Valerii Apetroaiei/iStock via Getty Images

Investment thesis

Dorman Products (NASDAQ:DORM) is expanding through an aggressive M&A strategy at a time when its profit margins have been significantly reduced as a result of the current macroeconomic landscape characterized by supply chain issues, inflationary pressures, and labor shortages. As a consequence, the long-term debt has reached a level that will set the course for the next few years.

Still, the company was generating enough cash from operations to cover both current interest expenses and capital expenditures before the coronavirus pandemic crisis, and now that net sales are expected to grow by 83% in 2022 compared to 2019, paying down the ~$800 million in debt should be reasonably easy once headwinds partially ease. But as a consequence of the increase in debt, the fall in margins, and the fear that the conflict between Russia and Ukraine will escalate to other geographies, as well as recessionary fears, the share price declined by 34.24% from all-time highs reached in November 2021. Furthermore, the PS ratio declined by 54% compared to May 2017, when it reached the highest peak of the decade, and this is despite higher expected net sales for 2023.

For these reasons, I believe Dorman products deserves to be taken into consideration as the upside potential seems reasonably high given the current level of pessimism among investors despite the enormous growth experienced in recent years.

A brief overview of the company

Dorman Products is a leading supplier of replacement parts and fasteners for passenger cars and light-, medium-, and heavy-duty trucks in the automotive aftermarket industry. The company owns the DORMAN and Dayton Partsbrands, as well as several sub-brands, under which it markets over 118,000 distinct components.

Under the DORMAN brand, it manufactures automotive aftermarket replacement parts, including fluid reservoirs, variable valve timing components, complex electronics, and integrated door lock actuators. It also manufactures small automotive replacement parts that are primarily sold in retail storefronts such as door handles, keyless remotes and cases, and door hinge repair parts. The company also manufactures lighting, cooling, engine management, wheel hardware, air tanks, and cab products for class 4-8 vehicles. And finally, it provides a wide range of electrical components for common repairs as well as customization and upgrading solutions for vehicles. Under the Dayton Parts brand, the company offers brake, spring, steering, suspension, driveline, and hitch & coupling product lines.

Dorman logo (Dormanproducts.com)

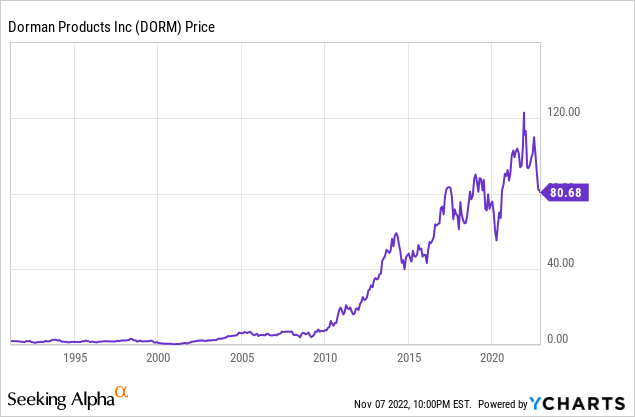

Dorman Products was founded in 1978 and its market cap currently stands at $2.49 billion, employing around 3,360 workers. It has certainly delivered astounding returns to shareholders in the form of capital gains over the years thanks to the continuous launch of new products to the market and acquisitions, as well as the share repurchases that have taken place during the past decade. Insiders own 16.47% of the shares outstanding, so their interests are aligned with the interests of the shareholders.

Currently, shares are trading at $80.68, which represents a 34.24% decline from all-time highs of $122.69 on November 23, 2021. This drop in the share price is the consequence of a significant decline in profit margins at a time when the company has taken on massive debt to fund two major acquisitions: Dayton Parts in 2021 and Super ATV in 2022. Both acquisitions are poised to raise the company to a level never seen before, but at the same time, the debt taken is putting its financial stability at risk since the current macroeconomic landscape is marked by supply chain issues, inflationary pressures, and labor shortages. That is why it is important to see things with perspective and assess what is the company’s situation in the long term because we could be in front of a good opportunity to acquire shares at a reasonable price.

A company in continuous expansion

In recent years, the company has expanded through the acquisition of other businesses. In 2017, it acquired MAS Automotive Distribution, a manufacturer of premium chassis and control arms based in Canada, for $67.2 million, a minority equity interest in a supplier for $10 million, and certain assets of Ingalls Engineering for $3.1 million. Later, in 2018, the company acquired Flight Systems Automotive Group, a manufacturer and remanufacturer of complex automotive electronics and diesel fuel system components based in Pennsylvania, for $27.5 million, and also acquired a minority interest in a vehicle diagnostic tool developer for $5 million.

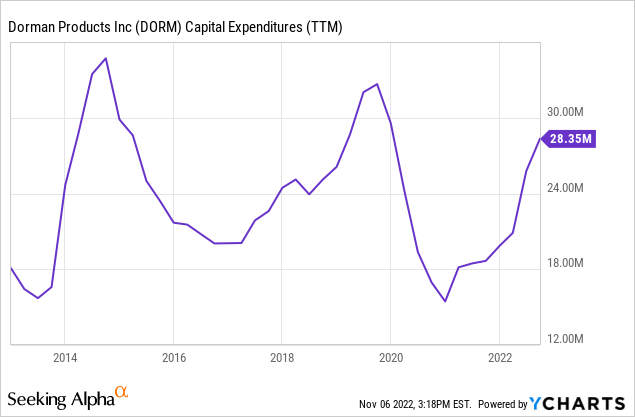

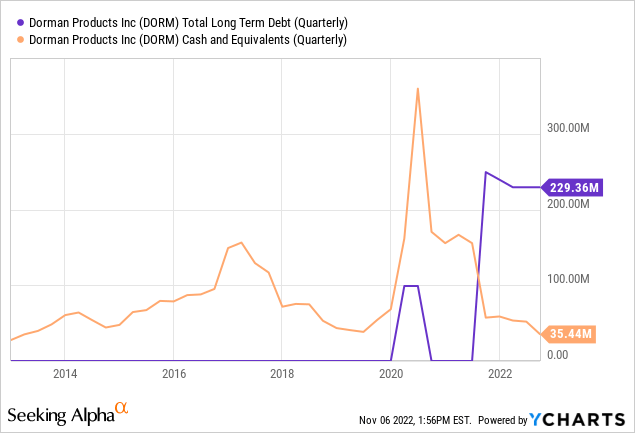

Then, in August 2021, the company made a major acquisition when it announced the purchase of Dayton Parts, a manufacturer, marketer, and distributor of after-market components, including brake, spring, steering, suspension, driveline, and hitch products in the United States and Canada, for ~$338 million ($100 million from cash on hand and the rest through debt). Before this acquisition, the balance sheet was debt-free, although the over $200 million of long-term debt taken did not imply too much leverage for the company since it was an easily payable amount given the massive amounts of cash that the company generates year after year of around $100 million, which are more than enough to cover around $30 million capital expenditures per year.

But even so, in October 2022, the company acquired Super ATV, a designer, manufacturer, marketer, and distributor of Powersports aftermarket components including suspension, steering, portal gear lifts, lighting, storage, vehicle protection, drivetrain, maintenance, accessories, and other product lines under a wide range of brands, including Assassinator Tires, Assault Industries, Black Ops, EZ STEER, Gear Driven Performance, Intimidator Tires, Keller Performance Products, RackBoss, REV1, Rhino, SandCat, Terminator Tires, Warrior Tires, X300, and XR Optic. The company paid $490 million, plus a two-year earn-out of up to $100 million based on performance targets.

The company also spends relatively high amounts of cash in order to continuously launch new products to the market, of which a big portion are aftermarket-exclusives, giving the company an edge. In this sense, and due to the two new acquisitions made in 2021 and 2022, we could determine that the capital expenditures are approximately $30 million per year, but could get higher as the company pours cash into the newly acquired businesses.

Every month, the company launches many new products in order to keep its catalog as updated as possible and maintain healthy profit margins thanks to the exclusivity of a large part of these products. As an example, in August 2022, the company launched 300 new auto parts, launched 200 new motor vehicle parts in September, and launched over 400 new motor vehicle parts in October in order to increase coverage for SUVs, EVs, and Heavy-Duty Trucks.

Net sales are taking off

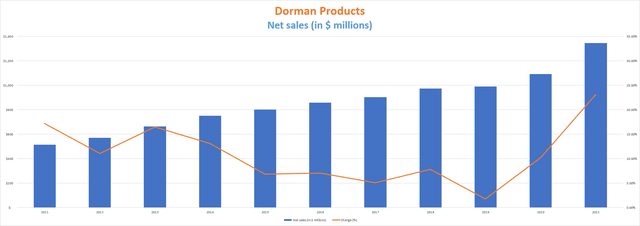

Over the years, Dorman Products has managed to increase its net sales at a very acceptable rate thanks to its constant efforts to expand its product catalog offerings, as well as the recent acquisitions that took place since 2017. Net sales increased by 10.23% year over year in 2020 despite the coronavirus pandemic crisis, and by 23.11% during 2021 boosted by the Dayton Parts acquisition.

Dorman Products net sales (10-K filings)

The company reported a net sales increase of 39.43% year over year during the first quarter of 2022, 34.38% during the second quarter, and 18.67% during the third quarter, and estimates for the full year currently stand at $1.67 billion, which would represent a ~24% increase compared to 2021. For 2023, estimates are at $1.96 billion, which would represent an additional increase of 17%. Still, I expect a slower pace thereafter as the company now has a debt load to take over.

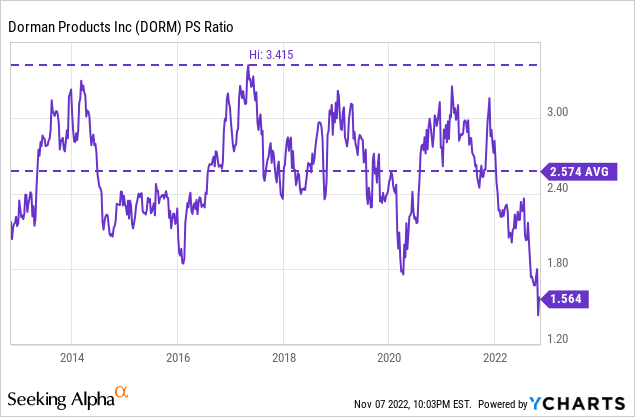

The recent drop in the share price despite high sales growth has caused a sharp decline in the price-to-sales ratio, which currently stands at 1.564.

This means that the company generates annual net sales of $0.64 for each dollar held in shares by investors at the current share price. This ratio is 39% lower than the average of 2.574 during the past decade and 54% lower than the spike of 3.415 reached in May 2017, which means that investors are less willing to pay for the company’s sales as a consequence of declining margins and increasing debt.

Using 2021 as a reference, 40% of net sales are provided by operations of the Powertrain product line, whereas 34% are provided by Chassis operations, 21% from Automotive Body, and 4% from Hardware. Around 94% of the company’s net sales took place within the United States in 2021, which means geographic diversification is very limited. Nevertheless, around 56% of the company’s net sales take place in automotive aftermarket retailers, whereas 33% are provided by warehouse distributors and 11% by the heavy-duty channel.

Margins are suffering the consequences of the current macroeconomic landscape

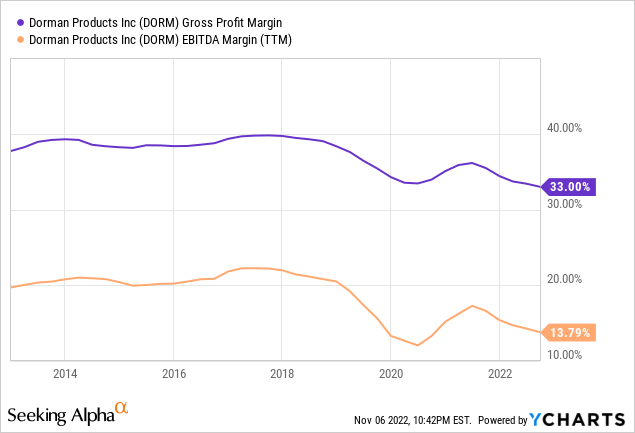

Thanks to the continuous launch of new products, of which a large part is exclusive, the company manages to maintain very healthy profit margins year after year. Currently, the trailing twelve months’ gross profit margin stands at 33%, whereas the EBITDA margin stands at 13.79%. This is significantly lower than the ~40% gross profit margin and ~20% EBITDA margin that the company was used to prior to the coronavirus pandemic in 2020.

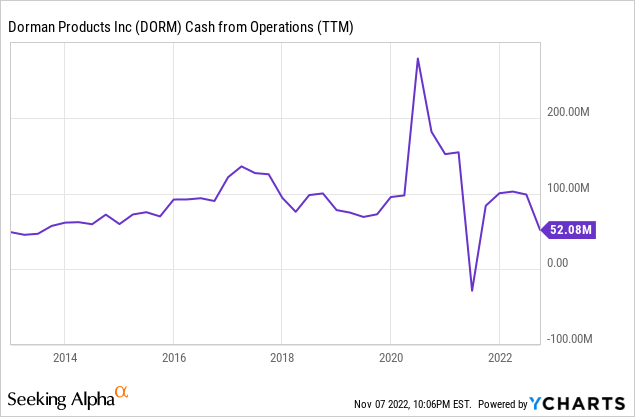

Things got even worse during the third quarter of 2022 as the company reported a gross profit margin of 31.90% and an EBITDA margin of 12.95%, both lower than the current trailing twelve months’ margins, confirming the continuation of the negative trend. This has caused a decline in the company’s cash from operations during the past twelve months to just $52.08 million.

Still, inventories increased by $202.4 million during the same period. Nevertheless, accounts payable increased by $49.3 million while accounts receivable declined by $29.9 million. Even after subtracting those $79.2 million from the increase in inventories, both cash from operations and the increase in inventories are more than enough to cover the average capital expenditures of $30 million per year and the excess that should be expected as a consequence of recent acquisitions. If we look at the last quarter, cash from operations of -$8.0 million is widely offset by an increase of $43.1 million in inventories, an increase of $15.8 million in accounts receivable, and a $4.3 million decline in accounts payable. In this sense, the company’s operations seem very stable given the current macroeconomic landscape.

The problem now is in the level of debt taken after the last two acquisitions of 2021 and 2022, which will mark the future of the company in the coming years.

Debt is skyrocketing, and the company needs to pay it down to keep going

The company enjoyed a debt-free balance sheet since 2010. Then it took over $200 million of long-term debt in order to fund the acquisition of Dayton Parts and was left with cash on hand of just slightly over $50 million.

Now, the acquisition of Super ATV, for which Dorman paid $490 million, plus a two-year earn-out of up to $100 million based on performance targets, is poised to raise the debt to over $700 million, which is serious business.

Still, it is very important to look at things with perspective. On the one hand, the company was already generating enough cash from operations to manage current debt levels prior to the coronavirus pandemic crisis. On the other hand, both acquired businesses will generate cash from operations on their own, especially when current inflationary pressures and supply chain issues ease (at least partially). Therefore, I consider that a debt of ~$800 million is assumable by the company since we must not forget that the cash from operations used to be around $100 million per year before the coronavirus pandemic crisis (not counting the cash generated by Dayton Parts and Super ATV) while capital expenditures rarely exceeded $30 million.

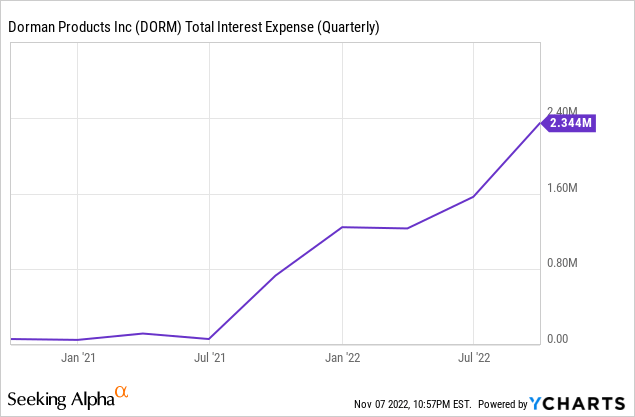

Even so, from now on, we must take into account the company’s interest expenses. During the third quarter of 2022, the company paid $2.34 million in interest expenses, while long-term debt was at $229.36 million. This would represent an annual expense of over $9 million. Therefore, investors should expect interest expenses of around $40 million per year, and therefore, the company must generate over $70 million in order to cover both interest expenses and capital expenditures, plus enough surplusses after that in order to pay down its debt pile.

To achieve this, one of the first measures that I believe the management will consider will be a temporary freeze on share buybacks, with which the management has been rewarding shareholders to this day. With this, the company would save over $30 million per year and cover almost all the interest expenses. Still, it is not yet clear that this will be necessary, but it should rather be considered as a bullet in the chamber.

Share repurchases as a way of rewarding shareholders

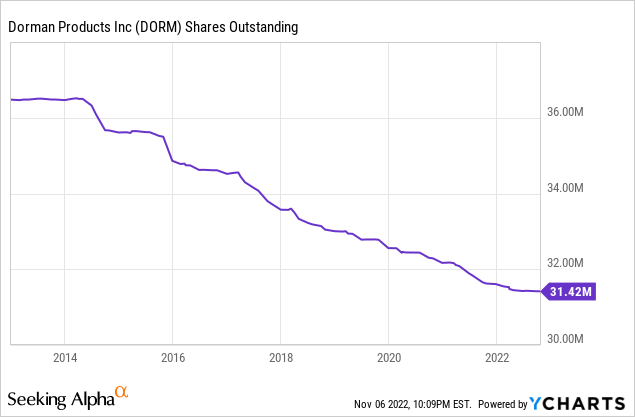

The company has successfully reduced the number of shares outstanding over the past decade by 13.87%. With this, each share represents an increasingly larger portion of the company since all the company’s results are divided among fewer shares, thus increasing per-share metrics.

Share buybacks are a more flexible way of returning cash to shareholders than dividends, as their rhythm can be modulated over the years based on performance. By contrast, reducing a dividend when it is actually needed has more severe consequences on the price of a company’s shares, as it is usually considered something that anticipates bad news.

Risks worth mentioning

- The company’s debt has risen to significantly high levels as a result of the acquisitions of Dayton Parts and Super ATV. From now on, the company will have to face an interest payment on the debt of ~$40 million every year, which will increase the risk in case profit margins continue to fall and will also partially limit future growth as some of the company’s profit will be used to cover interest expenses.

- Two such large acquisitions (Dayton Parts and Super ATV) in a short time frame bring the risk of the management not being able to successfully integrate their operations into the company’s operations or achieve enough synergies as expected.

- And lastly, I would like to remind investors that the company needs cash to cover both interest expenses and capital expenditures. If profit margins continue to decline due to a worsening of the already complex macroeconomic landscape, all the risks related to the company’s debt pile will increase significantly, which could weaken the company’s operations in the medium term.

Conclusion

Dorman Products is in a delicate situation, and hence the share price has fallen by 34% in one year. The company recently took massive debt in order to make two major acquisitions, one in 2021 and another in 2022, and declining profit margins as a consequence of supply chain issues, inflationary pressures, and labor shortages are jeopardizing the company’s ability to pay the said debt in a reasonable time.

Still, cash from operations was high enough prior to the coronavirus pandemic crisis, and although margins are temporarily depressed by the current macroeconomic landscape, current cash from operations is not so bad and the two acquired businesses will deliver new sources of cash from operations from now on, with which the debt should be able to be paid relatively easily in the coming years. Furthermore, the company has the possibility of pausing share buybacks, which would save enough cash to cover almost all the interest expenses.

For that reason, and because sales continue to rise while the price-to-sales ratio continues to decline, I believe this represents a good opportunity to acquire shares at a reasonable price as the current price-to-sales ratio suggests that potential capital gains when shareholder pessimism fades as current headwinds improve and debt is reduced are very significant.

Be the first to comment