AntonioSolano

2022 was quite a year for the Dividend Growth 50. Not only did it absolutely annihilate the S&P 500 Index in total return — as I chronicled in my previous article (here) — but the DG50 also had by far its best year of income growth ever, at 11.6%.

| YEAR | INCOME | INCREASE |

| 2015 | $811.82 | 7.6% |

| 2016 | $844.05 | 4.0% |

| 2017 | $913.11 | 8.2% |

| 2018 | $1,003.27 | 9.9% |

| 2019 | $1,093.06 | $8.9% |

| 2020 | $1,177.46 | $7.7% |

| 2021 | $1,261.54 | 7.1% |

| 2022 | $1,408.19 | 11.6% |

Given that the primary goal of many (or even most) Dividend Growth Investing practitioners is to generate a reliable, predictable and increasing income stream, the DG50 obviously has been a smashing success in the 8 years since I poured $25,000 into it on Dec. 16, 2014. The total return of 124% by the end of 2022 — 1% higher than an investment in the S&P 500 Index would have delivered — has been pure gravy.

Despite the DG50’s performance in both the income and total return realms, it’s important to remember that the project’s intent was never to convince readers to replicate the portfolio. From the start, it was about discussing investing concepts and presenting interesting candidates for further research.

And the 10 Seeking Alpha contributors who selected the 50 original companies way back in 2014 certainly did a great job of picking those potential investments.

Sure, a few individual stocks have turned out to be clunkers. The panelists were making selections based on what they knew then, and I didn’t tell them back in the summer of 2014 that their consensus 50 eventually would be turned into a real-money portfolio (because I didn’t know it myself at the time). Given the tremendous changes that have taken place — in industries, in macro conditions, in technology, in the world itself — the performance of this group of stocks has been outstanding.

Two of the panelists, Dave Fish and Bob Wells, passed away in 2018 and 2020, respectively, after contributing so much to this site’s DGI community for years. I dedicate this article to them and those who loved them.

Without further ado, here is how each DG50 position grew its income in 2022. (Note that, for comparison’s sake, I included the final column showing how income had grown in 2021).

| COMPANY | TICKER | 2021 INCOME | 2022 INCOME | INCOME GROWTH | PREV GROWTH |

| ConocoPhillips | (COP) | $16.92 | $45.04 | 166.2% | 7.4% |

| Wells Fargo | (WFC) | $6.57 | $12.24 | 86.3% | (49.2%) |

| Target | (TGT) | $26.69 | $34.01 | 27.4% | 20.0% |

| Carrier Global | (CARR) | $2.91 | $3.67 | 26.1% | 203.1% |

| Aflac | (AFL) | $24.59 | $30.54 | 24.2% | 21.0% |

| Deere | (DE) | $24.78 | $30.28 | 22.2% | 20.4% |

| Otis Worldwide | (OTIS) | $1.87 | $2.28 | 21.9% | 55.8% |

| Visa | (V) | $11.15 | $13.23 | 18.7% | 10.2% |

| Hershey | (HSY) | $19.83 | $22.95 | 15.7% | 10.5% |

| Baxter | (BAX) | $13.40 | $15.39 | 14.9% | 14.3% |

| Lockheed Martin | (LMT) | $39.26 | $44.90x | 14.4% | 15.2% |

| Automatic Data | (ADP) | $25.62 | $29.19 | 13.9% | 4.6% |

| Genuine Parts | (GPC) | $19.12 | $21.59 | 12.9% | 5.1% |

| Altria | (MO) | $48.55 | $54.67 | 12.6% | 11.5% |

| NextEra Energy | (NEE) | $36.40 | $40.96 | 12.5% | 12.3% |

| Realty Income | (O) | $41.37 | $46.45 | 12.3% | 6.4% |

| Microsoft | (MSFT) | $28.56 | $31.80 | 11.3% | 11.2% |

| Qualcomm | (QCOM) | $23.29 | $25.88 | 11.1% | 7.0% |

| Starbucks | (SBUX) | $24.72 | $27.38 | 10.8% | 11.7% |

| WEC Energy | (WEC) | $36.23 | $40.09 | 10.7% | 10.2% |

| McCormick | (MKC) | $21.28 | $23.51 | 10.5% | 11.3% |

| Raytheon Tech | (RTX) | $9.36 | $10.32 | 10.3% | (4.5%) |

| Caterpillar | (CAT) | $25.95 | $28.61 | 10.3% | 6.5% |

| McDonald’s | (MCD) | $31.20 | $34.39 | 10.2% | 6.7% |

| IBM | (IBM) | $25.63 | $28.18 | 9.9% | 5.8% |

| J.M. Smucker | (SJM) | $22.47 | $24.63 | 9.6% | 9.5% |

| Dominion Energy | (D) | $22.94 | $25.12 | 9.5% | (24.0%) |

| Kinder Morgan | (KMI) | $18.65 | $20.40 | 9.4% | 10.9% |

| Pepsi | (PEP) | $25.12 | $27.39 | 9.0% | 9.3% |

| Philip Morris | (PM) | $39.95 | $43.53 | 9.0% | 9.2% |

| Johnson & Johnson | (JNJ) | $24.90 | $27.13 | 9.0% | 8.1% |

| Procter & Gamble | (PG) | $24.68 | $26.87 | 8.9% | 11.7% |

| Omega Health | (OHI) | $56.54 | $61.58 | 8.9% | 7.8% |

| Coca-Cola | (KO) | $24.84 | $26.82 | 8.0% | 5.8% |

| Becton Dickinson | (BDX) | $14.75 | $15.92x | 7.9% | 6.6% |

| Southern | (SO) | $35.19 | $37.73 | 7.2% | 7.7% |

| Verizon | (VZ) | $36.87 | $39.46 | 7.0% | 6.6% |

| Exxon Mobil | (XOM) | $28.09 | $30.05 | 7.0% | 7.7% |

| Kimberly-Clark | (KMB) | $21.79 | $23.19 | 6.4% | 9.3% |

| Colgate-Palmolive | (CL) | $14.52 | $15.44 | 6.3% | 4.6% |

| General Mills | (GIS) | $25.44 | $27.05 | 6.3% | 6.4% |

| Clorox | (CLX) | $26.67 | $28.29 | 6.1% | 7.1% |

| Chevron | (CVX) | $35.12 | $37.21 | 6.0% | 8.6% |

| Apple | (AAPL) | $19.04 | $20.14 | 5.8% | 8.0% |

| Walgreens Boots | (WBA) | $15.62 | $16.47 | 5.4% | 6.5% |

| 3M | (MMM) | $21.28 | $22.22 | 4.4% | 4.1% |

| Kraft Heinz | (KHC) | $18.62 | $19.43x | 4.4% | 4.9% |

| Emerson Electric | (EMR) | $19.77 | $20.55 | 3.9% | 3.8% |

| Healthpeak | (PEAK) | $18.39 | $19.08 | 3.8% | (15.0%) |

| Walmart | (WMT) | $15.17 | $15.67 | 3.3% | 3.5% |

| AT&T | (T) | $45.17 | $35.00 | (22.5%) | 7.2% |

| General Electric | (GE) | $0.85 | $0.64 | (24.7%) | (7.6%) |

| Takeda ** | (TAK) | $3.85 | $1.63 | (57.7%) | 4.6% |

| TOTALS | $1,261.54 | $1,408.19 | 11.6% | 7.1% |

** Takeda is no longer in the portfolio. Merger activity had brought it into the DG50 a few years ago, but during 2022 I decided to divest the position and put the proceeds back into Baxter, from whence TAK came.

AT&T and Becton Dickinson also were affected by corporate activity in 2022; their spin-offs were almost immediately sold, with the proceeds going back into the original companies.

Important Note: Income Growth vs. Dividend Growth

In accordance with portfolio rules, all dividends were reinvested into the same stocks – a process informally known as “dripping.” This makes income growth for the DG50 different from the general concept of dividend growth.

For example, the DG50 held 13.621 shares of WEC Energy on December 31, 2021; a year later, the share total was 14.026 thanks to dividend reinvestment. So even though the company raised its payment to shareholders by 7.1% for 2022, the combination of that hike and the dripping of four quarterly dividends increased the actual cash that WEC delivered into the portfolio’s income stream by 10.7% year-over-year.

Gotta love the wonders of compounding!

Notes and Observations

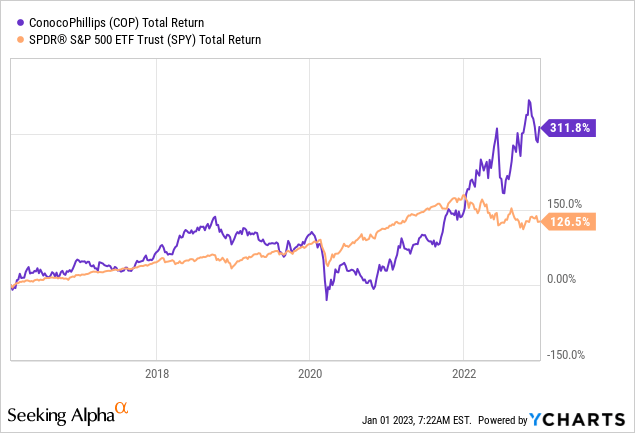

At 166.2%, the ConocoPhillips position delivered an amazing year of income growth to the DG50.

Late in 2021, the company raised its quarterly dividend 7%, from 43 cents/share to .46. Early in 2022, COP started giving shareholders what it called “variable return of cash” — payouts of 20 cents/share in January, 30 cents in April, 70 cents in July and $1.40 in October. Throw in dividend reinvestment, and the portfolio’s COP position generated about 2 1/2 times as much income in 2022 as it did the previous year. Nice!

Notably, ConocoPhillips had cut its dividend by 66% in early 2016. For many DGI practitioners, such an act would have triggered an automatic sell. I am not saying that strategy is wrong. For many companies — including DG50 components such as Kinder Morgan, Kraft Heinz and General Electric over the years — a dividend reduction could be a sign of serious fundamental problems, and it’s best to get out before things get even worse.

Sometimes, however, a cut is just a needed pause by a basically healthy company — and that certainly appears to have been the case for ConocoPhillips, which only needed a recovery in oil prices to return to profitability. Investors who held onto COP since that cut was announced on Feb. 4, 2016, were rewarded with market-crushing total return over time.

And with a forward P/E ratio of about 8.5, COP still could be an appealing investment for those who believe that the Energy sector’s up cycle will continue to have legs.

Wells Fargo, which slashed its dividend by 80% during the early stages of the COVID-19 pandemic, had a second straight year of huge growth in 2022. So did long-time dividend-hikers Deere, Aflac and Target; DG50 positions in all three companies saw 20%+ income growth for a second consecutive year.

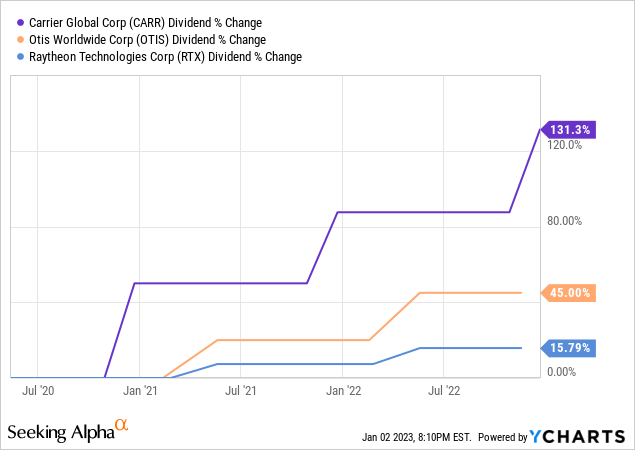

Carrier and Otis, which became stand-alone corporations after being spun off from United Technologies in 2020, are now aggressive income-growers. Raytheon Technologies, whose merger with United Tech spurred all the spin-off activity, also was back to producing a nicely increasing income stream for investors.

The Dominion Energy position produced an income decline in ’21 due to a dividend cut, but it was back with nice growth again in ’22. The company recently spooked investors by announcing a “top-to-bottom” strategic review, creating some doubt about what that would mean for the business model and, yes, the dividend.

Only two companies still in the DG50 — AT&T and General Electric — experienced income declines within the portfolio. T cut its dividend following its spin-off of Warner Brothers, and GE has been a train wreck for years now.

Hut … Hut … Hike!

The following table presents dividend-related information for each DG50 holding: the most recently announced dividend increase; the raise prior to that (again, to illustrate any trends); and Simply Safe Dividends’ “dividend safety” score.

| COMPANY | DIVIDEND INCREASE | PREVIOUS RAISE | SAFETY |

| Wells Fargo * | 50.0% | 100.0% | 50 |

| Carrier | 23.3% | 25.0% | 60 |

| Otis | 20.8% | 20.0% | 60 |

| Automatic Data Processing | 20.2% | 11.8% | 97 |

| Target | 20.0% | 32.4% | 90 |

| Visa | 20.0% | 17.2% | 99 |

| Hershey | 15.0% | 12.1% | 93 |

| Deere * | 14.3% | 38.2% | 83 |

| ConocoPhillips ** | 10.9% | 7.0% | 61 |

| NextEra Energy | 10.4% | 10.0% | 99 |

| Qualcomm | 10.3% | 4.6% | 80 |

| McDonald’s | 10.1% | 7.0% | 77 |

| Genuine Parts | 9.8% | 3.2% | 72 |

| Microsoft | 9.7% | 10.7% | 99 |

| Starbucks | 8.2% | 8.9% | 67 |

| Caterpillar | 8.1% | 7.8% | 93 |

| Raytheon Technologies | 7.8% | 7.4% | 70 |

| WEC Energy | 7.2% | 7.4% | 87 |

| Lockheed Martin | 7.1% | 7.7% | 84 |

| Pepsi | 7.0% | 5.1% | 93 |

| Johnson & Johnson | 6.6% | 5.0% | 99 |

| Chevron | 6.0% | 3.9% | 90 |

| Dominion Energy | 6.0% | 0.0% | 80 |

| General Mills | 5.9% | 0.0% | 69 |

| McCormick | 5.4% | 8.8% | 80 |

| Procter & Gamble | 5.0% | 10.0% | 99 |

| Aflac | 5.0% | 21.2% | 99 |

| Coca-Cola | 4.8% | 2.4% | 80 |

| Becton Dickinson | 4.6% | 4.8% | 91 |

| Apple | 4.5% | 7.9% | 99 |

| Altria | 4.4% | 4.7% | 55 |

| Colgate-Palmolive | 4.4% | 2.3% | 90 |

| Baxter | 3.6% | 14.3% | 82 |

| Exxon Mobil | 3.4% | 1.1% | 80 |

| J.M. Smucker | 3.0% | 10.0% | 96 |

| Southern Company | 3.0% | 3.1% | 65 |

| Kinder Morgan | 2.8% | 2.9% | 61 |

| Verizon | 2.0% | 2.0% | 87 |

| Walmart | 1.8% | 1.9% | 90 |

| Kimberly-Clark | 1.8% | 6.5% | 88 |

| Clorox | 1.7% | 4.5% | 75 |

| Philip Morris | 1.6% | 4.2% | 64 |

| Emerson Electric | 1.0% | 2.0% | 78 |

| Realty Income * | 0.8% | 5.1% | 70 |

| 3M | 0.7% | 0.7% | 75 |

| IBM | 0.6% | 0.6% | 65 |

| Walgreens Boots | 0.5% | 2.1% | 79 |

| General Electric | 0.0% | 0.0% | 45 |

| Healthpeak | 0.0% | (18.9%) | 41 |

| Kraft Heinz | 0.0% | 0.0% | 50 |

| Omega Healthcare | 0.0% | 0.0% | 40 |

| AT&T | (46.6%) | 0.0% | 70 |

* Wells Fargo, Deere and Realty Income each had more than one dividend increase in 2022; the percentage for each in the table equals the cumulative raise.

** ConocoPhillips also made 4 payments it called “variable return of cash.” Those are not included in the above table.

Notes and Observations

ConocoPhillips gets a mention here, too, thanks to its 10.9% dividend raise that took effect in Q4 of 2022. In addition, COP has declared yet another special distribution of 70 cents/share, to be paid on Jan. 13. Talk about a company on an income-increasing roll!

Compared to the previous year, Automatic Data Processing, Qualcomm and Genuine Parts came through splendidly for income-hungry shareholders with their latest boosts. Meanwhile, Dominion Energy and General Mills gave acceptable raises after having frozen their divvies.

And speaking of freezes … those are still in place for Kraft Heinz, Omega Healthcare and GE. AT&T was the only DG50 holding to announce a dividend cut during 2022.

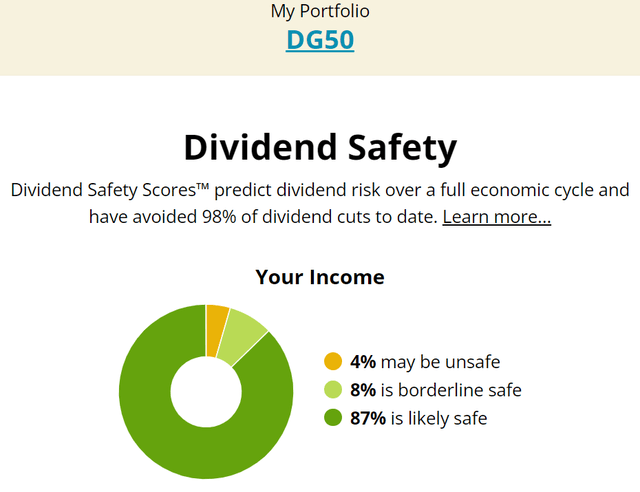

The Simply Safe Dividends score in the last column of the table is done on a 1-100 scale – with 81-100 considered “very safe,” 61-80 “safe,” 41-60 “borderline safe” and 40 and below “unsafe.”

Here is SSD’s breakdown of the DG50’s overall dividend safety:

Omega Healthcare is the only DG50 component in the “unsafe” category; SSD says the score is due to the REIT getting the vast majority of its business from the struggling skilled nursing facilities industry.

Overall, though, 87% of the DG50’s holdings had either “very safe” or “safe” dividends. Moreover, 20 of the components increased their dividends by more in 2022 than they had in 2021, and numerous others either equaled the previous year’s raise or came within a percentage point.

In other words, it was a good year for dividend hikes — which is how a portfolio achieves 11.6% year-over-year income growth. Showing that it was a fine year for increases overall (even beyond stocks traditionally owned by DGI proponents), the Vanguard S&P 500 ETF (VOO) position that I bought on Dec. 16, 2014, experienced nearly an 11% increase in dividends in 2022.

| 2021 DIVIDENDS PAID | 2022 DIVIDENDS PAID | GROWTH | |

| DIVIDEND GROWTH 50 | $1,261.54 | $1,408.19 | 11.6% |

| Vanguard S&P 500 ETF | $18.58 | $20.60 | 10.9% |

That was the overall market’s best year of dividend growth since this project’s inception. Maybe increasing income has become cool!

Conclusion

Here’s where I recognize and show appreciation to the 10 Seeking Alpha contributors who, back in 2014, selected the stocks that would go on to make up the Dividend Growth 50: Dave Van Knapp, Chowder, ScottU, Eric Landis, Dave Crosetti, Tim McAleenan, Eli Inkrot, Miz Magic DiviDogs, and our absent friends, Dave Fish and Bob Wells.

Self

The DG50 has served as an avenue to discuss the concept of building a growing, reliable income stream via a portfolio of individual stocks. In what might have surprised some, it also demonstrated that concentrating on high-quality dividend growers can lead to outstanding total return as well.

Year 8 truly was great for the Dividend Growth 50, but I like to think that the previous seven years provided a lot of useful information, too. Thanks to all of you readers who have followed the portfolio for so long.

Be the first to comment