Michael Vi/iStock Editorial via Getty Images

Not only did the market not like the quarterly earnings report of DocuSign (NASDAQ:DOCU), but also the company reported right into a bad reading on inflation. The stock fell to new lows dipping an amazingly large 10% to start the week following the big sell off after earnings last week. My investment thesis is naturally far more Bullish here after the eSignature company has completely normalized business growth plans while the stock has fallen below pre-covid levels offering a gift to new investors.

Struggling Bookings

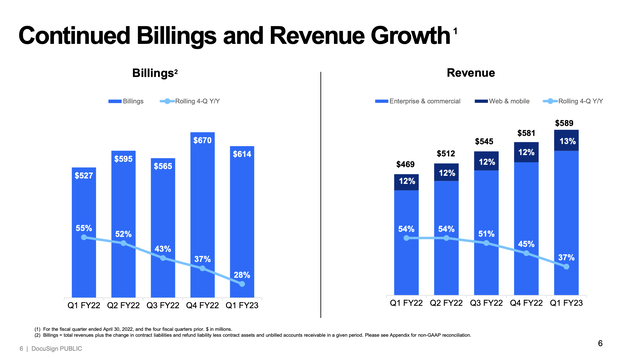

With the FQ1’23 earnings report, DocuSign reported quarterly numbers generally mixed compared to expectations with revenues actually beating by $6.8 million. What really spooked the market was the billings forecast for FQ2’23 predicting growth of only 1% to 2% above the FQ2 bookings level of $595.4 million last year.

In essence, the market is now extrapolating the bottom in the business may not occur in the current quarter. DocuSign guided to billings growth for the year at 7% to 8%. suggesting a rebound in bookings growth later this year as new sales leadership boosts the business.

The biggest fear is that some sort of competitive threat is stealing sales deals here, but investors already know that most tech. companies have faced pressure from covid pull forwards slowing growth this year. Companies that jumped at quick ROI projects during covid shutdowns are now taking longer to focus on implementing complete contract agreement deals.

DocuSign just announced an expanded strategic partnership with Microsoft (MSFT) in a move that should alleviate any concerns of competitive threats of the tech giant. In anything, the expanded cooperation could lead to a future tie-up.

The biggest concern for investors is the ultimate bottom of the bookings cycle for the business with a recession in the global economy looming. Ultimately though, the demand for online contract agreement software is only going to expand over time.

DocuSign guided to FQ2’23 bookings of $599 to $609 million. The electronic signature company has already printed a couple of quarters with bookings above $600 million in the indication of the current weakness in bookings.

Source: DocuSign FQ1’23 presentation

The company has a goal of reaching $5 billion in revenues with a market TAM hitting $50 billion. Revenues will need to double the $2.4 billion target for FY23 to reach this goal.

Take A Step Back

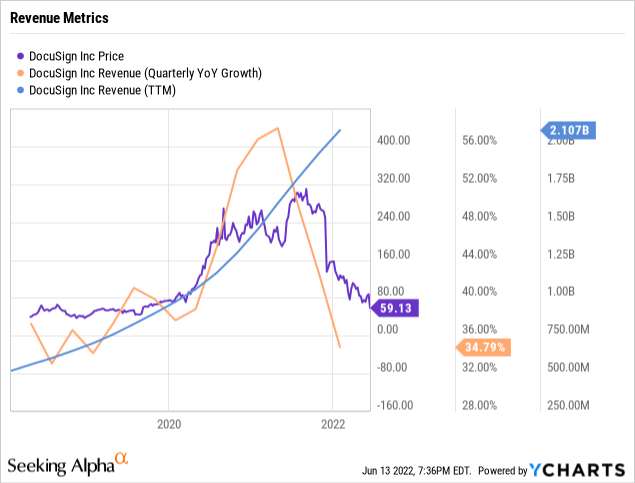

The market is getting caught up on the recent results similar to how people got caught up with the peak growth rates of 50% back a year ago. The stock surged to over $300, and investors had no fears of either demand destruction from covid pull forward or competitive threats.

Anyone taking a step back on viewing this picture of total revenues in comparison to the stock price has a far better feel for the current situation. DocuSign has generated consistent growth while the stock market extrapolates current trends too far at the peak and trough.

The stock has fallen below $60, and the market will probably get caught up focusing on the PE ratio. DocuSign still trades at 30x FY24 (January) estimates of nearly $2 per share.

For a software company with historical revenue growth rates in excess of 20%, such a forward PE ratio is relatively cheap. Not to mention, the current targets aren’t optimized for maximum profits as DocuSign absorbs a couple of years of subpar growth with excess operating expenses from not fully planning for the slowdown in bookings.

The market cap has dipped to $13 billion while the company generated $175 million in free cash flow in the last quarter. DocuSign has the balance sheet with net cash around $350 million and cash flows to invest in growth during any downturn over the next year.

Takeaway

The key investor takeaway is that DocuSign is now trading at trough type valuations for a business no longer optimized for the profits. The software company is generating the types of cash flows to guide the business through any bumpy period ahead.

Investors should use this massive collapse in stock prices to build a position in DocuSign. The stock might continue falling in the weeks and months ahead, but investors buying below $60 will be rewarded over the long term as the agreement cloud business builds.

Be the first to comment