gorodenkoff/iStock via Getty Images

Earnings season presses on. So far, second-quarter results have been strong, but we have yet to hear from much of the Consumer Discretionary sector. We will get clues on the health of consumers through the balance of the month. One regional retailer reports results next week during this busy back-to-school season.

According to Bank of America Global Research, Dillard’s (NYSE:DDS) is a regional department store with around 300 locations, including 20 clearance centers, in 29 states across the South and Midwest. The company was founded by William Dillard in 1938 and is still run by the Dillard family. Dillard’s offers a broad selection of merchandise from both national and exclusive brand sources.

The Arkansas-based $4.2 billion market cap Consumer Discretionary company trades at just a 4.9x P/E ratio and features a massive 20.1% short interest according to The Wall Street Journal.

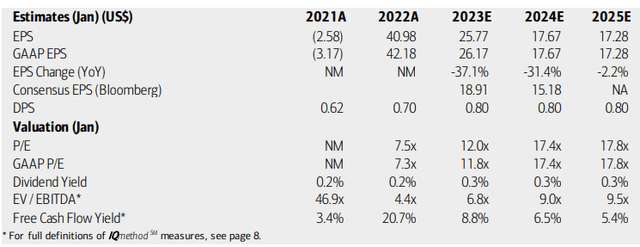

Dillard’s is struggling right now amid a tough consumer environment and margin pressures from rising labor costs. BofA analysts see earnings normalizing at lower levels from here. Hence, its low P/E ratio today is not indicative of a cheap stock. In fact, its earnings multiple may grow to be richer than that of the market in the coming years. Moreover, free cash flow is not overly impressive, and it does not yield much from a dividend perspective.

DDS: Earnings, Valuation, Free Cash Flow Yield Forecasts

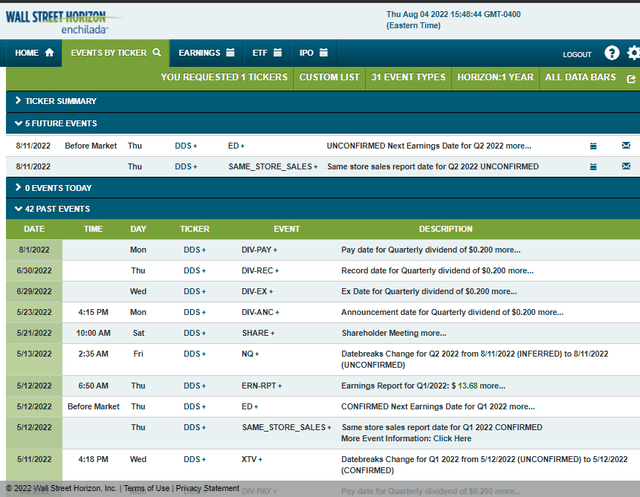

Dillard’s has an unconfirmed Q2 earnings date slated for Thursday next week BMO, according to Wall Street Horizon.

Dillard’s Corporate Event Calendar

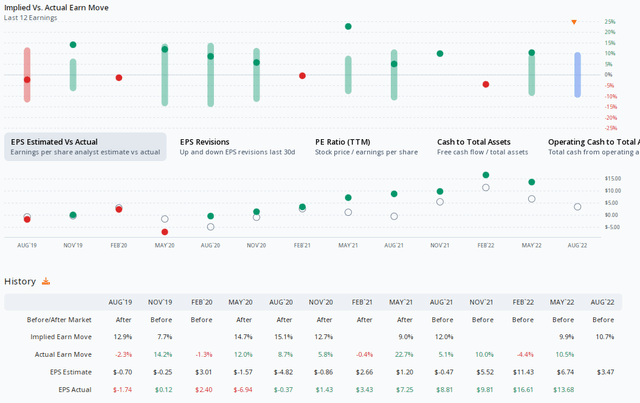

Digging into the market’s expectations on earnings, options traders expect a 10.7% earnings-related share price move, using the at-the-money nearest-expiring straddle, according to ORATS. Analysts see $3.47 of EPS, a sharp increase from a loss in the same quarter a year ago. Be on the lookout for a bullish move considering that DDS has beaten estimates in the last eight quarters, and it has a massive short interest.

Options Traders Expect A Big Move

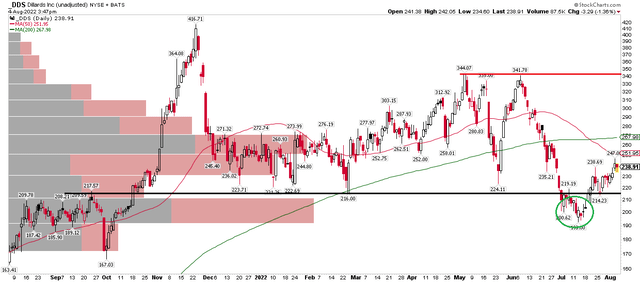

The Technical Take

DDS was arguably a meme stock at times during 2021. The stock’s one-year high was struck last November, about when many small caps and high-duration tech stocks reached a climax. After retracing part of the fall, the stock dipped under its December through March range lows in a bit of a bullish false breakdown. “From false moves come fast moves in the opposite direction,” as technicians are wont to say. I think the stock could rally up to the $340-$344 double top, but it may struggle there.

It has work to do, though, as there is a heavy amount of volume up to the 200-day moving average at $268. Overall, there are mixed signals here, but I would avoid the stock for now until it makes a more defined move.

DDS: A Messy Chart, Lacking Trend

The Bottom Line

I think DDS could rally in the wake of earnings next week, given its beat-rate history and high short interest on the stock. Longer term, though, growth looks weak, and the technical chart is mixed at best.

Be the first to comment