Mario Tama

In June, 2022, we have published an article on Seeking Alpha, titled: “Dollar Tree is too expensive”. In this article, we are revisiting our previous thesis on Dollar Tree (NASDAQ:DLTR) and give an updated view on the firm, in the light of the recent news and events.

We are going to highlight how our view has changed since our last writing, and the reasons, why we still believe that Dollar Tree’s stock is a sell.

Performance during times of low consumer confidence – not as strong as first thought

We have previously stated and described in depth that DLTR is likely to outperform the broader market during times of low consumer confidence, as people are likely to start saving money and switch to lower cost alternatives, when there financial outlook becomes more uncertain. On one hand, the macroeconomic environment has not materially improved since then, consumer confidence still remains at extremely low levels. On the other hand, the firm’s quarterly earnings announcement made us rethink our original view.

Management has painted a relatively negative picture of the EPS and revised its outlook for the rest of 2022, due to several reasons.

Competitive pricing at Family Dollar will over the long term enhance our sales productivity and profitability, and ultimately our opportunity to accelerate store growth. We are therefore making an investment in pricing at Family Dollar […] We expect the combination of this pricing investment at Family Dollar and the shoppers’ heightened focus on needs-based consumable products will pressure gross margins in the back half of the year. We have therefore reduced our EPS outlook accordingly.

Further, the management has elaborated on the margin performance as well:

…margin performance and outlook are being hurt by inflationary cost pressures, a material shift in consumer purchasing from higher-margin discretionary merchandise to lower-margin consumable goods and continued investments in labor, wages and store conditions.

One of the few reasons we liked DLTR earlier was the fact that the demand for their products is likely to remain high, irrespective of the consumer sentiment. Although the demand for DLTR’s products may indeed remain strong for the rest of the year, we believe that due to the margin contraction, the changing product mix and the pricing decisions the firm is no longer attractive from this perspective either.

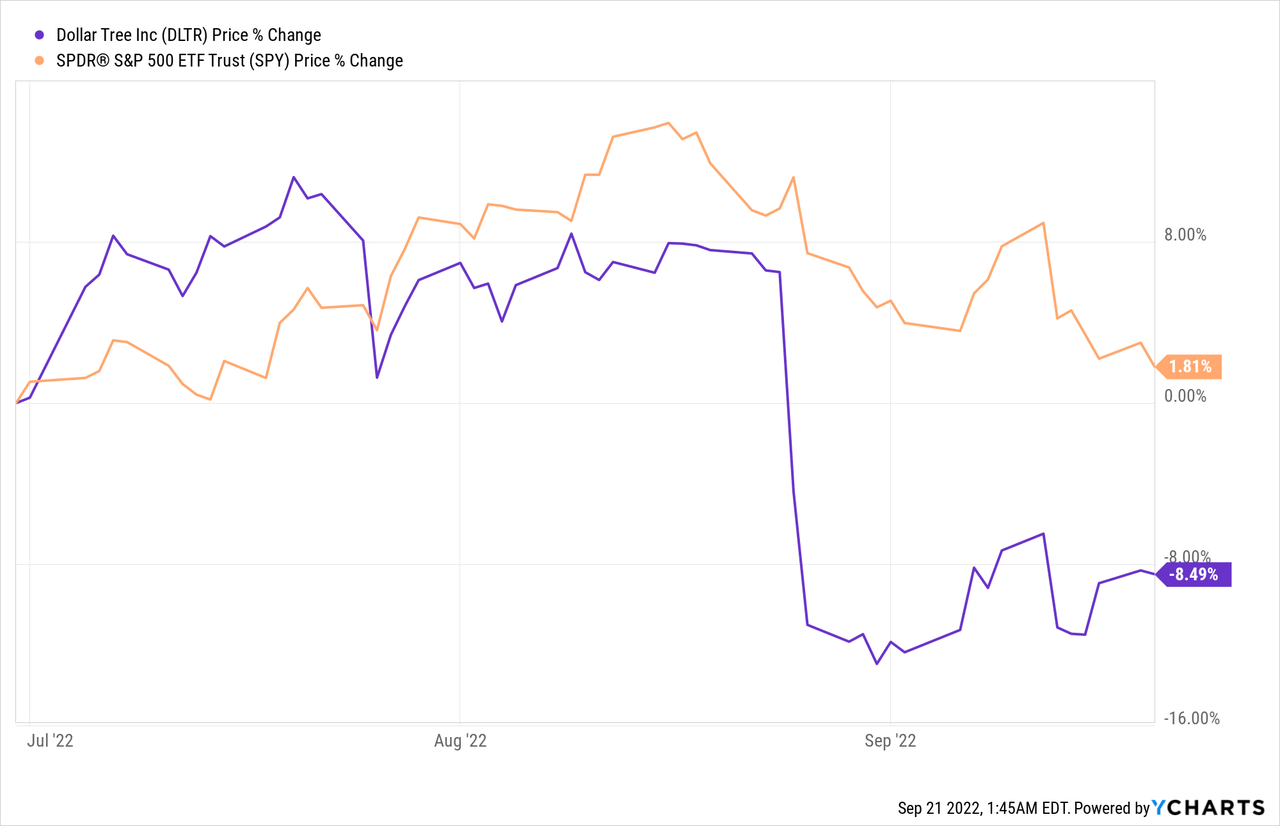

Since our last article, DLTR has already underperformed the broader market, and we believe that this is likely to remain so in the near future.

Valuation

When the earnings results were announced, the stock price has fallen by almost 10%. We believe that the stock was significantly overvalued before the earnings report, therefore such a fall in our opinion was justified. Further, however, we still believe that the firm is trading at a substantial premium.

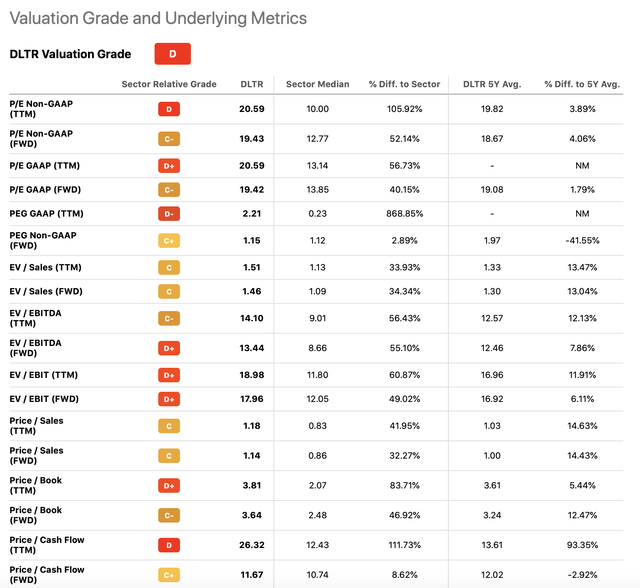

According to most of the traditional price multiples, the stock still has a much higher multiple than the consumer discretionary sector median, and even its own 5Y average.

Valuation metrics (Seekingalpha.com)

In our view, in the current macroeconomic environment, together with the worse than expected outlook and the contracting margins, the current valuation is even less justified.

Key takeaways

Despite the earnings induced sell-off, Dollar Tree’s stock is still trading at a significant premium compared to the consumer discretionary sector median, which we believe is not justified.

The recently announced worse than expected forecast for the rest of 2022, driven by the margin contractions, the changing product mix and the pricing decisions make us question our previous expectations about the firm’s robustness during times of low consumer confidence.

For these reasons, despite the recent sell-off, we maintain our sell rating on DLTR.

Be the first to comment