JossK/iStock Editorial via Getty Images

[Please note that all currency references are to Canadian dollar except if indicated otherwise.]

Dollarama Inc $84.00 (OTCPK:DLMAF)(TSX:DOL:CA) (Toronto symbol DOL) operates low-priced consumer goods stores in Canada and Latin America. The company was founded in 1992 and listed on the Toronto exchange in 2009. The headquarters is in Montreal, Canada.

Dollarama is undoubtedly the prime operator among the fixed-price, value retailers in North America. However, the company’s prospect for further growth in its home market, Canada, is muted while its expansion plans in Latin America come with a higher level of risk. The stock is fully valued leaving little room for profit disappointments.

Humble beginnings

The company traces its origins to 1910 when Salim Rossy opened his first S Rossy store in Montreal, Quebec. In 1973, his son Larry Rossy assumed leadership of the business and doubled the store count to 44 by the end of his reign in 1992. Dollarama was born when the third generation Larry Rossy took the helm in 1992 converting the stores to a fixed-price concept.

In 2004, the private equity outfit, Bain Capital purchased a majority stake in the fast-growing business. Bain sold their remaining stake in 2011. In 2015, Dollarama opened its 100th store and Neil Rossy was appointed President and CEO while Larry Rossy became the Executive Chair. In 2019, Dollarama acquired a 50.1% stake in the Latin American value retailer, Dollarcity.

Dollarama owns and operates 1,462 stores in Canada and 395 Dollarcity stores in Colombia, El Salvador, Guatemala, and Peru. In Canada, Dollarama is the market leader among the fixed price stores with the four nearest competitors combined making up less than half the store count of Dollarama.

In the 12 months to the end of October 2022, Dollarama generated revenues of $4.8 billion and net income of $761 million. The Dollarcity results are not consolidated in the group financials but are accounted for using the equity method. During the last financial year, Dollarcity had sales of $637 million and contributed net income of $33.2 million to Dollarama.

A sound long-term track record

Dollarama has an impressive track record of growing its revenues and profits over time, mostly organically but also through acquisitions.

Over the past 10 years to the end of June 2022, gross profit increased by 12% per year, net profit by 14%, earnings per share by 19%, and free cash flow per share by 27%. Growth has also been consistent with no interruption of the positive growth trend.

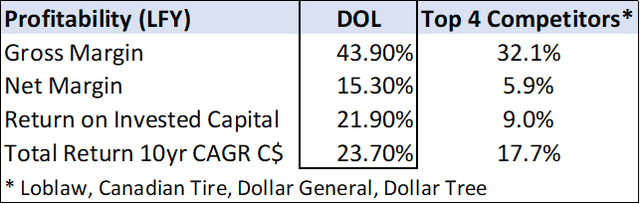

Profitability has been high and consistent over the past decade with gross margins averaging 40.5% and net margins 14.2%. The return on invested capital averaged 22.5% over the 10-year period.

Dollarama is a highly profitable business also when compared to its peers. On all the metrics listed in the table, the company performed much better than a group of North American comparables.

Somewhat unsurprising, the total shareholder return (including dividends) over the past 10 years was also better than its peers.

Dollarama is a much smaller operation – about 10% of the size – than the two largest U.S. fixed-price retailers, Dollar General (DG) and Dollar Tree (DLTR). Despite the smaller size, Dollarama generates higher average sales per store as well as higher average sales per square foot of retail space. The higher level of profitability of Dollarama is therefore not surprising.

A sound long-term track record

Dollarama has an impressive track record of growing its revenues and profits over time, mostly organically but also through acquisitions.

Over the past 10 years to the end of June 2022, gross profit increased by 12% per year, net profit by 14%, earnings per share by 19%, and free cash flow per share by 27%. Growth has also been consistent with no interruption of the positive growth trend.

Profitability has been high and consistent over the past decade with gross margins averaging 40.5% and net margins 14.2%. The return on invested capital averaged 22.5% over the 10-year period.

Dollarama is a highly profitable business also when compared to its peers. On all the metrics listed in the table, the company performed much better than a group of North American comparables.

Somewhat unsurprising, the total shareholder return (including dividends) over the past 10 years was also better than its peers.

Growth prospects – all eyes on the Latin American expansion

Apart from one major acquisition in 2019, Dollarama has mainly grown organically by opening new stores and by raising the upper price limit of the items sold in the stores.

Company management had previously set – and met – targets for the opening of new stores in Canada. These targets resulted in an annual addition of 70 new stores over the past 10 years. Management’s freshly revised target is 2,000 Canadian stores by 2031 – this implies 60 additional stores per year. In our view, the company is well represented across Canada with the prime areas well served and 80% of the population with 10 km of a Dollarama store. Nevertheless, if the growth target is achieved, the Canadian organic expansion plan could result in an additional $1.4 billion of revenue (2022 currency terms) which would add 30% to revenues.

Another potential source of organic expansion is the growth in same-store sales – which has benefitted from regular adjustments to the upper level of the price points. In Canada, same-store sales increased by an average of 3.4% per year over the past 5 years.

In 2019 Dollarama acquired a 50.1% stake in the Latin American value retailer, Dollarcity for US$93 million after providing consulting services to the business since 2013.

The Latin American expansion holds interesting growth potential for Dollarama. The four markets in which Dollarcity is active, have a combined population of $107 million which is 3 times the Canadian market size. However, the per capita income of these countries is about 80% lower than that of Canada while the store sales price points are not meaningfully lower than in Canada. Store development costs are roughly the same as in Canada. The Colombian operation is the largest with 234 stores – with a three-fold increase in the store count over the past 5 years. There are also 83 stores in Guatemala, 61 in El Salvador, and 17 in Peru. In 2022, Dollarcity contributed $33 million to the Dollarama operation, a 69% increase from the previous year.

Management now targets 850 stores by 2029 which implies that 65 new stores will be opened every year. This sounds like an achievable target compared to the substantial growth that the Latin American operations achieved over the past few years. However, the region has seen considerable political instability in the past and the current upheavals in Peru should serve as a reminder that the best business plans can become unstuck in a volatile political environment. Apart from organic growth for the Latam operations, Dollarama may also be required under certain agreements with the founders of Dollarcity, to acquire a further interest in Dollarcity.

Corporate governance: Entrepreneurs at the helm

The chair of the board is Stephen Gunn. He has been the lead independent director since 2009 and the chair since 2018. He was a co-founder of Sleep Country, a major Canadian mattress retailer, and holds degrees in engineering and business administration.

Neil Rossy (age 52), has been the President and Chief Executive Officer since 2016. He has been with Dollarama since 1992 and had been involved in all aspects of the day-to-day operations of the business.

The directors and executive officers jointly owned 4.2% of the outstanding common shares as of the end of March 2022.

Key aspects of executive compensation are a base salary, an annual performance bonus scheme, and a long-term incentive plan. The 2022 bonus scheme was based on an EBITDA growth target of 8%, a same-store sales growth target of 5%, and a target of 65 net new stores.

The President received a total compensation of $7.8 million and $6.8 million for the 2022 and 2021 fiscal years.

Dollarama leases 5 warehouses, 19 stores, and its head office from entities controlled by the Rossy family. The outstanding commitments under these lease contracts amount to $35 million.

Growing debt and financing costs but the free cash flow remains healthy

The company had shareholders’ equity of $41 million at the end of October 2022 while net debt amounted to $2.2 billion; the debt-to-capital ratio was 100%. The company also has lease obligations that amount to $1.8 billion. Net debt has grown by 21% over the past 3 years while the financing costs moved up as well.

Fixed-rate debt makes up 93% of the company’s total debt. Fixed-rate debt that matures over the next year amounts to 23% of the total debt and will probably be refinanced at a higher interest rate than the maturing debt. We note that $250 million of debt with an interest rate of 2.20% that matured in November was refinanced with longer-dated fixed-rate debt with an interest rate of over 5.0%.

Inclusive of the lease obligations, the net debt/EBITDA ratio is 2.8 times while EBITDA covers the finance cost a healthy 9.3 times. The main rating agencies ascribe investment-grade credit ratings to the company.

Cash flow from operations amounted to $692 million over the past 12 months while capital expenditures were $154 million leaving a sound free cash flow balance of $538 million. Free cash flow is stable and remained consistently positive over the past decade.

Large-scale share buybacks to decline

Dollarama pays a small quarterly dividend which amounted to $0.22 per share over the past 12 months. This absorbed $62 million of cash flow. In addition, the company is an active buyer of its shares in the open market. Since 2012, the company managed to reduce its share count by 34% spending $5.0 billion in the process.

Most of the free cash flow is used to buy shares back and pay dividends. After these payments have been taken into account, the balance regularly ended up in negative territory – that is 8 times since 2012 – which implies that the company borrowed money to partially finance the share purchases and dividends. We think that the company will scale back its share purchases rather than increase debt levels further until interest rates start to move lower.

Dollarama received regulatory approval to purchase for cancellation over the 12 months starting July 2022, around 7.5% of its ordinary shares. By the end of October, only a small portion of the repurchase program has been executed.

Recent results: Solid operational performance but finance costs up sharply

In the most recent quarterly results for the period to the end of October 2022 (nine months of the company’s 2023 fiscal year), revenues increased by 14.9% while adjusted diluted earnings per share increased by 14.8%.

A higher store count and a 10.8% growth in same-store sales helped to produce a sound increase in revenues. The costs of sales was up by 17.2% resulting in a gross profit increase of 12.0% and somewhat lower gross and operating profit margins.

The Latin American stores also performed well with a 26% increase in the equity accounted income from those operations.

Finance costs jumped by 32% in the third quarter as debt levels increased and interest rates moved higher.

Inventory levels were up 68% compared to last year as the company worked to rebuild its stock and purchased seasonal goods early to avoid supply chain troubles.

Management now guides for earnings per share of $2.73 (midpoint) for the year ending January 2023 which will be 25.2% higher than the previous year. Consensus estimates indicate 15%-20% growth for each of the following two years. This may prove to be optimistic if Canadian store expansion and same-store sales growth slow down over the next two years. Higher finance costs and a lower rate of share repurchases will further dampen the earnings per share growth rate.

Expensive valuation

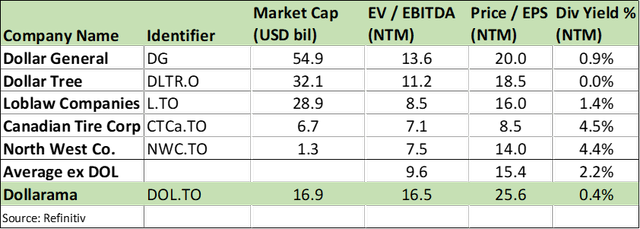

Given Dollarama’s current price and consensus forecasts for the next 12 months, the business is valued on an EV/EBITDA ratio of 16.5 times, and a price-to-earnings ratio of 25.6 times.

Compared to the peer group indicated in the table, Dollarama trades at a considerable premium to a relevant Canadian and U.S. peer group. The company has been growing faster than its peers but the significant premium seems unjustified.

Waiting for a better entry point

Dollarama has built an enviable track record in Canada. However, the Canadian growth rate is likely to slow down in the next few years and the Latin American expansion comes with risks. The shares are priced for perfection. Investors should wait for a more attractive entry point.

By Deon Vernooy, CFA, for TSI Wealth Network

Be the first to comment