Hispanolistic/E+ via Getty Images

After our Q3 analysis of Ecolab, we are moving forward in scrutinizing Diversey Holdings’ (NASDAQ:DSEY) accounts, which were not positively viewed by Wall Street. Let’s understand what is going on and, by looking at our deep-dive analysis, why we are more optimistic versus the consensus.

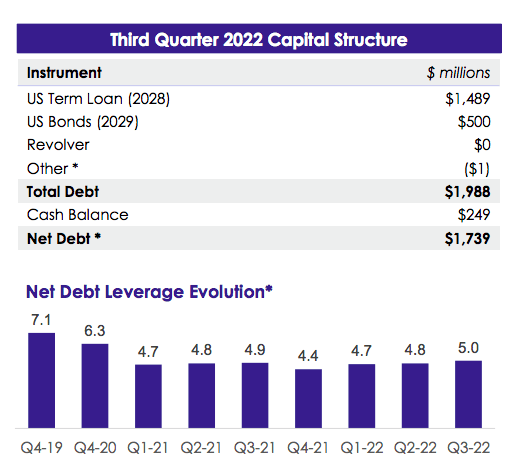

In our initiation of coverage, we provided a comps analysis between Ecolab and Diversey, checking respectively their debt exposure. Looking at Ecolab’s latest release, it is crucial to mention that the company’s 25% debt is with a floating interest rate; here at the Lab, we forecast an additional impact on the EPS of approximately $0.06 per share quarter on quarter. In detail, Ecolab’s net debt/EBITDA ratio is at 3.3x. As already mentioned, Diversey Holdings’ net debt/EBITDA ratio is higher than its closest competitor, and looking at the latest company presentation has reached a ratio of 5x. However, due to the higher amount of leverage, the company is much more protected on the interest expenses, having hedged its debt obligation from higher interest rates.

Diversey Net debt / EBITDA evolution (Q3 presentation)

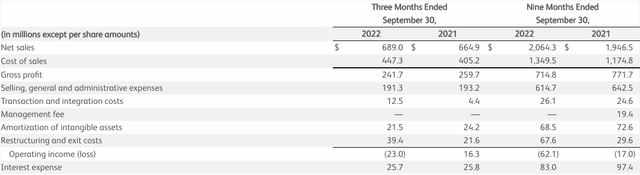

Looking back to the company’s 2021 annual report, we should mention that in Sept 2021, Diversey completed a private placement of $500.0 million with an interest rate of 4.625%, and redeem €450.0 million with a higher interest rate of 5.625%. Indeed, we are not surprised to see that over the course of 2022, the company managed to pay fewer interest expenses. In addition, the company entered a “series of derivative agreements to manage the impacts of fluctuations in interest rates and currency exchange rates“. This will help Diversey to lower future interest expenses. It is the company itself that provides the investor community with a good saving benchmark, quoting again the annual report: “A hypothetical 25 basis point increase in interest rates..would have increased our interest expense by $2.5 million per year“. Thanks to the company’s hedge in place, this is not happening. In the last line in the snap below, we can clearly see this positive development. Financially speaking, interest savings were $100k in Q3 and on the nine-month aggregate a total amount of $14.4 million.

Diversey Holdings Q3 interest payment (Q3 press release)

Q3 results

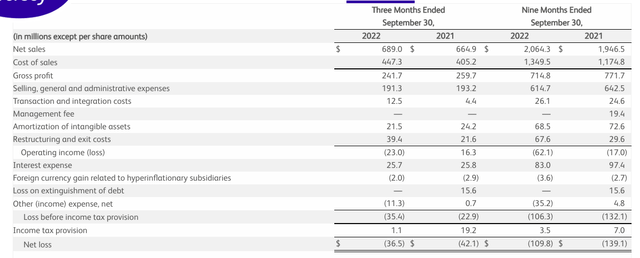

Following our Q2 results, we see similar negative and positive trends. As already mentioned, the company “is the second distant cleaning chemicals provider in the United States (after Ecolab); however, it is the number one player outside North America”. With 70% of its total top-line sales coming from international markets, the company is heavily exposed to FX development. Looking at the company’s press release, Diversey “delivered strong top-line growth in the quarter of 17% in constant currency“; however, adjusted for currency impact, the real growth was at 3.6%. The same negative trajectory was repeated going down in its P&L, adjusted EBITDA stood at $88 million with a decline of 17.4% compared to the same period in 2021; adjusting with the currency, the company was only down by 2.5%.

Cross-checking Wall Street analyst estimates, the company slightly misses EBITDA expectations, and we should note a positive development in higher volumes (up 5% on a yearly basis). Concerning the divisional segment:

- The Institutional adjusted EBITDA reached $69 million compared to Wall Street estimates that were forecasting $76 million. Excluding FX, EBITDA declined only by 3.4% thanks to higher volumes, which remains below the pre-COVID-19 levels;

- The Food and Beverage adjusted EBITDA stood at $27 million and was a beat. However, excluding FX, EBITDA declined by almost 13%. The F&B division seems to be more negatively influenced by raw material inflationary pressure.

Conclusion and Valuation

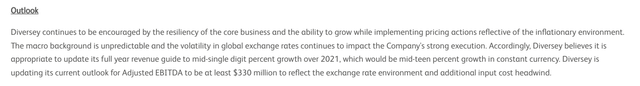

Following the half-year analysis, Diversey Holdings (once again) cut its EBITDA 2022 guidance, so we decide to lower our valuation. As a reminder, the company was forecasting an adjusted EBITDA between $350 and $390 million and now it is projected to “be at least $330 million”. This was due to unfavourable FX and higher raw material costs. We believe that this negative trend will persist due to the company’s sales coming from international countries. In Ecolab, we estimated this impact at $0.11 per share. However, we are not valuing Diversey Holdings with a P/E ratio due to the fact that the company is in negative territory.

Diversey Holdings net income (Q3 press release)

So, taking into consideration the latest negative development, here at the Lab, we provided a few changes to our forward earnings. Rolling forward our EBITDA over the next twelve-month projection, we reached $420 million, and applying an 11x multiple (at a discount compared to Ecolab), we are cutting our target price from $12 to $10 per share. The company’s discount is due to the higher debt and also its small float. Whereas, as already mentioned in our initiation of coverage and in Ecolab analysis, we still maintain our buy rating target thanks to the sector’s secular growth upside in infection prevention, the company’s high FCF generation, and its debt reduction.

Be the first to comment