piranka

Digital Realty Trust, Inc. (NYSE:DLR) has impressed me for a long time, both thanks to its savvy expansion of data centers where they are in most demand and its effective use of leverage to provide a positive cash flow for investors. The numbers speak for themselves.

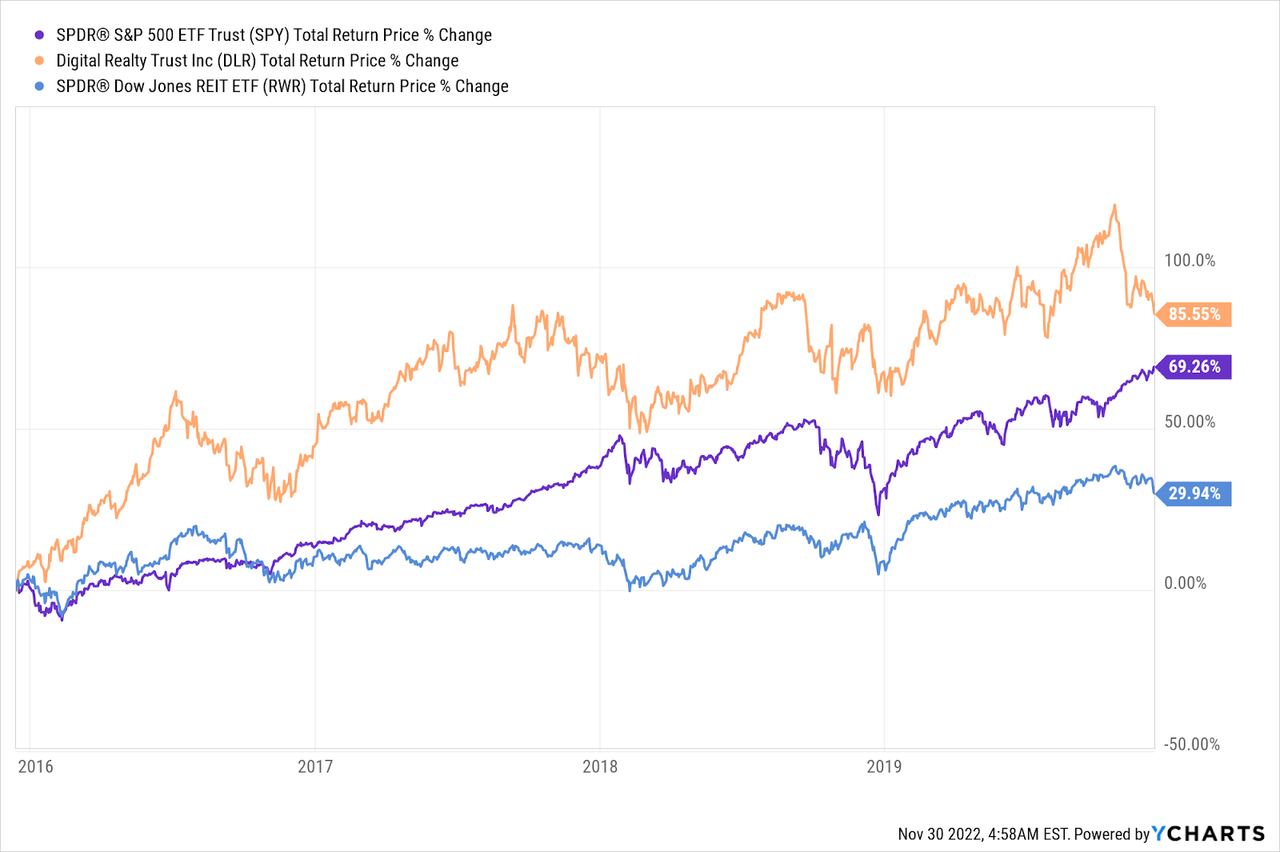

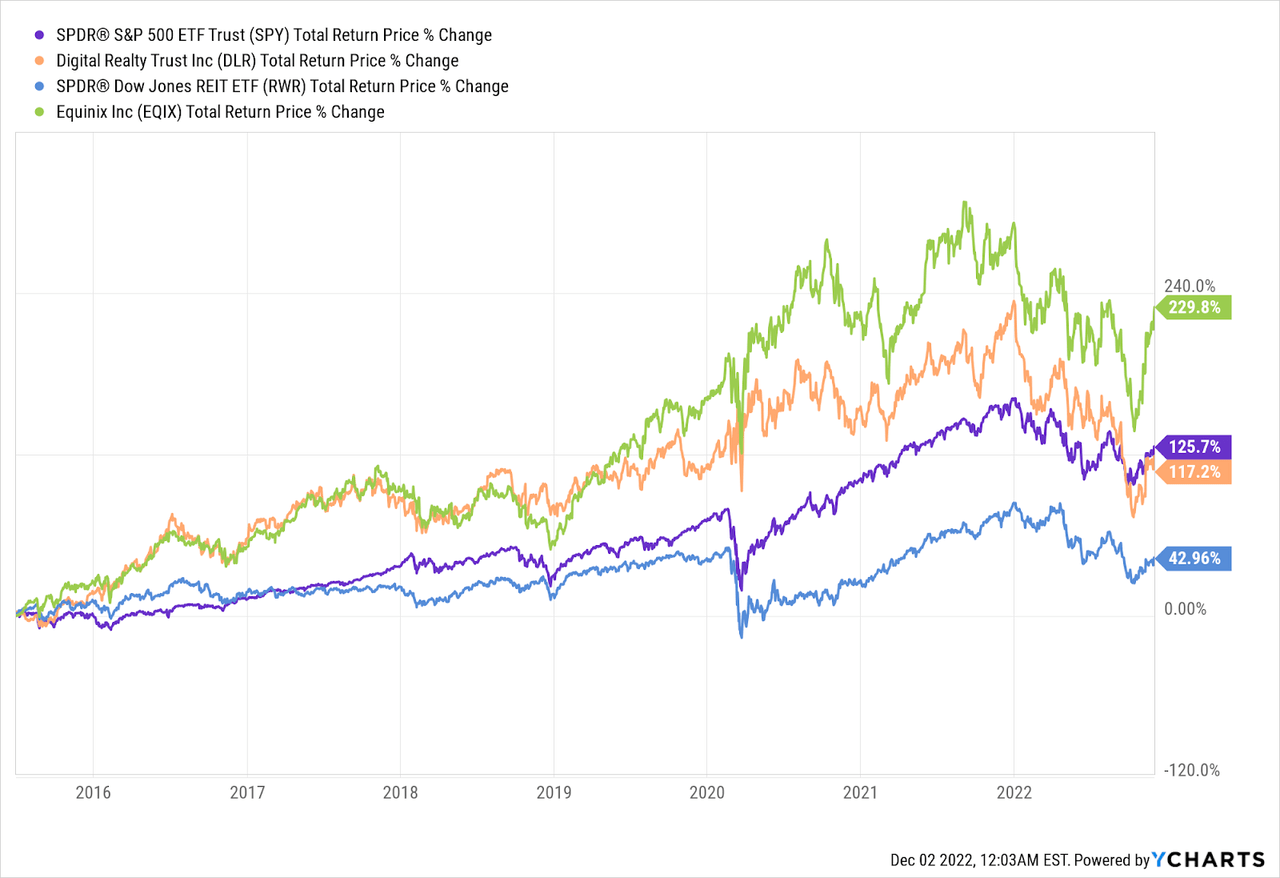

Ycharts

The five years following my first article on DLR showed the real estate investment trust’s (“REIT”) massive outperformance, crushing both REITs and the broader market. This is particularly noteworthy, because the late 2010s saw a lot of fear of REITs broadly due to higher interest rates, alongside other fears. Long term investors, however, dismissed those fears as noise, remembering DLR has a long history of outperformance.

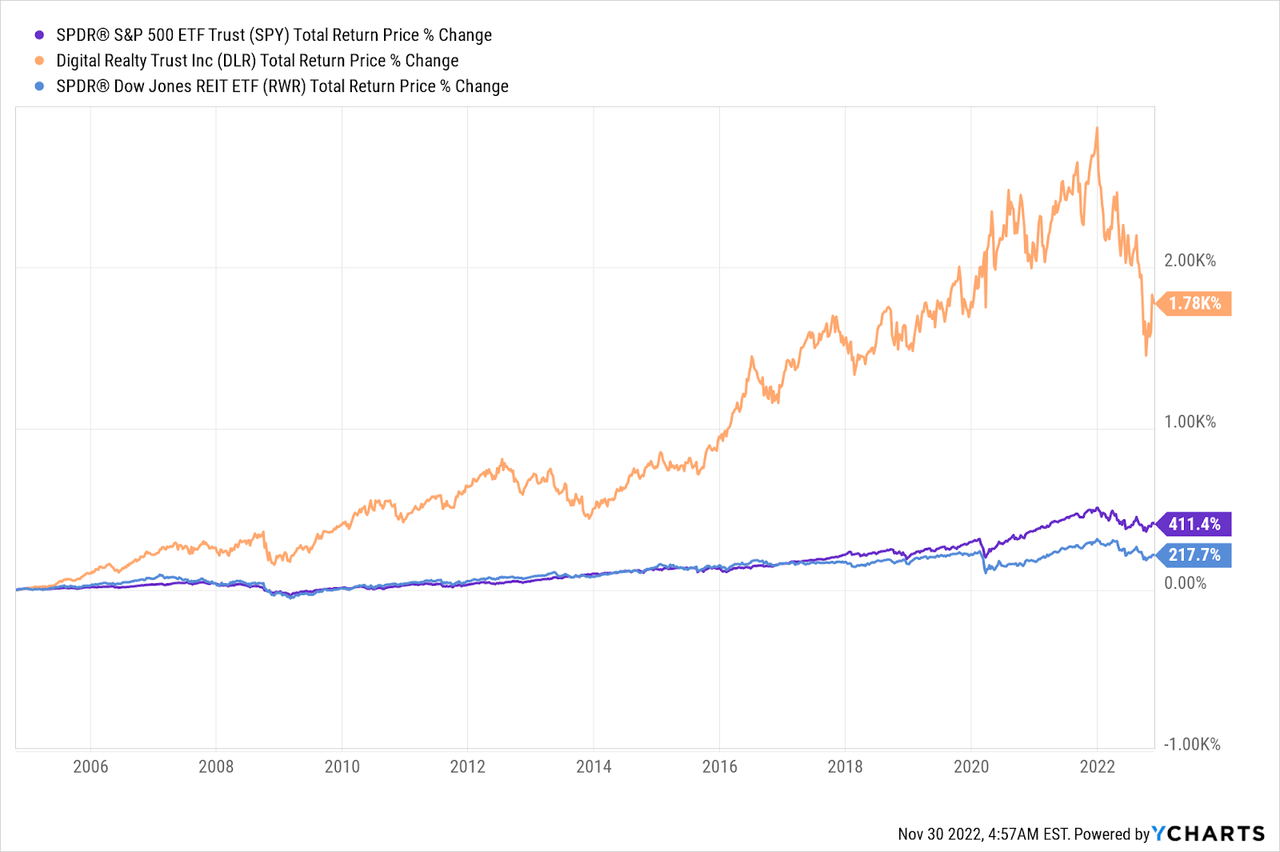

Ycharts

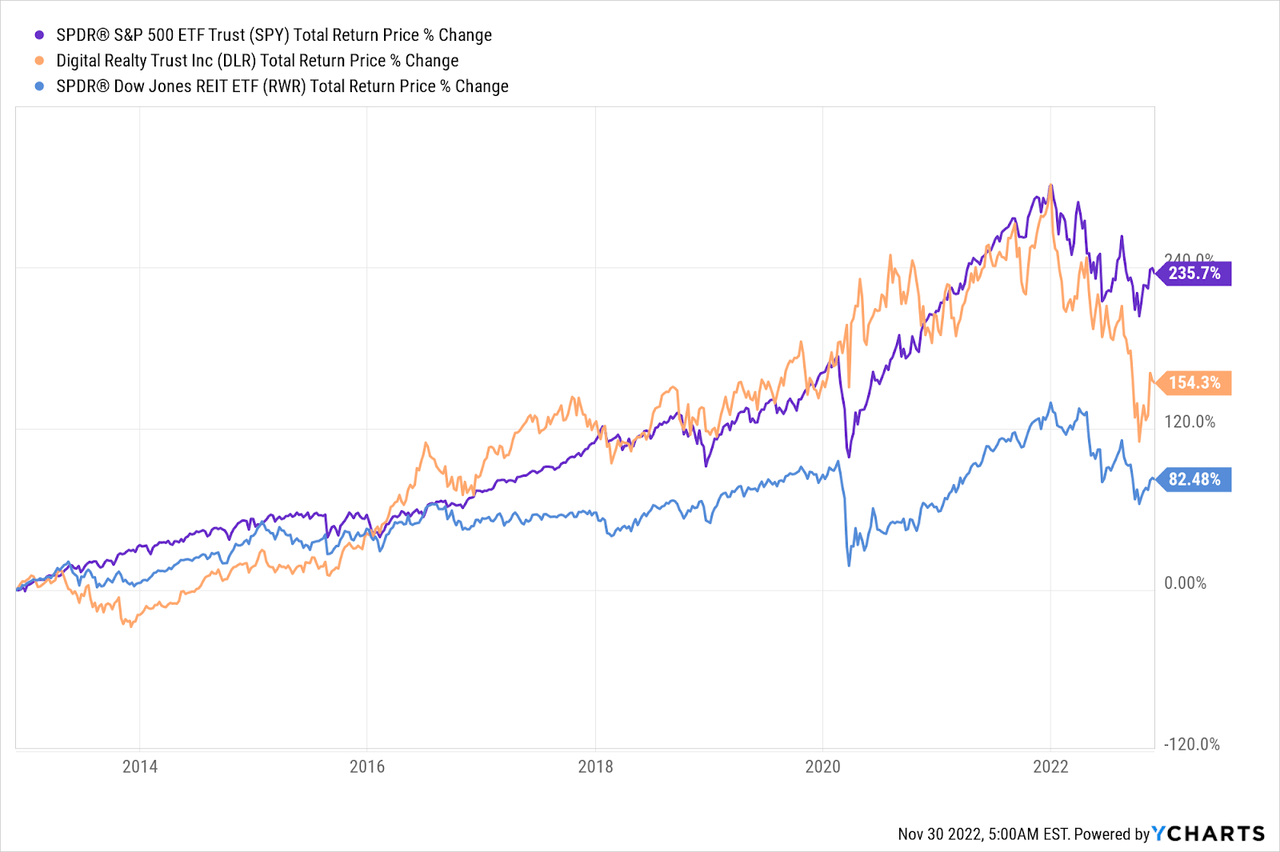

DLR returns have crushed both REITs and the broader market for a very, very long time, but that trend was firmly put to a stop not by the pandemic but by the Fed’s 2022 interest rate hikes; for the first time in history, DLR’s 10-year return has slipped to less than the stock market’s and has flirted with the broader REIT market’s low returns.

Ycharts

This brings us to the present day, which is either a massive buying opportunity for DLR or a warning that the very long trend has ended for one reason or another. We can answer these questions through a couple of quick looks at DLR’s current valuation and cost of capital, which also tells us whether the firm’s dividend is sustainable and whether its common stock is a buy at current levels or its higher yielding and lower risk preferred shares are a better buy.

AFFO Cost and Growth

An important and often overlooked metric for REITs, the price-to-AFFO ratio has, in my experience, been a phenomenal tool for measuring future performance. Firms with positive growth in physical footprint, a strong client base, and high tolerance to large capex initiatives will outlast short-term market panics over interest rates, changes in consumer demand, and even worries about future technological innovations disrupting a firm’s current model.

In the case of DLR, this has certainly been the case. At the end of 2015, the firm’s price-to-AFFO ratio was around 14; at 17.7, it’s a bit pricier now, but it hasn’t reached the 29 price-to-AFFO ratio it hit at the start of 2022; a similar return to such a valuation alone could cause DLR to

That valuation is unlikely to return anytime soon, however, as the market is bearish not just on REITs but on DLR specifically. REITs share a concern of rising capital costs due to higher interest rates, making leveraged investments harder to make profitable, while DLR is struggling from lowered expectations as the tech world cuts costs. DLR faces some very tough comparables thanks to massive growth in recent years.

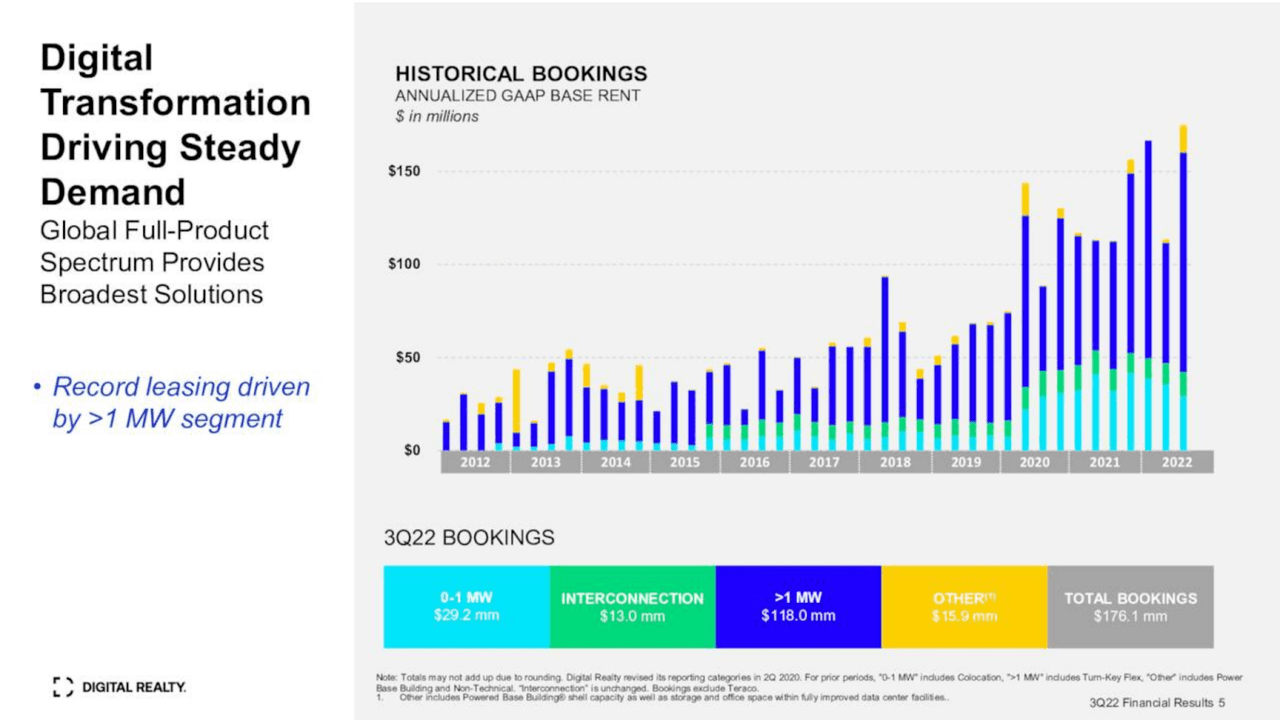

Digital Realty Trust

Behind this massive growth is a physical increase in DLR’s rentable square footage, but more important is the relentless demand underpinning this growth, as President and CFO Andrew Power noted in the last earnings call:

“The pricing power pendulum again, I think, is continuing to move in the favor of the providers given that demand has been robust for so long, and the outlook is looking to be — continue to be such and the supply has just been absorbed.”

The market has adapted quickly, with DLR customers realizing that they need to secure longer contracts with data centers, in turn lengthening the sales cycle and limiting DLR’s ability to increase revenue through higher rents (but also securing current income levels for longer).

This in turn has caused both uncertainty in DLR’s future rental revenue and profitability, lowering estimates for DLR future revenue and generally making the market bearish.

To get a sense of where DLR can go from here, we need to tackle three big questions:

- Is DLR’s revenue growth handicapped, and if so by how much and for how long?

- Is DLR’s WACC too high, or is it at risk of being too high, for competitive market cap rates, resulting in a weakening ROIC from current levels?

- Are technological innovations putting DLR’s primary business, the leasing of server space, at risk?

The third question is the hardest, but fortunately it’s been already tested enough to give us a certain baseline to work from; the first two, on the other hand, involve some simple math.

Revenue and AFFO Growth Trends

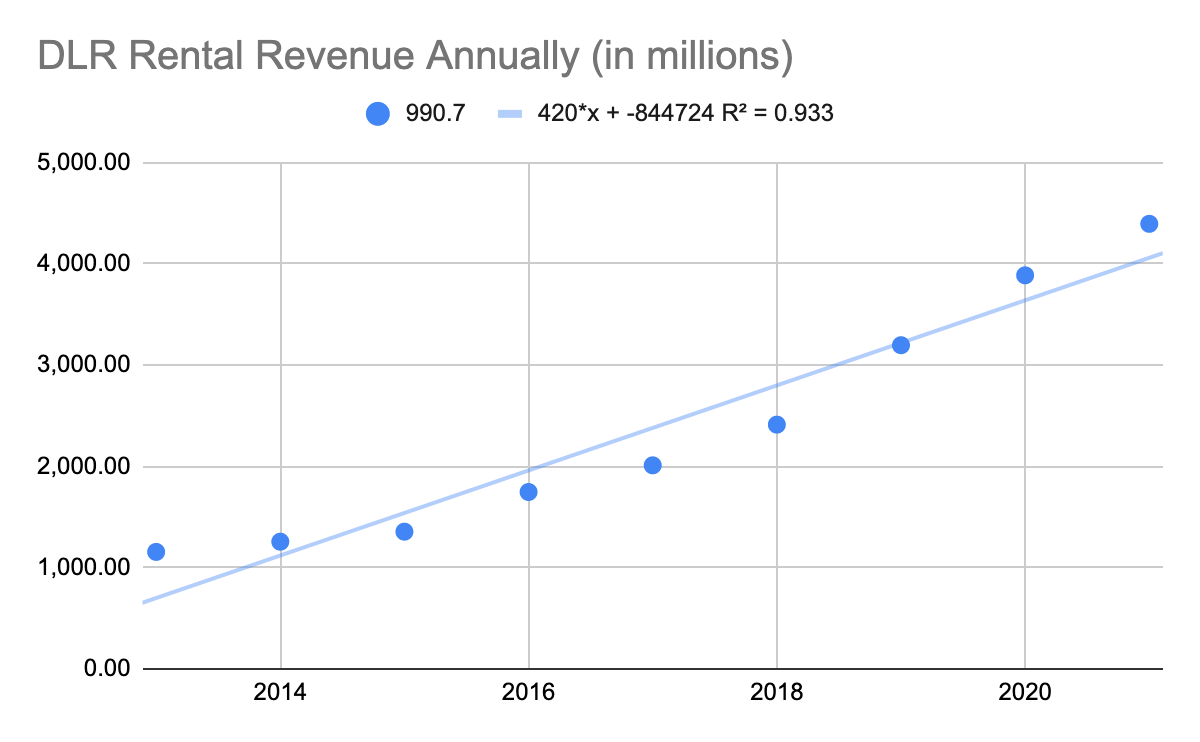

First, let’s look at DLR’s rental revenue growth over time.

Author

With an average 17.1% revenue growth boosted by strong numbers in 2016, 2018, 2019, and 2020, DLR’s deceleration has caused 2021 and 2022E to be disappointments, with a likely 6.7% YOY increase in revenue in FY22E and future downward estimates suggesting a step down in growth to come.

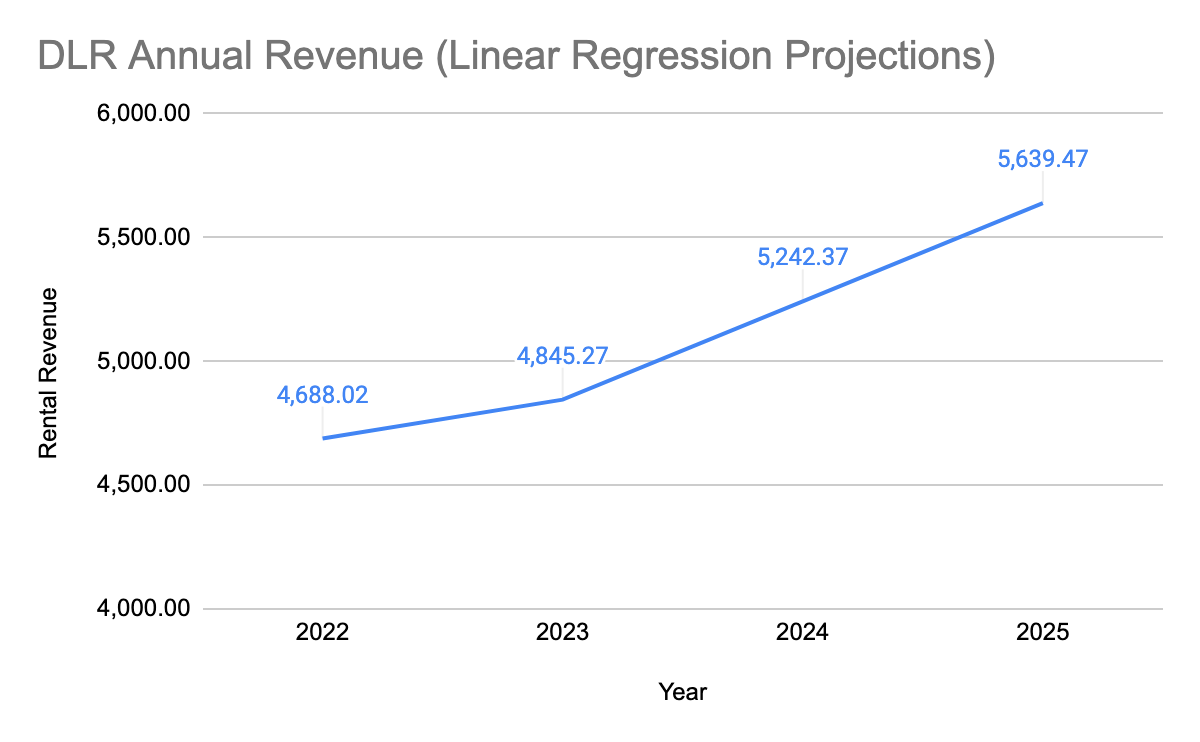

A linear regression including 2022’s estimated deceleration suggests FY25 revenues of $5.6b:

Author

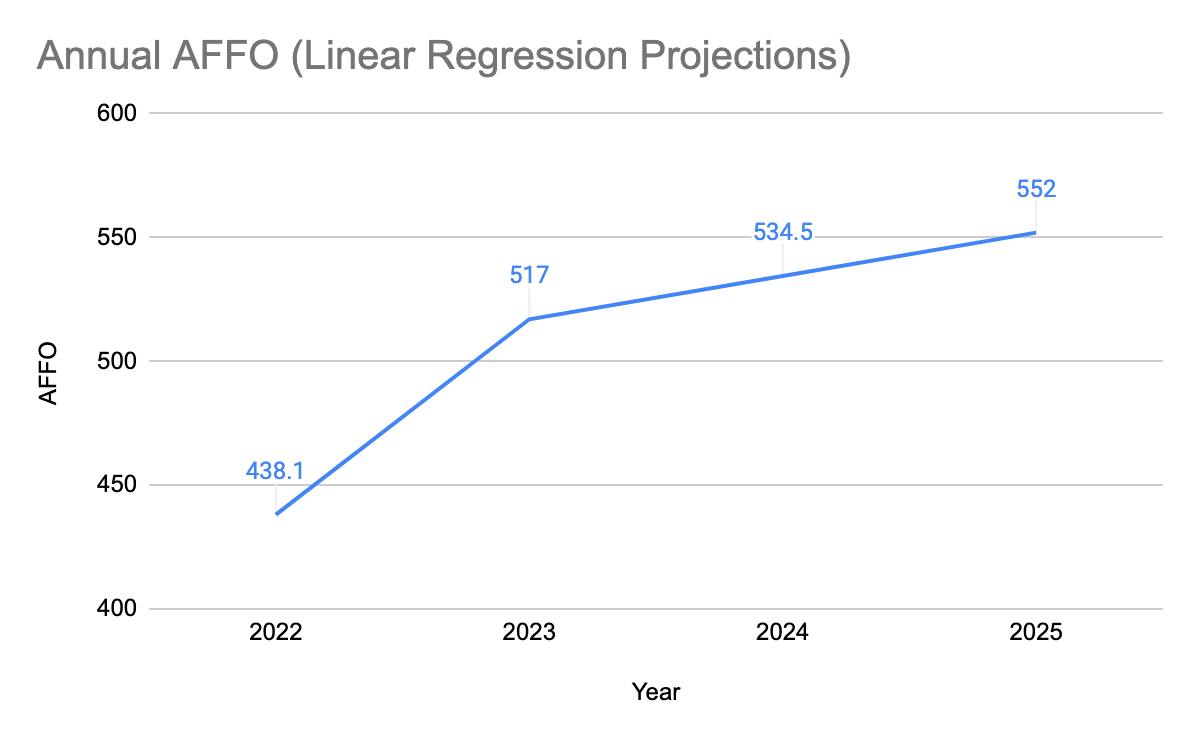

Similarly, we can project AFFO to rise 26% from our current run rate in 2025:

Author

At current prices, we’re paying a P/AFFO of 13.9 for FY25’s earnings, close to 2015’s level and a good metric to buy DLR; the firm handily beat REITs while almost matching the market from that last valuation, although DLR underperformed EQIX by a very large margin as well:

Ycharts

However, as DLR’s growth rates have lowered significantly since 2015, we should perhaps temper our enthusiasm for the P/AFFO valuation and look at whether higher interest rates can strap DLR’s profitability.

DLR’s WACC and Cap Rates

DLR’s borrowing costs have risen significantly, and DLR seems to have responded by borrowing less than in the very cheap borrowing days of 2020-2021.

Digital Realty Debt and Equity Offerings, 2020-2022

|

Date |

Amount |

Rate |

|

January 8, 2020 |

1700 |

1.00% |

|

May 12, 2020 |

1000 |

N/A (equity ATM) |

|

January 5, 2021 |

1000 |

0.63% |

|

September 14, 2020 |

750 |

1.00% |

|

January 4, 2022 |

450 |

4.75% |

|

January 5, 2022 |

750 |

1.38% |

|

September 23, 2022 |

550 |

5.56% |

|

November 30, 2022 |

350 |

5.55% |

With a 5.5% cost of debt, DLR has a WACC of 6.46% based on an assumed 7% return and a risk-free rate of 4.125%. That’s actually not much higher than the 6.07% DLR had during the pandemic (assuming 2.125% RFR), but the smaller delta between CoD and CoE suggests DLR may depend more on equity rather than debt financing until interest rates fall to the point where DLR can offer notes below 4%.

We also need to discount our DLR price target accordingly. While a 14 P/AFFO ratio in a low rate environment that saw rates rise to 4% was indeed a good (but not great) buy, our current environment suggests DLR’s debt-financed expansion may not be sufficiently profitable until FY24, when rates are projected to begin to fall from March’s 475-500bps target rate to a 425-450bps base rate at the end of December. This would suggest that comparing a forward P/AFFO in FY25 to the TTM P/AFFO in FY15 is fair, indicating the market has already discounted the short-term high rate environment for us.

Innovation and Data Center Physical Space Needs

A larger risk to DLR has come from a corner of the world I never thought would be a factor, but now it is: cryptocurrency.

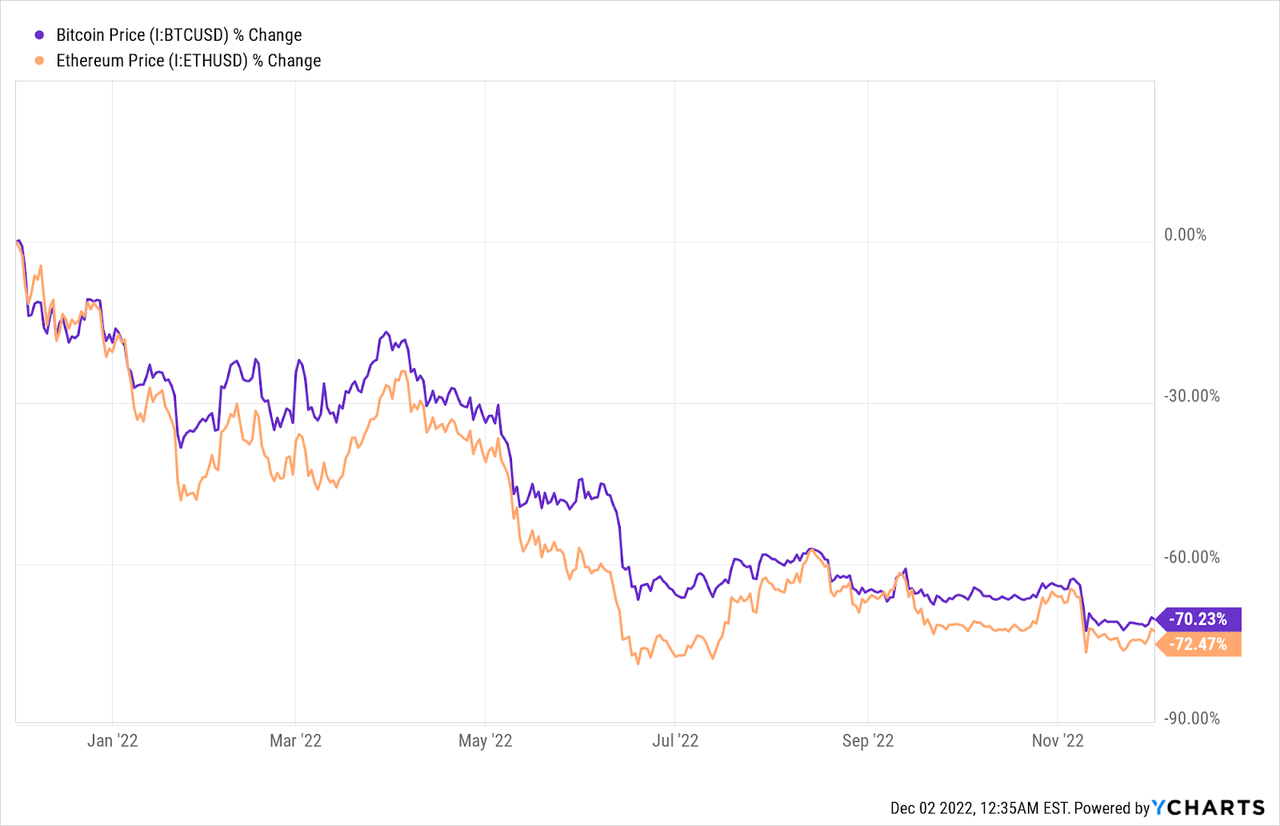

Ycharts

While the collapse in cryptocurrencies has not gone unnoticed, its impact on data centers has not been fully explored. This is partly because the connection is a hard one to make; while we can’t make quantitative statements about the rental revenue impact of the forthcoming loss of crypto as a venture, we can make some qualitative statements that help us discount our DLR expectations quite easily.

One saving grace is that the decline of cryptocurrency has been happening slowly-but there is a lot of evidence that that is changing.

First, let’s establish a baseline: Crypto VC funding fell 50% QOQ in 3Q22, but the $3.3b level for that quarter is far below the $8b average across 2021-2022; and that was when the collapses of Celsius (in bankruptcy), TerraUSD and Lunacoin (virtually worthless and illiquid, the founder now an international criminal) were the biggest headlines. The much more prominent collapse of Sam Bankman-Fried’s FTX will likely impact VC funding even further, especially as ETH and BTC prices fail to recover and contagion impacts other firms; BlockFi has already gone into bankruptcy, Three Arrows Capital has been wiped out, Voyager has filed for bankruptcy…you get the point.

The impact of the end of the crypto trend on data centers could be significant. We have seen significant dependence on these data centers rise with the rise of these firms, and the rise of very well-capitalized crypto-specialist data centers.

DLR’s exposure to this world has been peripheral and minimal. Focusing on very large clients like AT&T (T) and the Federal Government, the company has not been overtly exposed to the crypto bubble.

Furthermore, DLR’s clients have not been overtly exposed to the bubble; firms like Adobe (ADBE), T, and others have been too large or too wise to get caught up in the Web3 mess, and there’s little reason to think that DLR will be negatively impacted by the cuts to VC spending due to the death of crypto.

There is a reason to be marginally optimistic, as well; DLR’s opex and capex could be positively impacted at the margins as bankrupt, illegal, or fraudulent operations are liquidated, flooding the market with server space and servers. For this reason I’d suggest that the crypto collapse is a mild positive for established data centers but also a potential long tail risk that, at the moment, is too nebulous to be quantified.

DLR’s Preferreds: Low Risk, but Low Yield

An important additional note about DLR’s preferred stock (DLR.PC, DLR.PF, DLR.PG, DLR.PI, DLR.PJ, DLR.PK, DLR.PL): DLR common stock’s current 4.4% yield and current valuation indicate that DLR’s 2021 callable preferred shares (DLR.PC) currently yield too little, with similar concerns for others (DLR.PG), although the high yield on two other issues (DLR.PF, DLR.PI) suggest they are more compelling at current levels for risk-averse income seekers who wish simply to collect the income stream and wait for the shares to be called.

|

Ticker |

Market Price |

Coupon |

Current Yield |

Call Date |

|

DLR.PC |

$25.21 |

6.63% |

4.37% |

5/15/2021 |

|

DLR.PF |

$25.49 |

6.63% |

6.50% |

4/5/2017 |

|

DLR.PG |

$25.04 |

5.88% |

5.87% |

4/19/2018 |

|

DLR.PI |

$25.29 |

6.35% |

6.28% |

8/24/2020 |

|

DLR.PJ |

$22.16 |

5.25% |

5.90% |

3/14/2024 |

|

DLR.PK |

$23.59 |

5.85% |

6.20% |

3/13/2024 |

|

DLR.PL |

$21.49 |

5.20% |

6.20% |

10/10/2024 |

Source: Bloomberg

For the yet-to-be-called preferreds, given DLR’s track record and the likelihood of interest rates not declining significantly by then, March 2024 callable preferreds (DLR.PRK) are unlikely to be called at that point and so investors getting these shares should not expect a redemption by then. Similarly, December’s callable preferreds are less likely to be redeemed either, but very cautious investors who want the yield can hold on until then (and, at current prices, get significant upside as interest rates fall).

Conclusion: Price Targets for DLR

Given DLR’s challenging cost of capital and decelerating growth, a P/AFFO of 14 for FY25 seems to be extremely fair value, while acknowledging the risks of dilution in the short term from equity-based financing, indicating that DLR is currently a hold but with dips providing buying opportunities for an incredibly well performing and well run data center REIT in a world where the appetite for data centers is not declining.

Putting a sales target on DLR is challenging, however. Sticking to a FY25 valuation, when we see a P/AFFO ratio of 25 we likely will see the beginning of a red-hot REIT market, indicating that DLR remains a modest buy at current prices and is a sell at $200 per share. However, that price is unlikely to appear soon and is likely to come only after the Fed’s rate-cutting cycle has begun in earnest, suggesting perhaps a strong bull run in late 2023.

Be the first to comment