Pekic

Donegal Group Inc. (NASDAQ:DGICA) maintains a superb performance and sound fundamentals. It remains profitable with an ideal liquidity position. Growth prospects are still attractive, given its adequate capacity and the potential property insurance expansion. It is no wonder that the stock price now adheres to its financial trend. It is now in a very bullish pattern with a reasonable valuation. But, it still appears a bit cheap and may increase some more.

Company Performance

The pandemic has highlighted the importance of financial literacy. That is why capital market inflows have been massive in the last two years. The financial sector, especially banks and insurance, has been a staple amidst uncertainties. But, the disruptions in 2020 hurt some companies, including Donegal Group Inc. Even so, it kept its commercial and personal lines stable to sustain its impressive profitability.

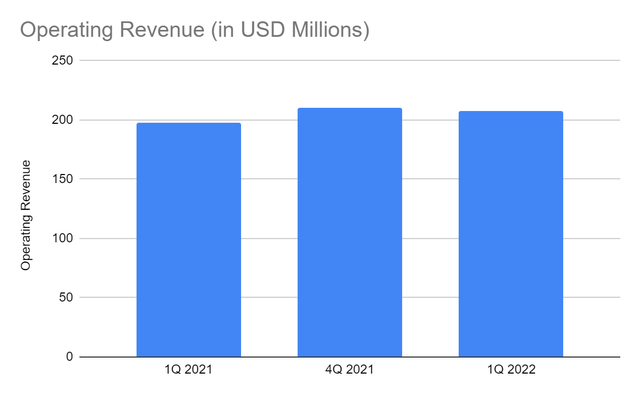

Today, Donegal shows more impressive results with its strong 1Q 2022. The operating revenue is now $208 million, a 5.2% increase from the comparative quarter. The strength lies in its premiums and investments. Thanks to the increased demand for its premiums, which fired up in 2021. It is more evident in its commercial lines, with a 14% year-over-year growth. Meanwhile, personal lines have a 4% decrease, but it is more stable now than in the last two years.

Operating Revenue (MarketWatch)

Donegal, like other companies, benefits from its capitalization on modernized technology. It continues to transform its business and improve processes to cater to more clients and increase productivity. It is more of a staple, given its wide coverage across the twenty-four states. It also helps it scale up operations, which is in line with the peak of digital transformation. It is timely and relevant for the potential expansion of the insurance market, which I will discuss later. Indeed, it is making a good development in improving its product mix. It continues to make a strategic shift to the commercial side. The operating results are showing how its business plan is paying off further.

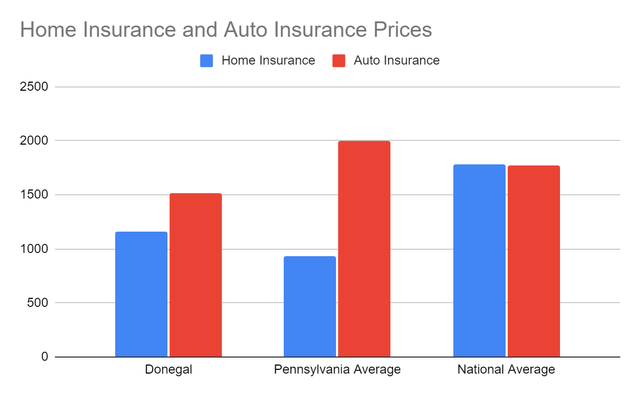

Donegal also appears to benefit from its strategic pricing. It is reasonable and lower than the national average. Its homeowner insurance price is $1,164 annually, which is higher than the state average of $930. But, it is far lower than the national average of $1,784. Meanwhile, its auto-insurance is only $1,519, and way lower than the state and national average. It has more flexibility when it comes to auto insurance, giving it an edge amidst the continued automobile boom. Also, it has solid premium retention and policy renewal increases. Given all these, it has more room to adjust its prices amidst the high-inflation environment. It will help offset the increase in operating costs and expenses. The combination of its flexible pricing, high market visibility, and strong market presence help drive its demand.

Home Insurance Prices and Auto Insurance Prices (nerdwallet and Bankrate)

As for its investments, DGICA also reaps the rewards of its billions of investments in fixed-income securities. Today, yields remain on the rise but volatility is firing up amidst inflation fears. The ten-year breakeven rate peaked at 3% in April, but recently it took a nosedive to 2.4%. The interest rate hikes may affect their value, and keeping risk-adjusted returns may become challenging. Even so, volatility does not appear to go into a summer lull as recession concerns come back. It is possible as higher interest rates encourage more savings than investment and borrowings. It may weaken consumer spending, which is the primary goal to stabilize inflation. Either way, I estimate the yield to remain within the range in the second half. I expect higher yields in 2024 as a more stable economy increases the appeal of fixed-income securities.

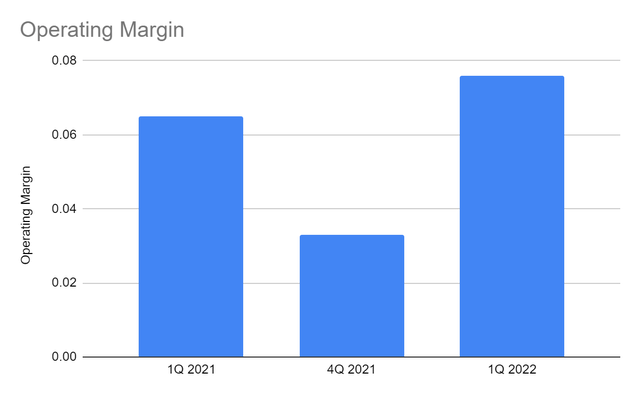

Likewise, the operating margin increases to 7.6% vs 6.5% in 1Q 2021. It is also a rebound from the negative margin in 3Q 2021 and 3.3% in 4Q 2021. It is reasonable due to the surge of claims and reserves after Hurricane Ida affected the state. Even if Pennsylvania does not directly face the Atlantic coast, the risk of hurricanes and floods is still high. Now, we also notice its stable costs and expenses with its larger capacity. It is also more visible in its commercial lines. The increased profitability amidst inflationary pressures and increased capacity can show two things. First, the robust demand and solid policy retention offset the increase in costs and expenses. Second, it has efficient asset management and prudent diversification of investments.

Operating Margin (MarketWatch)

Donegal Group Inc. Is Well-Positioned For Potential Growth Opportunities

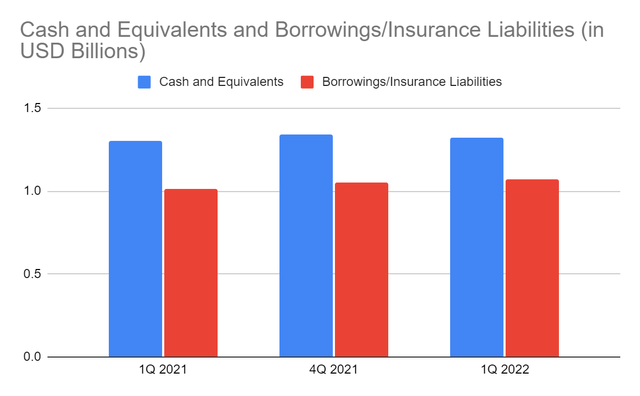

Donegal maintains its impeccable performance with its solid revenue growth and margin expansion. The increased demand and policy retention, matched with its prudent investments makes it robust. Yet, what makes it an ideal investment is its capacity to sustain its growth potential. In its Balance Sheet, we can see that the company is well-positioned. It has adequate resources to cover its insurance liabilities and borrowings.

Cash and investments alone are more than enough to pay its borrowers and policyholders. Their combined amount is over 80% of the total assets. Note that these are liquid assets, so the company has a good liquidity position. It also has more means to capitalize on expansion and innovation even without raising its financial leverage. Given the potential expansion of the insurance market, DGICA is well-prepared for it. It also appears more stable, which is vital amidst inflationary pressures.

Cash and Equivalents and Borrowings/Insurance Liabilities (MarketWatch)

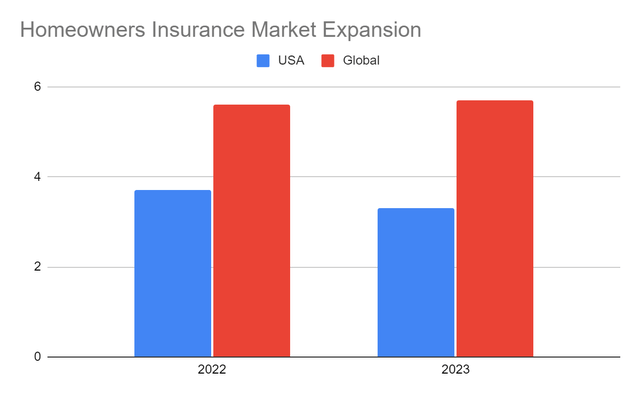

Moreover, the P&C insurance industry is at the forefront of climate change risk alleviation. With more frequent and destructive hurricanes, having home insurance is a giant step toward protecting wealth. Recently, the real estate market has appeared to cool down with a 3% decrease in revenues. The primary factor is the skyrocketing prices since the average is already over $400,000. Shortages are still a challenge so price decreases may not be expected anytime soon. On the flip side of the coin, inflation makes replacing house parts and belongings more expensive. As such, the surge in insurance demand may still be high. In fact, the demand is still higher than pre-pandemic levels with 43% of Millennials. That is why the P&C is expected to expand by 3.3-3.7% in 2022-2024.

Homeowners Insurance Market Size (Insurance Journal)

Likewise, the auto insurance industry is on an uptrend. With the increased demand for new and old cars, auto insurance benefits from its spillovers. Earlier this year, a survey showed that almost 80% of Americans still prefer to use cars when going to work and other establishments. It is adherent to the 7% increase in car sales in 1Q 2022. But like the housing market, shortages are still high. That’s why I am optimistic about the industry performance in the following years. More stable prices in houses and cars may drive an increase in P&C and auto insurance. Both scenarios may lead to an improvement in personal lines. It is still possible, given the company’s strong policy retention and renewal. The company may choose to expand to prepare and take advantage of the potential boom. But right now, its aim to improve its product mix and prudent investments must be its priority.

Price Assessment

The stock price of Donegal Group Inc. remains in an uptrend following its massive upside in the last two months. It has appeared to flatten since the third week of June. We can attribute it to the impact of sellouts by its top executives. But, the bullish pattern is still evident. At $16.80, it is already 20% higher than its starting price. Even so, it is still fairly valued as shown by its PE Ratio and PB Ratio.

Also, it is an ideal dividend stock having paid and raised dividends for twenty consecutive years. It is part of Dividend Contenders, showing its dedication to its investors. In 2020-2021, dividend growth sped up to 4-6%. Currently, the dividend yield is 3.95%, which is higher than the NASDAQ average of 1.51%. Dividends are also covered and reasonable with its Dividend Payout Ratio of 38%. We may assess the stock price better using the DCF Mode and the Dividend Discount Model.

DCF Model

FCFF 12,400,000

Cash 56,000,000

Outstanding Borrowings 35,000,000

Perpetual Growth Rate 4.2

WACC 7.4

Common Shares Outstanding 31,330,000

Stock Price $16.80

Derived Value $16.36

Dividend Discount Model

Stock Price $16.80

Average Dividend Growth 0.0309464492

Estimated Dividends Per Share $0.66

Cost of Capital Equity 0.07023216348

Derived Value $18.34

The two models come up with different assessments. The DCF Model shows that there is an overvaluation of 1%. Meanwhile, the Dividend Discount Model shows a potential undervaluation of 9%. But, we have to remember that Donegal Mutual owns 41% of Class A Common Shares and 84% of Class B shares. The common shares outstanding will become 16,107,000. If we use this to compute the DCF Model, the stock price will increase to $20.68. Using the derived value, there is an undervaluation of 10%. In the next 12-24 months, an upside of 9-10% is possible.

Bottom Line

Donegal Group Inc. has robust core operations and solid and intact fundamentals. It has an excellent market positioning against inflation with adequate means to cover its borrowings and dividends. The stock price has an undervaluation, which is confirmed by the derived values. It is already a good entry point, although I prefer a lower price at about $15.7-$16 before making a position. The recommendation is that Donegal Group Inc. is a buy.

Be the first to comment