Sundry Photography

Dear readers,

Dolby Laboratories (NYSE:DLB) is a great company – at least fundamentally speaking. In this article, I’m going to be showing you what upside Dolby can offer investors at what can be considered a somewhat attractive valuation – at least in theory.

We, of course, need to put this into context to the current market, and that’s where the issues start to enter the case.

Revisiting Dolby and the upside

As I mentioned in my initial article, Dolby went public in 2005, introduced 7.1 Dolby surround in 2010, and Dolby Atmos in 2012 – some of the more relevant standards on the market today.

Dolby is a pretty self-sufficient business that doesn’t do a whole lot of M&As but acquired Doremi Labs for $92.5M back in 2014. Overall, the company holds dozens of technologies for analog and digital noise reduction, encoding, compression, Audio and Video processing, and digital cinema.

The company, therefore, has in its business to improve the science of sight and sound and developing technologies to support this, to deliver solutions and creative experiences.

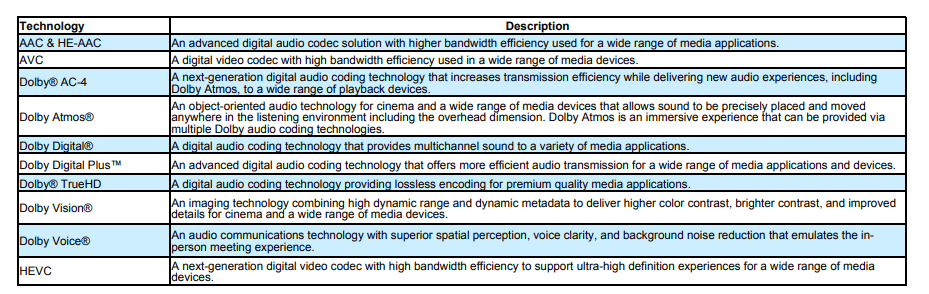

Its revenue generation is very heavily tilted towards licensing of its technologies. In fact, over 90% of the company’s annual revenues for 2021 came from technology licensing, with less than 8% coming from its products and services. These technologies which are licensed are the following.

Dolby Portfolio (Dolby 10-K)

These licensing technologies are, for the most part, and of 41% of revenues, directed at Television, 21% at mobile, 14% at CE, such as Blu-ray, soundbars, DVDs, etc., 12% towards computers, and 12% towards gaming consoles, auto DVD, Dolby Cinema and Dolby’s voice. The company, therefore, covers most of the market with its technologies. Licensing is used either in a two-tier licensing model, used by most customers, integrated licensing, patent licensing, and collaboration, each with different royalty fees, licensing fees, and payment structures.

What Dolby offers is pretty much used everywhere in the world. The company has over 13,200 patents, with another 4,100 pending in over 100 legal jurisdictions across the planet. The patents currently have expiration in May 2045, meaning around 25 more years of exclusive business. Some of the company’s patents have expired, and others will expire over the coming years. Previously, much of the company’s income was related to physical discs and licensing thereof, which is obviously no longer the case.

The main arguments for investing in Dolby are the ubiquitous nature of the technologies and standards it offers – both legacy and going forward. The company’s technologies are common enough that they’re used in a mandated fashion, including:

- DD+ and HE-AAC, which are mandated for terrestrial broadcasts in France, Italy, UK, Sweden, Germany, Poland, Turkey, and Russia, as well as digital tv markets in Africa, South-East Asia, and Brazil.

- DDD+ is the de-facto technology used by a wide range of Pay-tv operators and streaming services, including Apple TV+ Disney, Netflix, and Amazon. These all use Dolby technologies.

- DD is mandated for HD broadcast in multiple regions including North America and South Korea, and globally for DVD players.

- AC-4, the next generation of audio coding, has been adopted for implementation as a standard in North America, Europe, and LATAM. TV manufacturers are also using it, and are adopting it to a higher degree.

Dolby obviously has some of its own products as well, but it doesn’t build them. Almost all of its manufacturing is contract and outsourced. The company has some competition in certain sub-segments, and there are competing technologies for some of the company’s licenses. A large risk is also the ignorance of global IP laws by some nations, most notably China, which can impact license collection for the company.

The recent results for Dolby were solid. The company reported just south of $334M in revenue for 2Q22, which was up from $320M YoY, representing revenue growth of around 5%. The company’s licensing mix shifted somewhat toward PC licensing with a 7% QoQ mix growth, at a cost of broadcast and mobile licensing declines.

Margins saw a slight decline with around an 80 bps gross margin decline. The company posted a net income that dropped by around half. The company continues on its streak of new customers and technologies adopting the company’s tech, with everything from PUBG Mobile to Disney Star using Dolby Atmos for playing and broadcasting.

COVID-19 continues to affect the company’s income and mix, as do the current macro effects and their overall impacts on supply chains and the world’s current trends. The company does, as I mentioned in my article, have a dividend, but it’s a small one below 1.5% even after a close to 30% decline since my first article.

The company does give us some guidance for 3Q22, with slight decline in revenue, and further declining margins based on further pressure, and forecasts a relatively flat FY22.

Despite the slight negatives here, and despite the expectations, it’s important to remember that historically Dolby has outperformed. The company has paid a dividend for 5 years, and as such has very little dividend safety. The company also has no credit rating, but also only has 2% long-term debt to capital, making it essentially a debt-free company. It has a market cap of $10B, making it essentially a small-cap company on the NYSE. This combination makes it a dangerous investment for most retail investors -the small market cap with the low dividend and the very high valuation make for a dangerous prospect even after this decline.

Dolby Valuation

So what do I mean by “dangerous prospect” and “high valuation”?

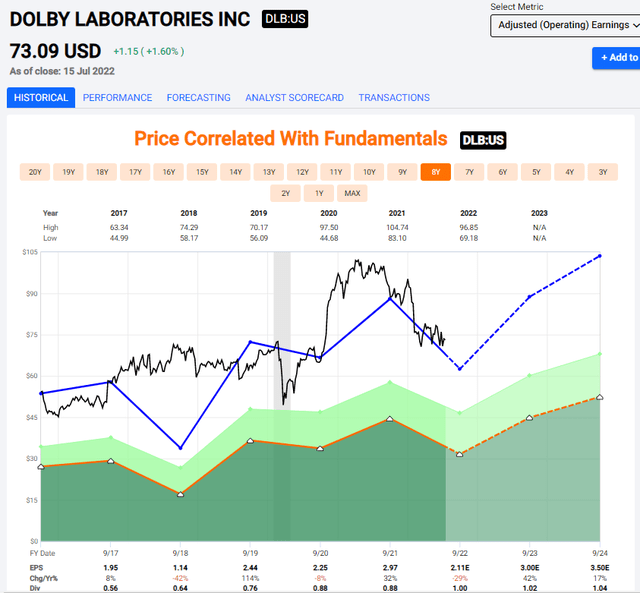

Well, Dolby usually trades at a multiple of around 25-30X to earnings. This is not something I usually like to see, but for Dolby given its portfolio, it can be understood. Still, the earnings aren’t as stable as we might want, given the cadence of licensing revenues and how they’re coming in. In 2018, EPS dropped by 42%, only to grow by 114%, and in 2022, the company is expected to see another decline of close to 30%.

So, Dolby is the sort of moat-inherent sort of company that I would look to invest in if it traded at 20-30% lower than it is today, but I wouldn’t be all that interested in where it’s trading today.

The difference between many of the large-cap companies is that they may actually quickly drop back down to these levels, which is why I’m writing about it and establishing a target here.

Despite a strong bull market, Dolby has outperformed even that bull market during the past 6-7 years. Earnings growth has been substantial, but the fact is that forward earnings growth is even more potentially impressive, with forecasts expecting EPS growth of 16% p.a. until 2023, not only due to the large EPS bump in 2021.

However, since I’m only willing to consider Dolby a 20-25X P/E trading range company, investing here would mean negative returns of between negative 13% to negative 3% p.a. until 2023.

Simply put, it’s still too expensive here – but unlike articles before, there is a positive scenario that can really be considered for the company.

Dolby valuation (F.A.S.T graphs)

Because if this premium actually holds, then you could expect not only a positive RoR here but significant outperformance to the market. It wouldn’t be out of character for the company to give us this. If the 30X Premium holds, the upside here is around 18.24% annually, or almost 45% RoR until 2024. Not bad for a company that has the sort of patent portfolio that Dolby has.

However, all of this is based on a continued premium, that might or might not materialize. You could make a very real argument that the company, based on these earnings will in fact not decline, but keep growing to 28X P/E until 2023, reflecting its 5-year average P/E. In that case, you’d make around 2.9% in total during those 3 years including dividends.

The current analyst targets for this company are around $100/share on average. 4 analysts consider the company at this level, from a low of $90 and a high of $128. 2 analysts are at a “BUY” here, meaning that the rest are at a variety of different ratings. Still – at this valuation, Dolby is actually cheaper than it once was, and it has an upside worth at least speaking about.

The company’s relative size makes it a no-go for me here. It’s too small relative to other investments to be of much interest to me even having declined as much as this.

I, therefore, use this article to update my thesis, which currently is the following.

Thesis

- Dolby is a fundamentally sound, well-run company with a solid moat. It lacks the usual dividend safety and tradition as well as credit rating, but its portfolio of patents makes for revenue security for the next few decades. I view it as a sound investment at the right price.

- Given the company’s moat and premiums, I consider 20-25X P/E to be valid for Dolby.

- This calls for a current 2021E share price of $70 and a 2023E share price of $80, making the company slightly overvalued and a “HOLD” here.

However, given enough of continued potential drop-off, I believe Dolby Laboratories to be a “BUY”. Stronger than Netflix (NFLX), Amazon (AMZN), or similar streamers or companies. Why? Because Dolby makes its revenues regardless of what streamers or what businesses that work with image or audio work their titles – it’s about the technology, which at this point, has become industry standard.

This is a business you want to be in above those aforementioned streamers if you’re a conservative dividend investor – that’s my view. I believe the upside for Dolby in the very long term to be there, and should the market take a dive back down, I will be here and loading up on Dolby as one of my investments.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

DLB is a “HOLD” here. It’s currently excessively overvalued given its current expected growth rate, and I’d advise waiting until the company at least reaches a sub-20-27X average weighted P/E multiple before buying.

Thank you for reading.

Be the first to comment