Justin Sullivan/Getty Images News

Investment Thesis

Reframing Perceptions of Dollar & Variety to Include Affordable Groceries

Dollar General Corporation (NYSE:DG) is seeking to blur the lines between dollar, department, and grocery stores, and we believe that this pivot may be the single catalyst that causes the company to gap its competitors. Dollar General’s foray into produce, DG Fresh, has allowed the company to safely expand into a market that applies to all customer demographics: Groceries. In 2021, groceries accounted for approximately 19% of total revenue for this industry and is expected to increase into the future.

There is a large amount of upside potential to be realized in serving frozen and refrigerated produce. Current grocery businesses’ largest costs include labor and shrink (also known as inventory lost due to spoilage). By leveraging its current fully staffed 18,000+ stores and specializing in foods with higher shelf lives, the company may be able to reduce its risk while gaining on this product segment. Discount stores have aggressively pursued the retail grocery market in the past few years and Dollar General’s DG Fresh shows that the company is sensitive to market demands.

Observe and Replicate

While Dollar Tree (DLTR) and Family Dollar have also entered the frozen grocery space, neither company has integrated a mobile app that allows customers to shop online, arrange for in-store pickup, or scan products to automatically apply relevant coupons. The DG Go app has mirrored the popular companion apps that many grocery stores use to keep customers from shopping elsewhere, as companion apps are proven to increase omnichannel shopping experiences. Grocery stores often use a combination of application data analytics and account history to offer incentives that are most appropriate for each shopper. Shoppers that utilize and are familiar with a particular store’s companion app are more likely to remain loyal to a particular store due to the difficulty in learning to navigate a new app to be used at another store.

Dollar General has also pioneered the use of self-checkout kiosks at more than 8,000 locations and is the first large dollar store chain to implement the technology on such a massive scale. As labor costs are the second largest drain on revenue for dollar and variety stores, the decision to implement self-checkout kiosks is a logical step in embracing technology to enhance profits.

Dollar General clearly studies the playbook of sector adjacent companies and works to implement change before direct competitors have caught on. This management direction has rewarded the company with impressive stock returns and defensible competitive advantage. It also reveals the company’s grand aspirations of elevating the brand beyond a dollar and variety chain.

Management & Shareholder Goal Alignment

Often, a company loses its competitive edge due to managers not acting in shareholder’s best interests. This is also known as an agency problem. Agency problems are common in publicly traded companies and are best solved by aligning the goals of managers with those of shareholders. The easiest way to do this is by compensating the managers in stock options, effectively making them shareholders.

Among Dollar General’s board of directors, the median current stock ownership is $4.68 million, which is 85% more than stock owned by insiders at DG’s largest competitor, Dollar Tree. Dollar General’s management has also been selling fewer shares than they are receiving though stock options for a net growth in stock ownership. The average tenure for DG’s leadership team is 12.8 years, which shows that the company is not susceptible to undue leadership changes and that the current team is responsible for the high growth that the business has earned over the last 10 years. Dollar General’s management has successfully steered the company to act on market trends and stock a wide variety of products in response to customer demand.

Company Overview

With an incredible 75% of the US population living within five miles of a store, Dollar General has found its niche. The company has proven that it is able to survive changing market conditions and is arguably the most qualified consumer defensive chain to invest in going forward. Dollar General provides customers with affordable options in food, housewares, seasonal items, cleaning supplies, basic apparel, and health & beauty products.

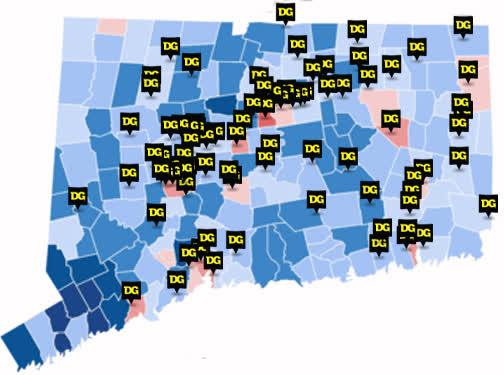

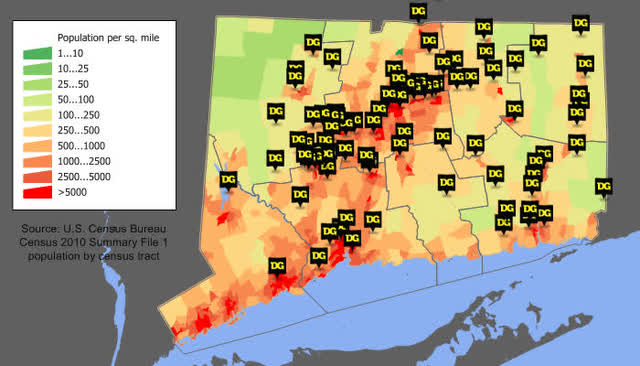

Figure 1

Dollar General 10K

A majority of Dollar General’s customer base are low to middle income families, with 58.5% of customers earning less than $50,000 per year. The company has shown that it understands its customers very well by establishing over 18,000 stores that are highly focused on serving the highest proportion of target customers. Dollar General’s stores are concentrated in population centers with high percentages of low-income earners.

Figure 1 shows a population density map with an overlay of Dollar General store locations in Connecticut, while Figure 2 shows a map of median household incomes with the same overlay; both exhibits show that the company aggressively pursues locations which are most consistent with its target customer base. The southwest corner of the state, often called the “Gold Coast” as a reference to its affluence, is completely barren of Dollar General stores.

Figure 2

Dollar General also exhibits a unique take on rural America’s convenience needs. The company has opened stores in along major highways in states that have exceptionally low population density. Wyoming, North Dakota, New Mexico, and Nebraska top the list for least densely populated states and feature Dollar General stores in prime locations. Property values and wages in these states are subsequently low and the company is able to penetrate these markets with minimum capital.

This rural expansion has been highly effective in generating consumer interest and has led to the roll out of many stores where supermarkets and department stores are not able to justify breaking ground due to uncertain profitability forecasts amid highly capital-intensive development needs. The benefits of limited inventory selection, small store footprint, and low marketing budget suit development in rural America well, the strategy is skewed toward lower risk and greater upside potential.

Forays into this relatively untapped market also present another distinct advantage: would-be patrons of small-town grocery and convenience stores are quickly becoming loyal customers of a nationwide discount store chain. The company leads the way with store openings in the U.S., with 1,910 store openings in 2022 alone, compared to 742 closures; the industry as a whole is expected to total 5,083 openings and 5,079 closures during the same period.

Macro Factors

The Economy and Recession

The state of the American economy, and ultimately the world’s, is in a state of constant flux. We are beginning to see the pendulum swing from a period of abundance to a time of scarcity. As inflation continues to devalue earnings faster than wage increases can keep up, Americans will be forced to rein in spending. Dollar & Variety Stores in general do very well during recessions, so much so that IBISWorld reports that increasing unemployment and poverty rates, as well as lower disposable income, are benefits to this sector.

Changes in American Class Structure

The class structure of America has been changing consistently over the last 50 years; however, this shift has been partially delayed by changes in the working habits of Americans. The distribution of incomes has widened significantly during this period.

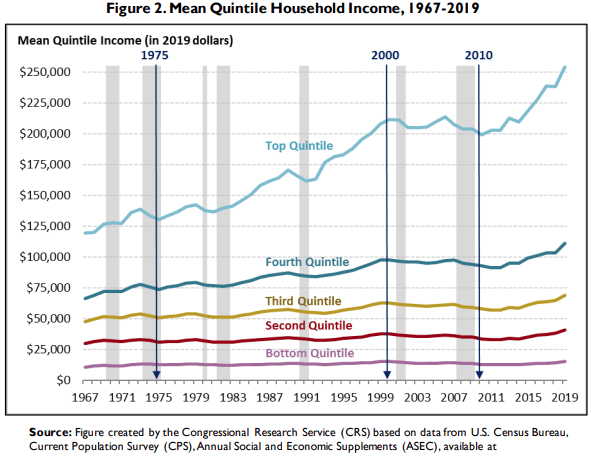

Figure 3 shows the breakdown of median incomes as divided by quintile (20% groups). The chart clearly shows that the trend is accelerating. During a recession, the less someone makes, the greater percentage of income they lose and the slower they are to recover financially. Although many articles have been published reporting that the middle class is shrinking, we do not believe most are able to argue the gravity of the situation. Americans have steadily transitioned from single to dual earner households, and this change has artificially propped up the portion of families that are in the middle-income bracket.

Figure 3

Congressional Research Service

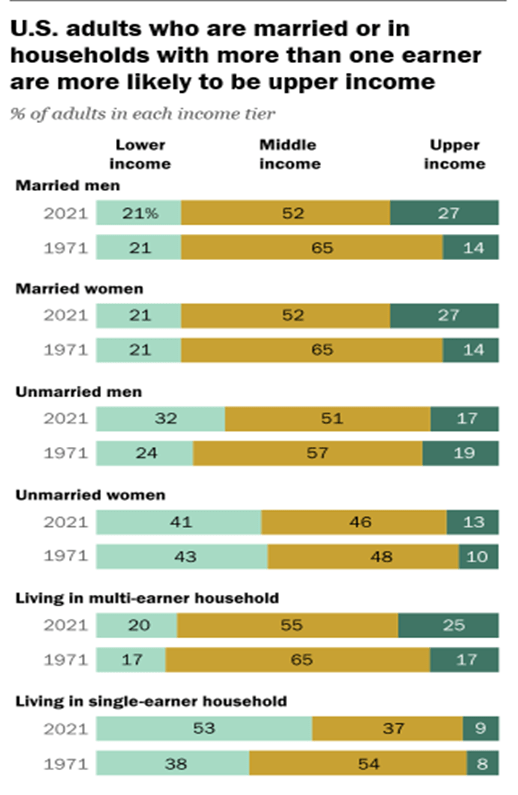

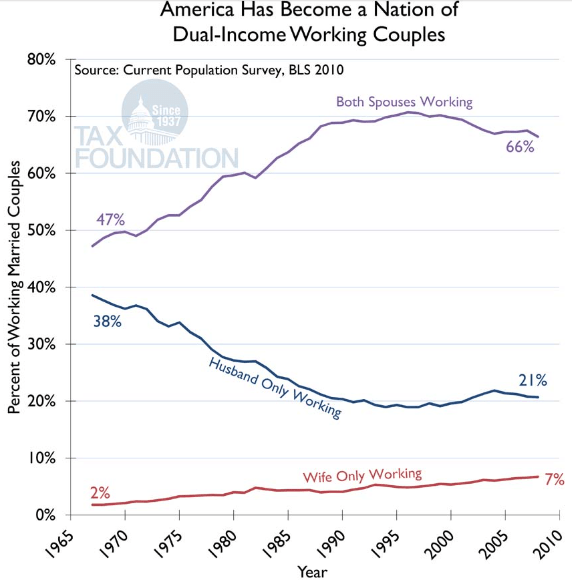

The next two exhibits show the changes in income across various family structures that have occurred between 1971-2021 and the breakdown of single vs dual income households up to 2008. We believe that this trend will be exhausted in the near future, and with that will come a rapid acceleration of families that fall out of the middle-class bracket. In addition to this trend, inflation is currently at a 40-year high with a year-over-year CPI increase of 9.1%. With every dollar being significantly less valuable as time goes on, consumers will look to stretch their earnings further than ever before.

Dollar General has proven to be extremely resistant to recession-based losses. As a value-oriented retailer with solid brand recognition, customers recognize that products can be purchased at a fraction of the price of retailers such as Target or Walmart. Most items in Dollar General are priced 20-40% less than their counterparts in grocery and drug stores, making the company an attractive place to shop in times of financial turmoil. Dollar General’s resilience to economic downturn stems from its business niche and is a crucial factor in considering the company for a hedge against uncertain market conditions.

Figure 4

Pew Research Center

Figure 5

The Tax Foundation

Dollar stores spend less on marketing, utilities, and purchases than supermarkets, and are able to pass these savings onto their customers. Over 90% of Americans report that they shop at dollar and variety stores at least a few times per year, so it is clear that most Americans are already willing customers of the model. The driving factors for continued success are thus increasing the frequency that customers visit these stores, how much they spend, and what product segments they are able to buy while shopping there.

Valuation

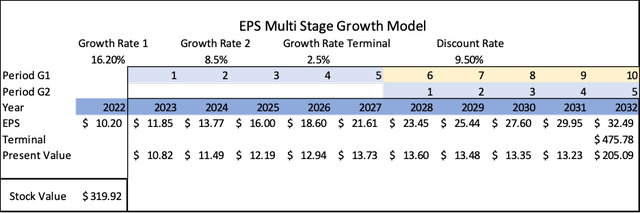

Dollar General stock has experienced a sustained run-up in price in recent years, and many investors may be tempted to ask, “How much longer does this stock have to run?” A Discounted Cash Flow (DCF) analysis tells a different story.

The DCF model uses Dollar General’s 10-year average EPS growth of 16.2% as its 5-year supernormal period before reverting to a 5-year 8.5% normal growth and ultimately a 2.5% terminal rate. While a 5-year supernormal period may be viewed as a bold choice by some analysts, the company’s aggressive pursuit of revenue growth in the past provides additional confidence into this period. It is especially important to utilize growth rates that are both historically accurate as well as conservative to limit over exuberance when conducting DCF analysis, and the numbers selected are well within normal ranges. This analysis found that the implied share price of Dollar General is $319.92, or a 23.5% premium over the current price.

Figure 6

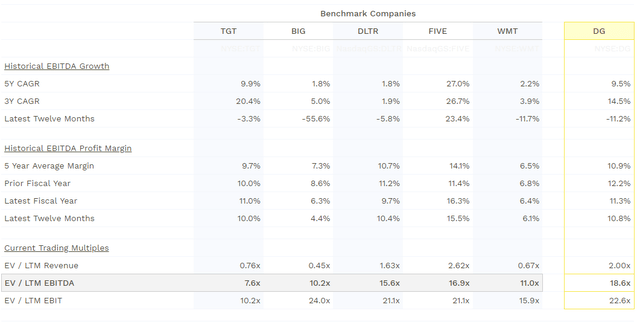

In using ratio analysis, we can see that Dollar General trades in line with its competitors. Figure 7 below shows this breakdown, and we can see that the company’s earnings multiples are closer to its direct competitors (Dollar Tree and Five Below (FIVE)) more so than those in adjacent sectors (Walmart (WMT), Target (TGT), or Big Lots (BIG)). While ratio analysis does not show a discount in this instance, it is more important to note that the multiples are within the same range as competitors, which helps to give confidence that the stock is not wildly overvalued compared to its peers.

Figure 7

We believe that psychological price anchoring is setting Dollar General’s current price. Investors may be unwilling to accept that the stock price is currently 40% higher than it was before the pandemic and therefore overvalued. However, the company has grown significantly during this period and is primed to sustain this growth rate into the future.

Risks

The majority of risk that Dollar General experiences stems from the fierce competition in this sector. Dollar General currently has the lion’s share of the market at 35.6%, however, Dollar Tree is not far off at 27.1%. If DLTR is able to gain share in untapped markets more quickly than DG, the company may find itself struggling to place stores in ideal areas that combine high customer density with lower average incomes. While the company currently leads the sector with store openings, this facet must be carefully watched to ensure a shift in market dominance does not take place.

One risk that effects all players in this sector is the transition from a growth to mature industry. Dollar stores have outpaced more conventional retailers in revenue growth, however, as the sector ages we will see diminishing returns in new ventures. In the conventional supermarkets and grocery sector, the market is nearly 100% saturated, which leaves little room for expansion. Supermarket companies overcome this challenge with merger and acquisition activity, which forces the acquirer to pay a premium for a target store that has a loyal customer base. Grocery stores also compete for market share through aggressive price cutting. Both strategies offer a bleak outlook for the grocery industry, as cap rates for acquired stores are kept to a minimum, and margins are reduced to razor thin levels. If the Dollar & Variety sector begins to mirror this trend, it would be wise to reevaluate investments in this sector.

Another risk is growing personal wealth and free spending habits. While it is unlikely that we will experience another period of relative abundance, cheap gas prices, and people spending their earnings more freely in the near future, the dollar and variety sector faces risk in that people will be more inclined to shop at stores that they perceive as having higher quality items if they can afford to do so. Dollar General is somewhat protected from this risk due to the company’s history of targeting lower income and densely populated areas.

Due to the nature of discount retailers in which a wide variety of merchandise is stocked in order to provide additional avenues for impulse purchases, Dollar General must compete with an equally wide variety of stores to gain market share. Discount retailers compete against pharmacies and grocers for non-perishable food items, seasonal supplies, and health & beauty products, as well as general retailers such as Target and Walmart for basic clothing, electronics, and office supplies. One factor that must be considered is that if Dollar General’s competitors are able to gain market share in a particular segment, the company may be forced to explore less fruitful ventures. This lack of specialization, also known as scope creep, can expose the business to brand dilution. DG has shown that it is highly capable of identifying market trends and stocking items that customers are interested in purchasing.

Why Dollar General over competitors?

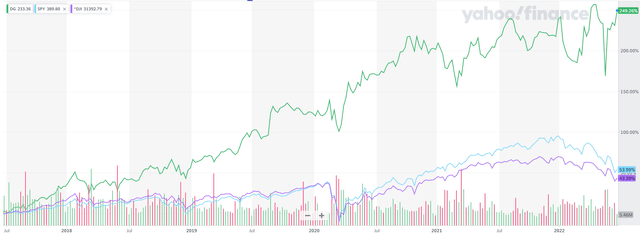

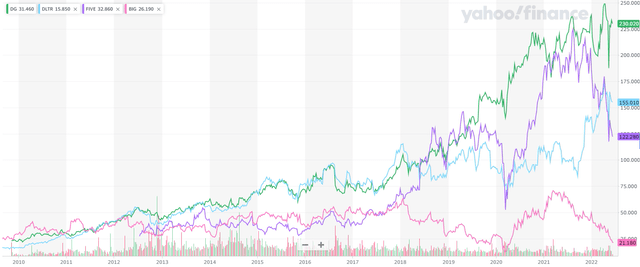

Although the Dollar and Variety sector shows that it is clearly a smart pick when it comes to hedging against recession risk, it is not nearly enough to select blindly from the sector. The following exhibits demonstrate Dollar General’s performance over the last 12 years as compared to its top competitors, Dollar Tree, Five Below, and Big Lots and how the company performed against the SP500 and DJIA indices. We can see that not only did DG perform exceptionally well during the 2020 recession, but it performed consistently better than its peers.

One interesting point to note in figure 9 is 2018, where Dollar General abandoned its relative tie to Dollar Tree’s stock range. 2017’s Q4 conference call notes that the prior year was focused primarily on increasing the compensation structure of store managers to reward sales as well as reinvesting profits in long term infrastructure projects. Dollar General’s stock price has had an average annual return of 20.9% since its initial public offering in November 2009 until now; the last five years have shown impressive growth, with an average annualized return of 27.6%.

Figure 8

Figure 9

The most critical take-away from Dollar General’s initiatives is that the company is aggressively pursuing novel methods of both capturing market share and determining additional fruitful markets to enter. This is another strong indicator that the company is very agile in adapting to the newest profitable trends among competitors and adjacent sectors and acting on them. It appears that the company is not prepared to revert to a mature earnings growth model any time soon. We believe that Dollar General’s management considers the company more closely aligned with the Discount Department & Supermarkets sectors than it does Discount & Variety.

Wrap-up & Conclusion

In conclusion, Dollar General presents a solid opportunity for investors. The company’s history of agile leadership decisions, efforts to reframe customer shopping experiences, and alignment of management’s values shows that Dollar General is worthy of consideration for any portfolio. Risks to an investment in Dollar General are generally broad sector risks, and the company has shown lucid and proactive responses to these risks. The current economic outlook also fares well for Dollar General. Among Dollar & Variety stores, Dollar General is the most likely winner: the company delivers excellent risk adjusted returns and shows that it has no plan to change that any time soon.

We would like to thank J. Becker for his contribution to this piece.

Be the first to comment