgets.

Given the efficiency of digital advertising and the way that people consume content today, I think it’s safe to assume that it will continue to see rapid expansion. Magna Global estimates that by 2023, the global digital advertising industry (excluding search) will be worth $225 billion, up from $170 billion in 2020 (DV S-1), as spending shifts further from traditional media to digital channels and platforms. My guess is that people will continue to spend more on digital media as more ways to get it and more ways to advertise it become available.

Accelerating programmatic ad buying is also a factor in the rise of money spent on digital ads. To streamline the digital ad buying process and provide more targeted ads based on large data sets, advertisers are increasingly turning to programmatic platforms to purchase digital media. Spending on programmatic advertising is expected to grow faster than spending on other digital advertising mediums, from an estimated $51 billion in 2020 (30% of total digital advertising spend) to $75 billion in 2023 (33% of total digital advertising spend) (DV S-1). Programmatic advertising is a game changer for many of these digital ad buyers because it gives them constant access to high quality and accurate data, which in turn improves purchasing decisions and optimizes ad efficacy. Also, having access to a single, unified data source from which to make real-time decisions about where to place programmatic ads across all channels and formats is a big reason why programmatic advertising is becoming more popular.

I mentioned that consumers now have more content consumption options than ever before. As new digital channels have emerged, such as social media and connected TV (CTV), advertisers have become increasingly interested in and invested in them. Thus, there is a growing need for precise digital measuring instruments. This is exemplified by the rising popularity of CTVs. As the global linear television media spend, which totals about $150 billion per year, gradually shifts to digital channels, CTV represents a significant new frontier for digital advertising. By 2023, eMarketer predicts, U.S. spending on CTV advertisements will have increased by more than 100% from its 2020 level, reaching over $16 billion, with programmatic platforms reserving over 50% of the available ad inventory (DV S-1). The opportunity for full-suite measurement providers is substantial in CTV because of the channel’s fragmented inventory and emerging ad fraud.

How important is it now to enhance the efficiency and quality of the media? A rise in fraud and wasted ad budgets due to unseen ads is a side effect of digital advertising’s meteoric rise in popularity. Globally, it is predicted that $42 billion, or 24% of all digital advertising spend, was wasted in 2019 due to constantly evolving ad fraud activities like bots, fake clicks, and fraudulent websites (DV S-1). If this statistic holds true, then ~25% of all digital advertising budgets are wasted. New and complex schemes are being uncovered every day, especially in the emerging channels of CTV and mobile in-app. By the end of 2020, DV had uncovered over 5,000 fake CTV apps, and CTV fraud impressions were up 220% from the previous year. Merkle reports that more than 40% of digital ads are ignored because they are not viewable (DV S-1). Advertisers, digital publishers, and media platforms all need reliable measurement tools to check how well their marketing campaigns are working and make sure they only get charged for ads that are actually shown.

Historically, DV has had a solid foothold in the display advertising market. However, through product development and channel expansion, DV has broadened its reach into the social media and connected TV advertising markets. This was a smart and strategic decision as it expands the TAM that DV addresses. Given that DV is competing in a space that is underserved and will experience substantial tailwinds in the near future. I believe DV has a very long runway to continue growing. In fact, according to DV’s estimates, in 2020, it was projected that less than 25% of the world’s population would be using DV’s core solutions; by 2025, that number is projected to grow to around $20 billion, with less than 50% penetration.

Broad ecosystem coverage provides great network effects and tons of data

Complete ecosystem coverage is a key strength of DV. With DV, you can track your performance on all of the most important digital channels, even in closed ecosystems like Google (GOOGL) (GOOG), Facebook (META), and Amazon (AMZN). It’s crucial because mobile devices now account for nearly 70% of all digital advertising expenditures. DV achieves this by collaborating with sites that provide direct, programmatic, and social advertising. As new media formats appear, DV can easily incorporate them into its ecosystem and find new integration partners to use as sales channels for its solutions. The case of CTV is just one illustration of this phenomenon. Some of the most popular CTV services, like AMZN and Roku (ROKU), have approved DV measurement solutions and formed partnerships with DV.

DV’s wide coverage, large user base, and unique place in the ecosystem have all contributed to a significant network effect. It would take years for new entrants to catch up. This gives DV a significant and growing competitive advantage that allows it to maintain its leadership position. DV is able to amass a sizable data asset as it monitors more and more media transactions. DV’s ability to leverage the billions of data points it collects every day across its existing solutions and to expand the data asset to launch new solutions to address advertisers’ evolving needs is a direct result of the insights it has gained from this data. With this positive feedback loop, DV is able to get better and better results as it adds to its data sets and improves its value to customers.

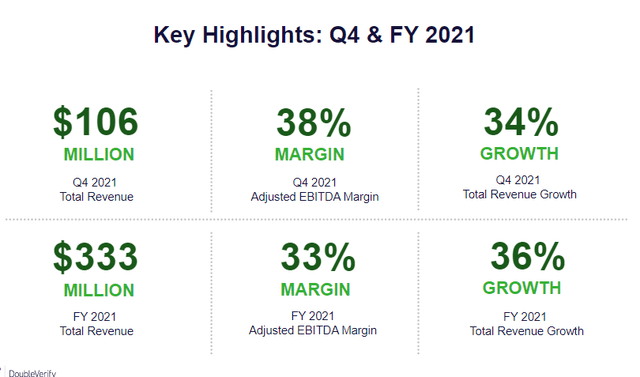

Attractive unit economics with several blue-chip customers

The DV software solution is supported by many of the world’s largest and most well-known advertisers, including Colgate-Palmolive (CL), Ford (F), Mondelez (MDLZ), and Pfizer (PFE). The fact that the DV solution has consistently maintained a net revenue retention rate of more than 100% and a gross revenue retention rate of more than 95% gives me even more confidence in it. All of these incredible results are only useful if DV is a profitable business, which it is. DV is already profitable on an adjusted EBITDA basis as of FY21 and has continued to grow revenue at a rapid pace (36% growth in FY21).

Valuation

Price target

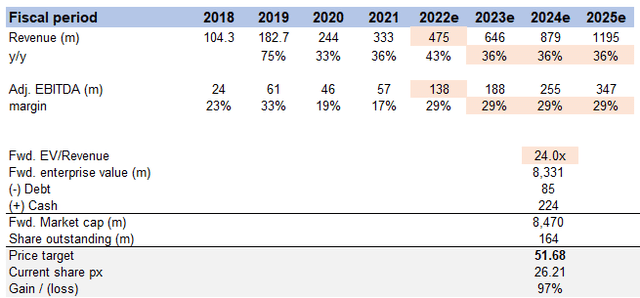

My model suggests a price target of ~$52 or ~100% upside from today’s share price of $26.21. This is on the basis of high 30s% growth from FY21 to FY25, an exit adj. EBITDA margin of 29% and a forward EV/EBITDA multiple of 24x. My assumptions for FY22 are based on management guidance, which I have full confidence in, given that they raised guidance in the 2Q22 earnings call.

Image created by author using data from DV’s filings and own estimates

Revenue growth

My model assumes DV to grow as per management guidance in FY22 (mid-point), and DV to continue growing at a similar pace as historically from FY22E to FY24E. I expect DV to continue enjoying strong tailwinds, I believe growing at historical rates is very plausible. There might be some blips over the years, but on a CAGR basis, it should be fairly consistent as history.

EBITDA margin

I believe DV can hit management guidance of 29% adj. EBITDA margin in FY22, and I conservatively assumed EBITDA margins would stay flat at 29% given that DV will need to continue reinvesting in the business to grow (which is the right choice).

Valuation multiple

DV currently trades at 24x forward EBITDA, and I assume this valuation to hold until FY25. I do not believe that DV can trade back to historical levels within the short-term given how the market is in a risk-off environment.

Risks

Very competitive market

There is a lot of rivalry in the digital advertising market, with everyone trying to increase their share of customers. I expect competition to remain fierce as new software is developed to address market needs. The world is developing at a rapid pace. The size of the digital advertising industry itself will continue to bring in competition, both from new, innovative solutions and from companies that have been in business for a long time and have strong balance sheets and services that can connect them to the digital advertising industry.

Economic downturn

The digital advertising sector’s robustness is indicative of the state of the economy as a whole. When times are good, businesses increase their marketing spending to increase revenue and market share, but when times are bad, marketing budgets are often the first to be cut to conserve cash. Consequently, DV relies heavily on the growth of its customer base and the prosperity of its integration partners as well as the need for digital advertising measurement and authentication. Customers of DV may cut their advertising budgets or slow the growth of how much they spend on digital ads if there are economic downturns or unstable markets in the markets and areas that DV serves.

Long sales cycle

It is difficult to predict when DV will generate revenue from new customers due to the long sales cycles that are common due to the nature of DV’s customers. Since DV’s quarterly sales or billings may not be consistent, this makes it harder for consensus or sell-side analysts to model.

Conclusion

To conclude, I believe DV is worth ~100% more than its value today ($26.21 as of writing). DV should continue to grow at a very high rate given the strong industry tailwinds and its leading position. As DV continues to grow, its network effect will continue to strengthen, thereby increasing the lead between itself and competitors. Overall, as DV continues to capture market share in this rising TAM, we should see continuous positive financial performance.

Be the first to comment