TU IS

DigitalOcean (NYSE:DOCN) continues to report strong growth rates in spite of tough macro headwinds, though the stock price valuation remains discounted. While the company appears to be utilizing pricing in order to sustain growth rates in the near term, this remains a rare pure-play investment opportunity in the cloud computing sector. The company’s announcement that it would be acquiring Cloudways illustrates yet another way that the company can accelerate future growth. This is a cash flowing company with a stock trading at compelling valuations – I reiterate my buy rating.

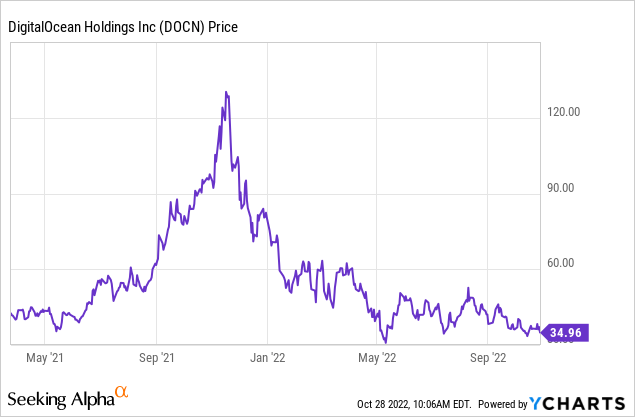

DOCN Stock Price

Prior to this tech crash, DOCN peaked above $130 per share but is still more than 70% below all time highs.

I last covered DOCN in July where I discussed the takeaways from the company’s Investor Day. The stock has since declined around 13%, but I foresee much more upside ahead for long term investors.

DOCN Stock Key Metrics

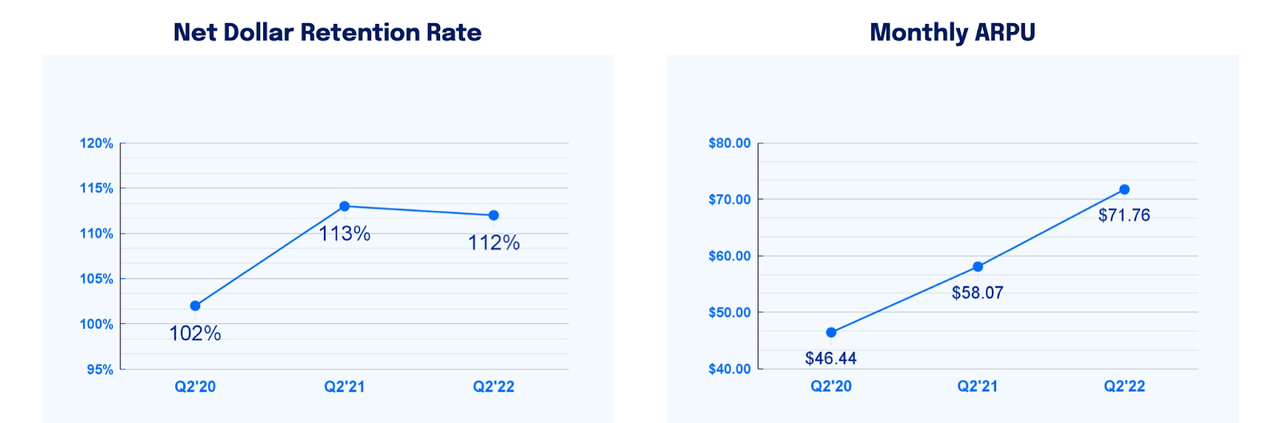

The latest quarter saw DOCN report robust 29% revenue growth paired with a 34.4% adjusted EBITDA margin.

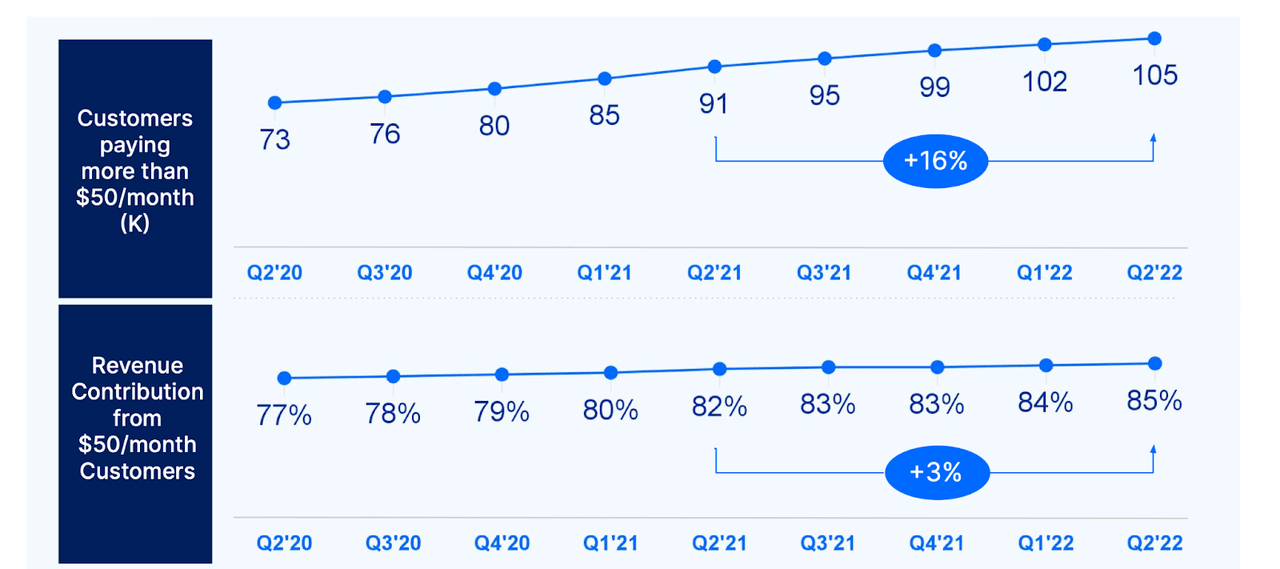

The company generated 16% growth in customers paying more than $50k per month, a cohort which made up 85% of overall revenues.

2022 Q2 Presentation

In addition to strong customer growth, DOCN posted a 112% net dollar retention rate.

2022 Q2 Presentation

Looking ahead, the company guided for up to $147 million of revenue in the third quarter (representing 32% growth) and $568 million of revenue for the full year (representing around 32% growth). DOCN also has guided for $54 million in free cash flow representing a 9.5% margin.

2022 Q2 Presentation

On the conference call, management stated that they would be “very cautious in adding new spend and will prioritize delivering strong margins and free cash flow” until they get better clarity regarding the growth outlook.

DOCN’s sustained strong results are a clear positive in an environment where many companies are using the macro uncertainty to revise guidance lower. That said, management was asked on the conference call how much of their projected growth would be due to their price increases. I did not find their responses satisfactory as it seemed like they were purposefully trying to avoid answering the question (implying that much of the near term growth will likely be due price increases, which is inherently unsustainable over the long term). One could argue that I am just nitpicking considering that the company still appears set to generate robust growth rates, even if it is boosted by levers in the near term.

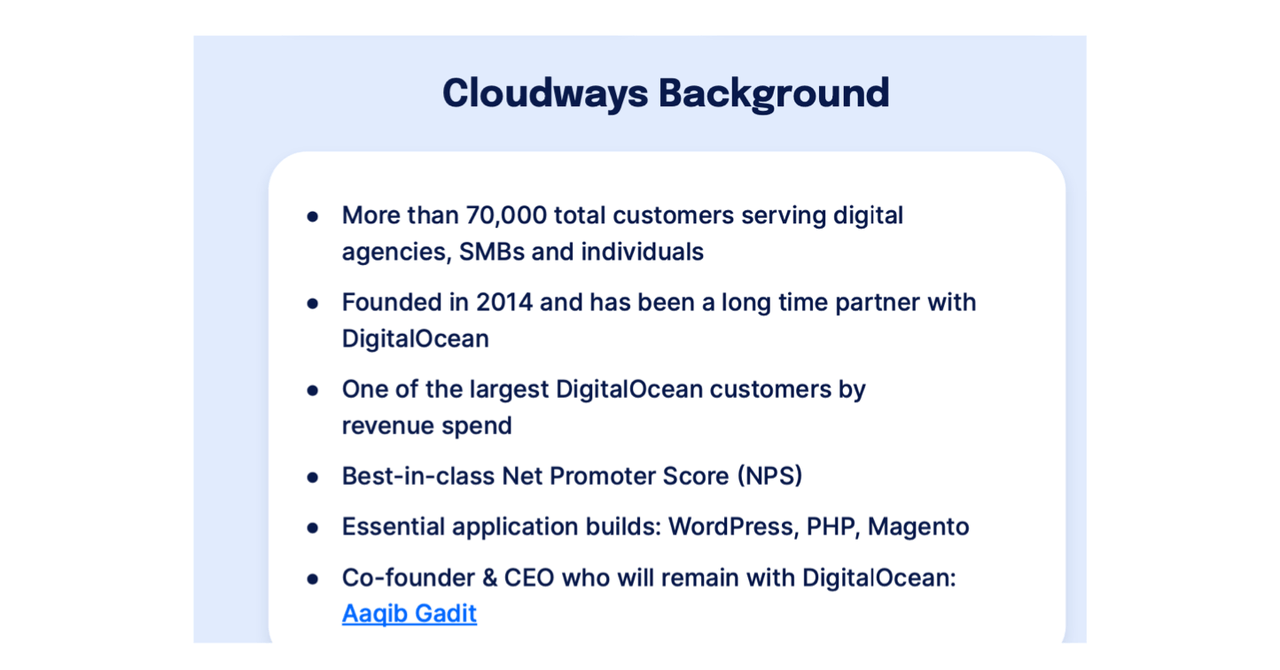

On August 23rd, DOCN announced that it was acquiring the managed hosting service Cloudways. You can think of Cloudways as providing value-added services on top of cloud providers like DOCN. Cloudways is very popular as a hosting provider for WordPress.

Cloudways Infographic

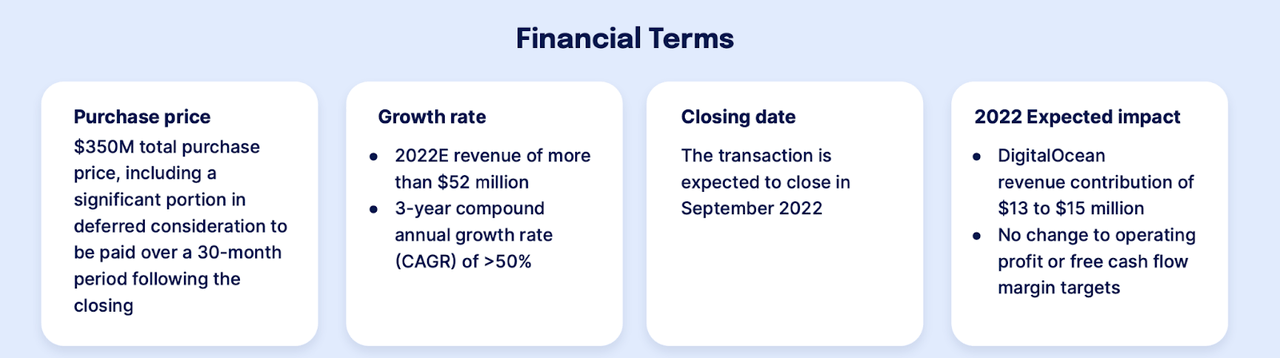

The deal will cost $350 million in cash and is expected to have no impact on margins but to be accretive to growth rates.

Cloudways Infographic

DOCN ended the quarter with $1.2 billion of cash and investments versus $1.5 billion of debt. Due to the company being cash flow positive, I have no qualms regarding the company’s decision to outlay $350 million of cash for M&A. To the contrary actually, the tech crash provides precisely the type of environment in which I would hope companies show some aggression in M&A.

Is DOCN Stock A Buy, Sell, or Hold?

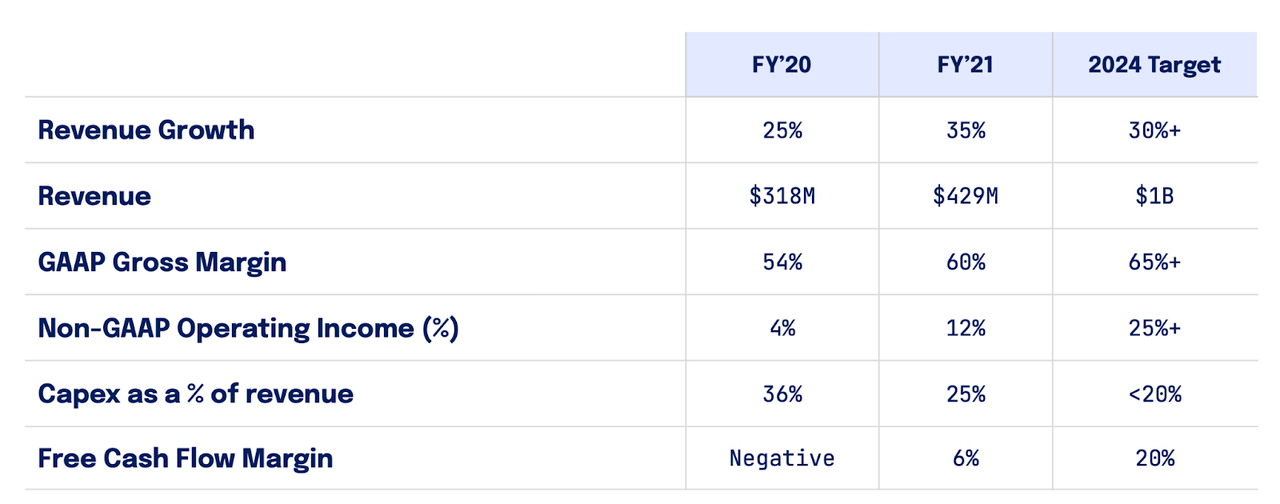

DOCN continues to guide for around $1 billion in revenues by 2024. Just a refresher, we can see the revenue and margin targets given at its Investor Day earlier this year:

2022 Investor Day

Based on management’s lack of clarity regarding the impact of pricing on near term growth rates, investors should expect the road to $1 billion to be a bit bumpy. Though because DOCN is a cloud computing provider, this is a secular growth story that should grow in-line with the growth of the internet. As DOCN continues to build out its product offerings to become more competitive versus alternatives, net retention rates may improve over time. Consensus estimates call for DOCN to fall short on its $1 billion target as well as its 30% projected exit growth rate.

Seeking Alpha

Even assuming that DOCN misses its targets and meets consensus estimates, the stock look cheap here. I could see DOCN achieving 30% net margins over the long term. Applying a 1.5x price to earnings growth ratio (‘PEG ratio’), DOCN might trade at 10x sales by the end of 2024, implying a stock price of $96 per share or around 35% annual upside over the next 2.5 years.

If DOCN does hit its targets, then its upside may be even greater – I could see the stock trading at 13.5x sales by the end of 2024, implying a stock price of $139 per share, or over 50% annual upside over the next 2.5 years.

I wouldn’t be surprised if DOCN eventually sustained a large valuation premium due to being in the cloud computing sector – Amazon’s AWS (AMZN) and Microsoft’s Azure (MSFT) are typically considered the crown jewels of those companies. That may make the return potential even more exciting as it may prove front-end weighted.

The key risk here is mainly due to the fact that DOCN is competing against formidable competitors in AWS, Azure, and Alphabet (GOOG) (GOOGL). It is possible that the cloud titans eventually seek to compete based on price, which would remove DOCN’s main advantage. This threat may also prevent DOCN from trading at a premium valuation in spite of being a cloud computing provider.

At these prices, not a lot has to go right for the thesis to work. The company has plenty of cash on its balance sheet even accounting for the Cloudways acquisition and is flowing free cash flow. DOCN would make a great addition to a diversified basket of beaten-down growth stocks – a strategy I have discussed with subscribers of Best of Breed Growth Stocks. I rate the stock a strong buy on account of the high potential for a near term re-rating.

Be the first to comment