timhughes/E+ via Getty Images

Investment Thesis

Digital Turbine (NASDAQ:APPS) stock is cheaply valued and offers a compelling risk-reward once the adtech market improves.

There’s a lot to like about Digital Turbine. But during a time when investors are apprehensive about getting involved in adtech stocks, Digital Turbine doesn’t exactly make the investment case easy, as its financial accounts leave a lot to be desired.

Note, as we go through this analysis, keep in mind that Digital Turbine is currently in fiscal Q3 2023.

Sentiment Sword

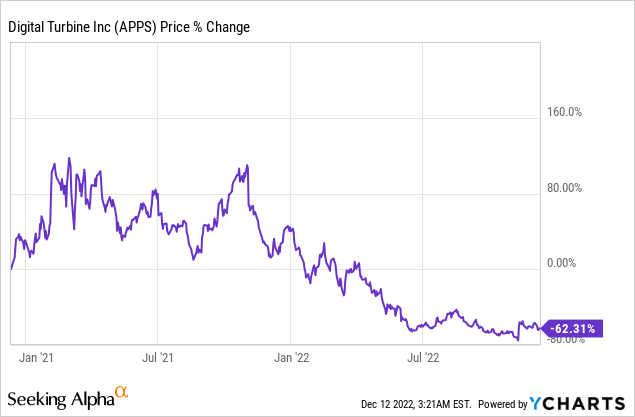

The graphic above is a reminder that anyone that has invested in APPS in the past 2 years is more likely than not to be holding a loss.

That is unless investors happen to have only learned about Digital Turbine after the middle of September 2022 and bought into the stock subsequent to this period. It’s possible, but odds are relatively small.

So what’s my point? The market got too carried away on the way up. Including myself, having been a shareholder in this name at one point.

And here’s the thing, sentiment is a double-edged sword. When the stock is going up, people are very excited about the company.

And when people are excited, their questions about the company go down. And management’s stock-based compensation goes up. Also, more deals happen (Digital Turbine made 3 deals made in 2021). Generally, everyone is happy.

The Other Side of the Sword

The problem though is that in the bear market, investors are extremely risk-averse. And I recognize that this is a blanket statement, yet the facts remain, that on average, there’s less excitement about Digital Turbine now, than there was this time a year ago.

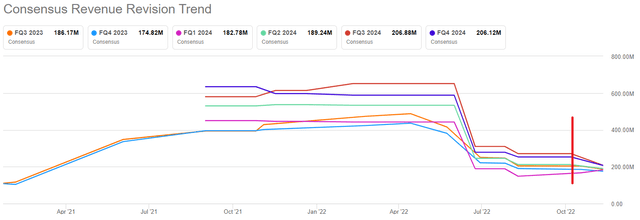

In fact, in the graphic that follows we can see analysts’ consensus revenue expectations for Digital Turbine.

APPS analysts’ revenue expectations

Analysts have significantly downwards revised their revenue estimates for Digital Turbine, even after Digital Turbine’s fiscal Q2 2023 results came out and were generally viewed very positively, with the stock jumping more than +70% on the day of the results.

Note, after fiscal Q1 2023 results came out, analysts changed their estimates for the change of accounting in revenues. The change after Q2 2023, is because of a downward revision in its outlook on Digital Turbine’s prospects.

Put simply, it’s not that investors do not think the stock is cheap. It’s just that investors are so pessimistic over the next few quarters, that no matter how cheap the stock gets, investors still ask for an even wider margin of safety.

The Handle on This Sword: Accounting

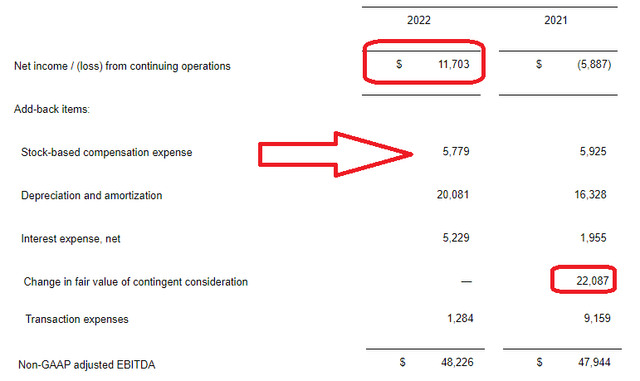

Digital Turbine reported a GAAP profit in fiscal Q2 2023. Yes, that’s after stock-based compensation. In the table that follows I’ve highlighted a few items of interest.

After adding back some pesky, but very much real costs, last year’s Q2 2022 saw Digital Turbine report $48 million of EBITDA. This figure compares with a very similar $48 million in this most recent quarter.

Meanwhile, looking ahead to fiscal Q3 2023, the high end of Digital Turbine’s guidance points to $57 million. This is the same figure as Q3 in the prior year.

Put another way, even if we assume that Digital Turbine’s Q3 2023 outperforms its guidance and delivers close to $63 million of EBITDA, this would still only be around a 10% improvement from the same period a year ago.

And this would point to 33% EBITDA margins.

Now, this is where things get complicated. Digital Turbine changed its accounting from gross revenues to net revenues. And at the time of writing, it hasn’t been made publicly available what the proforma revenue would have been in fiscal Q3 2022.

But I would ask you to consider this table:

APPS fiscal Q4 2022

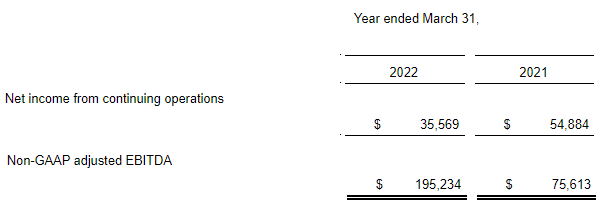

I took this table from Digital Turbine’s Q4 2022 press release. What you see is that for the year ended March 2021, Digital Turbine’s non-GAAP adjusted EBITDA is around $76 million.

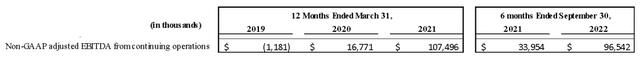

And now consider Digital Turbine’s investment presentation below, from slide 45.

APPS fiscal 2023 Q2 presentation

For all my effort, I can’t reconcile Digital Turbine’s $107 million non-GAAP adjusted EBITDA for the twelve months ended March 2021, with the prior table of $77 million.

The reason for this, I suspect, there’s been a lot of adjustments made over time, that make the two figures slightly odd.

Nevertheless, if we include Digital Turbine’s guided fiscal Q3 2023 results, plus the 6 months of its fiscal 2023, we get to approximately $150 million for the first 9 months of fiscal 2023. Which is substantially higher than what Digital Turbine reported in the full fiscal 2022 in the prior year.

The Bottom Line

I contend that APPS is not expensive. It really is not. Instead, the problem is that investors don’t have confidence in Digital Turbine’s prospects. Or perhaps, this explanation isn’t fair.

Perhaps, a more suited explanation is that investors recognize that Digital Turbine is cheap. But after the bear market of the past 2 years, investors’ capital is now so fully eroded away, that whatever capital investors have left, investors prefer to deploy towards companies that are perceived to be sure things.

There’s a flight to safety amongst investors. Investors’ appetite to take a long-term view is substantially reduced during a bear market. In a bull market, investors are more than willing to extrapolate +5 years out. While in a bear market, investors are rarely willing to consider any company’s prospects more than 6 months out.

Be the first to comment