Khaosai Wongnatthakan/iStock via Getty Images

A Quick Take On Docebo

Docebo Inc. (NASDAQ:DCBO) recently reported its Q2 2022 financial results on August 11, 2022, missing consensus revenue estimates.

The company provides online learning capabilities with AI-enhanced functions to improve learning results.

It is encouraging that DCBO has “turned the corner,” producing earnings and positive free cash flow while continuing an impressive growth trajectory despite some sales cycle slowdown.

I’m bullish on Docebo, and my outlook is a Buy at around $36.00 per share.

Docebo Overview

Toronto, Canada-based Docebo was founded in 2005 to develop an integrated learning management system [LMS] for organizations of all sizes to provide internal and external training capabilities.

The firm is headed by founder and Chief Executive Officer Claudio Erba, who was previously project leader at MHP Srl and product manager at Selpress.

The company’s primary offerings include:

-

Learn LMS

-

Impact Measurement

-

Analytics

-

Shape

-

Content

-

Flow.

The firm acquires customers through its direct sales and marketing efforts, both through inbound and outside sales teams.

Docebo’s average contract value was approximately $45,000 as of June 30, 2022.

Docebo’s Market & Competition

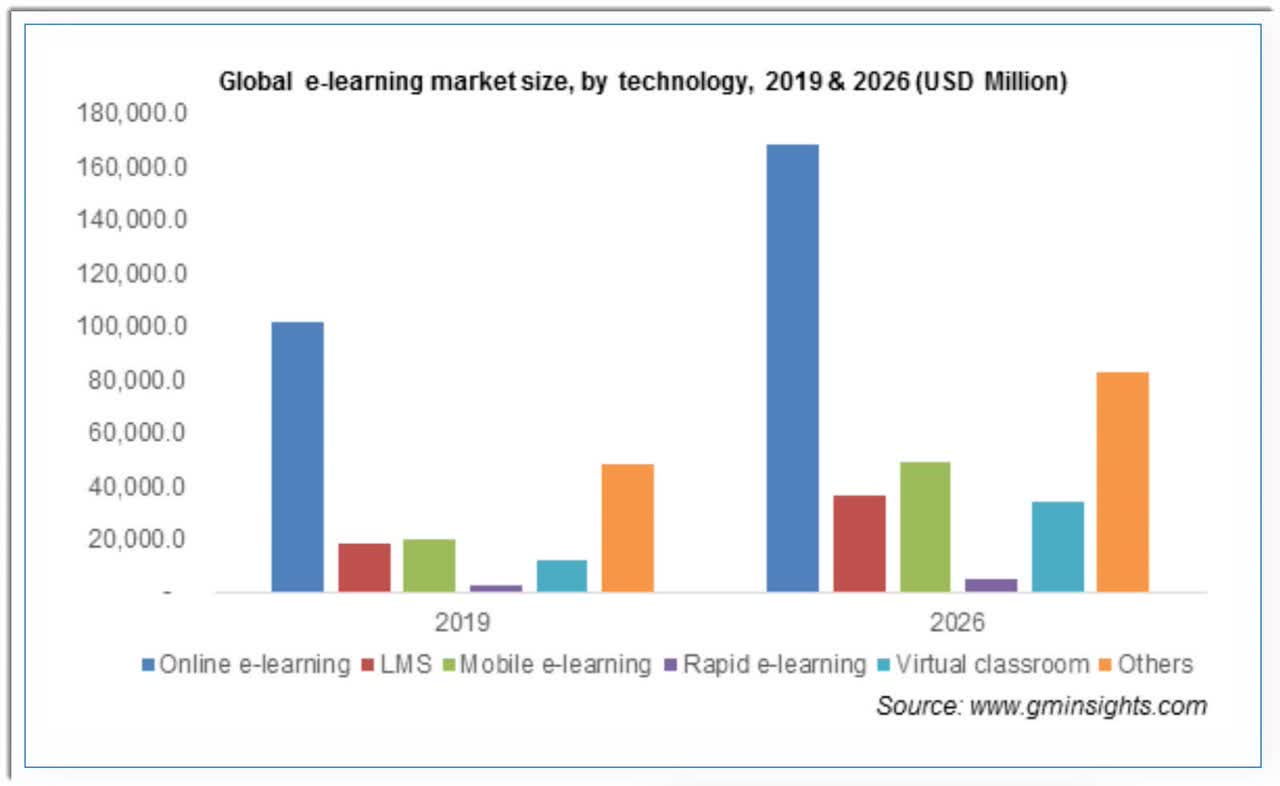

According to a 2020 market research report by Global Market Insights, the global market for e-learning services is expected to reach $375 billion in value by the end of 2026.

This represents a forecast CAGR of 8.0% from 2020 to 2026

The main drivers for this expected growth are continued technological innovation and growing Internet usage worldwide.

Also, the COVID-19 pandemic has acted as a forcing function for many users to pursue their education in an online environment, likely increasing the industry’s growth prospects in the years ahead.

Below is a chart showing the expected growth in the market by technology:

Global e-Learning Market (Global Market Insights)

Major competitive or other industry participants include:

-

Absorb LMS

-

SAP SuccessFactors Learning

-

Saba Cloud

-

Tovuti LMS

-

Cornerstone Learning

-

Captivate Prime

-

360Learning

-

SumTotal Learning

Docebo’s Recent Financial Performance

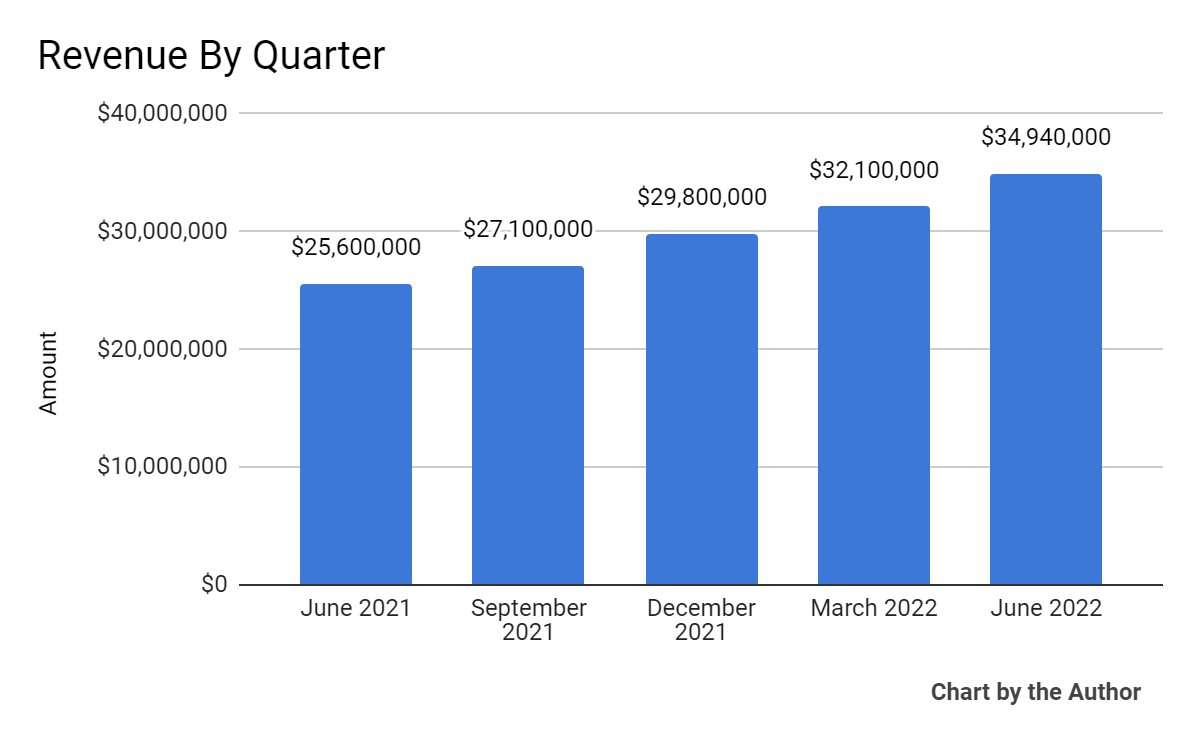

- Total revenue by quarter has risen over the past 4 quarters:

5 Quarter Total Revenue (Seeking Alpha)

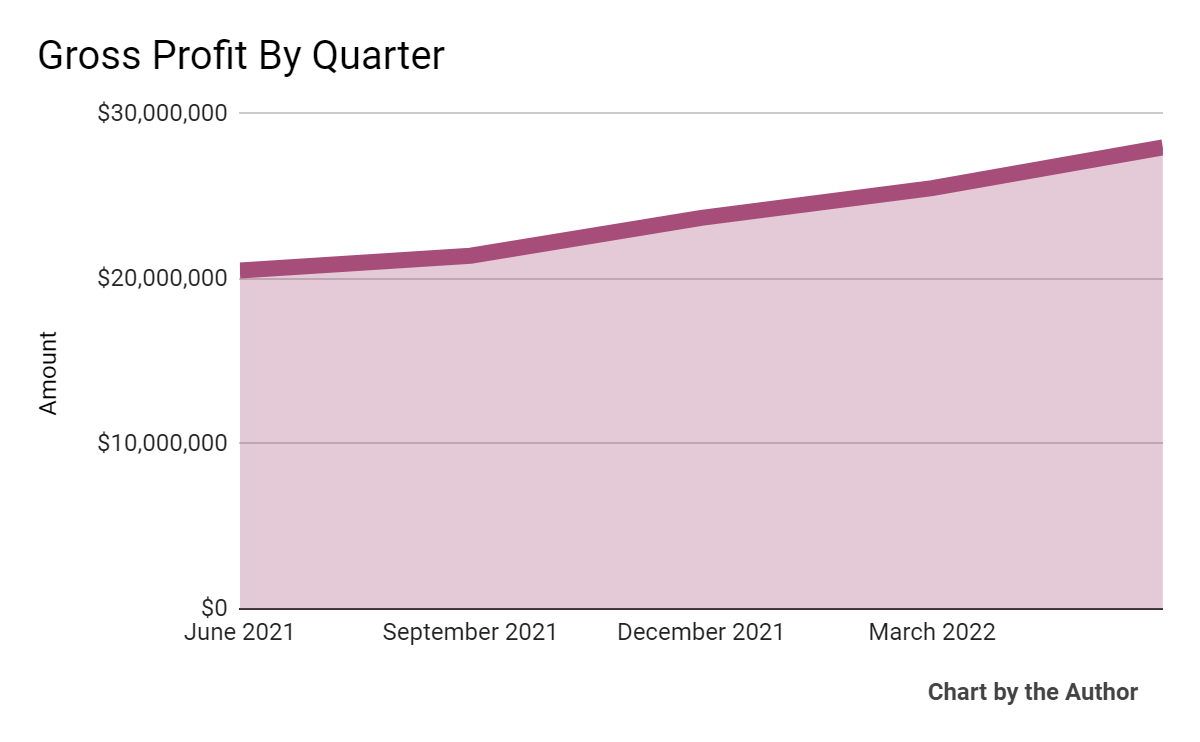

- Gross profit by quarter has followed a similar trajectory as total revenue:

5 Quarter Gross Profit (Seeking Alpha)

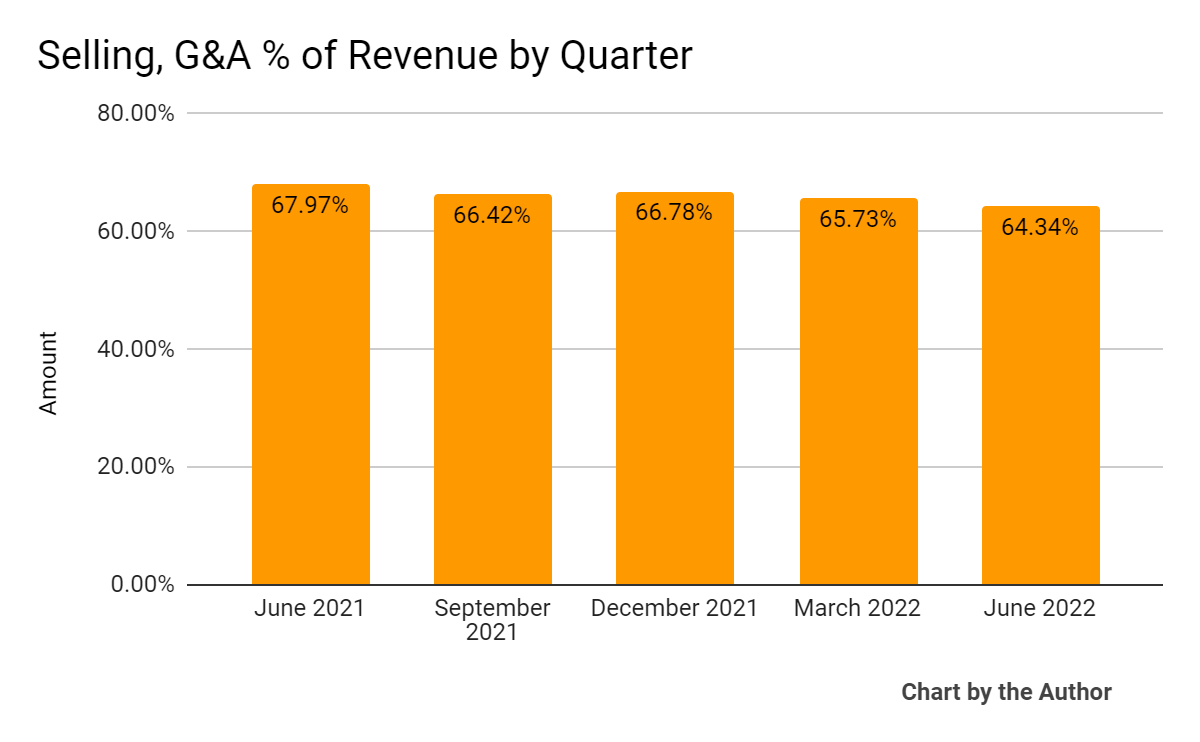

- Selling, G&A expenses as a percentage of total revenue by quarter have declined slightly over the past several quarters:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

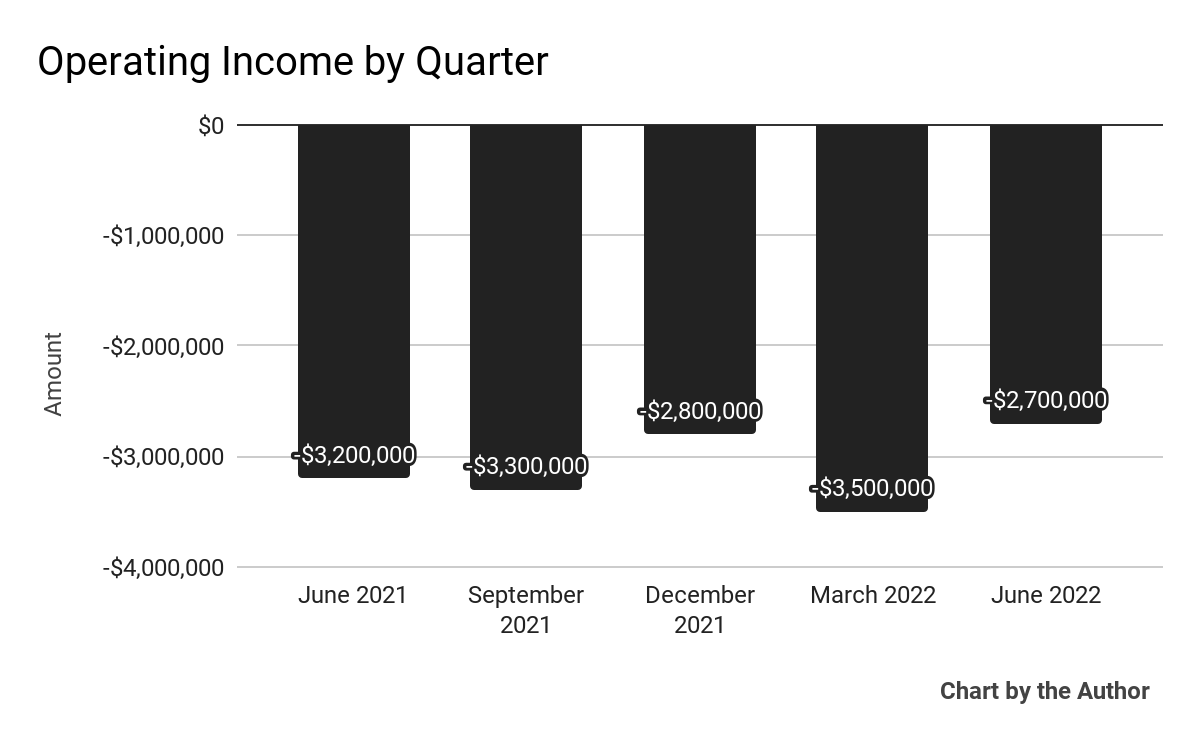

- Operating income by quarter has exceeded breakeven for the first time in the past 5 quarters:

5 Quarter Operating Income (Seeking Alpha)

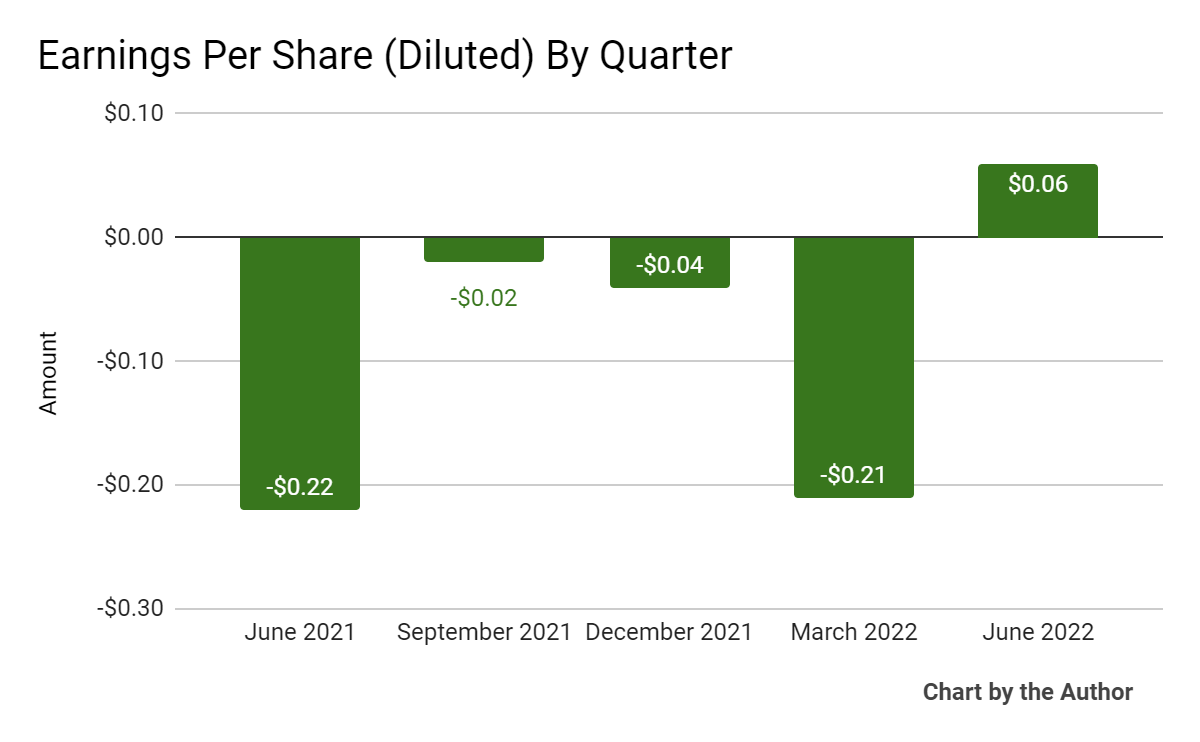

- Earnings per share (Diluted) also turned positive in the quarter just ended:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is IFRS)

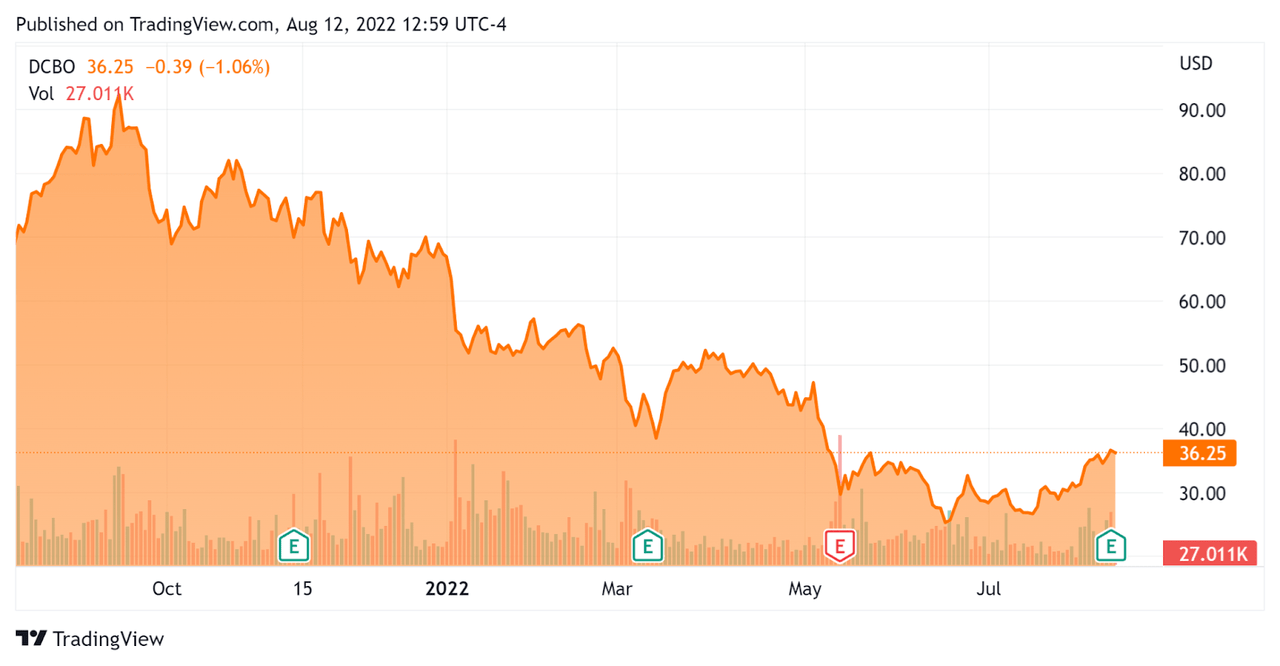

- In the past 12 months, DCBO’s stock price has fallen 47.5% vs. the U.S. S&P 500 index’ drop of around 4.5%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Docebo

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value |

$994,980,000 |

|

Market Capitalization |

$1,210,000,000 |

|

Enterprise Value / Sales |

8.69 |

|

Revenue Growth Rate |

61.1% |

|

Operating Cash Flow |

-$3,040,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.21 |

|

Net Income Margin |

-13.0% |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

DCBO’s most recent IFRS Rule of 40 calculation was 51% as of Q2 2022, so the firm has performed well in this regard, per the table below:

|

Rule of 40 – IFRS |

Calculation |

|

Recent Rev. Growth % |

61% |

|

IFRS EBITDA % |

-10% |

|

Total |

51% |

(Source – Seeking Alpha)

Commentary On Docebo

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted its single LMS approach as one that customers want, rather than silo’d solutions that don’t evolve as part of an integrated stack.

The result can be a longer sales cycle but ultimately a “stickier” and thus more valuable customer over time.

The firm added 159 net new clients, with over 60% of its additions from mid market and enterprise type customers.

As to its financial results, total revenue rose 36% year-over-year, with subscription revenue accounting for 91% of the total.

The average contract value [ACV] grew to $45,000, a rise of 18% year-over-year, while:

“ACV from new customers declined sequentially as a result of the lower lower contribution from deals valued over $100,000. This is a direct result of the elongation of the enterprise sales cycle…”

Gross profit margin was 80%, the same as the prior year, operating costs were slightly higher sequentially, while SG&A expenses as a percentage of revenue declined slightly.

For the balance sheet, the firm ended the quarter with net cash and equivalents of $212 million and generated $0.9 million positive free cash flow.

Looking ahead, management noted the U.S. dollar strength against its Canadian dollar results which will impact its revenues and expenses, producing some “headwinds” for revenue growth but helping it in regards to R&D expenses.

It expects “to deliver modest improvements in EBITDA and free cash flow” in the second half of the year.

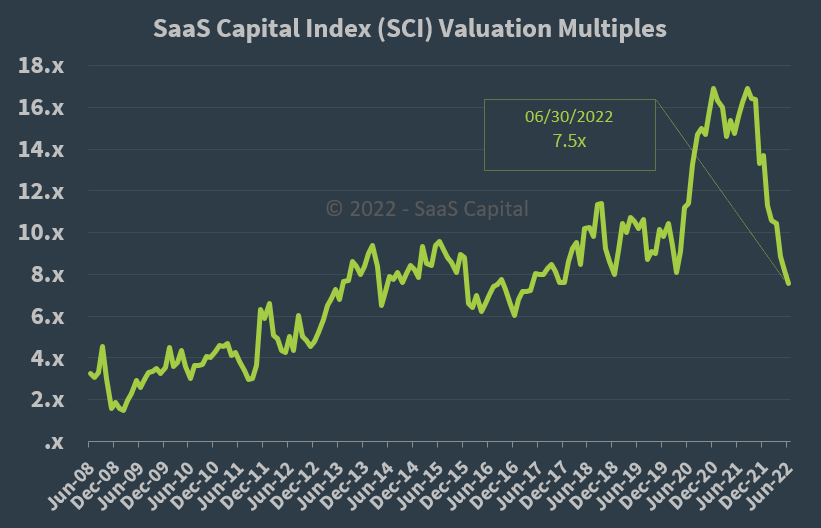

Regarding valuation, the market is valuing DCBO at an EV/Sales multiple of around 8.7x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, DCBO is currently valued by the market at a slight premium to the SaaS Capital Index, at least as of June 30, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which has already slowed its sales cycles and may reduce its revenue growth results.

An upside catalyst would be a reduction in U.S. interest rate increases, lowering the U.S. dollar’s rise against the Canadian dollar, potentially positively affecting its as-reported revenue growth.

It is encouraging that DCBO has produced earnings and positive free cash flow while continuing its growth trajectory despite some sales cycle slowdown.

I’m bullish on Docebo and my outlook is a Buy at around $36.00 per share.

Be the first to comment