Michael B. Thomas/Getty Images News

While the Digital World Acquisition (NASDAQ:DWAC) shareholders continue to languish in purgatory, Donald Trump is busy releasing digital trading cards, not building Truth Social and Trump Media & Technology Group (“TMTG”). The stock still trades near $20 despite no signs the SPAC deal will close anytime soon due to regulatory issues. My investment thesis remains Bearish on the stock with the proposed valuation out of touch with the reality now that Elon Musk owns Twitter reducing the free speech aspects of Trump Media.

Source: FinViz

Truth Social Languishes

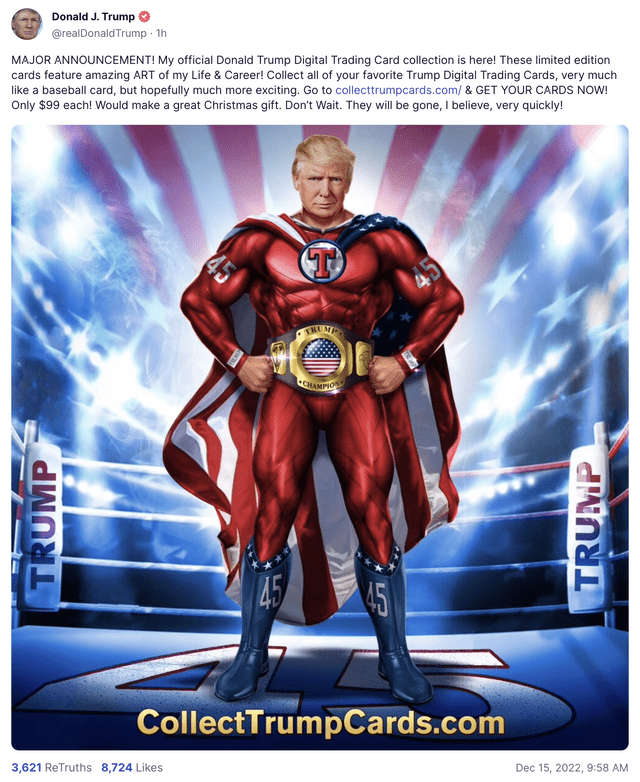

As 2022 comes to an end, Truth Social hasn’t made a lot of progress as a social media company. Donald Trump announced a digital trading card as a $99 Christmas gift and the post only got a few thousand likes and ReTruths (retweets) in the first hour.

Digital World jumped on the news Trump was going to make a major announcement on Thursday, but the former President only posted a digital card to make money for Trump, nothing for shareholders. Trump only has 4.7 million followers on Truth Social while he has 87.8 million followers on Twitter.

The former President hasn’t even posted on the platform since January 8 when the site suspended his account. Even with Musk reinstating his access in the last month, Trump hasn’t posted on Twitter and would probably have upwards of 100 million followers by now.

My last article documented that Trump already had 4.1 million followers after Truth Social had launched on February 21. The prime reason to use the new social platform has only added ~0.6 million followers over the last quarter.

Social Web listed the site as having 9 million visits in September with a bounce rate of 45%. The average number of page visits was 4.8 with a visit duration of 7:47 minutes.

In comparison, Twitter had 6.8 billion visits in the time period with average page views of 10.4 and visit duration of 10:58 minutes. The numbers suggest Truth Social has the potential for additional upside, though Musk owning Twitter likely limits the amount of conservatives interested in using Truth Social while liberals are now turned off by both social platforms.

Valuation Doesn’t Add Up

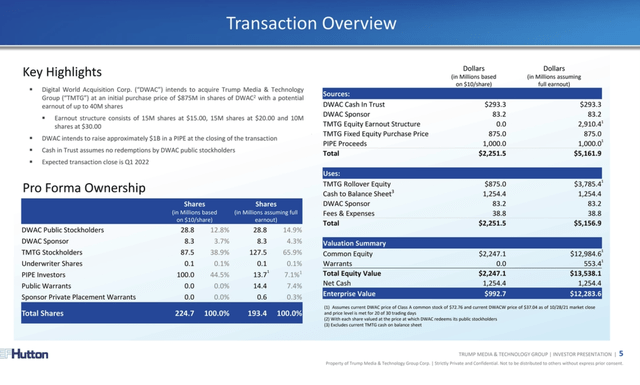

Whether or not the SPAC deal ever closes isn’t even something to consider here at this valuation. At $20, the market is valuing Trump Media at a market cap of $3 to $4 billion depending on the final share count.

If the deal doesn’t close, investors only obtain up to $10.30 per share on a forced redemption of shares. Shareholders finally voted for a one year extension of the deal close to September 8, 2023, but the SPAC still needs the SEC to approve the merger.

Remember, Rumble (RUM) only took 9 months to close. The online video platform hosting Truth Social and competing against YouTube traded around $12 at the SPAC close and has already fallen to $8.

Rumble had a similar valuation disconnect documented here leading to the stock falling once the deal closed. Trump Media would face an even bigger problem because at least Rumble lists 71 million MAUs while Truth Social probably only has a few million MAUs.

Digital World probably isn’t worth $10, but Trump Media hasn’t provided any updated financials. The deal saw $139 million worth of the original $1 billion PIPE investments walk away and the trust only has $300 million in cash. The new forecast would be for a cash balance of ~$1.1 billion now after transaction expenses.

Source: Digital World SPAC presentation

The share count calculation is tricky and only dips to ~210 million shares without the reduced PIPE and a $10 price at close. Digital World would still have a projected market cap of $2.1 billion under this scenario.

Of course, the TMTG earnout shares and the warrants could become issued and exercised at these prices along with the much higher PIPE shares from a conversion closer to $10 leading to the worse of both scenarios. The actual share count could reach 250 million shares on a combination of the 15 million warrants, the 40 million earnout shares and the PIPE investors still claiming 70+ million shares at a 40% discount to market prices. At $20, the market cap would be closer to $4.8 billion.

Takeaway

The key investor takeaway is that Trump isn’t doing a lot to build out a media empire. The Digital World SPAC remains far too expensive with a market cap in the $4 to $5 billion range now and no actual material business.

Investors should continue to sell the SPAC at prices above $10.

Be the first to comment