marchmeena29/iStock via Getty Images

One of the main appeals of Dividend Growth Investing is that even when things are going crazy in the world, the vast majority of proven dividend-growing companies keep on keepin’ on.

That’s certainly been the case the last couple of years when, despite an unyielding coronavirus pandemic that has killed millions of people worldwide and that has adversely affected numerous industries, most dividend-paying companies have kept distributing income to shareholders.

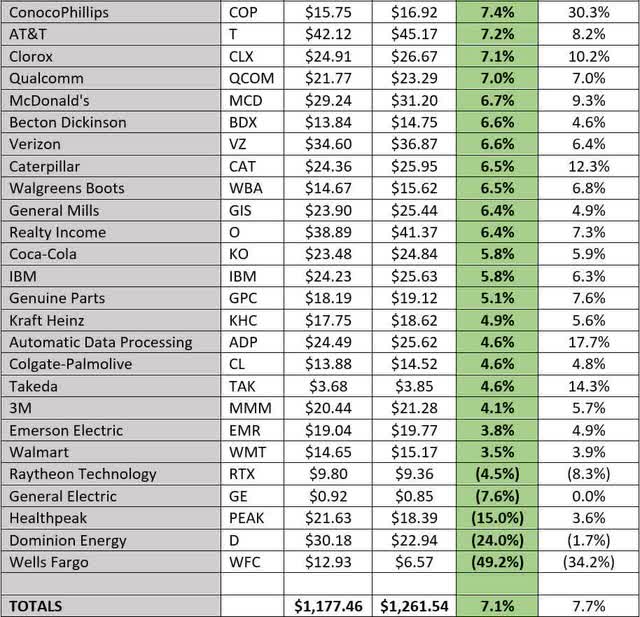

Within the Dividend Growth 50 — the real-money portfolio I’ve been managing for more than seven years — dozens and dozens of high-quality businesses increased their payouts during 2021, and several of those came through with aggressive raises.

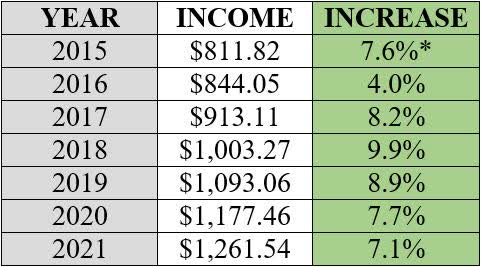

As a result, the DG50’s income stream grew more than 7% year-over-year.

The Genesis of the DG50

In 2012, I settled on Dividend Growth Investing as my main strategy, and I soon started writing for Seeking Alpha. Two years later, I asked 10 fellow contributors to choose 50 companies each, with the idea of creating a list of “DGI-type” stocks that could make good candidates for further research.

The panelists – Dave Fish, Bob Wells, Chowder, David Crosetti, Eli Inkrot, Eric Landis, Tim McAleenan, Miz Magic DiviDogs, ScottU and David Van Knapp – combined to select 163 stocks, with the 50 leading vote-getters forming what I first called the New Nifty Fifty.

I wrote several articles about the selections and eventually decided to turn it into a real-money, public portfolio. On Dec. 16, 2014, I divided $25,000 roughly equally between the stocks … and the Dividend Growth 50 was born.

It turned out to be a popular Seeking Alpha fixture for many years. And even though I haven’t written about it much lately because other projects have kept me busy, I have continued to manage the DG50. It’s become an example of a truly passive, buy-and-hold portfolio, one in which I haven’t put a single cent of “new money” since the original buys.

It turned out to be a popular Seeking Alpha fixture for many years. And even though I haven’t written about it much lately because other projects have kept me busy, I have continued to manage the DG50. It’s become an example of a truly passive, buy-and-hold portfolio, one in which I haven’t put a single cent of “new money” since the original buys.

I dedicate this annual look at the Dividend Growth 50 to our two absent friends, Dave Fish and Bob Wells, who contributed so much to this site’s DGI community before passing away in 2018 and 2020, respectively.

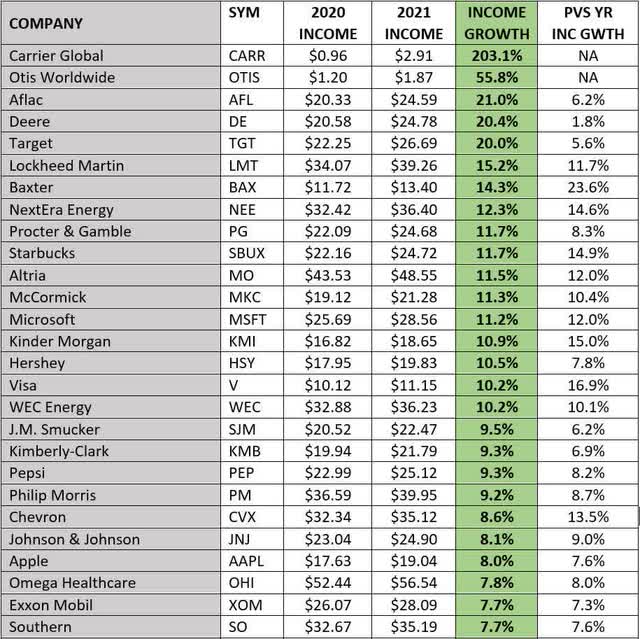

Without further ado … here is a position-by-position look at the DG50’s income growth from 2020 to 2021:

TABLE NOTES:

PY INC GWTH (the last column) is how much each position’s income grew the previous year (2019 to 2020). It is presented so readers can see whether the trend is up or down. For example, the DG50’s Hershey (HSY) position saw 10.5% income growth in 2021, a significantly higher percentage than the year before; the 7.4% income growth of the ConocoPhillips (COP) position was OK, but it paled in comparison to the 2020 output.

Takeda (TAK) became part of the DG50 in 2019 when it merged with Shire, which had acquired Baxalta, which had spun off from Baxter (BAX). Based in Tokyo, Takeda is the only DG50 company that gets foreign taxes and fees withheld from each dividend payment; the amounts shown are after taxes/fees were deducted.

Important: Income Growth vs. Dividend Growth

In accordance with portfolio rules, all dividends were reinvested into the same stocks – a process informally known as “dripping.” This makes income growth for the DG50 different from the general concept of dividend growth.

For example, the DG50 held 15.550 shares of McCormick (MKC) on December 31, 2020; a year later, the share total was 15.793, thanks to dividend reinvestment. So even though the company raised its payment to shareholders by 8.8%, the combination of that hike and the dripping of four quarterly dividends increased the actual cash that MKC delivered into the portfolio’s income stream by 11.3% year-over-year.

Gotta love the wonders of compounding!

Notes and Observations

Technically, the Raytheon Technologies (RTX) position brought in 4.5% less income in 2021 than it did in 2020. However, in ’20, the company spun off Carrier (CARR) and Otis (OTIS), which, as you can see in the table, generated their own income growth. In the end, the RTX-CARR-OTIS combo grew income by 18.2% for the DG50.

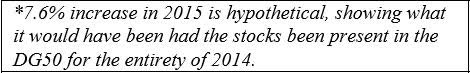

2021 was a busy year for Realty Income (O), which significantly grew its business with an $11 billion acquisition of competitor VEREIT. Realty Income also spun-off Orion Office REIT (ONL), bringing 1 share of ONL and about $10 in cash into the DG50. I didn’t think ONL was a high-quality company, so I immediately sold the share and used the proceeds to buy more Realty Income; I also used the cash to buy more O.

As a result of that activity — as well as the reinvestment of O’s dividends and the company’s dividend raises throughout the course of the year — the DG50’s Realty Income position grew by a little more than a share, which was worth an extra $3.18 in projected annual income.

As a result of that activity — as well as the reinvestment of O’s dividends and the company’s dividend raises throughout the course of the year — the DG50’s Realty Income position grew by a little more than a share, which was worth an extra $3.18 in projected annual income.

That served as a pretty good demonstration of the many ways an income stream can grow over time even when there’s no “new money” being invested into a position: dividend increases; dripping; corporate activity.

Eighteen DG50 positions (19 if the RTX-CARR-OTIS combo is included) grew income year-over-year. That was the case with only 12 positions last year, when the COVID-19 pandemic limited dividend increases.

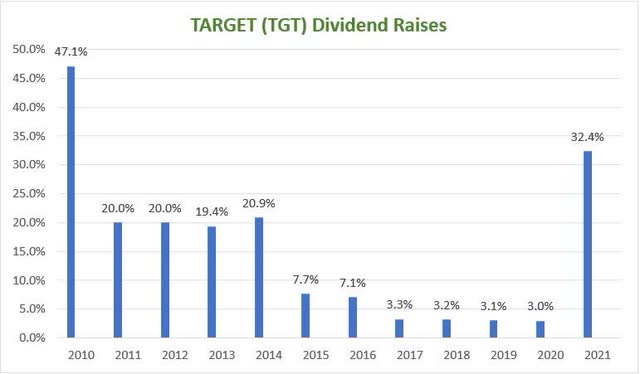

The Aflac (AFL), Deere (DE) and Target (TGT) positions delivered 20%+ income growth just one year after their percentages were only in the low to mid single-digits. Each had a large dividend hike during the year.

Hut … Hut … Hike!

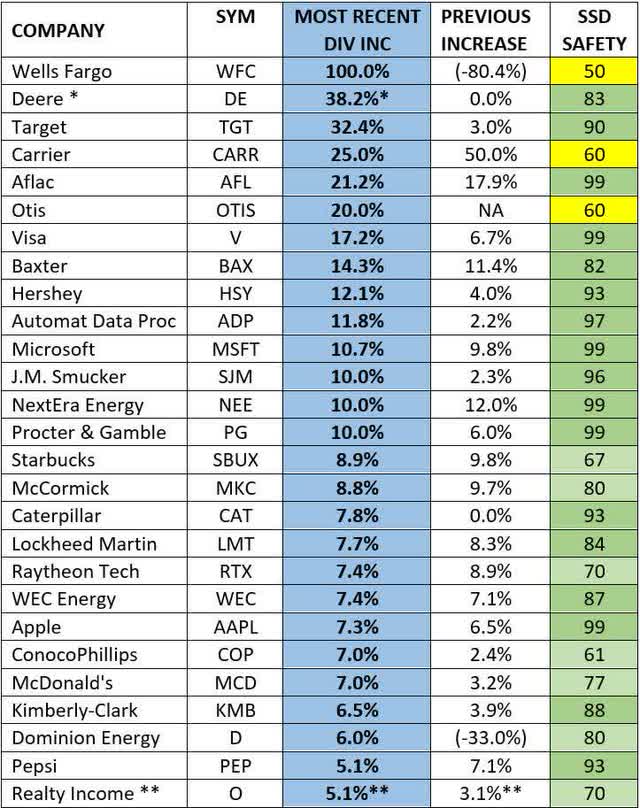

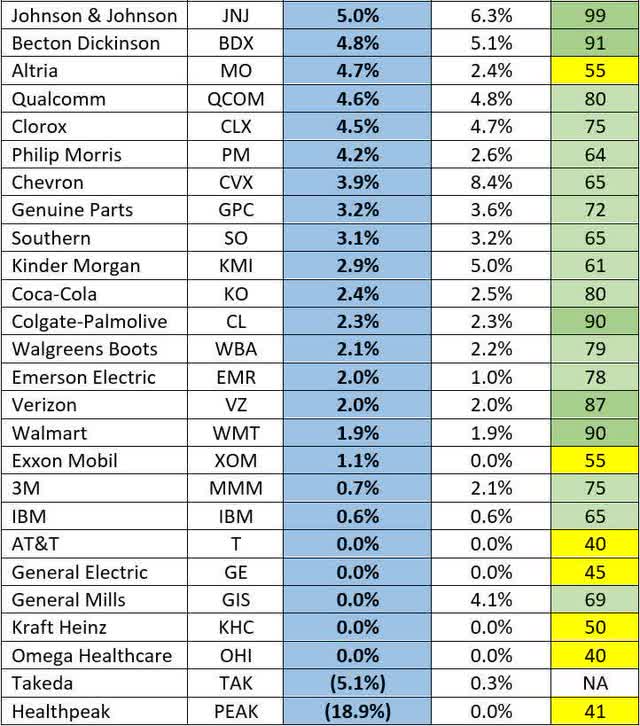

The following table presents dividend-related information for each DG50 holding: the most recently announced dividend increase; the raise prior to that (again, to illustrate the trend); and Simply Safe Dividends’ “dividend safety” score.

Notes and Observations

Wells Fargo (WFC) kept income investors on a roller coaster. One year after cutting its dividend by 80%, the bank doubled its payout. Even after that big hike, the divvy is 61% lower than it was before the pandemic.

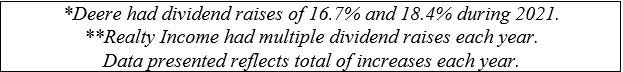

Deere froze its dividend for two full years but then celebrated America’s new trillion-dollar infrastructure package in 2021. In February, the company announced an 18.4% raise; only 6 months later, it gave investors another 16.7% increase.

In the latter part of last decade, Target (TGT) had to deal with all kinds of problems, from a botched rollout in Canada to a major data breach to indecision about how much it wanted to compete with Walmart in the grocery aisle. But by the end of the ’10s, Target had solved most of its issues … and earnings, sales and free cash flow soared. So in 2021, after years of tepid dividend raises, the company finally rewarded loyal shareholders with a major increase.

Dominion Energy (D), which cut its dividend by a third in 2020 after surprisingly exiting the pipeline business, got back on the positive side with a 6% increase. The only DG50 cutters in 2021 were REIT Healthpeak (PEAK) and Takeda, the latter due to foreign exchange.

Dominion Energy (D), which cut its dividend by a third in 2020 after surprisingly exiting the pipeline business, got back on the positive side with a 6% increase. The only DG50 cutters in 2021 were REIT Healthpeak (PEAK) and Takeda, the latter due to foreign exchange.

Five DG50 holdings froze (or continued to freeze) their dividends. One of those was AT&T (T) — which is expected to reduce its payout in 2022 after it completes a deal that will result in its WarnerMedia subsidiary merging with Discovery while AT&T focuses on its legacy communications business.

The Simply Safe Dividends score in the last column of the table is done on a 1-100 scale – with 81-100 considered “very safe,” 61-80 “safe,” 41-60 “borderline safe” and 40 and below “unsafe.”

Here is SSD’s breakdown of the DG50’s dividend safety:

Source: Simply Safe Dividends

The only two DG50 components whose dividends face possible cuts in 2022, according to SSD, are AT&T and Omega Healthcare (OHI).

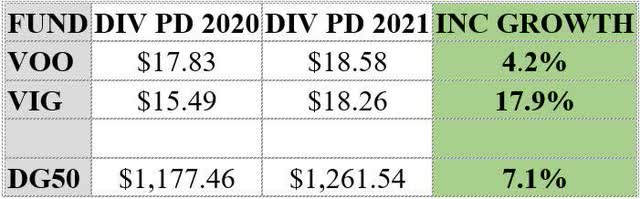

Now let’s take a look at how the Dividend Growth 50’s income growth compared to two benchmarks.

On the same date I funded the DG50 – Dec. 16, 2014 – I also bought about $500 each worth of Vanguard S&P 500 ETF (VOO) and Vanguard Dividend Appreciation ETF (VIG). Here is how each position’s income grew in 2021:

While the DG50 easily beat VOO, the VIG position had its best income-growing year ever.

While the DG50 easily beat VOO, the VIG position had its best income-growing year ever.

What About Total Return?

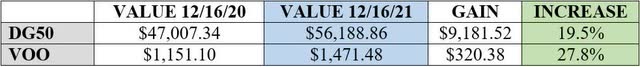

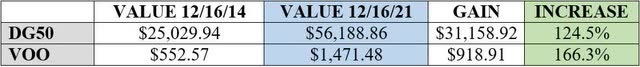

And while we’re talking about benchmarks, let’s take a quick look at total return. For that, I go back to how the DG50 did in relation to the S&P 500 ETF through Dec. 16, 2021 — the actual 7-year anniversary of the portfolio.

2021 was a red-hot year for the market, especially the large-cap growth stocks that dominate the S&P 500 Index, so I’d have been stunned if the equally weighted, low-beta DG50 had been able to keep pace.

Sure enough, even though the Dividend Growth 50 had a nice 19.5% total return, it was no match for VOO’s 28% gain. And with that performance, VOO widened its total-return lead over the life of the project.

A dozen of the portfolio’s holdings, from a variety of sectors and industries, did outperform the index during the DG50’s first 7 years:

- Microsoft (MSFT): 700%

- Apple (AAPL): 596%

- Deere: 348%

- NextEra Energy (NEE): 331%

- Target: 274%

- McDonald’s (MCD): 255%

- Visa (V): 249%

- Automatic Data Processing (ADP): 223%

- Starbucks (SBUX): 217%

- Qualcomm (QCOM): 213%

- McCormick: 192%

- Caterpillar (CAT): 179%

It might be hard to believe when you look at the respective total returns of the Dividend Growth 50 and the S&P 500 Index, but the DG50 actually outperformed the market in its first 2 1/2 years of existence.

Once the bull market really took off, however, the income-centric portfolio had little chance.

When the pressure’s on the market, that’s when a more defensive portfolio like the DG50 can shine. For example, in the first week of 2022, the VOO position was down 2.2%; the DG50, meanwhile, was up 0.8% — a 3% “mini-victory.”

Of course, for many (perhaps even most) DGI practitioners, total return takes a back seat to the growth and safety of their income streams. They use (or plan to use) those dividends for their needs and wants, as a supplement to Social Security, pensions and/or other retirement income.

Conclusion

I am starting to think the Dividend Growth 50 project might have run its course. The portfolio held its own in total return except for when the bull really got running, and it experienced outstanding income growth through a variety of market conditions. I’m not sure what else it has to “prove.”

In the coming months, I’ll be deciding if I want to keep it going or focus my energy elsewhere.

Regardless, I’d like to take this opportunity to thank the panelists once again … and, mostly, to thank the readers who have supported the DG50 all these years.

Be the first to comment