hapabapa/iStock Editorial via Getty Images

One of the downsides of being a value investor is that you sometimes underestimate the potential of a company. This can lead to missed opportunities, often resulting in an overly-conservative assessment of a business. One such example that I could point to involves a diversified restaurant play called Dine Brands Global (NYSE:DIN). For those not familiar with the name, the company owns, amongst other assets, two very iconic restaurant chains. These are Applebee’s Neighborhood Grill + Bar and IHOP (International House of Pancakes). Recent financial performance achieved by the company has been somewhat mixed. Revenue continues to increase nicely, though bottom line results have experienced some pressure. But even factoring in the pains the company reported, shares of the business look to be reasonably priced on an absolute basis and they are probably fairly valued compared to similar firms. Given the massive run-up in share price and the recent margin pressures, I do think it would be more prudent to rate the company a ‘hold’ at this time. However, I also acknowledge that my prior ‘hold’ writing, a call that led to significant missed upside, was off base.

A missed opportunity

Back in late June of 2022, I wrote an article that took a rather neutral stance on Dine Brands Global. In that article, I talked about how shares of the company were trading on the cheap. This came even at a time when its cash flow picture was improving. However, the company was experiencing some problems, such as a decline in location count and weak comparable store sales. When adding onto this picture the fact that shares looked more or less fairly valued compared to similar firms, I could not help but to rate the business a ‘hold’ to reflect my view at the time that shares should generate upside or downside that would be more or less in line with what the broader market would experience. Since then, the company has exceeded my expectations markedly. While the S&P 500 is up 9.6%, shares of Dine Brands Global have generated upside of 28.8%.

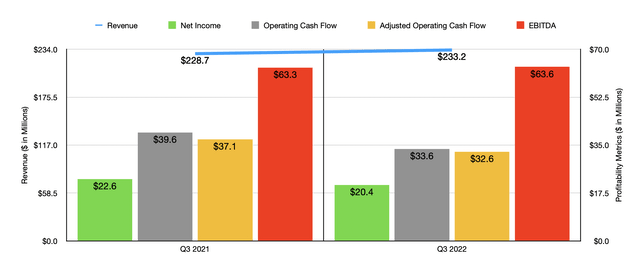

Author – SEC EDGAR Data

To really understand why the company has outperformed the broader market, we should first start with a discussion of how the business has performed from a fundamental perspective since the publication of that article. This would involve a look at the financial data provided by management covering the third quarter of the company’s 2022 fiscal year. During that time, sales came in at $233.2 million. That’s about 2% higher than the $228.7 million reported one year earlier. Even though the company benefited from an increase in location count for its IHOP restaurant chain from 1,750 to 1,766, it did suffer to some degree from a drop in the number of Applebee’s locations from 1,689 to 1,670. Even with this, however, domestic same-restaurant sales grew by 3.8% for its Applebee’s restaurants, while for IHOP the increase was 1.9%.

It’s great to see revenue increase. However, profits during this time took a step back. Net income fell from $22.6 million to $20.4 million. This decline came in large part as a result of a drop in the company’s gross profit margin from 41.4% to 40.4%. This 1% decline impacted bottom line results to the tune of $2.3 million on a pre-tax basis. Other profitability metrics followed suit. Operating cash flow fell from $39.6 million to $33.6 million. Even if we adjust for changes in working capital, it would have fallen from $37.1 million to $32.6 million. In fact, the only profitability metric to improve year over year was EBITDA. Based on the data provided, this inched up from $63.3 million to $63.6 million.

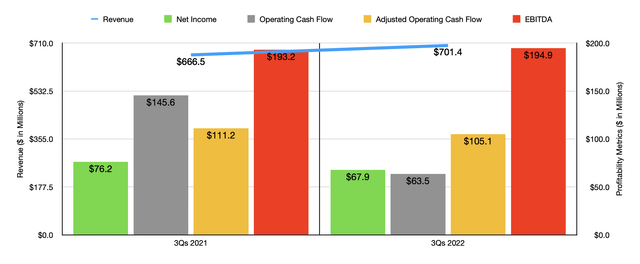

Author – SEC EDGAR Data

The mixed results experienced during the third quarter were also experienced for the first nine months of the year as a whole. Sales of $701.4 million beat out the $666.5 million seen during the same period of 2021. At the same time, profits for the company declined from $76.2 million to $67.9 million. Other profitability metrics fared similarly for the most part. Operating cash flow, as an example, dropped from $145.6 million to $63.5 million. Meanwhile, the adjusted figure for this dropped from $111.2 million to $105.1 million. The only metric to improve was EBITDA. According to management, this increased from $193.2 million to $194.9 million.

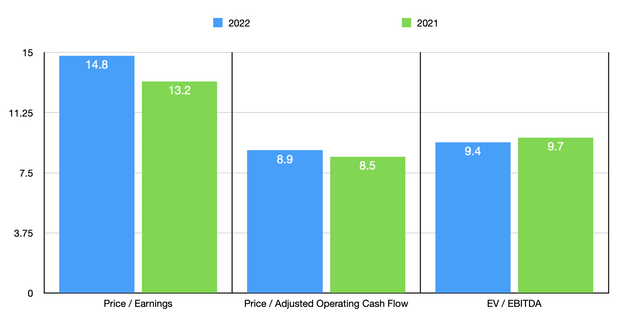

Author – SEC EDGAR Data

For 2022 in its entirety, it’s unclear what investors should anticipate. Management did say that EBITDA for the year should come in between $243 million and $248 million. If we then annualize the results experienced for the other metrics, we would anticipate net income of $85.2 million and adjusted operating cash flow of $141.1 million. Based on these figures, the company is trading at a price-to-earnings multiple of 14.8. The price to adjusted operating cash flow multiple should be 8.9, while the EV to EBITDA multiple would come in at 9.4. By comparison, using the data from 2021, these multiples would be 13.2, 8.5, and 9.7, respectively. As I do with other companies that I analyze, I also compared Dine Brands Global to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 13.4 to a high of 42. Meanwhile, the EV to EBITDA multiples for the firms ranged from 5.8 to 16.3. In both of these cases, two of the five firms were cheaper than our prospect. And finally, using the price/operating cash flow approach, the range was from 5 to 10.4. In this scenario, three of the five companies were cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Dine Brands Global | 14.8 | 8.9 | 9.4 |

| Brinker International (EAT) | 25.1 | 8.6 | 9.8 |

| Jack in the Box (JACK) | 14.3 | 10.2 | 11.0 |

| Bloomin’ Brands (BLMN) | 26.5 | 6.2 | 8.1 |

| Cheesecake Factory (CAKE) | 42.0 | 10.4 | 16.3 |

| Arcos Dorados Holdings (ARCO) | 13.4 | 5.0 | 5.8 |

As I mentioned in my prior article on the company, it was facing some issues from the perspective of growth. That picture does seem to be changing to some degree. In its third-quarter earnings release, for the 2022 fiscal year, the company said that development activity by Applebee’s franchisees in the domestic market would see between five and 15 net fewer restaurants year over year for the period ending with the final quarter of 2022. However, the number of domestic IHOP franchise locations is expected to be between 35 and 45 more than the company ended the 2021 fiscal year at. This is actually lower than the 50 to 65 new restaurants previously guided for, largely because of some of the locations being pushed into 2023’s fiscal year thanks to permitting delays and supply chain issues.

The company has also announced other growth initiatives. In early December of last year, the company agreed to acquire Fuzzy’s Taco Shop in a deal valued at $80 million in cash, with a total cost of $70 million net of tax benefits that the company is receiving. Collectively, that brand has 138 restaurants spread across 18 states. 98% of the system is franchised and systemwide sales in 2022 were approximately $230 million. Also in December, the company announced a partnership between its IHOP chain and General Mills (GIS), whereby General Mills has agreed to create a type of pancake cereal under the IHOP brand name. It’s unclear what kind of impact any of these initiatives will have on the company. But more likely than not, they will prove bullish in and of themselves.

Takeaway

Truth be told, Dine Brands Global is starting to grow on me. I definitely was overly conservative when I made my initial call on the company last year. Recently, sales growth has continued to be positive, even though bottom line results have come under pressure. The stock is quite cheap at this time on an absolute basis, though shares are priced at levels that should be considered appropriate relative to similar firms. I do like the recent announcements made by management, but it’s impossible to quantify the impact they will ultimately have on the firm at this moment. Because of this uncertainty, as well as the margin pressures the company has experienced, I do still think a ‘hold’ rating is appropriate at this time. But that picture could change depending on financial performance moving forward.

Be the first to comment