MoMo Productions/DigitalVision via Getty Images

Investment Summary:

DLocal Limited (NASDAQ:DLO) is an emerging fintech company benefiting from the digitization of the emerging market economies in Africa, Asia, and South America. DLocal’s revenue growth has a 5-year Compounded Annual Growth Rate (CAGR) of over 111% over the past five years, reaching over 291M. The company has grown earnings by over 100% over the past three years. The company’s EBITDA Margins are over 30% and it generated over 106M in free cash flow, representing a 36% FCF margin. DLocal continues to expand its moat and take rate pricing power by adding more merchants within complex geographies.

Company Overview:

DLocal is an international payments company that facilitates the exchange of cross-border transactions across geographies. It facilitates global merchants in the U.S., Europe, and China to receive (pay-in) and make (pay-out) online payments, enabling them to connect with local payment methods in countries such as Latin America, the Middle East, Africa, and Asia. DLocal’s largest customers are Google (GOOG, GOOGL), Microsoft (MSFT), Spotify (SPOT), and Nike (NKE) to sell products in developing countries. Impressively, in DLocal’s early stages, it has built credibility with many of these established companies who scrutinize a product before utilizing it, especially within the payments category. DLocal boasts a high Net Retention Rate of 198% (which includes upsells and cross-sells of products, geographies, and payment methods to such merchant customers), and gross churn of over 99%. Metrics that support the value proposition that the product provides to its customers.

Business Model:

DLocal utilizes a simple API which these global companies utilize to process payments. DLocal charges fees to merchants on a per-transaction basis, including MDR and FX fees. DLocal utilizes local banks, payment acquirers, online processors, payment service providers, and alternative payment methods to provide most of its services. This allows DLocal to get a speed advantage to allow them to access new markets quicker, with smart routing and fewer compliance burdens in those countries.

Key competitive strengths and tailwinds:

- International FX & Payments is difficult: DLocal’s product is solving a challenging problem for global companies that wish to sell their products to emerging economies with low digital penetration. Developing a synchronized payment platform between North American (USD) and emerging markets that simplifies currencies, FX, taxes, variety of payment methods in local countries into one-single API is a much-needed solution. They cover 37 countries as of Q1 2022. The business handles the complexity behind the scenes and provides an easy/smooth interface for its clients. The product value proposition relative to complexity is significantly high as a result, this should support higher take rates in the future and limits the number of competitors who can do this at scale.

- Switching costs: The more merchants build and expand on the platform. The more they process large volumes of payments, the harder it becomes to switch away. The company’s clientele are large enterprises and companies. As a result, it involves a long sales process but builds strong commitment over the long term. The consistently high net retention rate of >170% on a 3-CAGR is evidence of this stickiness. In its recent quarter, it had net revenue retention of over 190%. They have been extremely successful at growing wallet share from existing customers with minimal churn.

- Natural Barriers to Entry: The complexity of the business model and low gross margin profile is a natural deterrent for new entrants into the industry. The barriers come as a result of the interconnected complexities that result from managing a variety of banks and FX partners to process payments. This advantage is best evidenced in their large customer profile and competitive players within the space.

- Competitive landscape is niche: DLocal was one of the first movers into their particular category of helping U.S. large corps to sell into difficult markets. It is important to acknowledge they face competition from Adyen (OTCPK:ADYEY, OTCPK:ADYYF) and Ebanx, who are major players within emerging markets. Industry reports show that Adyen and DLocal have similar pricing. However, DLocal’s Big Tech customer clients is evidence of the niche they have created for themselves.

Emerging Market Growth Tailwinds:

The EMEA Addressable Market is the fastest growing in the world. The total card payment volumes for countries in Brazil, Mexico, Chile, Colombia, Argentina, and Peru in Latin America reached over US$700 billion in 2020, according to JP Morgan’s Latin America research and DLocal’s S1 Estimates. It is no surprise that due to the rapid acceleration of technology in emerging markets, this region is going to be one of the fastest-growing market segments, particularly in Africa, Latin America, and parts of Asia. Reports on digital penetration by Euromonitor and Insider Intelligence believe the increase in digital commerce has the potential to become permanent, driving a multi-year acceleration in adoption levels. Turkey, Brazil, and India are expected to grow at a CAGR of 39%, 30%, and 17% from 2020-2024, and over 80 million Nigerians are estimated to come online in the next five years. As long as DLocal maintains its strong market share, these are going to be strong tailwinds for the company’s growth.

In return, we know that as large U.S. companies run out of customers in North America or more developed markets, they will continue to want to expand into new geographic areas, especially EMEA, to access new avenues for growth. According to DLocal and Big Tech filings, Amazon filings generated over 17.5% of its revenue from emerging economies, Google derived over 16.6%, and Microsoft filings show over 14%. as of 2020. All these numbers have meaningful room to grow over the next few years as these big merchants work with DLocal.

Financials and Valuation

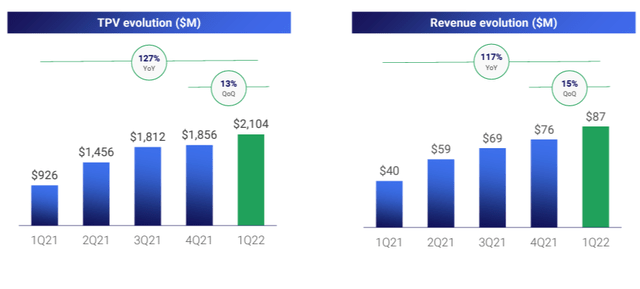

High Revenue Growth supports product-market fit. The company has consistently maintained a triple-digit growth rate on Total Payment Volume (TPV) and Revenue growth over the last 4-quarters. They went from $300 Million in TPV in 2019 to over $2 billion in 2022. Revenues went from $7M in 2019 to $291M within 3 years.

In its most recent Q1 2022 quarter, TPV grew 127%, reaching $2.1billion. The company grew revenue by 117% year-over-year and 15% quarter-over-quarter continuing to maintain the high velocity of growth. LatAm and African regions significantly contributed to the growth.

DLocal’s revenue growth (DLocal investor relations)

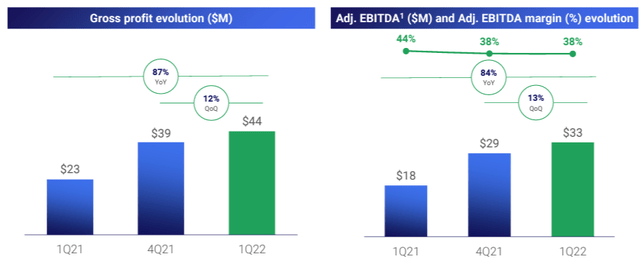

High Margins: DLocal maintained an Adjusted EBITDA Margins over 38% and on an EBIT basis, they had 33% margins. This high operating margin should continue to scale due to the fact the business operates using a Cloud-based API for its partners and it relies on local banks and merchant acquirers. At EV/Sales multiple of 16x and EV/EBIT of 80x for a company forecast to grow over 80% for the next three years, the company’s valuation is at an attractive level for long-term investors.

DLocal Website/Investor Relations

Competitive risks

DLocal’s primary risks are associated with competitive pressures from Adyen and Ebanx, which could affect DLocal’s take rates. The company has maintained a relatively higher take rate of 4%, meanwhile competitors like Adyen charge around 1.3%. If Big Tech companies like Amazon (AMZN) or Google (GOOG, GOOGL) want to set up an HQ in a local region to sell directly to customers, this will affects DLocal’s revenue or reduce their utilization of DLO. Also considering that many of the big technology companies make up the Top 10 clients for DLocal (almost 50% of revenue), there is always a risk that they lose a client. However, it is important to note that this 50% figure is down from 62% over a year ago.

Secondly, foreign exchange (FX) and currencies are complex. This is even more complicated when dealing with multiple countries at once. There is always the risk that FX and currency issues develop in one of these emerging countries, particularly with the global uncertainty that affects DLocal’s growth.

Summary:

DLocal is one of the fastest-growing international payments platforms that is solving a complex problem for global enterprises in emerging markets. As these emerging regions continue to gain digital penetration and more global companies seek new avenues for growth, DLocal should continue to maintain strong growth momentum.

Be the first to comment