Joe Kohen/Getty Images Entertainment

Investment Thesis

The Walt Disney Company (NYSE:DIS) hit the jackpot with its Marvel Cinematic Universe, when it first purchased the company for $4B in 2009. 27 movies later, the franchise had netted Disney an incredulous $9.92B of domestic box office and over $25B globally. It helped Disney grow its valuations by over fourfold in the last fourteen years and accelerated the adoption of its online streaming service, Disney+, after the Avengers: Endgame movie in 2019. The Marvel goldmine also continues to give, with new releases expected in 2022 and 2023, through theatrical releases and Disney+ releases.

In addition, as the largest theme park operator in the world with 155.9M annual attendance as of 2019, Disney is a commonly known household name in America and globally. Given its stellar performance in FQ1’22, we anticipate swift recovery and growth in the theme parks segment as a result of pent-up demand post-COVID-19-pandemic and global re-opening cadence.

Excellent Recovery Post-COVID-19-Pandemic

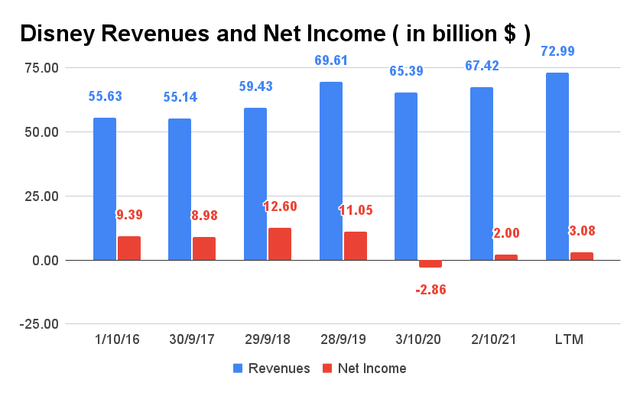

Disney Revenue and Net Income

Pre-pandemic, Disney recorded excellent revenues and net income growth at a CAGR of 7.76% and 5.58%, respectively. Though the company was severely affected by the COVID-19 pandemic in FY2020 and FY2021, recovery is imminent given its excellent performance in the last twelve months (LTM). In the LTM, Disney had reported revenues of $72.99B, representing an increase of 4.8% from FY2019’s levels. Though its net income has yet to catch up to pre-pandemic levels, we are encouraged by the return of its Theme Park-related revenues and the growth of its entertainment D2C revenues in FQ1’22.

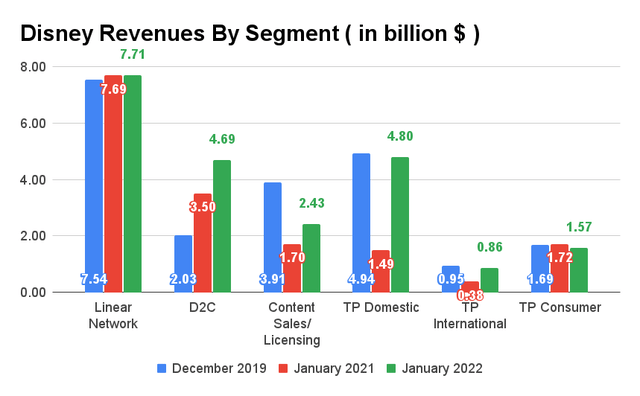

Disney Revenue by Segment

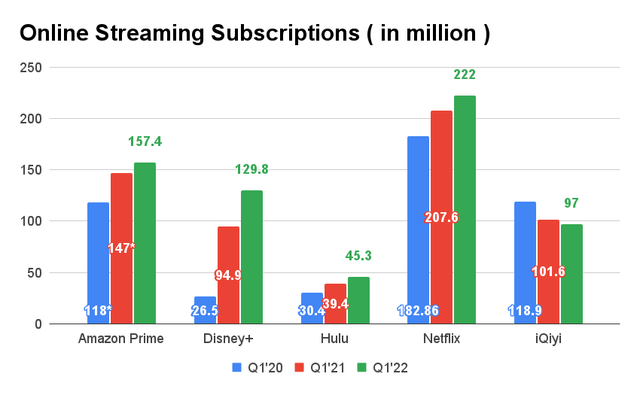

In FQ1’22, Disney reported impressive growth for its Media and Entertainment D2C segment with an increase of 34% YoY and 231% from FQ4’19 to $4.69B. The growth in the segment is partly attributed to the rise in paid memberships for Disney+ and Hulu from Q1’21 to Q1’22, at 36.7% and 14.9%, respectively. Despite being released in November 2019, Disney+ only took two years to reach 129.8M subscribers as of April 2022, compared to Netflix at eleven years from 2007 to 2018. The COVID-19 pandemic had clearly contributed to the boom, with the Motion Picture Association reporting a 30% increase in the global mobile entertainment market in 2020, with an additional 14% growth in 2021.

Online Streaming Subscriptions As of April 2022

The impact was apparent given how the global online video streaming market grew from $338.18B in 2019 to $376.06B in 2020 at a YoY increase of 11.2%. The pandemic has also aided the growth in virtual pay-TV subscriptions, such as YouTube TV and Disney’s Hulu, by 18% in 2020. In addition, the growth in the online streaming market boosted the number of online releases in 2021 by 15% YoY, with Disney releasing its highly anticipated extension of the Marvel Cinematic Universe, WandaVision and Loki, in Disney+ in 2021.

In addition, the global online video streaming market is expected to double from $419.03B in 2021 to $842.93B by 2027 at a CAGR of 12%. Since Disney has more exciting lineups to be released in 2022 through Disney+, including multiple Marvel and Star Wars franchises, we expect the company to report robust growth in membership and subscription revenues moving forward. Charles Rivkin, the chairman, and CEO of the Motion Picture Association, said:

We are just getting started in writing the next chapter of our industry as streaming continues to boom, theaters are rebounding, and the overall global market for our entertainment product recovers and breaks records. (Deadline)

As for Disney’s content sales/licensing sales, it is evident that the segment has yet to recover, with only 59% of Americans comfortable with returning to movie theatres as of 6 April 2022. In FQ1’22, the company only reported $2.43B in revenues for the segment, representing a decline of 37.8% from FQ4’19. In 2020, the Motion Picture Association reported a 72% decrease in global box office markets, with 2021 experiencing an 81% YoY recovery.

On the other hand, we can see that Disney’s theme park revenues have almost recovered to pre-pandemic times at $4.8B for the domestic segment and $0.86B internationally in FQ1’22, similar to $4.94B and $0.95B in FQ4’19, respectively. Furthermore, we have seen a 26% increase in domestic travel bookings during spring and summer break as a result of pent-up demand. Destinations such as theme parks have also seen an encouraging recovery in bookings and spending, with the global amusement parks market expected to recover to $71.6B in 2022, almost in line with $73.5B in 2019. In addition, the market is expected to grow to $89.2B by 2025 at a CAGR of 8.7%.

Given the projected recovery of Disney’s theme parks segment and massive growth in its online streaming segments, we expect the company to report robust growth moving forward, especially if its theatrical segment recovers to pre-pandemic levels. As a result of its unique market segments, we expect the legacy company to remain an outstanding industry leader for the next 100 years. Bob Chapek, CEO of The Walt Disney Company, said:

This marks the final year of The Walt Disney Company’s first century, and performance like this coupled with our unmatched collection of assets and platforms, creative capabilities, and unique place in the culture give me great confidence we will continue to define entertainment for the next 100 years. (Seeking Alpha)

Marvel Will Help Disney Regain Its Magic

In 2021 alone, Disney generated $1.17B in the domestic box office with $2.9B of revenues globally, accounting for over 25% of the domestic and global box office. It is also notable that the achievement is mostly attributed to its Marvel franchise, including Shang Chi, Black Widow, and Eternals. These three movies contributed $574M of revenue to the North American box office, accounting for an impressive 49% of its domestic box office. In addition, its collaboration with Sony for Spider-Man: No Way Home had grossed $1.8B worldwide, including $760.9M domestically.

This success was an extension of the global success that Disney enjoyed in 2019, when the company commanded 33.2% of the domestic box office at $3.72B. These were achieved with two of its Marvel franchise, Avengers: Endgame and Captain Marvel, bringing in over $1.28B in 2019, representing 34.4% of its revenues. Disney’s Marvel series has enjoyed a lot of success for 14 years, so there is no reason why it won’t continue to do so. Moreover, in 2022 alone, there are multiple notable releases with high potential for over $1B in box office revenues:

- Doctor Strange in the Multiverse of Madness in May 2022 – $676M in 2016.

- Thor: Love and Thunder in July 2022 – $850M in 2017.

- Black Panther: Wakanda Forever in November 2022 – $1.33B in 2018.

- With a special mention: Avatar 2 in December 2022 – $2.84B in 2009.

With Doctor Strange coming right hot on the heels of Spider-Man, we expect stellar performance as well, given that its 24 hours pre-sales have topped the charts in 2022. In addition, these movies franchises had previously grossed over $5.67B for their latest releases, with Avatar alone accounting for $2.84B globally. As a result, we have no doubt that Disney’s content sales/licensing segment would smash sales expectations in 2022, given its exciting theatrical release and, subsequently, in Disney+ after 45 days.

Disney further solidified its market dominance when it acquired Pixar in 2006, Lucasfilm in 2012, streaming services company BAMTech in 2017, and 21st Century Fox in 2019. The company carries the momentum further with four additional Marvel-related releases in 2023, including its highly anticipated movie, Blade. The original release of the Blade movie in 1998 had revitalized the superhero genre, while also achieving both critical and financial success for the struggling Marvel then. Additionally, its Pixar and Lucasfilm segments have also performed exceptionally well historically, with the ‘Star Wars Ep. VII: The Force Awakens’ earning $2.06B at the global box office in 2015 and Incredibles 2 earning $1.24B in 2018.

So, Is Disney Stock A Buy, Sell, or Hold?

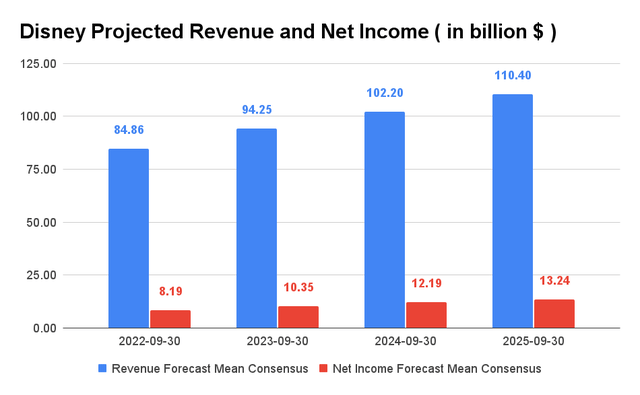

Disney Projected Revenue and Net Income

Disney is expected to grow their revenues at a CAGR of 10.9% over the next four years. In FY2022, consensus estimates that Disney will report revenues of $84.86B, representing an impressive post-COVID-19-pandemic recovery with YoY growth of 25.8%. In addition, the company is expected to report a net income of $8.19B in FY2022, representing an excellent recovery nearing pre-pandemic levels. Given its excellent FQ1’22 results, we expect Disney to beat consensus estimates, since it has been doing this in eight out of twelve quarters.

Disney is currently trading at an EV/NTM Revenue of 3.33x, lower than its 3Y mean of 4.21x. Consensus estimates also rate Disney stock as an attractive buy now, given its undervaluation and growth potential. In addition, the company is trading at $131.87 on 8 April 2022, down 30% from its 52-weeks high of $190.4. As a result, we encourage interested investors to add more to their portfolios now.

Therefore, we rate Disney stock as a Buy for long-term investors.

Be the first to comment