edwardolive

Cliches about gold

Long before digital or even fiat currencies, real gold already glittered as a store of value and a medium of exchange. Despite gold’s various shortcomings, people, investors, and governments still hoard it all around the world.

The most avid gold bulls may believe there is never a bad time to accumulate gold and there is no shortage of catchy cliches to back it up like “gold is money, everything else is credit.“ Gold is extra shiny right now because of the uncertainty surrounding a recession and a bear market.

Gold is commonly seen as a low-risk safe haven and a hedge against risky assets like stocks. The thinking is when investors feel risk averse, they rotate into assets that are perceived to be safer, like gold.

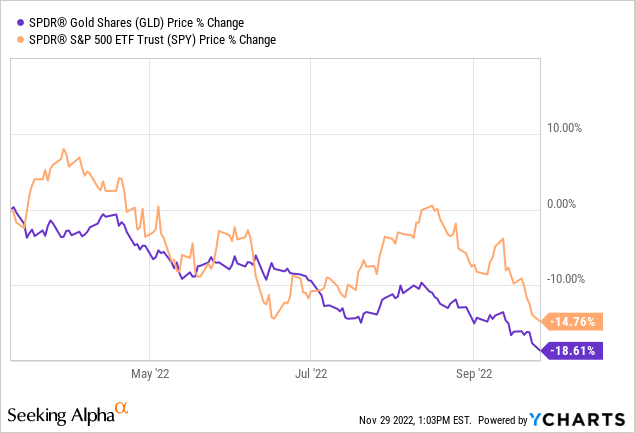

But this year, gold saw an intra-year drawdown of about -19% from April to September, while the S&P 500 was down by about -15%. This is shown in Chart 1 as the SPDR Gold Shares (NYSEARCA:GLD) and the SPDR S&P 500 ETF Trust (SPY).

Chart 1: GLD vs SPY Performance

Gold managed to bounce off its lows in Q4 and is now outpacing stocks for the year. However, a continued rise in interest rates could derail its recovery.

Gold prices are particularly sensitive to rates because it pays no interest, dividends, or other cash flows. As interest rates rise both opportunity cost and carrying cost increase for holding gold.

Rate increases originating in the U.S. can be even worse for gold because many commodities are denominated in U.S. dollars. When rising U.S. rates strengthen the dollar that also drags on gold prices.

We can question the biggest driver of gold’s performance, but the bigger question is should we view gold as a safe haven and a hedge against risk in the first place?

Gold as a hedge

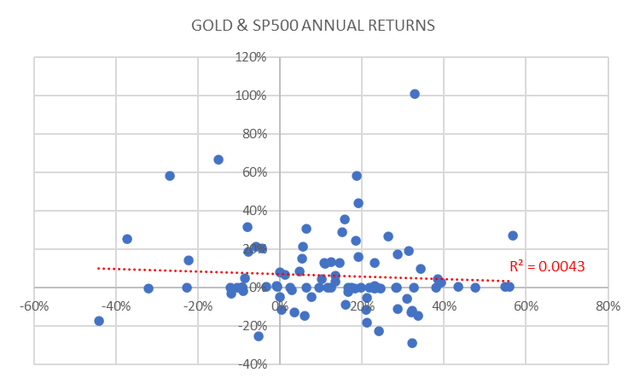

We can address the matter of gold as a hedge by looking at the historical correlation of returns between gold and risky assets like stocks. Chart 2 shows a linear regression of annual gold returns against S&P 500 returns from 1928 to 2021.

Chart 2: Gold & SP500 Returns

1928-2021 (Standard & Poor’s, MacroTrends, BCM)

There was a modest negative correlation of -0.0737. But the coefficient of determination (R-squared) of 0.0043 implies stock returns only explained about 0.43% of gold returns, not enough to be significant.

The data suggest gold and stocks are more non-correlated than strongly negatively correlated, and also suggest gold does not exhibit the hedging characteristics it is commonly credited with.

In other words, historically when stock prices fell, gold prices generally did not rise to offset losses in annual terms (not meaningfully, anyway). If it did, we would expect to see a tighter fit around a more negatively sloped trend line.

Gold as a safe haven

A lack of negative correlation with stocks does not preclude an asset from being a safe haven. For example, cash is one of the best-known safe havens even though it is not negatively correlated with stocks.

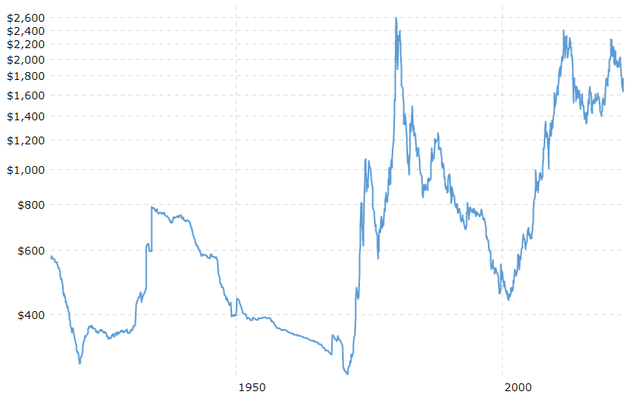

However, gold falls short of safe-haven status by another measure. If we define risk as volatility of price and uncertainty of return, then gold is not low-risk. Consider that gold prices peaked near $2600 in 1980 and then fell by more than -80% until bottoming around $445. Gold’s run-up to that $2600 peak was even more spectacular, over 800% (shown in Chart 3, prices adjusted for inflation).

Chart 3: Gold Prices

1915 to 2022 ytd, Inflation Adjusted, Log Scale (MacroTrends)

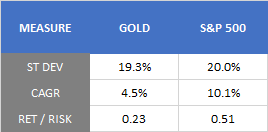

A low-risk, safe haven asset should not exhibit such extreme price movements. The magnitude of gold’s swings was more similar to high-risk assets like stocks. For reference, from 1928 to 2021 the annual volatility of return for the S&P 500 was 20.0% and it was 19.3% for gold as measured by standard deviation (Table 1).

Table 1: Gold & SP500 Statistics

1928 – 2021 (Standard and Poor’s, MacroTrends, BCM)

Not only were gold returns nearly as volatile as stock returns, but the annualized return for gold was only 4.5% versus 10.1% for the S&P. In other words, for every unit of risk taken, an investment in the S&P 500 provided more than two times the return of gold. From that perspective, gold does not look like a low-risk safe haven or even an attractive investment.

But gold still glitters

That does not mean investors should sell all their gold or avoid it. Gold can still be a good diversifier for investment portfolios. That is different from being a hedge. While effective hedging requires negative correlation, diversification only needs non-correlation to work.

As Chart 2 showed above, gold and stock returns showed little to no correlation. Combining non-correlated assets can reduce portfolio volatility and improve risk-adjusted returns over time (less risk and more return), which is the crux of proper diversification.

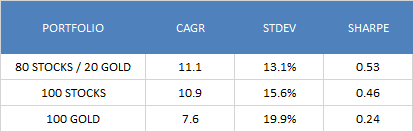

Gold can be useful in that respect. Consider a simple example of three investments; portfolio 1 is 100% gold, portfolio 2 is 100% U.S. stocks, and portfolio 3 is 80% U.S. stocks + 20% gold.

Backtesting from 1972 to 2021, stocks delivered annualized growth of 10.9% per year while gold delivered 7.6%. Stocks also had a lower standard deviation than gold during that period, 15.6% vs 19.9%, respectively. Based on those statistics, it seems stocks should be the preferred investment (higher return and lower risk).

However, the 80/20 portfolio actually delivers the highest returns (CAGR), lowest risk (st dev), and best risk-adjusted performance (Sharpe) of the three portfolios. This is summarized in Table 2 below.

Table 2: Portfolio Statistics

1972-2022, Gold Prices, Morningstar US Market Index (PortfolioVisualizer, Morningstar, BCM)

This was possible because the non-correlation between stocks and gold reduced overall portfolio volatility and produced smoother compound annual growth over time.

The reasonable bottom line

Based on historical data, gold does not appear to offer a meaningful hedge against risky assets like stocks. Furthermore, from a volatility perspective, gold has been as risky as stocks, and sometimes even more so.

These observations contradict the beliefs that gold is a low-risk safe haven and provides protection against stock market losses. Furthermore, gold’s long-term annualized return of 4.5% makes it less attractive on a risk-adjusted basis versus other assets that achieved similar returns with less volatility.

However, despite its shortcomings, gold can still be an effective portfolio diversifier. Gold’s lack of correlation with other asset classes can help reduce portfolio volatility and improve risk-adjusted returns over time.

Precious metal bulls may also point out gold’s tangible nature and physical utility provides it with an inherent safety that cannot be quantified or fully explained by numbers. If nothing else, gold can still conduct electricity and glitter as jewelry. Admittedly, that is more than we can say about fiat or digital currencies.

This is not a bullish or bearish opinion on gold, and I do not have a price target for the metal. This is a reminder we should be clear about our reasons for investing in gold, or anything else.

We should also be willing to objectively evaluate relevant data and recognize how information does or does not support our reasoning. Said another way, do your homework, do not just invest based on catchy cliches or what you read on the internet.

Be the first to comment