The best photo for all/iStock via Getty Images

DocuSign (NASDAQ:DOCU) reported pretty mixed FQ1 results with better than expected revenue, but some margin pressure and deteriorating net dollar retention rates. While the company benefited from the pandemic as customers shifted their businesses to an online-status, DocuSign is hitting difficult growth comparisons now.

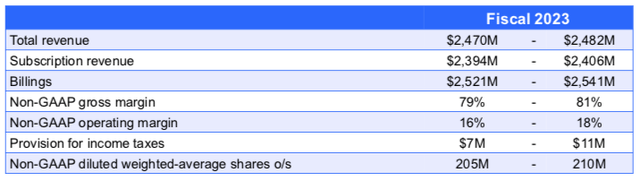

Revenue growth for the year is expected to be 18% yoy at the midpoint of guidance, and combined with non-GAAP operating margin of 16-18%, DocuSign might fall below the Rule of 40 score for the year.

In addition, a recent shake up at the CEO position may cause ongoing sentiment headwinds until the company can improve their execution.

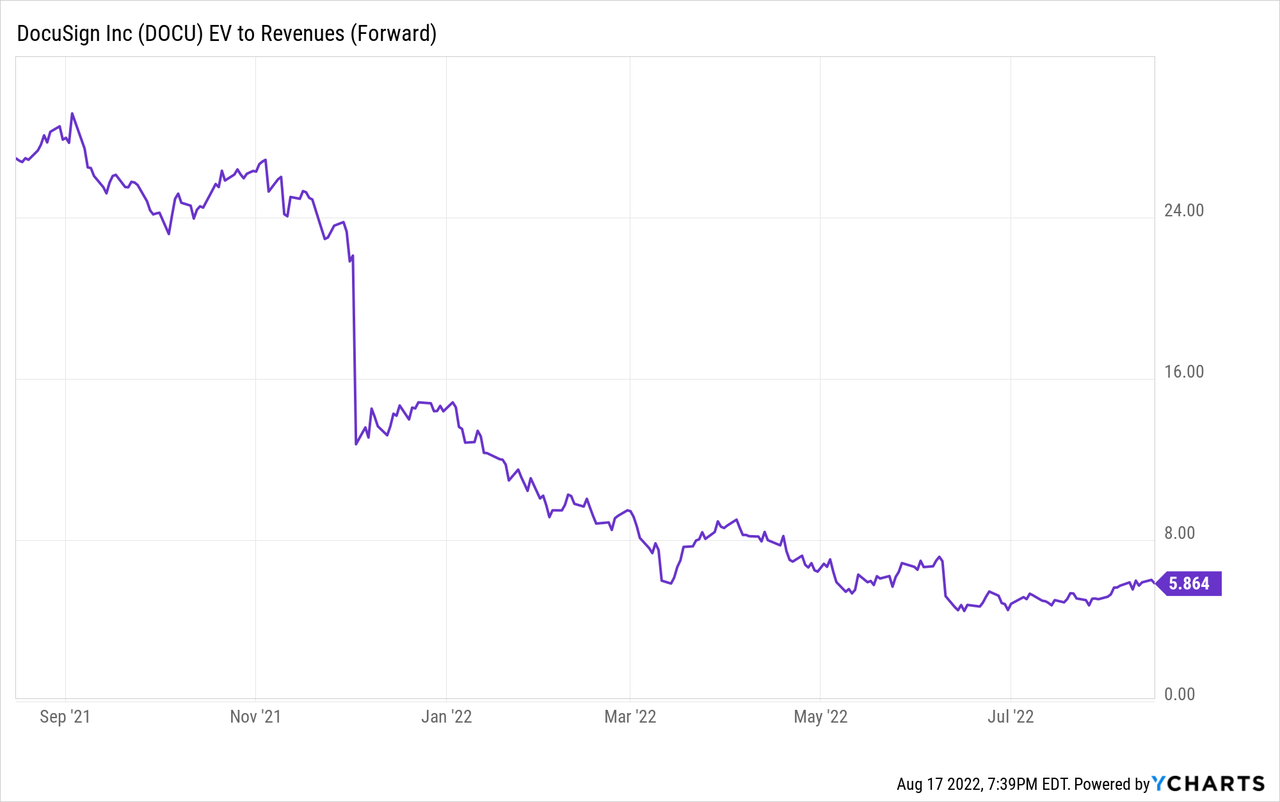

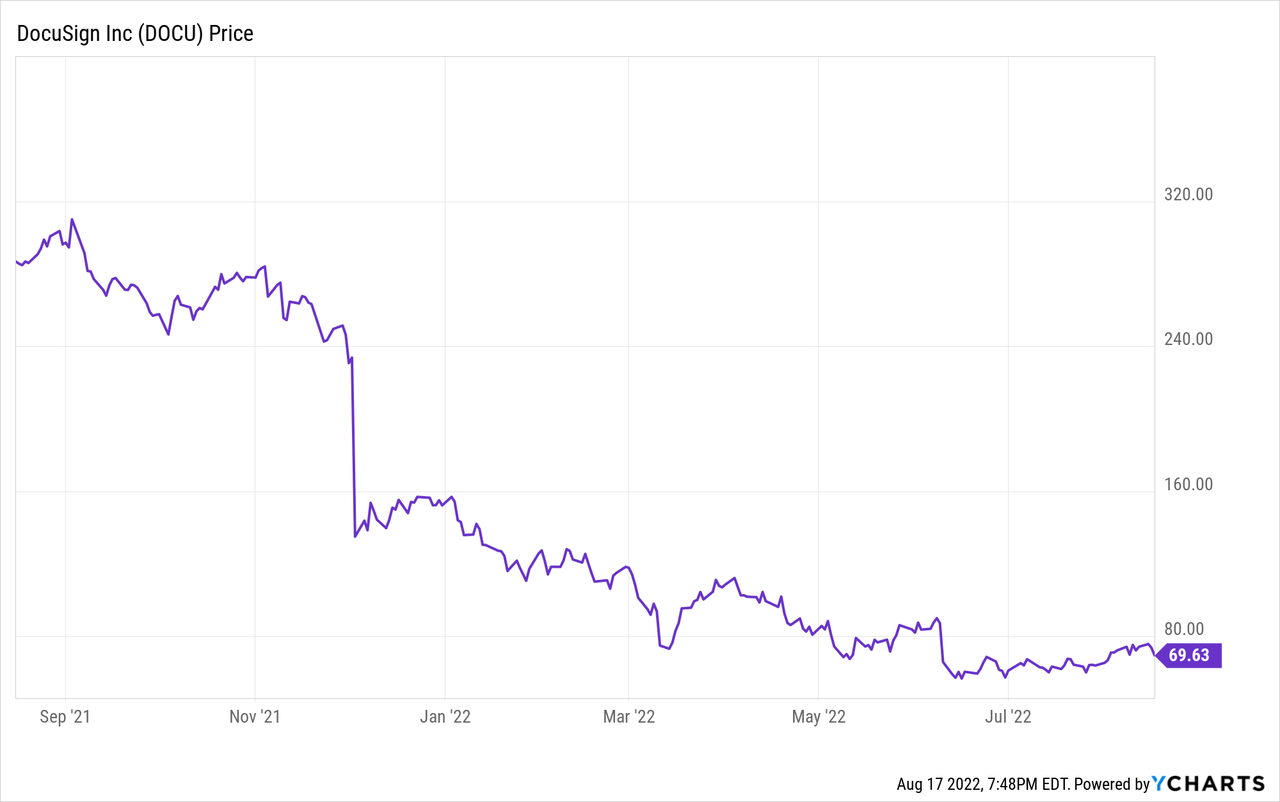

Currently, the stock is trading at just under 6x forward revenue and while this is significantly lower than their historical valuation levels, the company’s growth profile has materially changed. In the past, DocuSign had grown at a 40% revenue CAGR for many years and with growth now under 20%, investors are adjusting to the new norm.

Long-term, I believe DocuSign will likely maintain healthy growth rates, however, I remain on the sidelines for now as the challenging macro environment, recent executive turnover, revenue deceleration, and margin contraction all weigh on sentiment.

Financial Review and Outlook

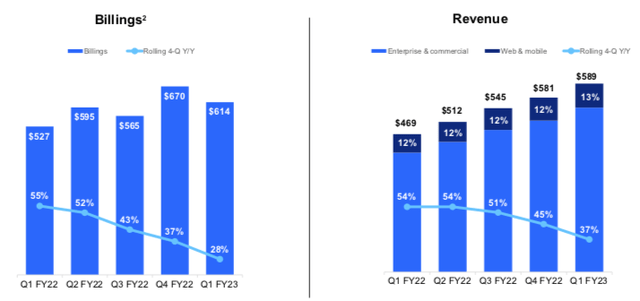

While the company reported mixed FQ1 results in early June, revenue growth continued to decelerate given the very strong growth trends from the year-ago period. During the quarter, revenue grew 25% yoy to $589 million, which beat expectations for $582 million, or 24% yoy.

In addition, billings growth was just 16% yoy to $614 million, which was 9pts below the revenue growth. In my opinion, this continues to demonstrate ongoing declaration, which is further backed by the company’s 18% yoy revenue outlook for the full year. Given the 25% yoy growth reported in FQ1, we are likely to see a steady path of revenue deceleration throughout the year.

Not surprisingly, the company’s gross margin remains healthy in the low-80%, which is pretty typical of software companies. However, operating margins during the quarter contracted to 17%, down from the 20% seen in the year-ago period. Yes, the company is still profitable, but the combination of revenue deceleration, somewhat weak billings growth, and profitability margins coming down is an eyesore for investors who are already cautious around a recession fears.

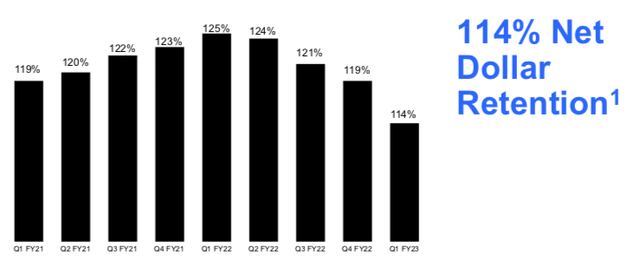

In addition, there has been a clear downward trend in the company’s net dollar retention, which was again down sequentially in FQ1 to 114%, down from 119% last quarter and down from 125% in the year-ago period.

Clearly, DocuSign was a pandemic beneficiary as customers rapidly changed their business models to a hybrid and virtual environment. As this occurred, customers were constantly looking at up-sell opportunities and adding more DocuSign products.

However, as many companies have slowly returned back to office or have become more cautious around their spending given the heightened concerns around a potential recession, there is ongoing risk towards this net dollar retention metric continuing to come down.

For the full year, the company is expecting revenue growth of $2.47-2.482 billion, which reflects 18% yoy growth at the midpoint. This implies ongoing revenue deceleration throughout the year, as FQ1 revenue growth was 25% yoy, meaning the company might even decelerate towards the low-teens growth rate by the end of the year.

In addition, non-GAAP operating margins are expected to be 16-18%, which reflects ~300bps contraction at the midpoint compared to ~20% margin last year. Yes, this is still nicely above the 12% margin in FY21, but investors typically do not like the combination of decelerating revenue and margin contraction, no matter how much one-time benefit they saw last year.

Not to mention, the macro environment continues to remain challenged as even though management commented on the macro during their earnings call, there has not been much, if any, improvement since their early-June report.

However, we are not immune to the macro-challenges with our customers and peer space. As Dan discussed, we are focused on that which is within our control, innovation across our product portfolio and improving our go-to-market execution. While we have made considerable progress bringing in leaders with significant experience at scale, it’s important to recognize that meaningful traction and better visibility will take multiple quarters.

Specifically, in Fiscal ’23, we are moderating our expenses and managing our hiring plans at a more measured pace, appropriately aligning our investments with the current climate and our growth. These elements have been incorporated in the current outlook.

With the company admitting the macro is challenging, it may take several quarters to regain traction and better visibility, and they are slowing down hiring, it appears revenue growth may remain challenged for the foreseeable future.

Additionally, in late June the company announced that their CEO, Dan Springer, agreed to step down as CEO. While Dan has done a great job leading DocuSign over the years, it appears that the board wanted to take a step in a different direction, appointing Mary Agnes Wilderotter as interim CEO. I believe this shake-up in leadership may take several quarters to play out in the company’s financials and remains a sentiment headwind.

Valuation

With the stock down over 55% year to date including over 20% pullback since they reported earnings, investors may point towards a cheap valuation for a reason to buy the stock. In general, high-valuation technology stocks have seen their valuations take a hit as they lap difficult growth comparisons and investors rotate to more defensive stocks.

Ongoing revenue deceleration, margin pressure, and executive management changes makes it difficult to be bullish at current levels. Additionally, DocuSign is still competing against a large tech player named Adobe, who has much greater scale and investment capabilities.

Currently, the stock is trading at just under 6x forward revenue and while this has pulled back significantly from their historical double-digit revenue multiples, I believe valuation is not yet cheap.

As seen by the company’s somewhat weak billings growth of 16% yoy during the quarter, revenue seems to be set up for ongoing deceleration. Full year revenue guidance is just 18% yoy at the midpoint, which is down significantly from the 40%+ revenue growth seen in the past.

While the stock is currently trading below pre-pandemic levels, the growth profile is much different now. In fact, the company will be lucky to achieve the Rule of 40 score during FY23. In the past, revenue was growing above 40% and the company was profitable.

Investors have re-rated the stock lower and rightfully so. Longer-term, I do believe the company can continue to grow double-digits. But for now, I remain on the sidelines given the new CEO change and a challenging macro environment.

Be the first to comment