Editor’s note: Seeking Alpha is proud to welcome Waterside Insight as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

svetikd

Investment Thesis

DocGo, Inc (NASDAQ:DCGO) has good momentum. This stock is not overvalued, and its future growth will depend on how expanding into new markets while keeping costs low. The company’s operating efficiency enabled by a highly sophisticated technological system is critical in helping to achieve that goal. After estimating a fair value for the DCGO stock price, I recommend an option strategy to take advantage of the price action. Read below for details.

Qualitative Highlights

I take a holistic view of DocGo to analyze its business prospects.

Company Overview

DocGo was founded in 2015 and filed for IPO on Nasdaq in 2021 via SPAC merger with Motion Acquisitions Corp. It offers both telehealth and “last-mile” healthcare services to patients in their homes or at work, such as testing, vaccinating, bloodwork, IV hydration, wound care, and mobile imaging, among other services. Since its IPO, DocGo has undergone fast growth and several transformations. It became cash flow positive this year, and its earnings are forecast to grow 24.77% per year in the next 3-5 years. And it was added to the Russell 2000 index just three months ago.

The questions I had in mind about DocGo were twofold. It’s been pulling in a lot of revenue from COVID testing and COVID-related demand. What will happen to its bottom line when the pandemic becomes endemic? Can DocGo continue to penetrate new markets at a rapid pace? Below is my analysis:

Strength

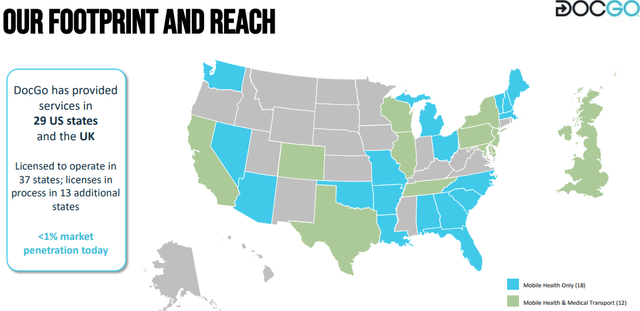

With its headquarters in New York City, DocGo is highly adapted to the urban environment. Providing last-mile medical services in densely populated areas is particularly challenging. This experience has helped the company establish its expertise in this niche area. In its latest Investor Presentation, DocGo said the clients achieved a 35% reduction in ER visits with its mobile health program. It estimated mobile health and medical transportation could reach a $278 billion market value by 2025. And this market has only <1% penetration (see a snap of the company presentation below).

Mobile Health market penetration (DocGo)

It is not difficult to see that medical care demand has only increased substantially following the pandemic. In the next 5 to 10 years, it will be a secular trend to provide more personalized, on-demand, non-urgent medical care. When the niche becomes mainstream, this could be a tremendous opportunity. Before that happens, DocGo needs to worry about not raising too much debt too quickly and not losing its efficiency in the process. So far, the company has expanded into new markets by signing new contracts and acquisitions. For example, it acquired Mid Atlantic Care soon after its IPO to get into the markets in Delaware, Maryland, and Pennsylvania. To fund the acquisition efficiently, it must carefully manage its free cash flow. In this regard, I am cautiously optimistic. We will see why by taking a look at its operation.

Upon reviewing DocGo’s business operation, what stands out most to us is its technological propensity. The company has been building software that has “evolved into a highly sophisticated system”. Its president Anthony Capone (formerly the CTO) said during the Q2 2022 earnings call that “at its heart, DocGo is a technology company”. Its application infrastructure received ISO 27001 certification about nine months ago. Within this integrated infrastructure, the company builds a system of proprietary algorithms that assess and evaluate the clinical system and patient experience. This system allocates its resources based on predictive demand analysis generated by the system. And it uses machine learning algorithms to “predict reimbursement and help ensure collectability”. This saves time and costs in improving reliability and optimizing its response to various emergency medication situations. At the heart of this prediction is a large amount of data it accumulates over time. The longer the business runs, the algorithm adapts better as longer historical data helps greatly. The more markets it enters, the more diverse the data is and the more accurate the prediction becomes. It will be more efficient in cutting costs while expanding. As a result, it has a competitive technological advantage that helps it expand into new markets while maintaining profitability.

Another strength of DocGo is the differentiation of its revenue components. The company has four categories of clients: hospitals, payers, municipalities, and events. Among them, the municipalities seem to offer the most stable revenue stream in the long term. CEO Stan Vashovsky had this to say in the recently concluded earnings call cited above:

It is clear that the municipal customer segment will remain a cornerstone of our business for the foreseeable future, providing us with a stable base of revenue upon which we can build.”

DocGo works with municipalities in complex urban scenarios, such as homeless shelters and street medicine programs. And it works in most of these programs through contracts with municipalities. These municipal mobile health contracts could help provide a recession-proof cushion to its revenue as most of these contracts tend to be multi-year. It appears that their relationship with the municipalities will be able to carry them through when mass COVID testing revenue dries up in Q3. It had about $28 million in revenues from Q2 from mass covid testing. This is expected to decline significantly in Q3. However, according to Vashovsky, “the same relationship with NYC municipalities will transition from COVID testing to primary care at homeless shelters”. He expects “the transition to new non-covid projects to reduce the impact of the transition on the company’s revenue generation.”. The company didn’t break down the percentage of municipal mobile health contracts in the total mobile health revenue. But the CEO’s statement implies that it could be substantial. So if I look at mobile health in general, excluding mass COVID testing, this section’s revenue was $59.3 million in Q2 and $52 million in Q1. If I extrapolate the 1H for the whole year, this line of business will be bringing in $222.3 million a year. That is about 51.2% of the total revenue, based on its 2022 revenue guidance that was raised to $435 million in the last report. This will give a floor to the stock price in the case of an extreme sell-off during volatile market conditions. Having a stable cash flow enables it to wait for the direct-to-consumer market to mature, which represents the greatest potential growth opportunity for the future.

Quantitative Highlights

Financial Overview

DocGo reported strong results in Q2 2022, with total revenue rising to $109.5 million, a 76% increase YoY although a 7.12% decline from Q1. The company’s Cash On Hand has increased steadily to $198.14 million after a substantial jump, from $59,000 to $175.54 million in Q4 2021. Its net-net working capital increased from slightly negative a year ago to $1.66 million in Q2. While its total liabilities have decreased from $84.93 million in Q1, the highest since its IPO, to $77.46 million in Q2, roughly the same level as Q3 of 2021. Its Debt-to-Equity ratio declined to 0.06 from 0.43 in Q2 2021. Overall, it is in a healthy financial position.

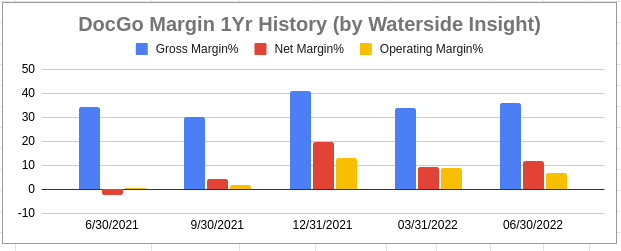

On the earnings and profitability front, DocGo’s EPS has improved – from losing $18.19 in Q2 2021 to earning $0.11 in Q2 2022. The company has maintained a steady gross margin of 30% – 40% since Q2 2021, while Net Margin and Operating Margin are seeing continuous improvement on a YoY basis. It shows continued improvement in efficiency in the core business. Its technological platform could be a valuable contribution in this regard.

DocGo Margin History (DCGO Filing, Waterside Insight)

DocGo Valuation

First, I want to calculate its Cost of Equity based on CAPM (Capital Asset Pricing Model). The beta of DocGo is 1.12, as determined by MarketWatch. With the risk-free rate as the yield of the 10-Year Treasury Note, the inflation rate of 8.3% reported by the U.S. Bureau of Labor Statistics, and assuming the market-expected return to be the same as the inflation rate of 8.3%, I calculated the expected annualized return to be 9.83%. Based on this, I estimated its WACC ((Weighted Average Cost of Capital)) to be 9.56%, with the cost of debt estimated to be 5.23% and the effective tax rate as 3.1%, given by its income statement.

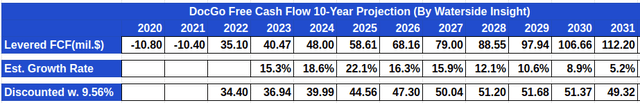

Then, I do a sanity check on the intrinsic value of DocGo. Since the company doesn’t pay dividends, I performed a Discounted Cash Flow analysis to value its current stock price based on its future cash flow projections. As the company is young with limited history, it is more pertinent to project future cash flow properly to value the stock. DocGo has substantial growth momentum since it has just turned cash flow positive by a large margin this year. As a result, I expect the second half to maintain this momentum with a small discount due to market uncertainty. Since its first 6-month Levered Free Cash Flow (LFCF) is $19.5 million, I projected it to be $35.1 million for the whole year of 2022. The looming recession threat and rising interest rates could, however, undermine its momentum. So based on my analysis above, I ran a simulation with my proprietary models. They capture a more conservative growth rate that initially slows down and then accelerates to a peak before reverting to the industry’s average growth rate.

DCGO 10Y LFCF Projection (Waterside Insight)

After discounting the LFCF and summing them up, the Present Value (PV) of the projected LFCF is $456.79 million. Then I calculate the PV of the terminal value discounted with the 9.56% rate of return, which gives $768.63million. Summing up these two gives $1.22 billion, and then dividing by the outstanding number of shares, I reached a fair price of $12.13 for DocGo. Now, if I change the assumption in the market expected return in the CAPM model to be 9.1%, the average inflation rate of the U.S. and U.K. (since it operates in the U.K. as well), its valuation drops to $10.41. In terms of the upside risk of this investment thesis, if DocGo can successfully penetrate its target market by more than 5% from less than 1% currently, with manageable debt from its expansion, its growth rate could accelerate much higher than what I simulated due to the network effect. The downside risk is that if it is hit hard by the looming recession, it could have no growth through 2023. In that scenario, assuming an inflation rate of 9.1%, my valuation is $9.07 ((In a deep recession, all bets are off)). Based on this, it seems that right now the market is actively trying to price in the recession risk for DocGo. Overall, the risks to this investment thesis are skewed towards the upside.

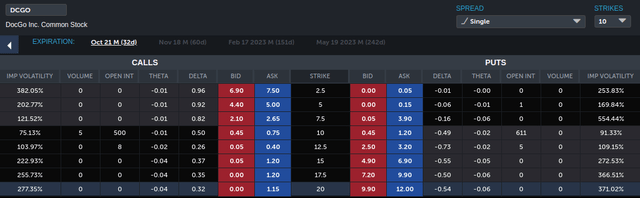

DocGo is undervalued at the current price. Long-term buy-and-hold investors can start accumulating when the price drops. Considering the volatility ahead in the current environment, if an investor doesn’t want to own the stock outright, he/she can sell a put option with the intention to buy should the price push lower. See the option chain below.

DCGO OptionChain (TradeStation)

An investor can sell an Oct 21 put option with the strike of $7.5 for $3.9. Your maximum risk is $3.6, and your maximum reward is $3.9. Should the price fall below $7.5, you can exercise the option and purchase DocGo’s share below its intrinsic value. Otherwise, you can just collect the $3.9 premium as income. Due to recent market volatility, an investor should use real-time prices to calculate the risk/return before entering a position.

Weakness/Risks

Of course, risks and uncertainties remain for DocGo as a new company. Firstly, since its IPO, shareholders have been substantially diluted, with total outstanding shares growing by 602.8%. The company announced a share repurchase program of up to 40 million common stock in May, in which it repurchased 70,000 shares at an average cost of $7.1 during the quarter. Despite this, as it uses acquisitions to enter new markets, it will likely issue more shares in the coming years in a higher-interest-rate environment to fund its operations, so shareholders may need to hold on to the shares for longer to reap the benefits. Secondly, inflation risk is still high for the company. Increasing fuel costs and rising labor costs for highly specialized medical staff will continue to erode its margin. The company saw a 73 basis point impact of increased gas costs on its gross margin in Q2 compared with 55 basis points in Q1. Its current guidance assumes the labor cost inflation rate to be 7% ((as we know, the inflation rate in Q2 turned out to be 9%)). Investors should keep an eye on how its assumption changes in its Q3 report. Ultimately, how fast and how big it could grow depends on how telehealth and last-mile care are being massively adopted. The pandemic was a boon to DocGo’s service model, and I have seen a secular trend of people increasingly adopting alternative ways to care for their medical needs. It remains to be seen how the pace will progress from here.

Conclusion

My analysis indicates that DocGo has the potential to unlock substantial market growth while still generating cash flow at a steady rate. The company’s operational system, which uses artificial intelligence and is standardized, could be a competitive advantage critical to its future growth. I simulated a conservative projection of its future growth to find its fair value while considering possible near-term market volatility in the next few quarters. It shows the stock is undervalued and can be accumulated should the price drop below $9.07. Selling a one-month put option at strike $7.5 with reasonable risk/reward could help investors to generate income while waiting for a more attractive entry point. Overall, I find DCGO an interesting stock to keep an eye on for long-term investors who want to diversify their portfolio by taking on a small cap with a healthy risk/return profile. Looking forward, my investment thesis shows that the potential risk is skewed towards the upside in the long term.

Be the first to comment