Joe Raedle/Getty Images News

Investment Thesis

The Walt Disney Company (NYSE:DIS) stock has continued to struggle in 2022 despite its pretty robust FQ1’22 earnings card in February. The company’s Parks segment has recovered remarkably with the reopening, and its direct-to-consumer (DTC) business also impressed. Notably, it occurred while Netflix (NFLX) astounded investors in its previous quarter’s earnings.

But, we argued in our previous article (Hold rating, down 23%) that the market may have already priced in Disney’s DTC transition. It was pretty clear because DIS stock traded well above its historical metrics. Some analysts/investors even suggested that DIS deserved a higher multiple because Netflix stock was priced at a steeper premium. However, Netflix’s significant value compression reminded us of the importance of valuation discipline. As a result, DIS stock also experienced steep compression, as its stock last traded 35.7% below its 2021 highs.

However, as we demonstrate subsequently, DIS stock is still not cheap. There’s still an embedded growth premium, even though it has been digested meaningfully. DIS stock is now caught between the compression of the work-from-home premium and the reopening tailwinds.

However, we think the market has already positioned DIS stock as a DTC behemoth with Disney+ optionality, bolstered by its legacy Parks business. Therefore, we believe its stock performance would be benchmarked on its performance against its streaming peers moving forward.

Still Priced At A Premium Despite The Steep Compression

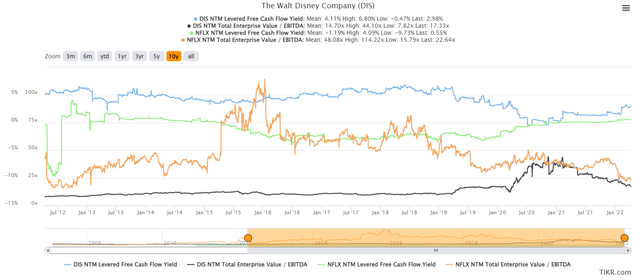

DIS stock valuation comps (TIKR)

Investors can easily glean that DIS stock still traded at a premium against its 10Y average despite the steep value compression. For example, its NTM EBITDA multiple of 17.3x is way ahead of its 10Y mean of 14.7x. Moreover, back in November, it still traded at 25x NTM EBITDA.

We recall that some analysts/investors highlighted that their SOTP valuation models suggest that DIS should trade closer to Netflix’s premium, given its faster growth. However, their SOTP models failed to account for Netflix’s substantial growth premium. As a result, as NFLX fell from the sky, DIS stock followed. We can clearly observe the correlation from the chart above. Therefore, we think Disney investors need to consider the significant impact of its DTC business in how it affects DIS stock valuation.

Furthermore, DIS stock’s NTM FCF yield of 3% is still markedly below its 10Y average of 4.1%. Disney has also committed to a massive $33B (and maybe more moving forward) in content-related spending in FY22, an increase of $8B from FY21. We think this would further impinge on Disney’s FCF margins, despite the recovery of its legacy Park assets.

A quick look over at NFLX stock’s NTM FCF yield trend is telling. NFLX stock’s 10Y mean is -1.2%. The heavy investment in content necessitated the investments that impacted its FCF generation. Therefore, it’s straightforward to understand why its valuation was de-rated. Netflix’s main thesis is linked to its subscribers’ growth. So, if that growth is expected to slow meaningfully, then investors would inevitably focus on profitability. But, NFLX’s NTM FCF yield is still only 0.55%!

Hence, we think Disney investors need to contend with markedly lower FCF yields moving forward unless its DTC service can ramp its profitability significantly.

Parks Recovery Should Drive Higher Margins

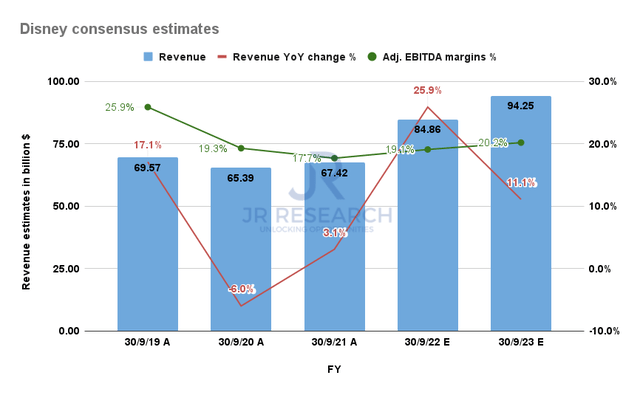

Disney consensus estimates (S&P Capital IQ)

Consensus estimates suggest that Disney should be able to surpass its pre-COVID revenue in FY22. Disney is projected to post $84.86B in revenue, up 25.9% YoY. The gains from the recovery in its Park segment would be critical to Disney continuing to meet guidance. In addition, Disney’s adjusted EBITDA margin is also expected to improve to 19.1%, from FY21’s 17.7%.

Despite that, it remains way below FY19’s 25.9%. Therefore, we believe that the growth of the DTC segment will continue to impact margins in the near term. Notably, DTC was still unprofitable in Q1. Hence, investors need to focus on DTC growth as its Linear Network’s growth has likely stalled.

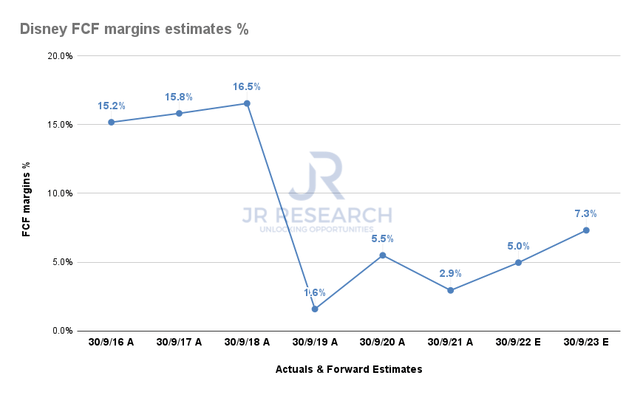

Disney FCF margins estimates % (S&P Capital IQ)

Furthermore, Disney’s FCF margins are still expected to improve but remain well below its pre-COVID margins. As a result, we think the market should continue to expect Disney to surpass expectations in re-rating the stock, given its implied growth premium and lower than historical profitability.

Therefore, we think it’s imperative for Disney investors to have conviction over its DTC plans. We believe the success of its DTC segment would be fundamental to its stock’s re-rating moving forward. Furthermore, Disney investors should also be ready for significant value compression if the streaming space becomes even more competitive, impacting Disney’s growth and profitability.

Is DIS Stock A Buy, Sell, Or Hold?

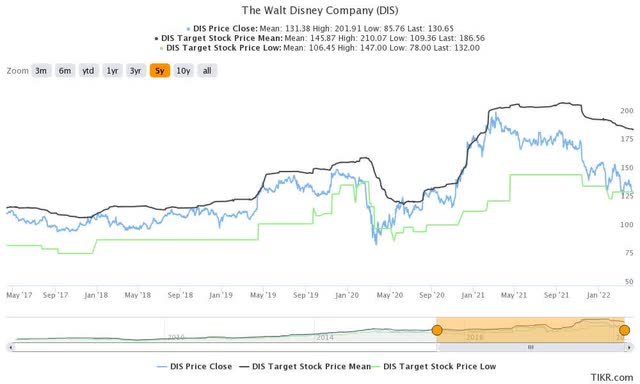

DIS stock consensus price targets Vs. stock performance (TIKR)

We think DIS stock valuation is delicately balanced at the current levels. While the recovery in its Parks segment should be positive, we believe it has been priced in. Therefore, investors’ expectations are focused on the performance of its DTC segment, given its growth premium.

But, we think the value compression, coupled with improving profitability, should lead to a re-rating of DIS stock moving forward. Nevertheless, we don’t consider DIS stock as significantly undervalued at the current levels.

Still, the stock last traded near the most conservative price targets (PTs), which should help to support the stock in the near term.

As such, we revise our rating on DIS stock from Hold to Buy.

Be the first to comment