Bet_Noire/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on March 25th, 2022.

The Vanguard Short-Term Inflation-Protected Securities ETF (NASDAQ:VTIP) is an index ETF investing treasury inflation-protected securities, or TIPs. TIPs are issued by the U.S. government, and so are incredibly safe, but low-yielding, securities. TIPs are indexed to inflation, and so see higher coupons, yields, and returns when inflation is high, as it currently is. VTIP’s safe holdings, effectiveness as an inflation hedge, and 5.5% yield, make the fund a buy. VTIP is particularly appropriate for more risk-averse investors, especially those seeking to hedge their portfolios against rising inflation.

TIPs Overview

VTIP exclusively invests in TIPs, a relatively niche asset class. As such, I’ll be including a short explanation as to how these securities work. Feel free to skip this section if you already know all about TIPs.

Treasuries, including TIPs, are the safest assets in the world, backed by the full faith and credit of the U.S. governments. Treasuries offer investors ultra-safe, dependable, albeit low, interest rate payments and dividends.

TIPs have the added benefit that their dividends, capital, and returns, are protected against inflation.

TIPs are protected against inflation, as their face value and coupon rate payments are indexed to the Consumer Price Index, or CPI, an inflation index, for positive values of said index. In simple terms, TIPs returns are equal to their interest rates plus inflation. So, higher inflation directly leads to higher returns, making these assets effective inflation hedges,

Let’s explain the above with a quick example.

Say you invest $1,000 in TIPs at a 1% yield, equivalent to an interest payment of $10 per year.

If inflation increases to 10%, so would the value of your investment and interest. Your investment would increase in value from $1,000 to $1,100, while your interest payment would increase from $10 to $11.

Total returns would be equal to $100 plus $11, effectively equivalent to inflation plus interest rate (10% + 1%). Returns are generally distributed to investors in the form of dividends.

Higher rates of inflation would lead to greater gains and vice versa.

Deflation, on the other hand, has no effect on the value of your investment, interest, or shareholder returns/losses.

If inflation decreases to -10%, your investment would retain its $1,000 value, and your interest payment would remain at $10. This holds true for all rates of deflation.

With the above in mind, let’s have a look at VTIP.

VTIP – Basics

- Investment Manager: Vanguard

- Underlying Index: Bloomberg US 0-5 Year TIPs Index

- Expense Ratio: 0.04%

- Dividend Yield: 5.53%

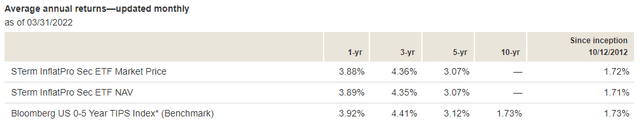

- Total Returns CAGR Inception: 1.72%

VTIP – Overview and Investment Thesis

VTIP is an index ETF investing in short-term TIPs. VTIP is administered by Vanguard, the second-largest investment manager in the world, and the largest provider of index funds in the same. Vanguard is almost always my top choice for simple, cheap index ETFs, due to the company’s low fees and investor-friendly corporate structure.

VTIP itself tracks the Bloomberg US 0-5 Year TIPs Index, an index of these same securities. It is a relatively simple index, investing in all relevant TIPs with maturities from 0 to 5 years, with an average maturity of 2.6 years. Not much else stands out about the fund, its index or holdings.

VTIP’s investment thesis is quite simple, and rests on the fund’s safe holdings, and effectiveness as an inflation hedge. Let’s have a look at these two points.

Safe Holdings

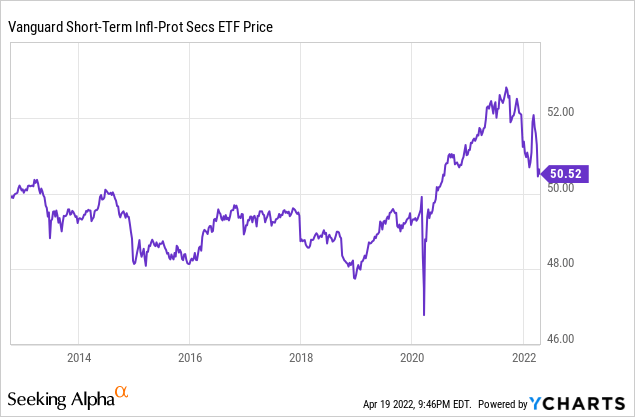

VTIP’s underlying holdings are all incredibly safe, relative stable securities, and so is the fund. VTIP’s share price has oscillated between $48 and $52 per share since inception, a relatively tight price band. Volatility is low, capital losses infrequent and short-lived.

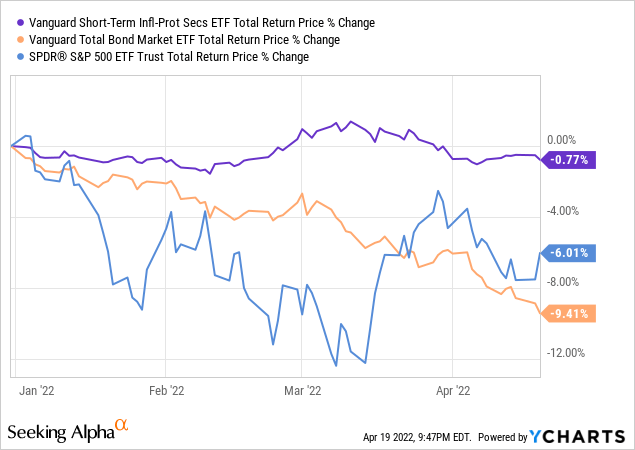

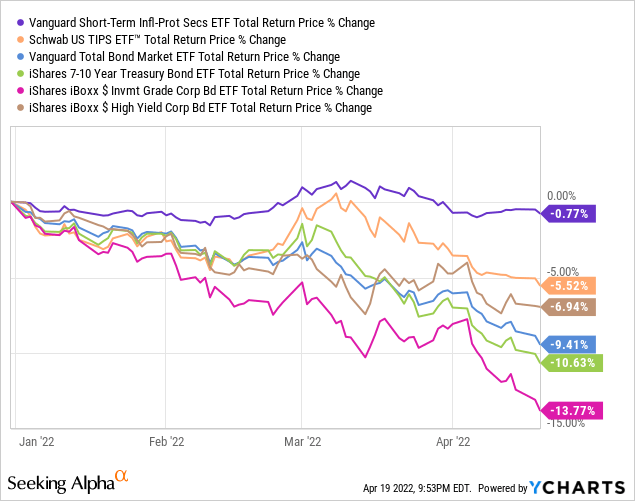

VTIP’s safe holdings also perform comparatively well during corrections, downturns, and recessions. As an example, the fund is only down 0.8% YTD, a period of broad-based asset class losses. The fund significantly outperformed relative to broad-based equity and bond indexes, a solid combination.

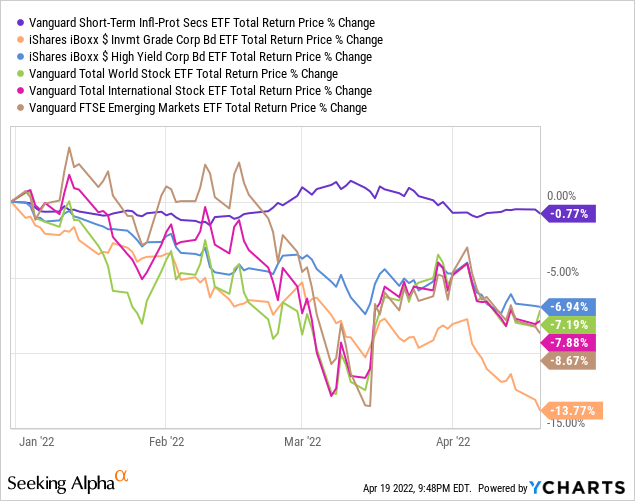

VTIP’s returns compare favorably well to most other relevant asset classes and sub-asset classes too, including treasuries, investment and non-investment grade corporate bonds, as well as U.S., global, international, and emerging market stocks.

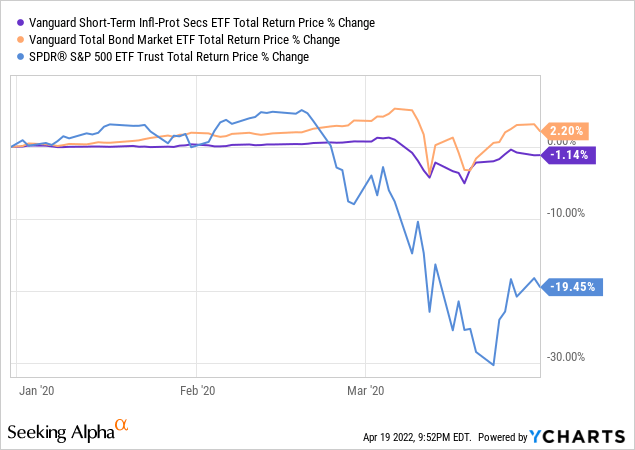

VTIP has performed reasonably well during prior downturns too. As an example, VTIP posted losses of about 1.1% during 1Q2020, the onset of the coronavirus pandemic, and the most recent recession. Losses were low and relatively short-lived. At the same time, the fund slightly underperformed relative to broad-based bond indexes, but outperformed relative to equities.

VTIP’s short-term holdings are also somewhat insulated from interest rate risk. Can’t really have a lot of price volatility in an asset in which the government guarantees your cash-flows, which matures in a year or two. VTIP’s low interest rate risk has been particularly beneficial YTD, during which market interest rates have risen. Bonds are down across the board, and although TIPs are down too, losses have been comparatively small.

VTIP’s stable share price, outperformance during downturns, and low interest rate risk, are significant benefits for the fund and its shareholders. The fund is particularly appropriate for risk-averse investors, for whom capital preservation is paramount.

Effective Inflation Hedge

VTIP’s underlying holdings are indexed to inflation, and so the fund sees higher yields, share prices, and returns when inflation is high and rising. There are two benefits to this.

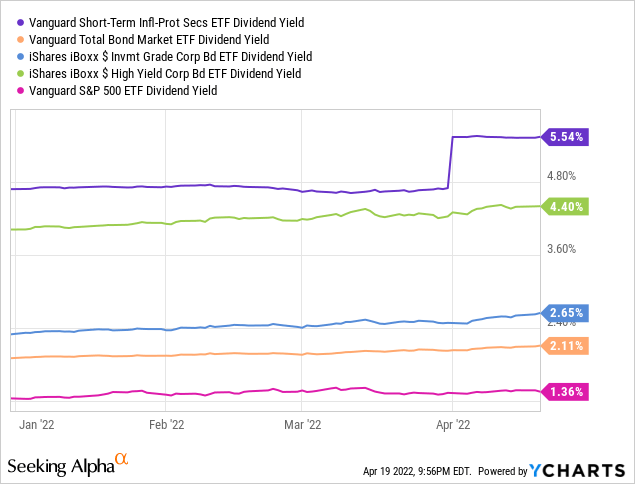

First, is the fact that inflation is currently high and rising, with all the benefits that entails. High inflation means higher TIPs yields, with VTIP itself boasting a 5.5% dividend yield. It is a reasonably good yield, and higher than that of all relevant bond sub-asset classes, and equities. VTIP’s yield is particularly impactful considering the fund’s comparatively safe holdings: VTIP is a high-yield low-risk investment opportunity, a solid combination.

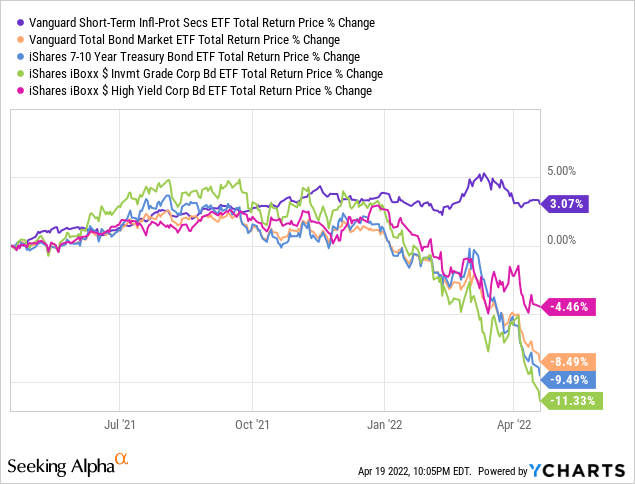

Strong yields lead to strong returns, with the fund outperforming relative to most of its peers for the past twelve months or so.

VTIP is simply a fantastic investment when inflation is high, as is currently.

Second, is the fact that VTIP should see even higher yields and returns if inflation continues to increase, and so the fund can be used as a hedge against rising inflation. Investors concerned that inflation will spike in the coming months can choose to invest in VTIP, in the knowledge that their investment and income will rise in value to combat the increase in cost of living. This is not true for most investments or saving vehicles, including deposits, treasuries, bonds, and equities, but it is true for VTIP, and is a significant benefit for the fund and its shareholders.

VTIP – Drawbacks and Risks

VTIP is a strong, safe investment opportunity, but it is also one with drawbacks and risks. Two stand out.

VTIP’s most significant drawback is the fund’s low long-term expected returns. VTIP invests in treasuries, which almost always carry rock-bottom yields, and with little potential for capital gains. Long-term expected yields and returns are quite low, with the fund’s annual total shareholder returns averaging 1.8% since inception. Long-term average yields are not materially different.

VTIP Corporate Website

VTIP’s yield and returns are strong right now due to above-average inflation rates, but these should normalize in the coming months. As such, the fund is not an appropriate investment vehicle for more aggressive, long-term investors. The fund remains an excellent investment for more risk-averse investors, willing to sacrifice long-term returns for stable share prices, and an effective inflation hedge.

VTIP’s most significant risk is the possibility of lower inflation rates. As the fund’s underlying holdings are indexed to inflation, the fund should see lower dividends, share prices, and returns if inflation were to significantly decrease. VTIP would underperform if inflation plummets to 2.0% in the coming months, for instance. Although this seems incredibly unlikely to me, there is simply no catalyst for lower inflation, it is a distinct possibility, and important for investors to consider.

VTIP is a fantastic investment opportunity when inflation is high, but that will almost certainly not always be the case. Expect dividend cuts and stagnating share prices in the coming years, if perhaps not months.

On a more positive note, the above issues are relatively small. Remember, VTIP’s underlying holdings are quite safe, and the fund’s share price is quite stable. Although the fund is likely to underperform if inflation were to decrease, losses should be minimal.

Conclusion

VTIP’s safe holdings, effectiveness as an inflation hedge, and 5.5% yield, make the fund a buy.

Be the first to comment