mesut zengin

Overview

This post serves as an update to my coverage in late September.

Dole plc (NYSE:DOLE), in my opinion, is still undervalued and has the potential to provide long-term returns. Following the release of the 3Q22 earnings report, I am encouraged by DOLE’s Fresh Fruit business’s underlying strength and progress on turnaround initiatives. However, I expect some blips in the numbers for the remainder of the year due to currency headwinds and lower fresh vegetable volume. The fact that, despite weaker third-quarter results, DOLE shares outperformed the market on earnings day is a positive indicator for the market. On the other hand, Dole now expects EBITDA to finish near the lower end of its prior $330-$350 million EBITDA range, which in the grand scheme of things (i.e., profit margin wise) was acceptable.

Performance review

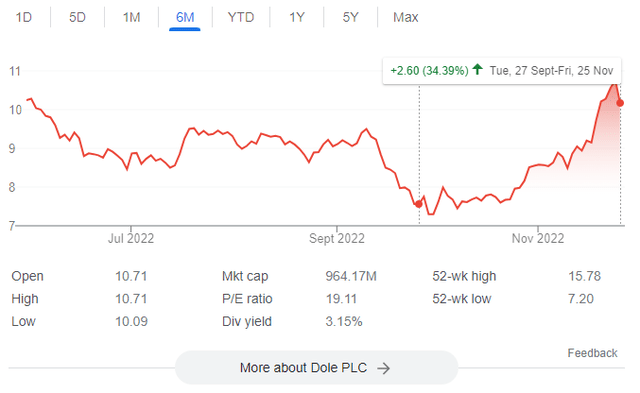

DOLE’s share price has increased by 34.39% since my initial post, which is obviously a good sign that the market is recognizing DOLE’s intrinsic value and my thesis is playing out.

DOLE share price (Google)

Earnings review

Even though DOLE’s results for the third quarter were slightly below expectations, the company’s stock still managed to outperform the market on earnings day. This is probably due to the fact that investors’ concerns about a more significant reduction in projections were allayed. The strength of Fresh Fruit was able to help offset the weakness of salads, one-time logistical bottlenecks in Chilean grapes in the third quarter, and negative FX impacts; as a result, the company now anticipates that its EBITDA will finish near the lower end of its prior range of $330-$350 million EBITDA.

Financial and growth objective highlights

DOLE’s adjusted EBITDA for the third quarter of fiscal year 2019 was $73.0 million, which was higher than the consensus estimates of $72.4 million. This was due to exogenous, temporary costs in the Fresh Vegetables and DFP-RoW segments. Due to a poor harvest of iceberg and romaine lettuce in California, the Fresh Vegetables business segment experienced cost under-absorption, which led to a delay in the anticipated return to profitability of the segment (delay was caused by a 30–40% shortfall in the domestic supply). Furthermore, management anticipates that these headwinds will continue into the fourth quarter of 2022 due to the necessity of an earlier harvest of its crop in Arizona to offset the supply conditions in California. That said, management is optimistic that things will start looking up after that, particularly as the various initiatives designed to turn things around begin to bear fruit. As a consequence of volume losses and inventory write-offs, DFP-revenue RoWs and EBITDA were negatively impacted as a direct result of port delays, which caused product to become spoiled.

In spite of these obstacles, the reported results demonstrated a greater level of profitability than I had anticipated. This was particularly the case in the Fresh Fruit division, where tighter market banana balances supported pricing throughout the quarter. The findings of DOLE have not, in general, caused me to alter the way that I’m approaching my thesis. Even with the improvement in core Fresh Fruit performance, FDP still trades at a significant valuation discount when compared to smaller and less integrated peer FDP, which trades at 8x forward EV/EBITDA. This is because FDP is less integrated than its competitor (a difference of 1.7x). Despite the fact that it has taken the Fresh Vegetables business longer than anticipated to return to normal profitability, I believe that the headwinds have been more than fairly discounted, and I am still of the opinion that the valuation risk/reward remains compelling for investors who are willing to hold on for the longer term.

Model update

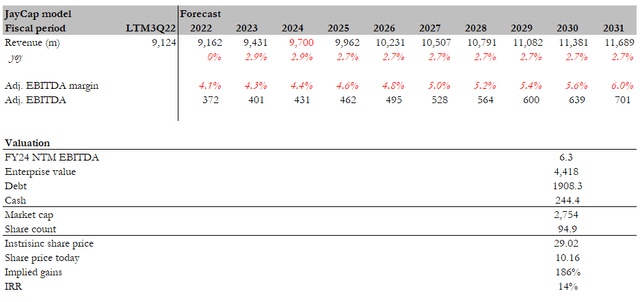

My model has been revised so that it more accurately represents revenue for FY22 in light of an anticipated incremental FX impact and a lower volume of fresh vegetables. As the results of 3Q22 demonstrated, I also anticipated DOLE to generate a greater amount of profits in its early years. I continue to be of the opinion that DOLE is undervalued, both on a DCF and relative basis, and that the recent surge in share price provides an appealing entry point for investors. Moreover, I believe that investors will be able to profit from this undervaluation.

In light of my new assumptions, I believe that the DOLE upside continues to be appealing and has the potential to produce an IRR of 14% for investors over the long term.

Author’s estimates

Conclusion

It is still my opinion that DOLE is currently undervalued, and that patient investors could make a profit in the long run by purchasing the stock. I am encouraged by DOLE’s progress toward its turnaround objectives in Value Added Salads and the company’s underlying strength in its Fresh Fruit business after the release of the 3Q22 earnings report (acknowledging setbacks continue to inhibit recovery). I expect incremental FX headwinds in the coming quarter and lower volume of fresh vegetables, both of which could cause some hiccups in the numbers for the rest of the year.

Be the first to comment