master1305

By Rob Isbitts.

Summary

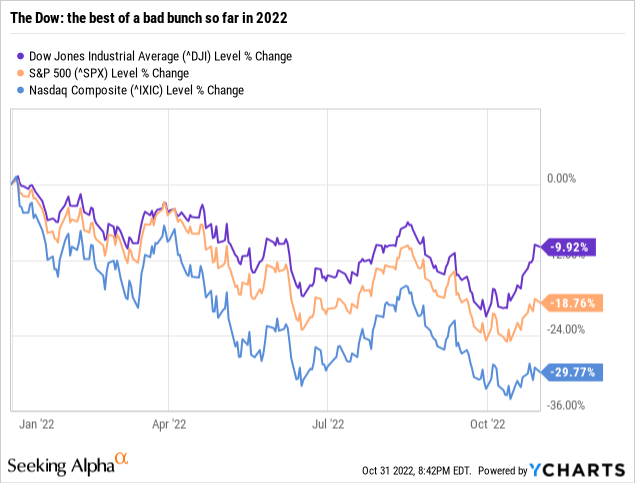

ProShares Short Dow 30 ETF (NYSEARCA:DOG) is an inverse exchange-traded fund (“ETF”) that aims to do the opposite of what the Dow Jones Industrial Average does. While technically DOG aims to track the “inverse Dow” on a daily basis, it has been around since 2006, and we have used it several times in our model portfolios. That experience has convinced us that it is more than just a day-trader vehicle. 2022 is proving to be a good example of that, as the Dow has significantly outperformed other major indexes.

Strategy

For many years, investors have not had to worry much about sustained declines in the stock market. Declines of 20% or more occurred in 2011, and again in late 2018 and early 2020. However, 2022 has brought the reality that the stock market was overvalued. Despite a steep drop in stock prices this year, there is strong evidence that the decline could still have much further to run. As with other ProShares single inverse ETFs we follow, DOG allows an investor to have something other than cash or bonds to hedge with.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Inverse

-

Sub-Segment: Inverse Dow

-

Correlation (vs. S&P 500): Very High (negative)

-

Expected Volatility (vs. S&P 500): Similar (but in reverse)

Holding Analysis

DOG aims to be a mirror image of the Dow 30 Index by entering into swap contracts with major Wall Street firms, as well as shorting Dow futures contracts, to target the inverse of the Dow’s return. That swaps portfolio is backed up by U.S. T-bills.

Strengths

I’ll go out on a limb and say that I’ve been investing in single inverse ETFs about as long as any investor has. The concept of buying an ETF that essentially shorts the stock market, without leverage, without options or futures, with intraday liquidity and with pinpoint accuracy, has been around since 2006. DOG has been, and appears to continue to be, a reliable, straightforward way to let your inner bearishness about the Dow Jones Industrial Average shine through.

In particular, an inverse Dow ETF affords the investor much more precision than one that shorts a more diverse stock index. The Dow only has 30 stocks, and 15 of those account for a large portion of the holdings. So effectively, you are shorting that basket of stocks. It is a lot easier to know what you own, or what you are shorting, when the underlying index is only really influenced by 15-20 stocks.

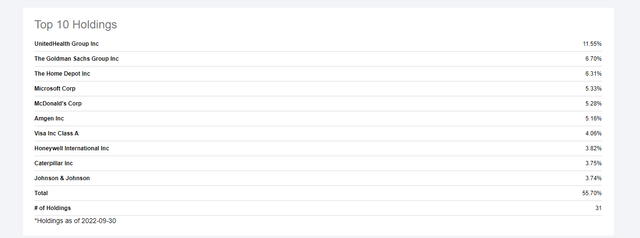

Here are the Top 10 holdings in the Dow as of 10/31/22. They make up more than 55% of the total index. This is what you are essentially shorting when you own DOG.

DIA (DJ Industrials) ETF top 10 holdings (Seeking Alpha)

Weaknesses

DOG is not quite as liquid as some other inverse ETFs. In fact, there are two inverse ETFs for the S&P 500, one for the Nasdaq 100 and another for the Russell 2000 Smallcap index, that each have more than twice the assets under management as DOG. Still, with an average dollar trading volume of about $35mm per day, DOG is far from illiquid. That smaller size may be a statement about where investor attention has gone over the years, whereby the venerable old Dow Index, created 140 years ago, has faded as the definition of “the market.”

Opportunities

Show me a bear market and I’ll show you a set of inverse ETFs that, if used tactically, can be some of your best friends in attacking the bear and defending equity portfolios. Inverse ETFs like DOG have been particularly timely in 2022. This was the year the bloom came off the rose for bonds, as they did not provide the classic alternative to stocks that today’s investors have been accustomed to. The longer and deeper the bear market in stocks goes, the more viable DOG can be, particularly if the Dow Index is falling in sync with the broader market.

Threats

The biggest long-term threat of DOG is fairly straightforward and transparent. It moves opposite the Dow, so when the Dow rises for an extended period, DOG is going to lose as much as the Dow gains. The other, more current threat is the potential for the Dow to continue to be the relative “flight to quality” that it was during the first 10 months of 2022, and at other times in the past. If you are short the Dow, but it holds its value better than other indexes you could have shorted instead, that’s an opportunity cost. Of course, there’s nothing stopping an investor from holding more than one inverse ETF, or switching from one to another at any time.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Buy

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

The next time you hear the news shout “Dow drop 1,000 points,” it feels pretty good to have one part of your portfolio making a lot of money. This is the appeal of all single inverse ETFs, at all times. Because you never know when a bear market will come, and how long it will stay. So you might as well learn how to not only defend it, but attack it as well! We keep DOG in our stable of ETFs available to potentially be used for hedging or attacking down market cycles. This one is nowhere near the “dog house” with us!

ETF Investment Opinion

We currently rate DOG a Buy. It would be a Strong Buy, except that a chunk of the bear market has already occurred. Should the Dow Industrials rally into 2022 year-end, then resume the “lower-lows” pattern that has been in place since January, DOG could potentially be elevated to Strong Buy.

Be the first to comment