Marc Piasecki/Getty Images Entertainment

Introduction

CEO of The Walt Disney Company (NYSE:DIS), Bob Chapek, is certainly not shy when it comes to telling the market what a great company he is running, with references on the first page of the 2Q22 result to “fantastic performance” and DIS being “in a league of our own”.

“Our strong results in the second quarter, including fantastic performance at our domestic parks and continued growth of our streaming services—with 7.9 million Disney+ subscribers added in the quarter and total subscriptions across all our DTC offerings exceeding 205 million—once again proved that we are in a league of our own,” said Bob Chapek, Chief Executive Officer, The Walt Disney Company.

Source: DIS 2Q22 Earnings Result, page 1.

Such bold statements from Chapek and other Disney executives may well have contributed to many investors tagging DIS shares with a ‘high-quality’ label. The investment industry is full of rubbery, subjective statements and categorizations (often put forward with great conviction, particularly when a fund manager is talking their own book) and I’d argue that any claim regarding a company or investment being high-quality should be taken with a pinch of salt. However, putting investment considerations aside, when it comes to content and product, I’d agree that DIS puts out high-quality material, and perhaps Chapek’s reference to DIS being in a league of their own on that front is fair.

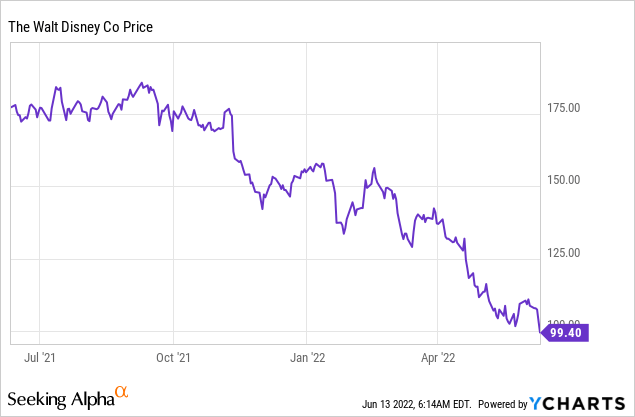

As a value investor, when a company generally regarded as being high-quality has a price chart like the one below – showing a big fall from grace – I start to get interested. In this note I take a look at DIS from the perspective of a value focused investor, and assess whether the investment case stacks up.

(An upfront disclaimer. I have noticed that DIS research notes sometimes attract rather heated commentary and discussion which has a cultural/political flavor. It is not unreasonable to consider a company’s position on cultural or political issues in the context of reputational risk and market positioning – but I feel that the debate on these matters in regard to DIS has grown somewhat out of proportion to the relevance of such on the DIS investment case. I will therefore not touch on these potentially controversial topics in this note.)

Sustainable Earnings

My primary focus for company valuations almost always falls upon sustainable (or normalized) earnings. Unfortunately, in the case of DIS, the task of identifying sustainable earnings with a high level of confidence is currently almost impossible, due to a number of complicating factors:

- The acquisition of 21st Century Fox “TFCF” in March 2019 distorts prior period comparisons, making long term trends hard to discern.

- The major strategic shift to focus on direct-to-consumer “DTC” services, including the launch of Disney+ in late 2019.

- Ongoing launches of DTC products into new regions/countries.

- A segmental reporting restructure and company reorganization in October 2020.

- Disruptions related to COVID-19 from early 2020 onwards.

Sell-side earnings forecasts are often presented in a detailed manner, which gives the impression of precision. When a company has predictable, stable income streams, such detailed forecasts do have a high probability of being quite precise. However, for DIS, given the factors mentioned above, and the huge uncertainty regarding how the DTC strategy plays out, I have no idea how an analyst could put together a detailed multi-year earnings forecast with any real level of confidence.

Rather than throwing in the towel when confronted by such muddy waters (which did cross my mind after reading through the company’s results materials for the last few years), I have attempted to identify components of the DIS operations that can be slotted into a sustainable earnings framework. After deriving a sense of value relating to the more sustainable DIS income streams, it is then possible to use this a base from which to consider what the company’s market capitalization is attributing to the more unpredictable DIS operations. This isn’t the way I would normally approach a valuation assessment, but in the circumstances, it seems to be a sensible path to take in order to arrive at an initial stock rating for DIS.

Segment Operating Income – Approach With Caution

Before looking at the DIS segment results with the aim of drawing out the sustainable earnings streams, let’s dig into how DIS defines segment operating income. Here’s what the company tells us about how they define segment operating income, and why it is used:

- The Company evaluates the performance of its operating segments based on segment operating income, and management uses total segment operating income as a measure of the performance of operating businesses separate from non-operating factors. The Company believes that information about total segment operating income assists investors by allowing them to evaluate changes in the operating results of the Company’s portfolio of businesses separate from non-operational factors that affect net income, thus providing separate insight into both operations and other factors that affect reported results.

Source: DIS 2Q22 Earnings Report, page 2.

On first read, the approach sounds fair enough, suggesting that segment operating income can perhaps be used for valuation purposes as it better reflects underlying earnings generation. One of the adjustments that DIS makes to arrive at segment operating income is to add back the net interest expense charge – this can be thought of as aligning segment operating income with something more akin to EBIT, which I consider to be a sensible step. Some of the other DIS segment operating income adjustments deserve to be looked at more critically.

Segment operating income excludes ‘corporate and unallocated shared expenses’. These corporate/unallocated expenses are not trivial – with -$272m incurred in 2Q22, and -$928m incurred in FY21. An estimated annual run rate of -$1bn pa for this item does not seem unreasonable. In my view, it is a bit rich of DIS to exclude annual costs of around -$1bn that are quite predictable in nature from the definition of segment operating income. From a valuation perspective, I have treated the annual -$1bn cost as a sustainable item.

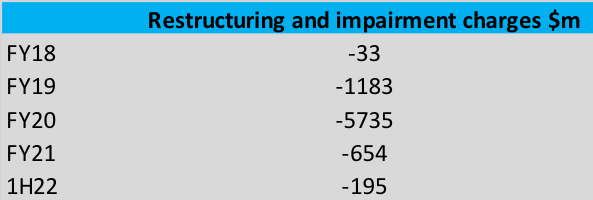

The other DIS adjustment that caught my eye is ‘restructuring and impairment charges’. For many businesses, particularly large, diverse companies with multiple operating buckets (such as DIS), restructures and associated asset impairments occur frequently and can be considered business-as-usual. Despite this, we very often see restructuring and related costs reported as ‘exceptional items’ and shown outside the earnings metrics that a management team puts forward to the market. The future cost savings identified with these ‘below-the-line’ items aren’t typically called out in the same way – and so, in effect, the company captures the optical benefits of lower future reported costs whilst not properly taking ownership of the restructure expenses incurred in order to generate those future savings. It is therefore always sensible to pay close attention to earnings adjustments that companies make in regard to restructuring and associated activities.

As set out in Table 1 below, over the 3.5 years to 1H22, DIS has incurred a total of -$7.8bn in restructuring and impairment charges. In the FY19 Annual Report (page 51), DIS referenced an expectation for the total severance and related costs in regard to the TFCF integration of around -$1.5bn. Comments in subsequent annual reports point to the eventual cost being closer to -$2bn. Whilst I think that it is reasonable to treat TFCF integration costs as exceptional, it is impossible to know whether or not DIS used the TFCF integration project as a means to create non-integration related cost savings – in other words, as an opportunity to blend in business-as-usual efficiency actions with the reported restructure charges. Note that around -$5bn of FY20’s huge -$5.7bn hit was for the write-down of intangible assets and goodwill relating to traditional media channels as DIS shifted focus to the DTC channel.

Table 1:

Source: constructed by author using DIS annual and quarterly reports.

In terms of thinking about sustainable earnings, if we are to use the disclosed segment operating income numbers as a starting point, my view is that an allowance for ongoing restructure and impairment charges should be factored in for DIS. I have allowed -$200m pa in my valuation assessment (granted, this is not a scientifically derived number – but even this guestimate is better than assuming zero).

A final point to make on this topic – readers should not conclude from the above discussion that DIS is ‘cooking the books’. The type of treatment that DIS applies when putting forward non-statutory earnings numbers is very common, and often warranted. It is, however, important for investors and analysts to carefully review non-statutory earnings adjustments for reasonableness and consistency (both across time and relative to adjustments embedded in the investment cases of other current or potential future portfolio holdings).

Disney Parks, Experiences and Products

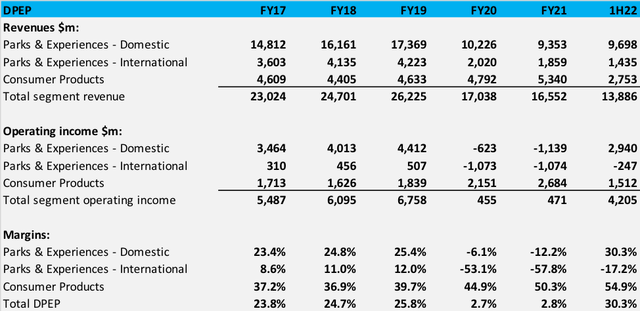

In Table 2 below, I set out historical segment revenue and operating income results for the Disney Parks, Experiences and Products segment – “DPEP” – along with a simple margin calculation. The severe impact of COVID-19 on DPEP can be clearly seen in FY20 and FY21; it was only thanks to very strong results in Consumer Products that DPEP was able to avoid material losses over those two years.

Table 2:

Source: author calculations based on DIS annual and quarterly reports.

Parks & Experiences revenue grew strongly from FY17 through to FY19 (up +17% over the two years), with margin expansion helping to deliver cumulative growth in Parks & Experiences operating income of +30% over the period. Growth in Consumer Products was solid but more muted over the same period, with operating income increasing by 7%. DPEP therefore looked to be in good shape prior to COVID-19, with Parks & Experiences driving strong operating income growth.

I think that it is logical to assume that DPEP’s Parks & Experiences operations will eventually return to at least pre COVID-19 levels of profitability once the pandemic is fully behind us. Indeed, it can be argued that Parks & Experiences earnings will bounce back to above FY19 levels due to DIS taking cost out as a means to offset COVID-19 downside. DIS CFO, Christine McCarthy, spoke to the cost-out benefit during the 1Q22 results Q&A session:

“I would say we’ve been saying this all along through the pandemic, where we have taken measures to really look at the cost base and how we’re doing things. And there’s been a fundamental shift in some of the operational processes that the parks had used for many, many years – things like the ability to do mobile dining or not having to check in with the human being at a hotel, those kinds of things are all things that add to upside that we have at the parks.” Christine McCarthy – Senior Executive Vice President and Chief Financial Officer.

Source: 1Q22 Earnings Transcript, page 20.

Although domestic Parks & Experiences generally operated without significant mandatory COVID-19-related capacity restrictions in 1H22, park attendance numbers have potential to increase further from the levels delivered in the last two quarters. International visitor numbers to domestic parks are still low, and can be expected to recover post COVID-19. Also, DIS is deliberately self-limiting capacity to provide a lower-density guest experience given that some people remain nervous about COVID-19 in crowded environments. In addition, there is currently an element of capacity limiting constraint in hospitality provision due to labor shortages. My expectation is that higher future visitor numbers will have a slightly negative impact on the average per-visitor spend, but the net outcome of greater visitation is clearly likely to be positive at the operating income level. 1Q is traditionally a strong quarter for Parks & Experiences, and 1Q22 performance may have additionally benefitted from COVID-19 related pent up demand, so there is some risk of overstatement if we simply annualize the 1H22 domestic Parks & Experiences operating income – but that risk would probably be mitigated by post COVID-19 capacity upside influences. On balance, I don’t feel uncomfortable with a starting point for sustainable/normalized domestic Parks & Experiences operating income of $6,000m pa.

An important issue to be aware of when using FY19 as a guide to sustainable earnings for DPEP is that at the end of FY19, DIS flagged an expectation that operating income from Hong Kong Disneyland would fall by around -$275m in FY20 (from FY19 levels) due to political unrest in Hong Kong and an associated fall in inbound tourism. This implies that operating income for international Parks & Experiences was running at around $230m pa before COVID-19. International Parks & Experiences were almost fully open during 1Q22, but the Shanghai and Hong Kong facilities were again badly impacted by COVID-19 in 2Q22. 1Q22’s international Parks & Experiences operating income of $21m looks low relative to the pre COVID-19 run-rate of $230m pa, however it is important to remember that although the international DIS parks were open, certain of the operations were still dealing with negative influences of mandatory capacity and travel restrictions. Relative to domestic Parks & Experiences, it is much harder to get a good sense as to what level of sustainable/normalized operating income we can expect for international Parks & Experiences. Taking what I think is a conservative stance, I adopted a starting point for sustainable/normalized international Parks & Experiences operating income of $200m pa (which I note is lower than the estimated pre COVID-19 run rate).

Capital expenditures for the DPEP segment have been above the corresponding depreciation charges. In 1H22, capital expenditures for DPEP were ~$300m above depreciation expenses. Some of the capital expenditure outlay likely relates to investments to support new components of earnings growth (cruise ship expansion for example), but without additional clarification from the company, I am inclined to make a negative adjustment to my sustainable earnings calculation for the material gap between capital expenditure and depreciation. I have allocated this adjustment with a weighting of 80% to domestic Parks & Experiences and a 20% weight to Consumer Products.

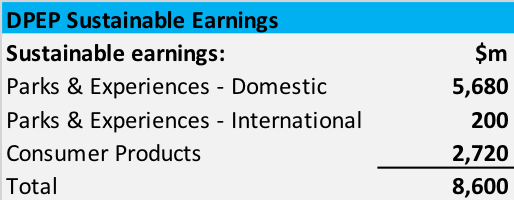

Bringing the above analysis and discussion together, Table 3 shows the sustainable earnings base for DPEP that I landed at for this initial valuation assessment:

Table 3:

Source: author calculations.

Disney Media and Entertainment Distribution – Abundant Uncertainty

Disney Media and Entertainment Distribution – “DMED” – represents a source of great uncertainty regarding total DIS group sustainable earnings, and I believe that this segment has been the primary driver of swings in investor sentiment toward the company. There is scope for a huge discrepancy between the views of DTC bulls (perhaps persuaded by market enthusiasm for Netflix) and DTC bears, and so the sentiment shift between these two camps can be expected to impact the DIS share price.

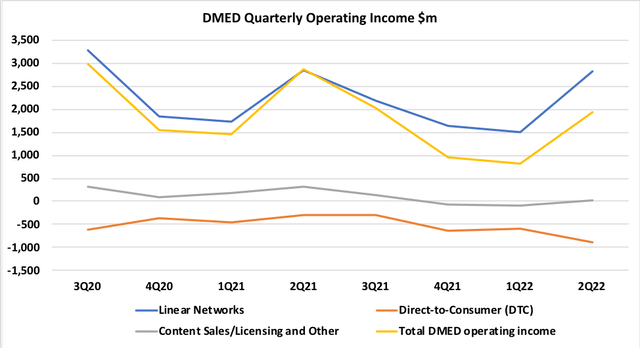

DMED is broken down into three buckets – Linear Networks, DTC, Content Sales/Licensing and Other. Before touching on some of the factors that lead me to lack confidence regarding DMED sustainable earnings, let’s have a look at the components of DMED’s operating income results over the last eight quarters:

Chart 1:

Source: author calculations based on DIS quarterly reports.

The chart highlights a couple of key issues. Firstly, Content Sales/Licensing and Other has gone from a business generating operating income of around $1bn pa to a business that is making losses (which are expected to continue). Secondly, DTC losses have expanded rapidly since 3Q21. DIS is clearly betting that investment in DTC, and particularly relating to Disney+, will secure DMED’s future, but the near-term DTC losses appear likely to be very substantial. At FY21, DIS guided to Disney+ achieving profitability in FY24, after passing through peak losses in FY22. In my view, as things stand today, an element of faith is needed to fully embrace the Disney+ bull story – and faith isn’t something that I like to build investment cases upon. That said, I am inclined to think that the strategic shift that DIS has made towards DTC is a sensible move.

For readers not familiar with the background to the company’s strategic shift to DTC, here’s a brief overview of what drove DIS to change direction and how they plan to execute the strategy:

- Consumer preferences for consumption of video content have changed over recent years. The widespread adoption of video streaming has disrupted traditional distribution channels for film and TV content.

- Film content was traditionally distributed first in the theatrical market, followed by the home entertainment market and then in the TV or subscription-video-on-demand “SVOD” market. Regular television content was traditionally distributed through cable and TV networks (linear networks) and then in the TV/SVOD market.

- To respond to the new market dynamics, DIS decided to increase its focus on distribution of content via its own DTC streaming services.

- DIS will produce exclusive content for DIS owned DTC streaming services.

- Rather than selling content in the TV/SVOD market, DIS may choose to distribute content through their own DTC streaming services.

- In future, DIS films may be launched concurrently via DTC streaming and in theaters.

- Potential use of pay-per-view via DTC.

Looking across DMED as a whole, it is important to recognize that DIS expects success in DTC to have a negative impact on its Linear Networks and Content Sales/Licensing operations. In that context, the DTC strategy should not be considered as a pure growth play – there is an obvious defensive aspect to the strategy shift.

Since late 2019, DIS management commentary, along with sell-side focus, has been heavily skewed towards DTC, and particularly Disney+. DIS is naturally very keen to talk about growth in DTC subscriber numbers, and the company has recently provided more granular disclosure regarding paid subscriptions. It’s easy to find positives in the data – for example, total Disney+ paid subscribers have increased impressively from 103.6m at 2Q21 to reach 137.7m at 2Q22. There are many temporary positive influences embedded within the Disney+ subscriber number growth trends, some of which we can expect to fade over time (for example – gains from entering into new markets, gains from temporary price discounts). When a business is in market share expansion phase it is difficult to get a sense of the eventual steady state that will be reached, and we also struggle to get a sense of the stickiness of the customers being acquired – which is a live issue at present. For subscribers who don’t have children, and who therefore do not run the risk of little ones going ballistic at the loss of their favorite shows/movies, cutting back on a Disney+ entertainment subscription is a relatively pain-free way to alleviate cost of living pressures.

When Disney+ launches into a new market/segment, we should expect to see initial customer pricing set at a relatively low level – as a means to ensure strong early subscriber growth. As the business matures, DIS is likely to shift pricing up. Given that the Disney+ business is still immature, we do not yet have a good feel as to how sticky the subscriber base will be when it comes to price-increase-related subscription cancellations.

A further issue to mindful of here is that DIS appear to have underestimated the ongoing level of investment required in content production to support Disney+ and the DTC strategy more generally. The realization that more content is required and delivery thereof ought to put upward pressure on customer pricing, which may lead to a reduction in subscriber numbers (either from lower new subscriber additions, or from higher rates of customer attrition). This dynamic is just one of many complex issues that make predictions about the future profitability of the DTC segment highly uncertain. From the perspective of a value investor focused on sustainable income streams, DTC is tough to slot into an investment case.

In contrast to the heavy focus on DTC subscriber growth, the cannibalizing effect of DTC upon Linear Networks in particular is rarely discussed. In Table 4, I show the change in domestic subscriber numbers to cable channels from September 2019 to September 2021 (as estimated by Nielsen Media Research). For most channels, we can see reductions of in excess -5% pa.

Table 4:

Source: author calculations based on DIS annual reports.

It would be easy to devote a long research note entirely to discussing the DTC strategy and how this might play out for the DMED division. Such analysis is relevant and interesting, but from the perspective of trying to confidently identify sustainable earnings streams, I am not convinced that it would be a productive endeavor – simply because the spectrum of potential outcomes involved is so wide.

Valuation Assessment

In this section I attempt to derive a range of implied market valuations of the DMED segment by working back from the company’s enterprise value and the sustainable earnings for DIS ex-DMED that I have described and analyzed above. Having established a range of implied valuations for DMED, I then use this to back-solve to implied levels of sustainable DMED earnings.

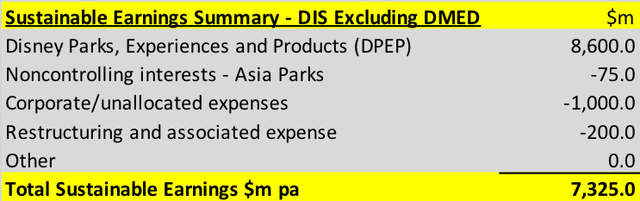

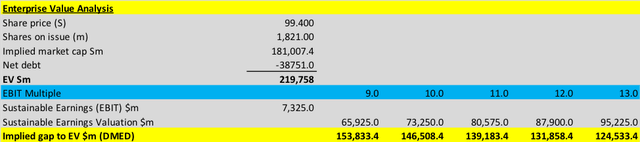

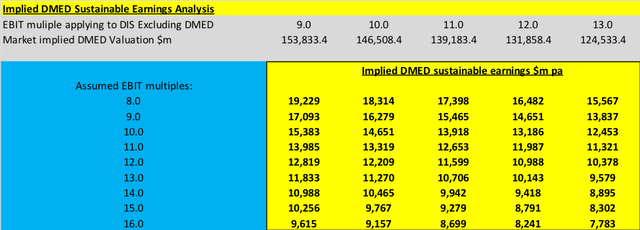

Table 5 provides a summary of my estimate of sustainable earnings (which can be thought of as equivalent to sustainable EBIT) for DIS excluding the DMED segment. Table 6 links to the sustainable earnings shown in Table 5, and sets out a simple enterprise value framework, applying different EBIT multiples to derive a range of implied market valuations for DMED. Table 7 takes the analysis a step further and works back from the implied DMED market valuations shown in Table 6 to arrive at a range of implied annual sustainable earnings results for DMED.

Table 5:

Source: author calculations based on DIS annual and quarterly reports.

Table 6:

Source: author calculations based on DIS annual and quarterly reports.

Table 7:

Source: author calculations based on DIS annual and quarterly reports.

Summary & Conclusion

Based on the analysis described above, and a DIS price of $99.40 per share (market close 10 June 2022), the sustainable earnings for Disney Parks, Experiences and Products along with corporate costs and assumed ongoing restructuring expenses account for between 30% and 43% of the total DIS enterprise value. The primary source of future earnings uncertainty in regard to DIS – being the Disney Media and Entertainment Distribution segment – therefore clearly remains very significant to the stock’s overall valuation equation (accounting for between 57% and 70% of DIS enterprise value). For investors seeking companies with valuations that can be comfortably supported by sustainable earnings streams, DIS is unlikely to offer much appeal at the current share price.

Applying an earnings multiple of 12x to the components of DIS for which I feel quite confident in regard to my ability to estimate sustainable earnings, I arrive at a back-solved implied market value for the Disney Media and Entertainment Distribution segment of around $132bn. In the twelve months ending 2Q22, operating income for the Disney Media and Entertainment Distribution segment was $5.72bn. If I exclude the large losses associated with the DTC (Direct-to-Consumer) division, then adjusted ex-DTC DMED segment operating income for the twelve months to 2Q22 increases to $8.13bn – which points to an implied EBIT multiple for DMED of slightly above 16x. For a business such as DMED, I regard an EBIT multiple of 16x as full but not outlandish. It is also important to recognize the high degree of uncertainty regarding the level of sustainable earnings that can be generated by the DMED segment. If I assume that DIS is able execute well on the DTC strategy without significant cannibalization of other DMED earnings streams, I could in theory arrive at an implied EBIT multiple for DMED that would support a valuation-based BUY rating.

On balance, my conclusion is that at around $100 per share, a buy rating on DIS would require high conviction that the company’s DTC strategy will pay off. Whilst I lack the conviction on DTC to support a buy rating, my valuation analysis does not point to DIS currently being extremely expensive. My initial review of DIS therefore concludes with a rating of HOLD.

Be the first to comment