rmitsch/E+ via Getty Images

By Sam Korus

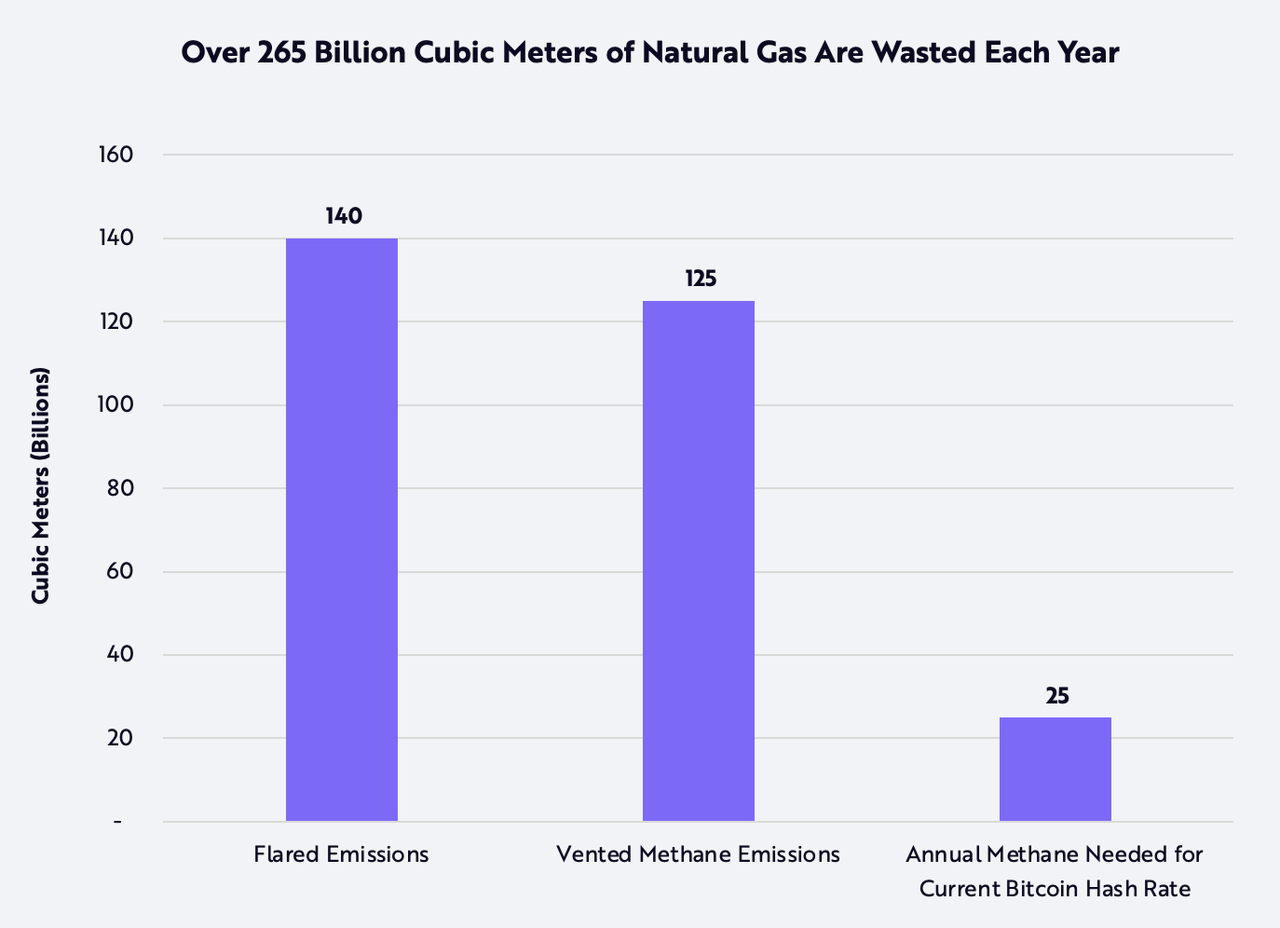

Methane, a potent greenhouse gas, is a byproduct of oil and natural gas drilling. Every year, the global oil and gas industry spews 265 billion cubic meters (bcm) of natural gas emissions into the atmosphere, vast amounts of energy that Bitcoin mining could harness productively, as shown below. While oil and gas companies flare/burn roughly 140 bcm of natural gas emissions to convert methane into less harmful carbon dioxide, it vents the other 125 bcm of methane directly into the atmosphere. Only 25 bcm, or ~10%, of total natural gas emissions would be necessary to support Bitcoin’s current hash rate[1] globally.

For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold, any particular security or cryptocurrency.

Source: ARK Investment Management LLC, 2022; Chen et al. 2022[2]

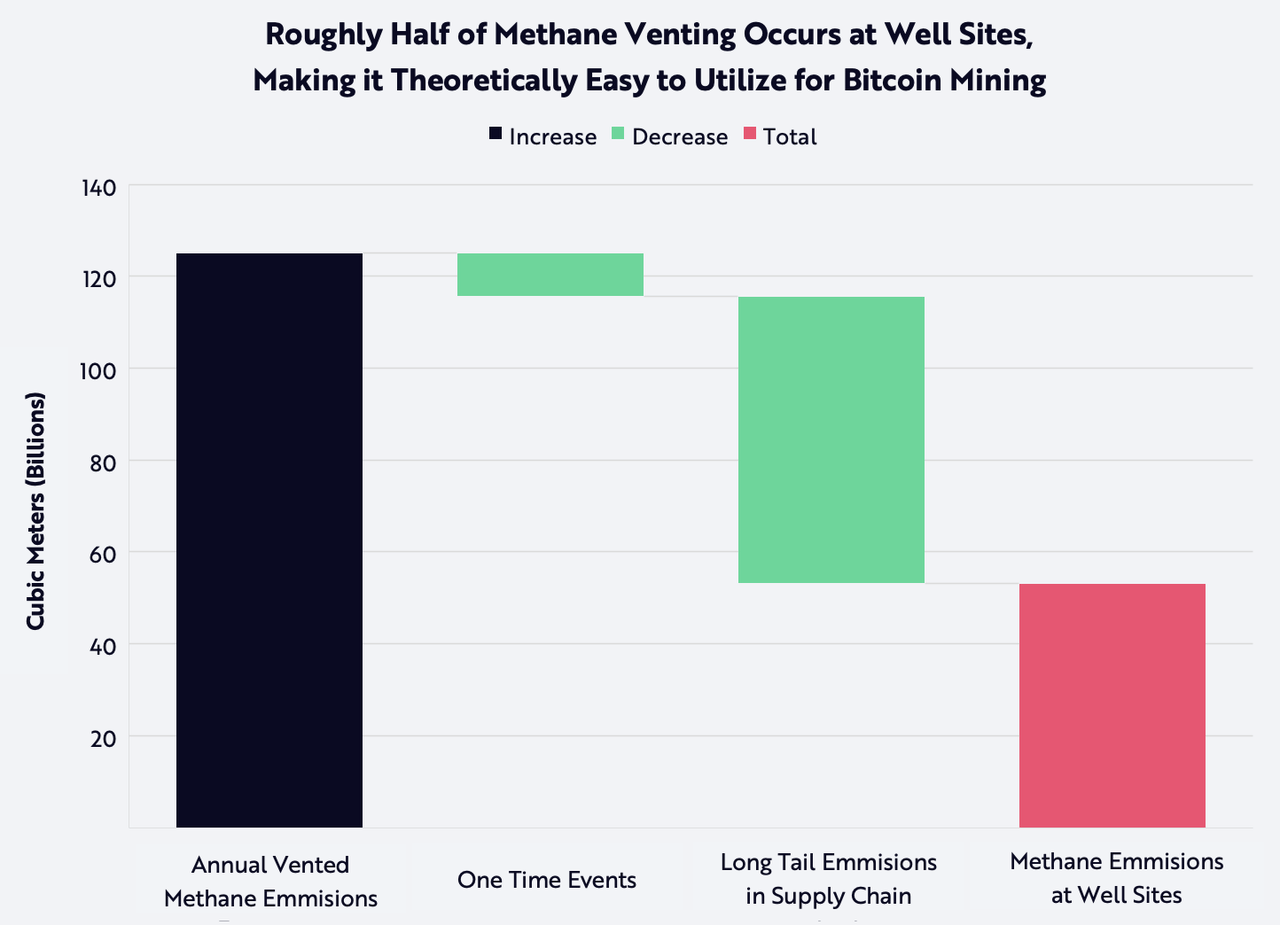

The oil and gas industry will not be able to capture and convert all 265 bcm of natural gas emissions into electricity. While both flared and vented methane emissions could be used for Bitcoin mining, ARK believes that vented methane will be the first target because it is ~120 times more toxic than carbon dioxide when released into the atmosphere[3], and companies haven’t sunk infrastructure costs into flaring ecosystems. Of the 125 bcm in vented methane emissions, ARK estimates that only half occurs at well sites, the easiest and most productive locations for Bitcoin mining, as shown below.

For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold, any particular security or cryptocurrency.

Source: ARK Investment Management LLC, 2022; Chen et al. 2022; International Energy Agency 2022[4]

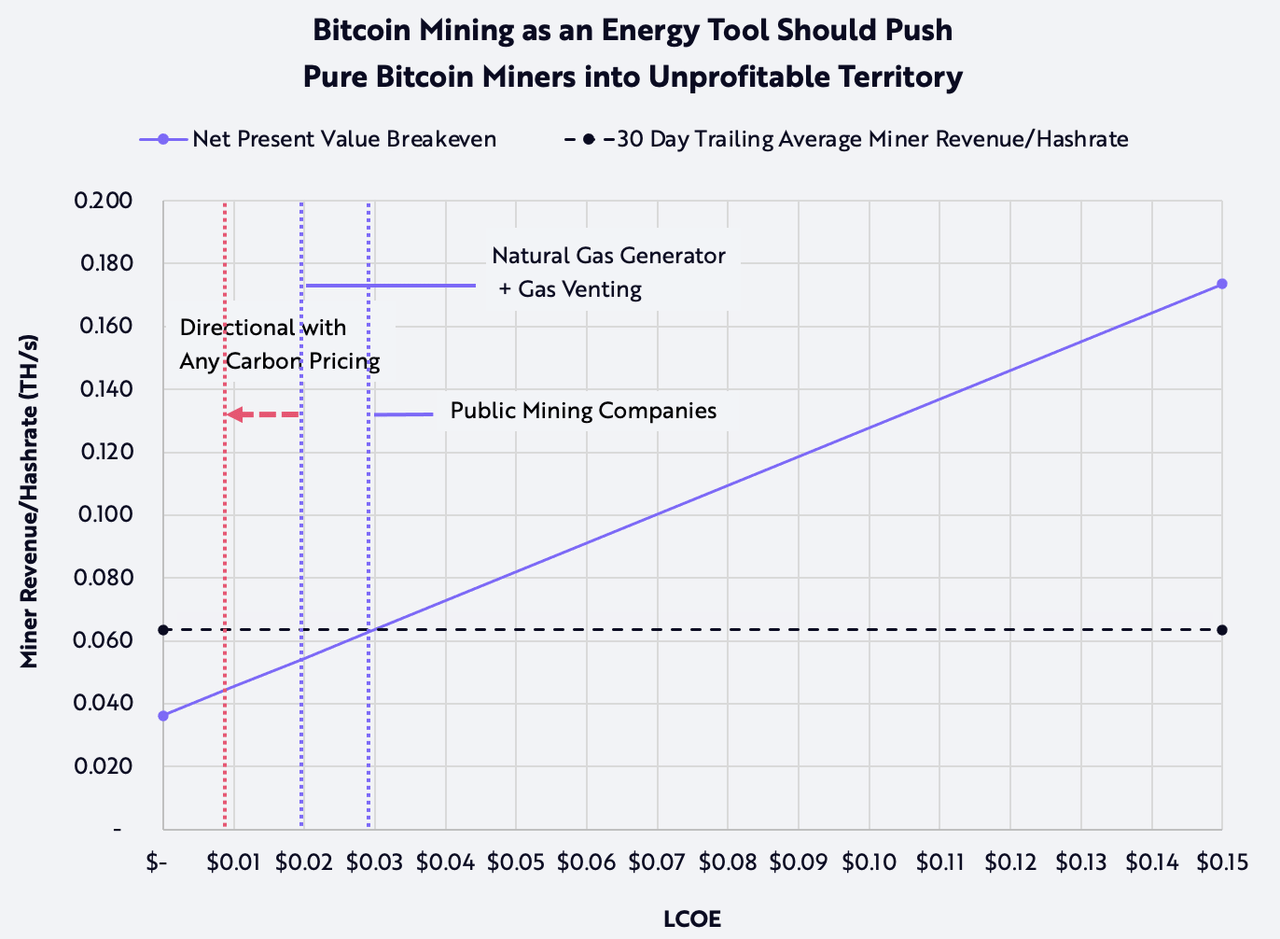

ARK’s research suggests that installing natural gas generators at well sites and using methane that otherwise would be vented to mine Bitcoin could generate electricity at a cost much lower than public Bitcoin mining companies pay today. Assuming no supply constraints on mining hardware, Bitcoin miners could harness vented methane and undercut “pure play” Bitcoin mining companies, pushing them into the unprofitable territory. Moreover, if utility regulators were to introduce carbon abatement pricing plans, using vented methane to mine Bitcoin would become that much more attractive. We illustrate this competitive dynamic in the chart below.

Bitcoin miners often tout their economies of scale and low levelized cost of electricity (LCOE) as competitive advantages. ARK’s research suggests the LCOE of a natural gas generator using stranded methane[5] is lower today than that of public Bitcoin mining companies. If more companies or individuals were to mine Bitcoin at well sites, the network’s hashrate likely would increase, lowering the average revenue/hashrate of miners elsewhere. If Bitcoin miners using vented natural gas were to generate revenue/hashrate at a price below 6 cents, then public mining companies paying roughly three cents for electricity today potentially would be forced out of business.

For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold, any particular security or cryptocurrency.

Source: ARK Investment Management LLC, 2022

While harnessing vented methane in other ways is possible, ARK believes that Bitcoin mining is ideal: it is distributed and highly scalable with modular hardware that can be transported to and shifted among operating well sites. Because oil and gas wells often have short lifespans, Bitcoin mining could make the difference between high and low returns on investment in oil and gas fields.

1* Hash rate is a measure of computational power used to mine and secure proof of work blockchains.

2* https://pubs.acs.org/doi/10.1021/acs.est.1c06458

Yuanlei Chen et al. 2022. Quantifying Regional Methane Emissions in the New Mexico Permian Basin with a Comprehensive Aerial Survey.

3* http://large.stanford.edu/courses/2016/ph240/jadhav1/

International Energy Agency. 2022. “The Energy Security Case for Tackling Gas Flaring and Methane Leaks.”

5* Methane that otherwise would be unused or vented.

Disclosure: ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For a list of all purchases and sales made by ARK for client accounts during the past year that could be considered by the SEC as recommendations, click here. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities in this list. For full disclosures, click here.

Disclaimer: ©2021-2026, ARK Investment Management LLC (“ARK” ® “ARK Invest”). All content is original and has been researched and produced by ARK unless otherwise stated. No part of ARK’s original content may be reproduced in any form, or referred to in any other publication, without the express written permission of ARK. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence.

Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice. All statements made regarding companies or securities or other financial information on this site or any sites relating to ARK are strictly beliefs and points of view held by ARK or the third party making such statement and are not endorsements by ARK of any company or security or recommendations by ARK to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that ARK’s objectives will be achieved. Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. For full disclosures, please go to our Terms & Conditions page.

The Adviser did not pay a fee to be considered for or granted the awards. The Adviser did not pay any fee to the grantor of the awards for the right to promote the Adviser’s receipt of the awards nor was the Adviser required to be a member of an organization to be eligible for the awards. For full Award Disclosure please go to our Terms & Conditions page. Past performance is not indicative of future performance.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment