yujie chen

(This article was in the newsletter on Oct. 31, 2022.)

Disney (NYSE:DIS) long ago made a statement about inclusion and diversity that earned the ire of the state of Florida. That ire meant that a very inadequate law was passed that meant for Florida to dissolve the self-governing unit that Disney has for its business unit, the theme park. But the law never stated how to unwind decades of business deals, nor did it state how bondholders would be paid off. Paying off the bondholders is part of the bond covenants.

Since then, things have quieted down and probably nothing would happen because the state of Florida would immediately owe the relevant bondholders money the minute it took over.

But then the CEO made a statement about “woke” which the news promptly carried and may well start the whole thing up again if management is not careful. As long as cooler heads prevail, then probably a reasonable solution will be reached, or the status quo will remain.

Still, the statement itself is worth careful examination. The CEO’s comments stressed neutrality. The company itself is neither woke nor not woke. However, any film or entertainment that’s released in any of the businesses is vetted to make sure it maximizes sales while minimizing friction or backlash. Movies are there, for example, to maximize profits. If those profits do not happen due to a movie bomb, for example, then management will correct the situation quickly.

Disney does not spend the money it spends in its various business units to promote politics. It’s there to make money. Therefore, everything that constitutes a business is focused on maximizing the business prospects. For the company prospects, minimizing backlash in the process is also a long-term goal.

But management comments and statements are another matter. Still, it will be interesting to see how the latest comments are received by the market and the business world. Next year is supposed to be a year in which the company’s recovery from the fiscal year 2020 continues. Hopefully, any management statements made are not something that would derail the continuing recovery.

The result of all of this is that the Disney release schedule as well as existing sales based upon movies and franchises already released have been criticized for not being mainstream enough. The test of that statement should come from the marketplace, not from either politicians or the news. Investors are going to find out if the future releases are going to do better or worse than projected. Anything not meeting expectations will be adjusted as has been the case for many years.

Recent Releases

Hocus Pocus 2 is a movie released on Disney+ that appeared to be a commercial success. In fact, the movie actually became a streaming record breaker for the streaming service. So there apparently are enough people not bothered by the recent comments made. Business as usual is so far continuing. But more importantly, if a record is set, then there’s not a material backlash to worry about.

The Wakanda Forever movie is set to open soon with high expectations.

Meanwhile, the horror movie Barbarian has become an unexpected minor hit.

In short, the company seems to be navigating this experience pretty well.

Streaming Challenges

Probably the biggest challenge remaining is to make streaming profitable.

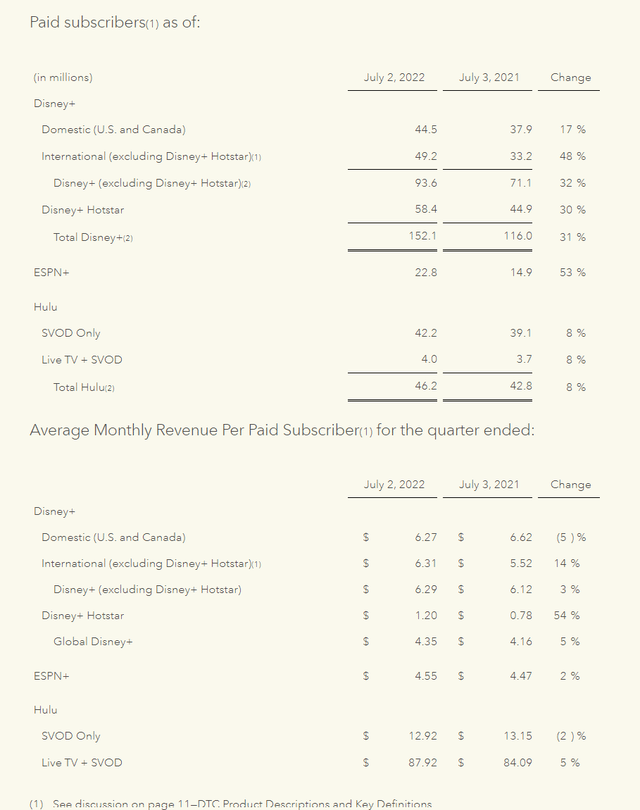

Disney Summary Of Progress Made In The Streaming Business Third Quarter 2022 (Disney Third Quarter 2022, Earnings Summary Press Release)

The subscriber business shown above has grown rapidly. It also has produced a big loss for the company, which other divisions more than offset so that the company reports a profit. Now there’s going to be a movement towards a profit according to management, and some things have already begun that process. When the fourth quarter reports, an update on this whole situation will be critical.

For all the talk about characters being appropriate for families and children, the company seems to have had no problems attracting streaming customers. This business, however, now needs to turn from the showing loss to a profit. That may or may not be possible, given that the streaming “wars” are just getting started.

Disney does have an advantage in that the other parts of the integrated company may derive enough benefits from the streaming segment so that the company does not have to report a profit. Not all competitors appear to be in the same position. The other consideration is that the streaming business could “disappear” tomorrow and still the company has plenty of profit opportunities because the streaming business is not a material size for the losses generated. Now, admittedly, the future could be different. But Disney is established enough to acquire a decent streaming business should that prove necessary.

Amazon (AMZN) purchased MGM studios to add to its entry into the streaming business. That’s at least some confirmation that the integration that Disney possesses is an advantage that Amazon sees as it enters the streaming wars itself. Whether that will be enough to successfully compete long-term remains to be seen.

Cash Flow

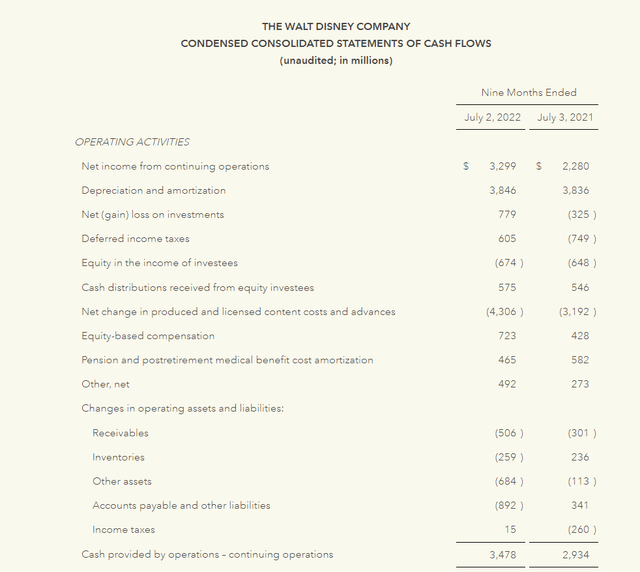

The cash flow statement reflects the ramp-up of post-pandemic activity.

Disney Summary Of Cash Flow From Operating Activities (Disney Third Quarter 2022, Earnings Press Release)

Notice that the change in operating assets and liabilities shows that current assets needed funding to the tune of roughly $2 billion. Not as much working capital and current assets were needed during the pandemic. But that’s clearly not the case with parks open and movies being made. Such an expansion of the current accounts should be expected by investors.

But that same funding is not going to be needed to anything close to the extent seen above in the next fiscal year. The parks are now open and generating cash. Movies have begun to be released and so also are generating cash that offsets the costs of future releases now being made. Therefore, cash flow is very likely to grow by that roughly $2 billion in the next fiscal year.

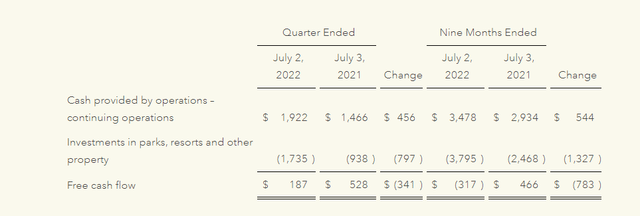

Disney Free Cash Flow Calculation Third Quarter 2022 (Disney Third Quarter 2022, Earnings Press Release)

Similarly, Disney shows increased investment in the free cash flow calculation that’s necessary to open up the parks in the post-pandemic period. Therefore, in the coming fiscal year, the investment line is likely to decline to something similar in the past years of ongoing business. Free cash flow also will benefit from the previously discussed increase in cash provided by operating activities.

When that’s combined with a normal movie release schedule along with expected movie profits, one can easily see free cash flow with the potential to approach five billion before any extra contributions from the recent acquisition of 21st Century Fox just before the pandemic. That acquisition is likely to benefit Disney in the future as well.

The Future

Disney got itself caught in an unfortunate situation about diversity. Right now, that discussion appears to be largely out of favor in Florida. Despite the law being passed, there’s unlikely to be a material change in the situation because bondholders have a change of control as part of the bond covenant. That and any solid planning for a change of control are likely to prevent that change of control for the time being. There are currently a lot of loose ends that would need to be taken care of before any changes happen.

In the meantime, it’s clear that cash flow is likely to take a big step forward in the current year. That includes free cash flow.

The acquisition of 21st Century Fox has yet to be fully exploited. That will likely happen in the post-pandemic period. But it could take a year or two for investors to see the results.

Clearly, the current stock price anticipates some of the potential improvements noted. But there’s likely to be far more improvements as the post-pandemic period proceeds. The recovery potential far outweighs any adverse possibilities in Florida, if they even happen.

Be the first to comment