Michael M. Santiago

DoorDash, Inc. (NYSE:DASH) is a TechStockPros favorite. Our bullish sentiment on the stock is based on our belief that DoorDash’s pullback creates an attractive entry point to invest in the company’s 2023 growth catalysts. We believe DoorDash’s 62% YTD drop results from the company losing its pandemic catalysts. The company witnessed orders soar during the pandemic as customers relied on DoorDash for food delivery while COVID restrictions constrained customer access to restaurants.

We’re constructive on the company, as we expect the post-pandemic weakness has been factored into the stock, for the most part. We believe DoorDash is better positioned to beat expectations and grow meaningfully as it expands into the European marketplace. We recommend investors don’t shy away from the company based on its YTD pullback and instead take advantage of the opportunity to invest in a major food-delivery technology platform at a discount.

Food delivery industry breaking up with the pandemic

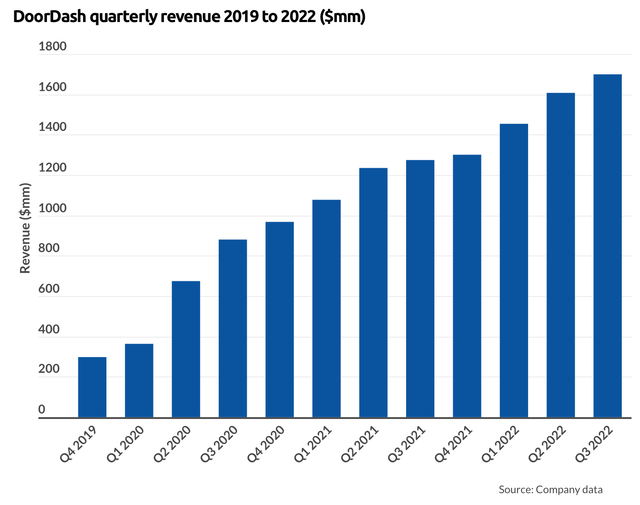

We believe DoorDash took a hit as we globally moved out of the pandemic environment. DoorDash is a technology company connecting customers conveniently with the best of their neighborhood businesses. The company surged nearly 51% between January and December of 2021. The company’s revenue grew by 69% in 2021 alone. We believe the company’s growth was the result of increased customer demand for access to restaurants and businesses under the COVID lockdown. In the post-pandemic environment, we’re seeing the number of total orders slowdown, with the most recent November quarter reporting 439M compared to 426 a quarter earlier.

The following graph outlines DoorDash’s quarterly revenue between 2019-2022.

While DoorDash stock crashed in the post-pandemic environment, we believe the company is better positioned now to beat expectations and grow meaningfully. The company has forecasted the 4Q22 gross order value to be $14.1B, around $400M above the consensus forecast. Our bullish sentiment is based on our belief that the post-pandemic weakness has been priced into the stock, and DoorDash will likely outperform.

Growth drivers to boost order volumes

Now, we expect the food-delivery giant to grow meaningfully as it replaces the pandemic catalyst with new growth drivers, namely geographic expansion and non-restaurant services to leverage customers.

Geographic Expansion:

DoorDash exists not only in the U.S. and Canada but also across Japan, Australia, and Germany. We’re constructive on DoorDash’s expanding marketplace. During 3Q22, DoorDash’s international marketplace grew by over 50% Y/Y. We expect DoorDash’s recent combination with Wolt will allow the company to further expand into new marketplaces and offset weak consumer spending in the U.S. We expect the Wolt acquisition will drive growth in DoorDash’s marketplaces outside the U.S. and recommend investors buy the stock before it rallies.

Growth in the non-restaurant category:

We expect DoorDash’s expansion beyond restaurants will help the company retain current customers and leverage new ones with new services. DoorDash’s non-restaurant marketplace grew over 80% Y/Y during 3Q22. The company is seeing a growing number of first orders from non-restaurant categories. We expect the non-restaurant category to continue to drive growth going forward.

We expect the international expansion, coupled with the new non-restaurant category, to replace the pandemic as DoorDash’s new growth drivers.

Winning the food delivery war

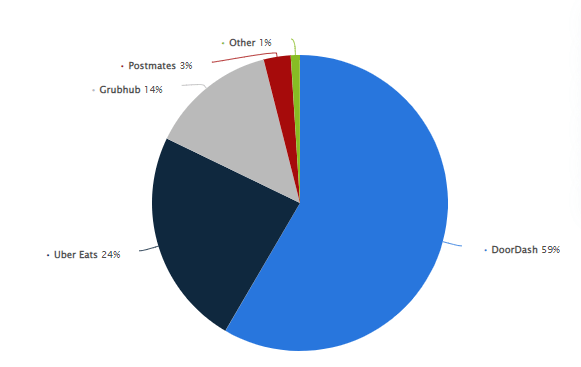

We’re bullish on DoorDash’s position within the food-delivery industry, estimated to grow at a CAGR of 18.9% between 2022-2030. While DoorDash faces stiff competition from UberEats (UBER) and GrubHub (OTCPK:JTKWY), we like the company’s position within the market. DoorDash dominates the U.S. online food delivery market in the U.S. with a 59% market share as of March 2022. While the stock has had a rough year, we expect DoorDash’s position within the market to enable the company to beat expectations going forward.

The following graph outlines DoorDash’s market share among online meal delivery companies in the U.S.

Statista

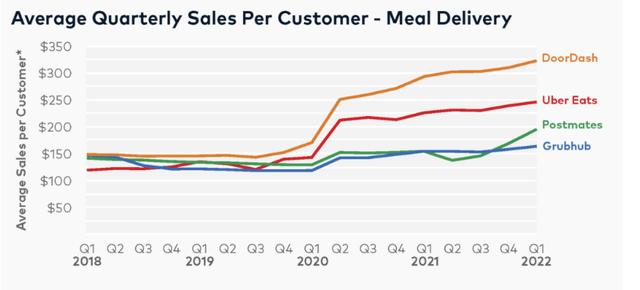

We’re also constructive on DoorDash based on its average sale per customer. We believe DoorDash’s neighborhood-friendly model focused on empowering local economies enables it to retain users and grow significantly on the back of customer loyalty. We expect the company to also grow as the macroeconomic headwinds ease. We attribute part of DoorDash’s YTD decline to weaker consumer spending as fewer people opt to order out during tough financial times.

The following graph outlines DoorDash’s average quarterly sales per customer.

Stock performance

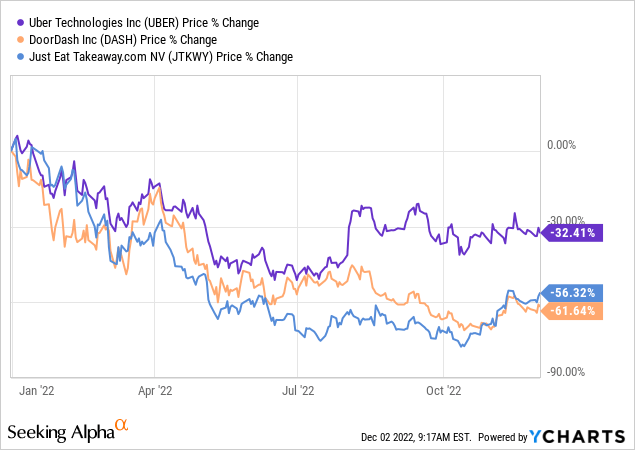

DoorDash went public right before the pandemic environment unfolded in late 2020. We’ve never seen the stock perform outside the pandemic environment until recently. YTD, the stock is down around 62%. We don’t believe the stock’s YTD decline is the result of any shortcomings from the company itself; instead, we attribute them to the weak consumer market in the post-pandemic environment.

UberEats, DoorDash’s largest competitor, is also in the negative YTD, dropping nearly 32%. Yet, we believe it’s not fair to compare the two stocks as Uber stock reflects both its driver-riders segment, as well as its UberEats segment. GrubHub, acquired by Just Eat Takeaway.com, declined around 56% YTD. We expect the stock to rebound now that the weakness has been priced in and recommend investors buy the stock at a discount.

The following graph outlines DASH’s YTD performance compared to the competition.

TechStockPros

Valuation

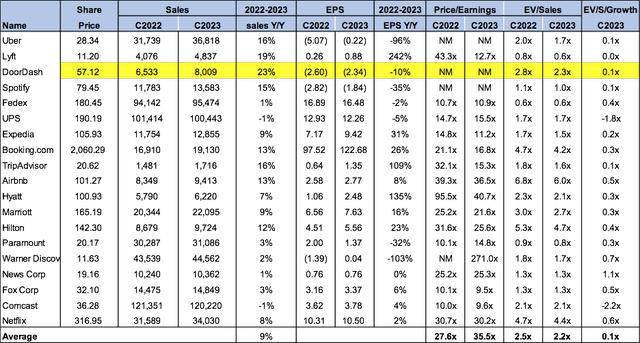

We believe DoorDash stock is reasonably priced. On an EV/Sales basis, the stock is trading at 2.3x C2023 EPS ($2.34) compared to the peer group average of 2.2x. We believe DoorDash provides an attractive entry point at current levels to invest in one of the largest food-delivery companies.

The following table outlines DASH’s valuation alongside the peer group.

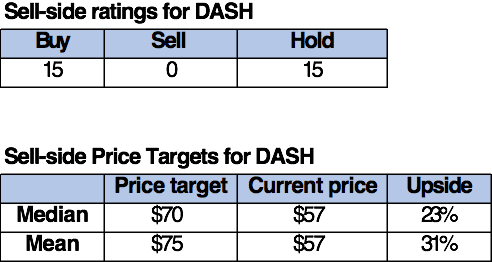

Word on Wall Street

Wall Street is torn on the DoorDash stock. Of the 30 analysts covering the stock, 15 are buy-rated, while the remaining are hold-rated. We attribute the lack of consensus on DoorDash to be the result of hesitation about the company’s performance post-pandemic. The stock is currently trading at $57. The median sell-side price target is $70 while the mean is $75, with a potential 23-31% upside.

The following table outlines the sell-side ratings and price targets on the stock.

TechStockPros

What to do with the stock

DoorDash stock rallied around 16% the day after announcing its 3Q22 earnings, in which the company reported a 33.9% jump in revenue Y/Y despite losing its pandemic growth catalysts. We expect DoorDash to rebound meaningfully after dropping around 33% from its 52-week high of $171. We believe the company is adapting to the post-pandemic environment and introducing new growth drivers: geographic expansion and non-restaurant categories. We believe the stock is reasonably priced and recommend investors buy DoorDash, Inc. at current levels.

Be the first to comment