LeoPatrizi

fuboTV (NYSE:FUBO) has caught the attention of investors, likely due to its consumer-facing product and the fact the stock has popped several times, creating tremendous allure from a short-term gains perspective.

Maybe you can time the market or exactly when a meme stock is going to rocket to the moon, but I can’t. Call me old fashion, but I still rely on searching for undervalued companies with strong revenue growth, high gross margins, and the ability to generate positive cash flows.

Given FUBO’s nearly 80% fall in price this year, I wanted to see if this company checked any of the boxes that make a great long-term investment opportunity.

Q2 Earnings Analysis

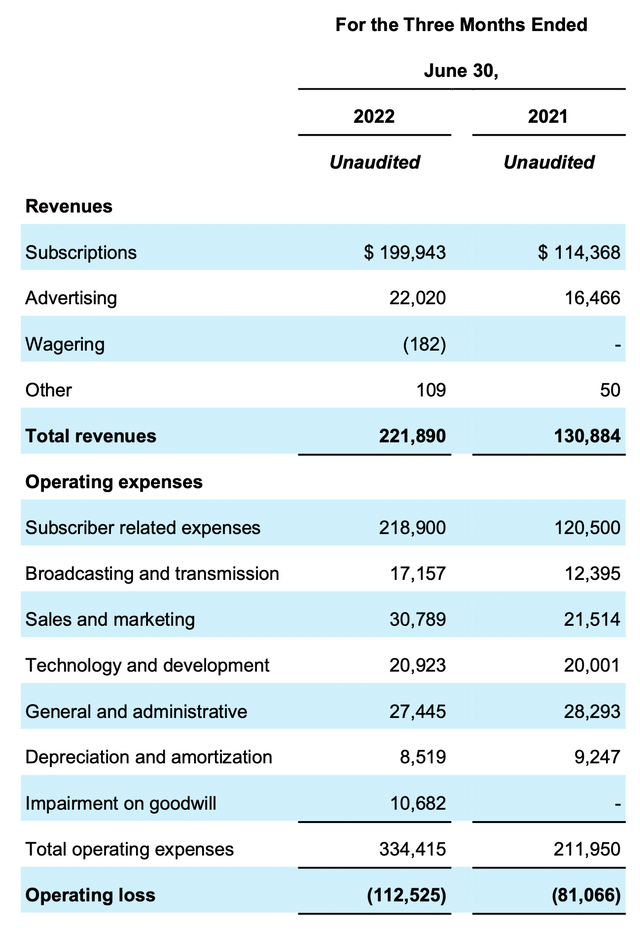

FUBO reported Q2 on August 4th. Revenue grew 70% Y/Y, however, that did miss expectations. Not only that, Q3 revenue outlook and full-year guidance came underneath expectations.

The difficulty for FUBO to generate operating profits isn’t unique. Over the years, I’ve analyzed DirecTV and other broadcast platforms. The owners of the content hold most of the leverage, especially in an era where distribution platforms are far more plentiful than in decades past.

We see evidence of this on the Subscriber-related expense line. Total revenues grew 70% from $114M to nearly $200M. However, the subscriber-related expenses – which are content rights to the media companies like Disney (DIS) for ESPN – went up 80%!

This puts FUBO in a tough spot. The company is never going to achieve high gross margins from the subscription business because the hurdle to switch from FUBO to a competitor like Google’s (GOOG, GOOGL) YouTube TV is far less than traditional cable/satellite providers enjoyed in a different era.

Consequently, FUBO is always going to operate on razor-thin margins from the subscription side of the business. This is why the other streams of revenue are going to make or break FUBO in the long run.

Encouraging for investors is the fact that ad revenue Y/Y was up 32% to over $22M. That’s ultimately where some positive gross profits will come from as the subscriber business doesn’t have pricing power.

Sportsbook

FUBO also recently announced it wasn’t going to develop a sportsbook offering on its own. A decision the company should have come to at the start – considering many casinos outsource the sportsbook operations to a third party like William Hill or DraftKings (DKNG).

Ultimately, partnering with a major provider will cut down the time to market and dramatically reduce cost. FUBO would be wise to move quickly, as the start of the NFL season is just weeks away. However, integrating a sportsbook seamlessly with a partner is likely difficult, and I view this as a missed opportunity.

Additionally, sportsbooks have relationships already in place with sports leagues, ESPN and other major media outlets. It might be complicated, or downright not contractually possible to partner with FUBO.

In short, FUBO is never going to achieve high gross margins from subscribers alone. The advertising & sportsbook will need to scale up in order for FUBO to achieve anything other than a low multiple on sales. Given the company’s lack of experience and cash flows, I wouldn’t expect miracles anytime soon.

Fundraising

It’s no mystery that FUBO needs to raise money. The company’s CFO said as much at a shareholder event this week.

When we ultimately decide to raise capital, we expect to maintain optionality and we’ll use the most efficient means possible

FUBO CFO John Janedis

Looking at the company’s cash flow paints a bleak outlook. FUBO needs to raise money likely by the end of Q4.

| Cash | $273M |

| TTM Cash Burn | ($323M) |

Ideally, FUBO would be swept up in a “meme stock” short squeeze, as the 30% short interest could create a spike in FUBO shares; something that’s materialized before. A follow-on offering at a higher price would be ideal for existing shareholders.

I want to be clear, however. I’d never recommend buying a stock from a fundamental perspective based on the fact the company might be able to raise money because of a short squeeze.

A short squeeze fueled fundraise is a short-term cure to a larger problem with FUBO’s business model. However, it’s occurring with some regularity in these markets that it’s worth noting in the realm of possibilities.

Absent of a short squeeze/follow-on offering, FUBO will be at the mercy of the markets. Companies with negative margins, cashflows and no superior competitive advantage might find the debt markets closed or with steep borrowing costs. An equity raise on a stock trading under $10 is also dicey.

Ultimately, the risk is far too high to hold this stock before clarity on where the next fundraising round comes from.

Earnings Estimates

FUBO announced Q3 guidance between $200M – $205M or roughly 29% growth from the midpoint. For the full year, revenues are expected between $910M – $930M roughly 45% growth.

Looking out is difficult considering the macro environment, but also FUBO specifically with the ad business and sports book essentially in infancy. However, analyst estimates are for $1.23B in revenue in 2023, or roughly 30% growth.

With a valuation hanging in the $1B range, FUBO is obviously not wildly overvalued from a revenue perspective. However, difficult to expand that multiple given the state of the fundamentals.

Acquisition Target

Additionally, one could imagine FUBO being an acquisition target given the dramatic price decline, however, it’s difficult to think of the potential buyer.

Certainly, a sports book like DraftKings or MGM (MGM) could entertain owning an integrated media and betting platform. However, FUBO’s only proprietary asset is the streaming software, so the acquirer would need to see value in that. Additionally, a sports book might alienate existing relationships with leagues and other media networks if it were to buy FUBO.

Finally, a media company has little use for FUBO as it already has the technology stack and its own direct to consumer offering by now.

Conclusions

The fundamentals paint a picture of a company with no real competitive advantage and little pricing power. Shifting into advertising will help a little, but it’s not going to save the company. The sportsbook idea is interesting, but the fragmented market and the need for a partner complicate the situation.

A longer-term focused investor would be wise to wait to see how the next round of fundraising impacts the shares. A short squeeze event should be sold as the company will be doing the same in order to raise cash. The 2023 outlook isn’t enough to drive the shares higher on its own, meaning investors are at the mercy of hype. I would avoid FUBO.

Be the first to comment