Vlada_Z

ZIM Integrated Shipping (NYSE:ZIM) is an innovative Israeli shipping company that works on a capital-light model that provides considerable flexibility. We are bringing this to our members’ attention as we see some potential here.

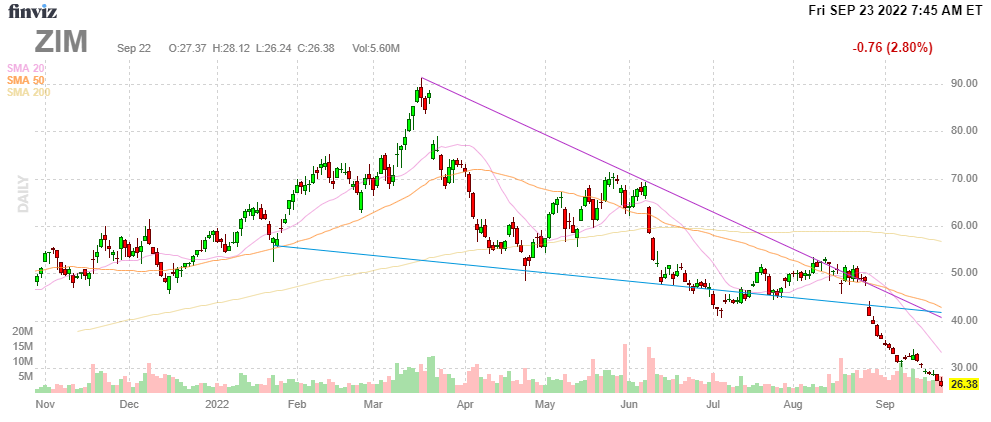

At first sight, this is odd as shipping is notoriously cyclical and with many parts of the world economy slowing down. A recession is looming in parts of the world, so the industry is in a downcycle, after an enormous boom in the last couple of years. The share price reflects this:

FINVIZ

But quite a number of SA contributors have pointed to the huge dividend yield and suggest the shares are attractive. They could be, but we argue that they are also risky as spot container rates, on which ZIM depends more than most of its competitors, can fall much further.

Business model

There are five elements in the company’s business model that put it apart:

- Capital-light model

- Data analytics

- Customer-centric model

- Incubator

- Green

Capital-light

Unlike most of its competitors, ZIM owns almost no vessels as it charters 96% of them (while competitors charter up to half). This hasn’t prevented it from amassing the 10th largest container fleet, managing 149 ships, in fact, one could argue the opposite.

This capital-light business model does provide the company with a considerable amount of flexibility to adjust capacity according to changing circumstances.

For instance, if you’re worried the company will be stuck with a lot of overcapacity in the coming years if the worst fears for the world economy materialize, be aware that next year charter contracts for 28 ships expire and another 34 in 2024.

Yes, the company also has commissioned 46 new ships over the same period but:

- That’s still 16 vessels less than expiring contracts.

- The charter rates are also likely to be lower as the expiring contracts were engaged at the height of the container boom.

- Operating costs are also likely to be considerably lower as these are new vessels and 28 of these are LNG driven.

The company is vulnerable to spot container rates for half of its traffic (the other half are generated by longer-term contracts with more stable rates).

Data analytics

Data analysis is at the heart of the optimization of processes, keeping customers happy and vessels fully occupied. From the 20-F:

Our digital investment in our information technology systems has allowed us to develop a highly sophisticated allocation management tool that gives us the ability to manage our vessel and cargo mix to prioritize higher yielding bookings. The capacity management tool as well as our agility in terms of vessel deployment enable us to focus on the most profitable routes with our customers. The net impact has been demonstrated through our industry-leading Adjusted EBIT margins for the last 28 consecutive quarters.

A series of alliances enabling partners to tap into each other’s facilities further help in these efforts.

Customer-centric

The company prides itself on its customer-centric approach and there is considerable evidence this works. For instance, its 10 largest customers have all been customers for at least 10 years. Central is SmartCS, its (20-F):

unified holistic program called SmartCS, a unified organizational structure, working methodology and best practice processes, supported by an advanced IT infrastructure and tools for better managing our customers’ experience across our customer service units worldwide

Additional services play an important role in this plank, here are some main examples from the 20-F:

Several recent examples of our digital services include: (i) ZIMonitor, which is an advanced tracking device that provides 24/7 online alerts to support high value cargo, (II) eZIM, our easy-to-use online booking platform; (III) eZQuote, a digital tool that allows customers the ability to receive instant quotes with a fixed price and guaranteed terms; (iv) Draft B/L, an online tool that allows export users to view, edit and approve their bill of lading online without speaking with a representative; and (V) ZIMGuard, an artificial intelligence-based internal tool designed to detect possible misdeclarations of dangerous cargo in real-time.

Apart from location, ZIMonitor enables customers to monitor the conditions of reefer cargo that need special conditions like unnecessary door openings, temperature, and/or humidity (pharmaceuticals, perishable products, electronica, etc.). The company has a 24/7 response team to address alerts.

Apart from their own services, they also have collaboration deals with providers of additional services on a range of issues like cybersecurity, blockchain, scanning, etc.

Incubator

The technology focus of the company actually extends beyond its borders to tap into the rich startup scene in Israel. Basically, the company functions as a sort of incubator, taking positions in promising startups which are developing relevant technologies and solutions, like (earnings deck):

ZIM earnings deck

From the Q2CC:

We have been very active on this front and have recently completed four investments. We did two follow-on investments in WAVE BL and Sodyo, and first time investment in Data Science Group and Hoopo Systems. Highlighting our most recent investment in Hoopo, they are a provider of cutting-edge tracking solution for unpowered assets. The solution is extremely durable, cost-efficient and power-efficient creating a tracking device that can last up to 10 years without changing the power source. Our investment in Hoopo would be used in part to develop a solutions suitable for the containers.

The $5.5M participation in Hoopo strikes us as especially relevant given the advanced telematica capabilities that company is developing, from the PR:

Hoopo’s solution is designed specifically for tracking and monitoring of unpowered assets by leveraging a unique, power-efficient tracking technology that creates long-lasting, highly durable and affordable tracking units that are suitable for any fleet size. Hoopo’s Location Intelligence technology can be used across complex logistic operations such as transportation, aviation, waste management, and maritime. Customers using Hoopo’s solutions gain improvement in asset utilization and cycle times, identify bottlenecks, optimize operations for higher efficiency, and offer elevated customer experience. Proceeds of this investment are intended to, among others, further develop Hoopo’s technology for the maritime industry, specifically dry containers, including the use of solar energy to power the tracking devices.

The market

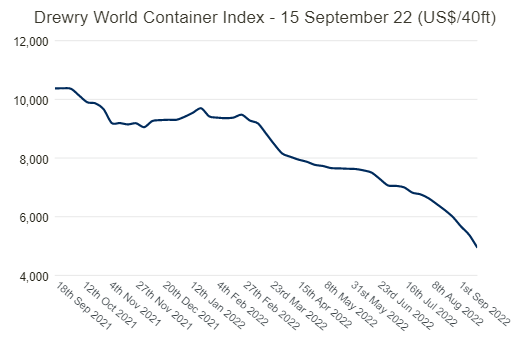

It won’t surprise anyone that the industry is highly cyclical, spot container rates, like other shipping rates, go through extensive boom-bust cycles producing gyrating prices which are the main determinant of company’s fortunes. From Drewry:

Drewry

It’s no surprise either that with the world economy slowing down considerably, the industry is in a downturn, after feasting on pandemic-induced capacity shortages and supply chain issues drove rates into the stratosphere last year.

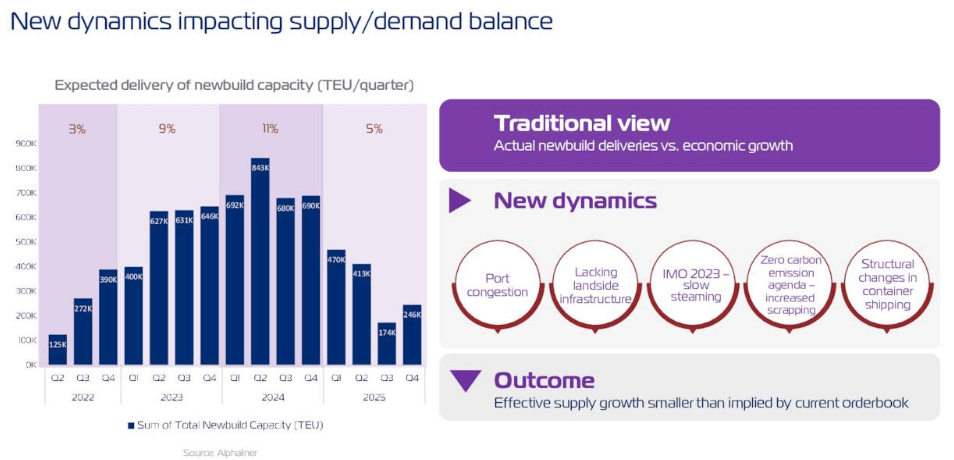

Rates are now off 52% below the peak a year ago and there are few signs that the bleeding is stopping anytime soon. Additional shipping capacity coming online in the coming years could exacerbate the downward trend:

ZIM earnings deck

How is ZIM dealing with this? Well, so far, their financial results seem to indicate little if any market deterioration and the company reaffirmed FY22 guidance and even increased its dividend payout (see below), but this will undoubtedly come, but in a reduced fashion by:

- Long-term contracts

- Charter rates are also cyclical

- Optimization, choosing routes and niches

- Fleet renewal

Long-term contracts play a significant part, especially on the transpacific lane where 50% of their transport is based on long-term contracts. However, management is not increasing that share and it has to be said that ZIM is more exposed to the spot market than most of its competitors.

Optimization

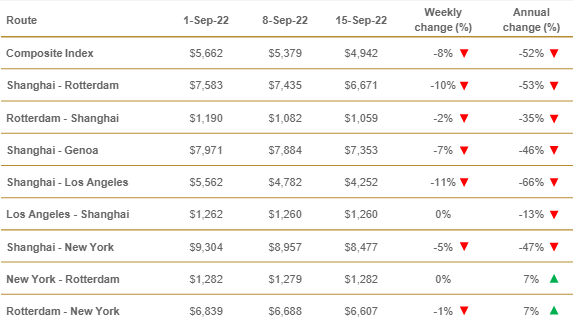

While most rates are down considerably, one might appreciate the wide variety in shipping rates and their evolution:

Drewry

But route and capacity optimization are probably no match for the rate decline no matter how sophisticated their algorithms are, but it can soften the impact.

For instance, intra-Asian trade is still booming and this is a niche where ZIM actually has a considerable and increasing presence, so this can also serve as a bit of a buffer:

Fleet renewal

The company has 46 new vessels coming in until the end of 2024, 26 of these are LNG-driven to bolster their green credentials and play its part in the transformation towards a more sustainable shipping industry:

But the new vessels do more than just bolster their ESG strategy, they will also lower cost, from the Q2CC:

the chartering costs that will be paid for each of those brand new vessels, they are going to be far more competitive that they — the last vessels that we fixed in the spot charter market, as we know, very hot

Finances

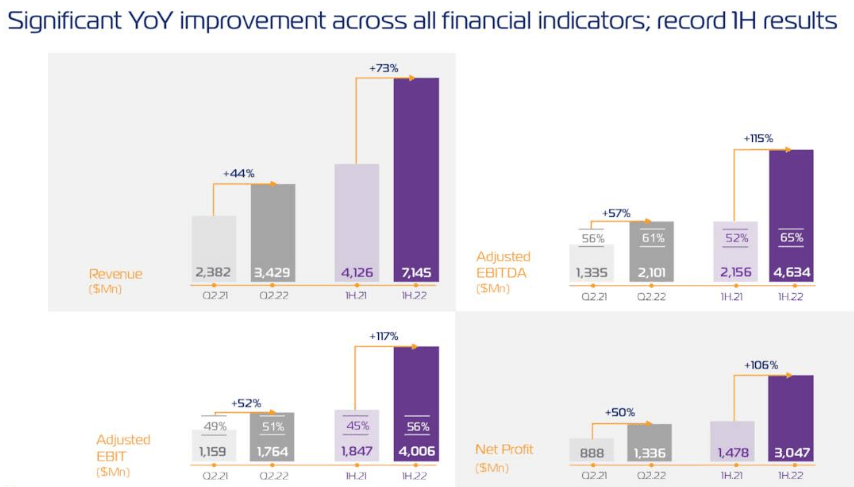

The finances are of course terrific:

ZIM earnings deck

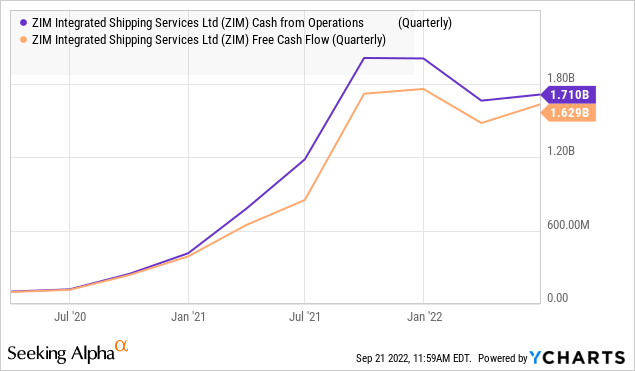

The company is benefiting from a veritable cash bonanza:

YCharts

And all that cash has enabled the company to greatly improve its balance sheet:

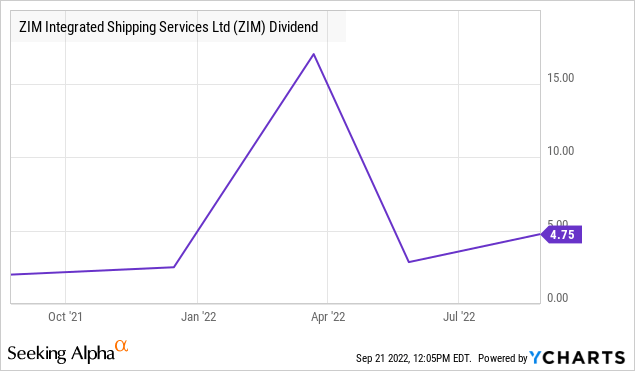

But keep in mind the company still has a considerable amount of debt at $4.57B and they have to pay for a few of the new ships as well. The cash flow bonanza also enabled the company to pay huge dividends:

YCharts

The $17 per share dividend it announced with the presentation of Q4/21 results is of course the highlight and represented 50% of net income, a dividend payout which it is repeating for FY22:

ZIM earnings deck

Guidance

Despite plunging container rates and a plunging share price, management was remarkably upbeat during the Q2CC a month ago, reaffirming its FY22 guidance:

There are some reasons for that, they see a ‘gradual’ decline in spot rates in H2 and their longer-term contract rates are double those of 2021. They even expect a recovery in volume growth (which was down in H1).

But we can’t help but wonder how many of these longer-term contracts will be negotiated in the face of plunging spot rates, we give you the headlines and a quote from a recent article:

Ocean carriers’ exorbitant profits are at risk as a sharp drop in spot rates prompts a review of contract rates.. As spot rates in the trade between the world’s two largest economies continue to fall, shippers are pushing carriers to renegotiate long-term fixed contract rates, upsetting shipping companies that have grown accustomed to having the upper hand in rate negotiations recently. two years.

Customers could simply shift more of their volume to the spot market so we’re not sure how strong the negotiating position of shippers is.

Management does expect volumes to increase in H2 (after a decline in H1) because they expect the congestion in (mostly) US ports to decline and also because of new ships coming online.

Management also argued that if the congestion at US ports doesn’t improve, shipping rates will stay higher, so that wouldn’t necessarily be a problem.

Capacity utilization isn’t a problem (or at least, it wasn’t a month ago when the Q2CC was held), from the Q2CC:

So our vessels have been selling full up until today and for the remainder of the year we are also assuming that the utilization will continue to be extremely strong, and this is why, we think that we will be able to catch up on our volume assumption on a full year basis, because utilization will remain strong

The impact of shipping rates on performance

An indication of the impact is given by comparing the rates in Q2/22 with those a year ago when shipping rates rose an average of 64%. Over that same period:

- Revenue rose by 44% (to $3.43M, from $2.38M in Q2/21)

- Net income rose by 50% (to $1.33B from $888M in Q2/21)

- Cash flow was 93% higher, but in Q2/21, it was still pretty good at $861M

While shipping rates are not the only variable impacting the financial results (volumes had an impact as well, which were actually down a bit in H1/22 versus H1/21), it’s a pretty safe conclusion that the company would still be very profitable if rates went back to their Q2/21 levels (which they already have).

Company profits are holding up because longer-term contracts are still much higher than a year ago, but as we argued above, one can wonder how long that will last.

One should be aware of the fact that spot rates were generally much lower before the pandemic, which produced a shortage in capacity as people shifted from buying services to buying goods. To give you an idea (gCaptain):

A year ago, rates from China to North Europe were around $14,000 for Antwerp and Rotterdam and $16,000 for the UK, with cargo being rolled from week to week. However, back in September 2020, you could ship a 40ft from Shanghai to Rotterdam for about $2,000.

Here are two pacific routes, from SHIFEX:

SHIFEX

So this isn’t painting a rosy picture for the coming quarters, we think it’s highly likely that spot rates will come under further pressure from a slowing world economy.

Conclusion

Much of the insane profitability, cash flow, and dividend of ZIM over the past couple of years is likely to be an aberration, the product of a pandemic-induced explosion in shipping rates.

Given the bleak economic outlook for the world economy, these rates are likely to keep on declining, and could very well undershoot their pre-pandemic levels if the economic climate gets grim.

However, given the nimbleness of the company, ZIM is well placed to sail through this and they are still producing a cash flow bonanza with which to further improve their balance sheet and soften the blow for investors with big dividends at least for a coming couple of quarters.

We think it’s likely that the stock price risks heading back to $10 with cash flow generation rapidly declining as well, greatly reducing dividends if not eliminating them altogether next year.

So, we think the shares are still pretty risky here, despite the plunge they already went through.

However, management actually confirmed their FY22 guidance and is (or at least was, at their Q2CC) much less pessimistic in their outlook and even increased the dividend payout ratio.

Apart from keeping in mind that the guidance is for H2/22 only, there are several possible explanations for this:

- Management provided the guidance in mid-August; things might have gotten considerably worse compared to the ‘gradual’ decline in rates they expected for H2/22.

- Management expects a recovery in trading volume in H2.

- Profits are held up by their longer-term contracts, which are twice the level of last year.

- Costs (fuel, charter rates, new more efficient vessels replacing less efficient older ones) are also likely to come down.

We think the first and third are by far the most important, but perhaps management knows something that the market doesn’t, perhaps they’ll be able to maintain some of their long-term contract terms beyond this year at present terms.

What we hope is that they have the wherewithal to reduce their debt levels, which we think is the best use of cash in the face of rapidly declining container rates, rapidly rising interest rates, and a worsening outlook for the world economy.

Be the first to comment