piranka

DigitalOcean (NYSE:DOCN) has quickly shown during its tenure in the public market that it is a serious contender in the generational trend of cloud computing. Its business model is particularly interesting as it tackles the issue from a niche point of view, specifically targeting small and medium businesses (SMBs) that have been left behind by the cloud hyperscalers.

Recent performance demonstrates how the business is growing very fast while also achieving consistent profitability. However, as you would expect the market is therefore assigning exuberant valuations to the stock that adds too much risk at current levels. Let’s dive deep into the details of this great business.

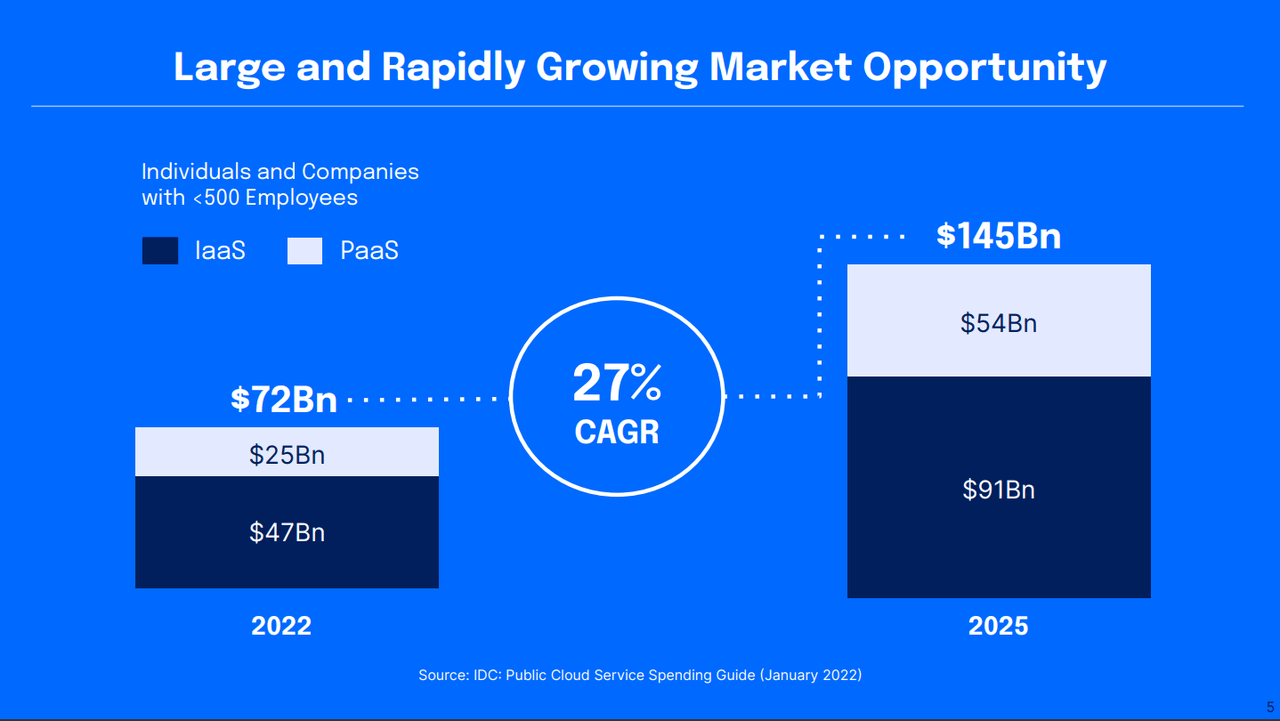

DigitalOcean goes after a massive market

The thesis around DigitalOcean business model is an ever-growing need for cloud capabilities not only from enterprise customers, but also from SMBs. The evolution of the cloud embodied by Amazon Web Services (AMZN), Microsoft’s Azure (MSFT) and Google Cloud (GOOG) was built around the needs of big, global firms. Their offerings are too complicated and too expensive for the simple needs of startups and SMBs, and that’s the niche that DigitalOcean strives to fill.

DOCN Earnings Presentation Q2 2022

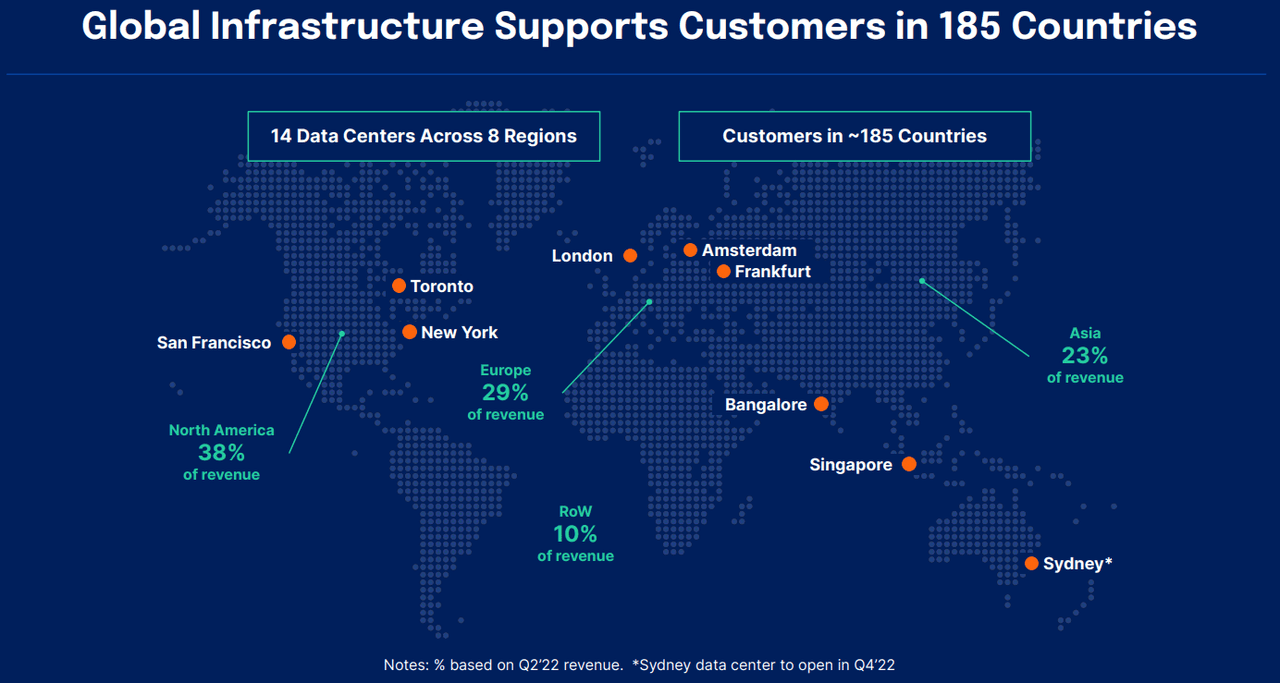

The platform is self-serve but DigitalOcean offers extensive educational material online to help developers navigate the company’s offering, as well as direct support no matter the customer size. The company generates its revenue in multiple areas around the world as the slide below shows. At the same time, the company is not able to effectively measure the impact of currency fluctuations on its revenue as they bill all their customers in USD. This choice however hardly means that there is no impact from an unusually strong dollar, but rather that the impact is more subtle as it might deter new customers to get on board or force existing customers to spend less due to the DigitalOcean being more expensive now in the customers’ local currency.

DOCN Earnings Presentation Q2 2022

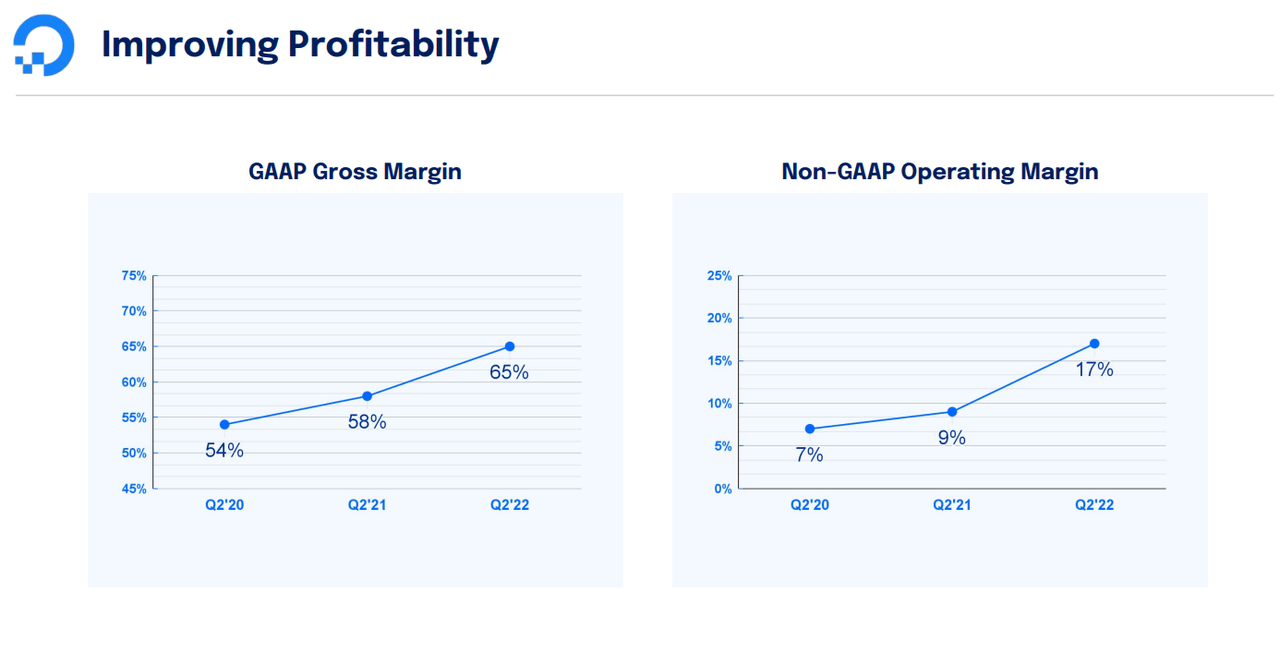

Despite these headwinds, the company grew revenue 29% YoY in the latest quarter and is still projecting 30+% revenue growth for the future Q3 2022. At the same time management prudently trimmed unnecessary expenses and achieved 17% Non-GAAP operating margin.

An impressive improvement of gross margins from 58% to 65% was achieved thanks to lower spending in hardware as well as exercising some pressure on datacenters operators in order to achieve better rates, which is a sign that DigitalOcean is increasingly becoming a strategic partner and therefore gaining some pricing advantage. These do not appear as one-time events but rather structural efficiencies that should allow the company to maintain these kinds of gross margins or even improve them if DigitalOcean will scale even more.

DOCN Earnings Presentation Q2 2022

The company has successfully initiated a price increase in July 2022 and has experienced no impact to customer acquisition, as well as much lower churn that initially accounted for based on internal models. That is definitely a testament for DigitalOcean’s resilience and how crucially important it is for its customers. Nevertheless, management is seeing some slowdown in spending from existing customers in Europe and Asia due to macro headwinds:

Looking under the hood, we see the dollar churn in these regions remain stable, but it is the expansion rate of our customers that has slowed. So customers are steady and still growing nicely on our platform, but adjusting their spend level somewhat as they are cautious in managing their businesses as well. And even with these trends, ARPU is still growing greater than 20%.

Overall the company still managed to maintain 112% net dollar retention rate, slightly below 113% a year ago but still healthy considering that DigitalOcean targets only SMBs which are most likely to go out of business compared to enterprise customers. Therefore, any business that targets SMBs will naturally show lower net dollar retention rates than others.

On a free cash flow basis, the company is showing first signs of operational leverage which is very intriguing from an investment point of view. From June 2020 to June 2022, the quarterly CapEx was pretty much stable in a range of $20 to $30 million, while in the same period cash from operations grew from about $15 million to the most recent figure of $45 million, a constant growth that is fueling consistent free cash flow. If the company is able to maintain CapEx/Revenue stable, it should lead to massive growth of free cash flow which can be then reinvested in the business or used for possible acquisitions.

Valuation adds too much risk at current levels

There is a lot to like about DOCN business; however, the company is currently trading at levels that imply perfect execution from the management and that is the main risk in investing today in the company’s stock.

The company targets 1 billion revenue by 2024 (implied yearly growth of 33% from guided FY2022 revenue of around $566 million) and 20% or better FCF margin.

The company is guiding for 9%-10% FCF margin for FY2022, which equates to about $53 million of FCF at the midpoint. Assuming it will reach 200 million free cash flow (20% FCF margin) by 2024, that would imply growth of 94% CAGR. That seems too optimistic, therefore let’s assume instead that the company reaches its target of $200 million FCF in 5 years (30% CAGR) and then grows its FCF for 15% yearly for 5 more years. After 10 years, we will assume a somewhat reasonable P/FCF multiple of 20 for a much more mature business. At a 10% discount rate, the result of this scenario is an implied market cap today of $3.8 billion, roughly its current value as of today.

It is hard to value growth companies at all, but such an exercise helps me figure out which kind of scenario the market is expecting today in order to justify the current valuation. You can judge yourself how optimistic the above scenario is, but in my opinion this leaves too much room for error and therefore downside for the stock price.

Nevertheless, DigitalOcean is performing very well, showing early signs of operational leverage and is riding a generational trend targeting an interesting customer niche. For my portfolio, I would much rather wait for a possible drop in price given the generally negative market sentiment, as the current price adds too much risk for an otherwise great prospect.

Be the first to comment