TebNad

Recap

We wrote that DISH Network Corporation (NASDAQ:DISH) was losing customers because of the CDMA shut-off acceleration and the lack of compatible devices with the Band 70 available in the market. As a result, we believed that as DISH was facing a cash flow problem, it would limit DISH from actively participating in Auction 108 and require DISH to raise additional capital. The results were in, and T-Mobile (NASDAQ:TMUS) won 90% of the licenses sold in the auction.

In conclusion, we expressed our reservations about DISH because uncertainties loom as to whether DISH can improve its short-term outlook. First, the CDMA shut-off acceleration has made it difficult for DISH to retain and acquire customers. Delay in the approval also exacerbated the issue. Indeed, DISH’s 5G network is up and running, yet only one supported device is available in the market.

Second, tight cash flows might limit DISH from actively participating in the upcoming spectrum auction, which means that the gap between DISH and other players might not be closing soon. More spectrum means more speed. And falling behind in terms of spectrum holdings can reduce DISH’s competitiveness in the market.

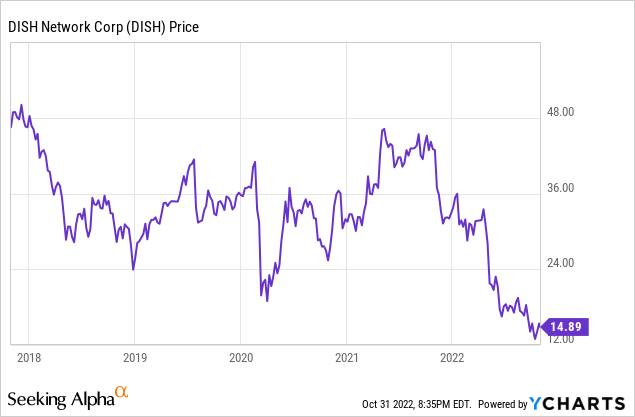

Since our last article in May, DISH’s shares are down 30% to around $14.9 per share. What should we expect as the 3Q22 earnings results are set to release on 2 November?

A Breath Of Fresh Air Came In, But Problems Remain

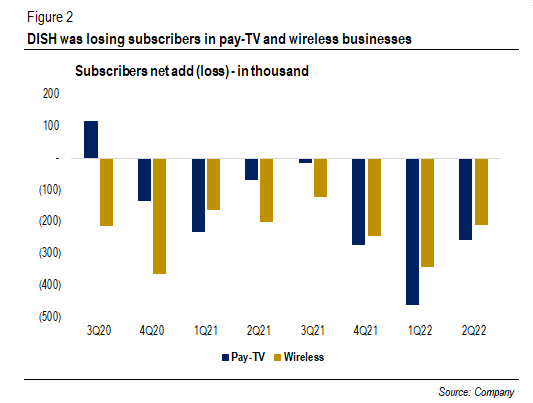

As most investors would have known already, DISH continued to lose subscribers, reporting a net loss of 257,000 Pay TV subscribers and of 210,000 wireless subscribers in 2Q22. As the Pay TV market is declining, a contract dispute, such as that between DISH and Disney (NYSE:DIS), exacerbated the situation, only for them to reach a “handshake agreement” after a 48-hour blackout.

And such a dispute is not the first time after DISH settled a four-month dispute with TEGNA (NYSE:TGNA) earlier this year. Moreover, while DISH is raising its satellite subscription fees by as much as $5 per month for most packages, the increased programming costs might offset the price increase.

Subscribers Net Add (Loss) – in thousand (Company)

Nevertheless, a breath of fresh air came in, as Boost Infinite postpaid plan, which will use DISH, T-Mobile, and AT&T (NYSE:T) networks, is set to release later this year and will likely come out with aggressive pricing.

During the 2Q22 earnings call:

One is the Charlie alluded to it, but our network deals allow us to go nationwide out of gate at competitive pricing. And we are going to come out with aggressive pricing.

So from our perspective, we are not worried about losing customers or doing anything disruptive in the marketplace that could sort of shake up the current dynamics. We have a lot more to gain than we have to lose. So that puts us in a position where we can definitely play offense, and take some big funds.

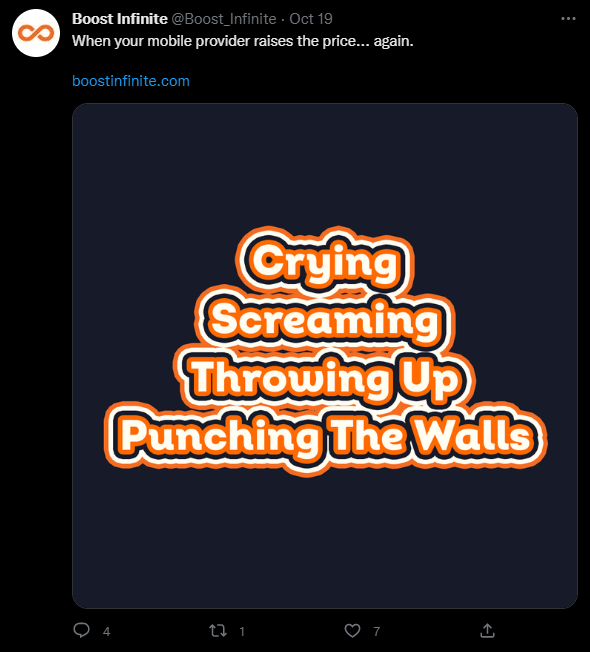

Moreover, as posted on its Twitter account:

Boost Infinite Twitter Post (Twitter)

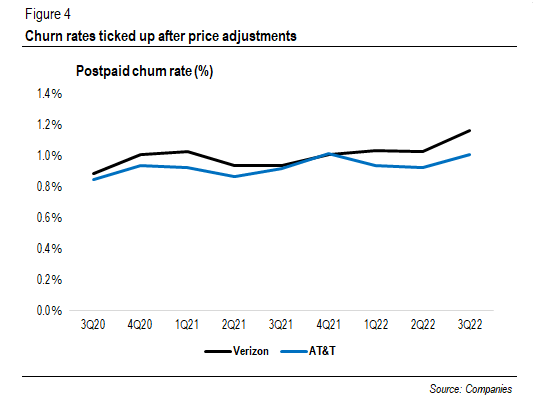

A price increase is increasingly important once inflationary pressures start to kick in. For example, Verizon’s (NYSE:VZ) churn rate ticked up after it made fee adjustments, and so did that of AT&T.

Postpaid Churn Rate (%) (Companies)

We believe that as Boost Infinite, with its aggressive pricing, comes to the market, things will get more competitive, which should be DISH’s near-term tailwind especially because people are looking for cheaper options. But more importantly, what is the long-term strategy? Moreover, despite DISH’s promise to launch in the fall this year, Wave7 Research said that an internal launch with DISH employees has been postponed.

Still, DISH’s differentiated value proposition will come from its standalone, cloud-native network, which DISH has spent billions of dollars to build. How is the progress? Will DISH meet the FCC coverage deadline by 2023?

First, the good news is that the newly released iPhone 14 supports Band 70, a spectrum unique to DISH. DISH has been saying that when Band 70 devices hit the market, they can “start hitting the gas.”

During the 1Q22 earnings call:

We expect to be able to start launching commercially with Band 70 devices in late Q3 and that’s really when we can start hitting the gas in terms of loading retail subscribers on the network those sorts of things.

Nevertheless, analysts deemed that DISH’s network build was behind the schedule. For example, DISH said in October that its 5G SA network covered “well in excess of 25% of the U.S. population,” only about 5% more than the FCC requirement of 20% four months earlier. Meanwhile, the FCC set the deadline for DISH to cover 70% of the U.S. population next year and 75% of the population in the Partial Economic Area by 2025.

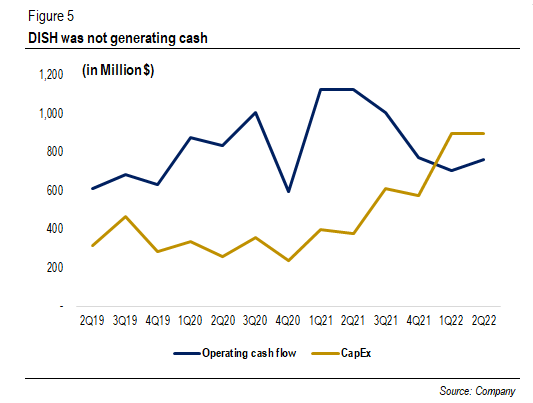

The company not generating cash is also a part of the problem, and it is increasingly more likely for the company to miss the network build deadline, in our view. Moreover, DISH might not acquire the 800 MHz spectrum for $3.59 billion, despite the management’s interests.

DISH’s OCF and CapEx (in million $) (Company)

Additionally, the company carried $21 billion in debt ($23 billion including operating lease) but only had $2.6 billion in cash as of 1H22. Moreover, DISH has $1.5 billion of senior notes that will be due next year, thus forcing the company to look for additional funding.

CONX Corp (NASDAQ:CONX), a SPAC founded by Charlie Ergen, is looking to acquire Boost Mobile and has held talks with DISH. At the time of writing, a special meeting is taking place on October 31 that might extend the date for the SPAC to acquire a company from November 3, 2022 to June 3, 2023. The acquisition will help DISH deleverage its balance sheet and provide some cash for its network build. The management refused to comment about the SPAC during the last earnings call, however.

Is There Any Turnaround Story?

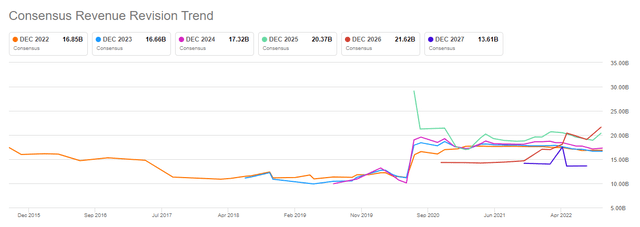

The market remains bearish on the stock: DISH’s 1H22 revenue of $8.5 billion represents a 51% run-rate of the consensus estimate vs. 50% of last year’s run-rate of the actual result.

Consensus Revenue Trend (Seeking Alpha)

We believe that all the problems have been priced into the stock. However, is there any turnaround story for DISH? Two key points investors should watch as the 3Q22 earnings results are upon us.

1. Boost Infinite strategy

DISH’s management has given only a bit of clarity on the Boost Infinite strategy besides its aggressive pricing. While we believe that Boost Infinite, with aggressive pricing, will be a near-term tailwind for DISH, questions remain of what the long-term strategy will be. Furthermore, it is equally important to know whether there is any indication of a delay.

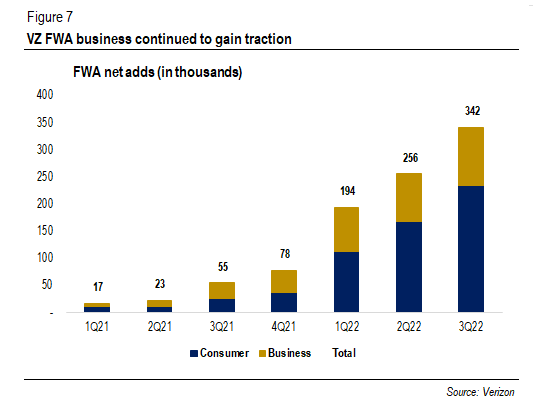

2. DISH’s involvement in FWA business

Fixed wireless access (FWA) continued to gain traction in the U.S.. In 3Q22, VZ raked in a net increase of 342,000 FWA subscribers, bringing the total subscribers to more than one million. Furthermore, T-Mobile expects to reach 7 million to 8 million fixed wireless subscribers by 2025.

VZ FWA Net Adds (in thousand) (Verizon)

How DISH will pursue the FWA business remains in question after Charlie Ergen said during the 2Q22 earnings call that “there’s some interesting things we could do with fixed wireless.” However, according to Fierce Wireless, DISH is waiting for the FCC approval to test the “coexistence between Direct Broadcast Satellite (“DBS”) and fixed wireless access (FWA)” in the 12 GHz band.

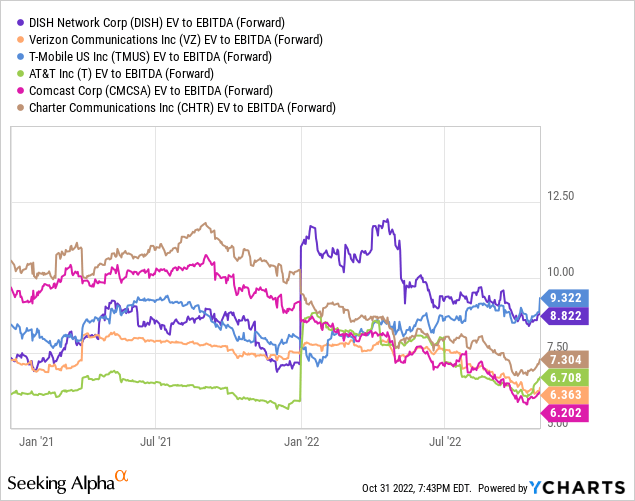

Valuation

DISH is trading at almost 9x of its forward EBITDA, higher than its peers. Indeed, based on Morningstar data, the shares were trading below its 5-year average. Have its fundamentals improved? This was not the case, in our view. Subscribers flocking away, negative free cash flows, and uncertainties surrounding the FCC deadline and financing justifiably put pressure on the stock.

Conclusion

The story of DISH has not changed, in our view: the decline of the Pay TV business, the company having to spend billions of dollars on network build, and massive debt. Furthermore, the postpaid plan launch delay could put more pressure on DISH stock. Therefore, the shares still do not provide a buying opportunity, in our view.

What could go wrong? First, the success of the Boost Infinite, with its aggressive pricing, can bring in sizable, loyal subscribers. Second, the company could successfully launch fixed wireless access.

What do you think? Will the launch of Boost Infinite be on schedule and be well received in the market? Will DISH be able to meet the FCC deadline by 2023? Is the FWA business coming to the rescue? We will update the 3Q22 results in the comment section. If you have any thoughts, please do not hesitate to comment below.

Be the first to comment