ipopba/iStock via Getty Images

Investment Thesis

Digital Turbine (NASDAQ:APPS) has been on a terrible roller coaster ride, where nearly everyone that has been associated with its stock today is more likely than not holding a loss.

And when your whole shareholder base is likely to be holding a loss, it does something to all stakeholders, including employees’ motivation, as their stock-based compensation will now be worth substantially less than it was perceived to be worth just a year ago.

Today, Digital Turbine is a shadow of its former self. That being said, I believe that when we come out of this economic downturn, advertising stocks will be the ones that will bounce back first, in the same way as they were the first to turn lower as macro headwinds mounted in 2021.

Nonetheless, I now revise my EBITDA estimates given this new macro environment.

I believe that APPS is being priced at around 40x depressed EBITDA. However, once we get past the next six months, and the economy reestablishes its footing, I believe adtech stocks will be amongst the first to bounce back.

In sum, it’s not immediately obvious why paying 40x depressed EBITDA could be cheap, so read on.

Digital Turbine’s Revenue Growth Rates Slow Down

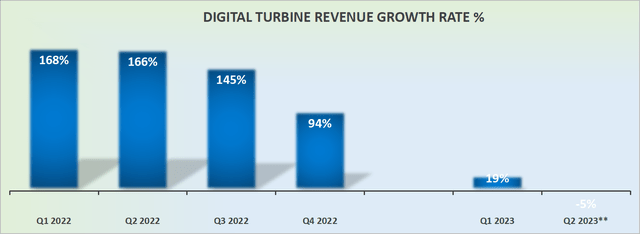

APPS revenue growth rates

As I highlighted in my previous article, the table above is Digital Turbine’s revenue growth rates adjusted for its recent change in accounting, from a gross to net basis.

Realistically, most investors have come to terms with fiscal 2023 being a write-off for Digital Turbine.

But as Digital Turbine now has had plenty of time to integrate its three acquisitions and restructure its business for the new economic reality, I believe that Digital Turbine could soon turn a corner.

And here’s why.

What’s Next for Advertising Stocks?

As noted in the introduction, advertising stocks were one of the first sectors to turn negative in this bear market. In fact, looking back, small and medium-cap stocks started to turn lower in February 2021.

At the time I strongly believed that the market had got APPS wrong. I was pounding my fist on the table that the stock was undervalued.

But as I’ve already stated here, I had to give up this holding in March 2022. In hindsight, it appears to have been a prescient call, as the stock proceeded to sell off.

Clearly, the market was right to be troubled about Digital Turbine and other adtech companies.

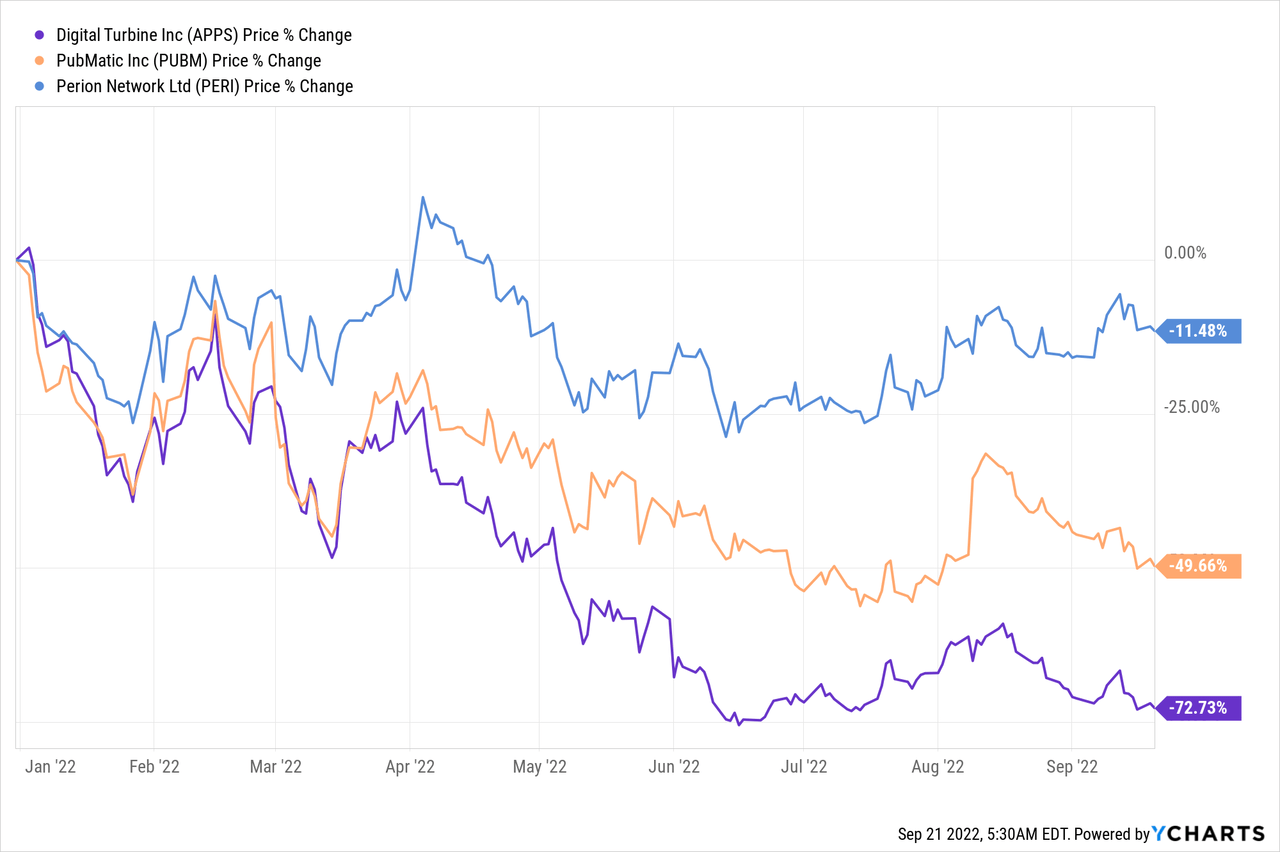

As you can see above, the whole group has been out of favor with investors. With Digital Turbine by far faring the worst.

Yet I will not be so brave as to claim that the bottom for Digital Turbine is here.

What I can claim is that we are a lot closer to the bottom than the top. Thus, the risk-reward from this point is significantly more attractive than it’s been at any point in the past year.

Here’s what we know now. We are very likely to be eyeing up a recession in the US if we are not already in a recession.

But we also have to note that in the same way as advertising spending is the first to get pulled as the economy slows down, it will also be amongst the first to get increased as the economy gets back on steady footing.

But what’s also true is that the stock market will start to inflect ahead of economic data. Remember, after all the market is a leading indicator of economic activity.

Spending Through the Phone is a Real Trend

Many Asian markets appear to be more predisposed to mobile e-commerce. Recently I echoed Coupang’s (CPNG) statement that by 2025 Korea is expected to become the third biggest eCommerce country behind China and the US and ahead of the UK and Japan.

Thus, there’s an undeniable trend for us to spend more time on mobile devices, and even without much further increase in the number of handsets, Digital Turbine’s Android base (GOOG)(GOOGL) should allow it to continue to increase its revenues per device, a metric that Digital Turbine has up until recently shared with investors as a means to track its progress in its operating metrics.

Digital Turbine’s CEO Bill Stone believes that even though sales cycles have become elongated in the current business cycle, this isn’t a permanent shift in advertising budgets.

We are simply in unchartered territory of slowing economic growth plus high inflation. But companies that want to increase their sales will need to spend on advertising to reach consumers where they find themselves, on their mobile devices.

APPS Stock Valuation – 40x EBITDA

Digital Turbine is an adtech company. And one thing that this sector does really well is report strong free cash flows.

That being said, I don’t believe that it’s wise to give any credence to the forecasts that Digital Turbine gave back on its Investor Day this time last year.

Nevertheless, I do believe that’s entirely possible that Digital Turbine’s EBITDA could reach at least $170 million of EBITDA. Here’s the math, fiscal Q1 2023’s EBITDA was $51 million, while Q2 2023 is guided for $50 million.

Given the slowing macro environment discussed, it’s entirely possible that H2 2022 could only see around $70 million.

That’s less than $195 million reported in fiscal 2022. However, the macro environment for the next six months is expected to be more restrictive than the same period a year ago.

Thus, one way or another the stock today is priced at around 40x depressed EBITDA.

Consequently, the market has been justified in selling off this stock. Realistically, given that Digital Turbine is priced at 40x EBITDA the company should be delivering sustainable revenue growth and it’s not.

On the other hand, it’s likely that once we get past the next six months of economic malaise, Digital Turbine is well positioned to get more wallet shares from brands looking to get closer to the consumer.

The Bottom Line

There’s no denying that mobile advertising is a long-term trend that is here to stay. The only question that’s left is whether or not Digital Turbine will be able to successfully capture enough market share.

Right now, there’s only fear, uncertainty, doubt, and pessimism.

Yet, I believe that anyone that is reading this has had plenty of time to ask serious questions about their APPS investment.

Or put another way, I believe that anyone that wanted out from this stock is either out now, or likely to be out in the coming weeks, after Q3 2022, as we get into tax loss season.

In practical terms that means that the marginal seller of this stock will be out of this name over the next month or two. And what’s left will be only investors that won’t sell at any cost. And at that time, it will be a very interesting time to revisit this name.

Be the first to comment