Jian Fan/iStock via Getty Images

Digital Realty (NYSE:DLR) is a Real Estate Investment Trust [REIT] which owns over 300 data centers globally. The company has an elite list of over 4000 customers which include IBM, JPMorgan, Meta, Oracle, and many more. Digital Realty is in a prime position to benefit from the secular growth trends across the Digital Transformation of enterprises. The cloud computing market is forecasted to grow at a rapid 15.8% CAGR between 2022 and 2028, reaching over $1 trillion by 2028.

Digital Realty has seen its share price get butchered by 42% from its all-time highs in December 2021, mainly due to the rising interest rate environment and FX headwinds. Despite this, the company reported solid results for the third quarter of 2022, as it beat analyst expectations for revenue. In this post, I’m going to break down its third-quarter earnings report in granular detail and then reveal the valuation, let’s dive in.

Third Quarter Breakdown

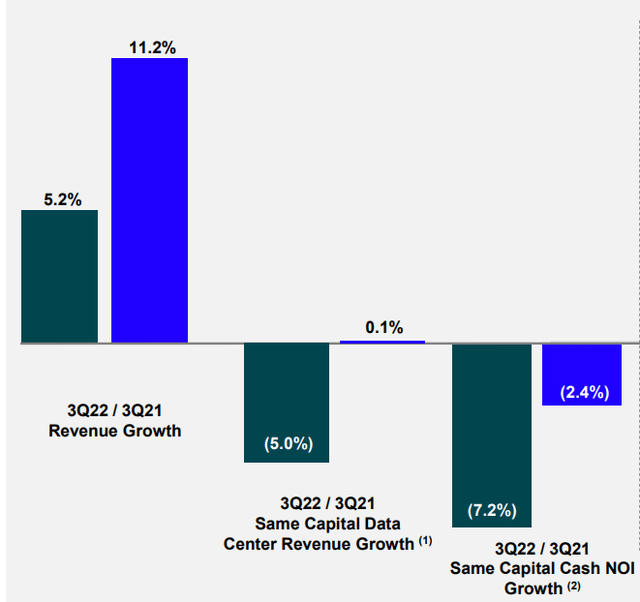

Digital Realty generated strong financial results for the third quarter of 2022. Revenue was $1.19 billion, which increased by ~5.2% year over year and beat analyst expectations by $5.23 million. On a constant currency, basis (blue bar below) revenue increased by a substantial 11.2% year over year.

Its solid growth was driven by strong new customer growth with 103 new customers signed during the third quarter of 2022. Notable wins include:

- A Global Fortune 2000 luxury goods manufacturer, which has adopted a data exchange on PlatformDIGITAL.

- A Global 2000 technology manufacturer also expanded its hybrid IT setup across two regions globally.

- A Global 2000 retailer which rationalized its data centers as part of a hybrid IT setup.

- A Global 2000 U.S. energy provider (Hybrid Cloud Transformation)

- A Global 1000 insurance company that has moved to PlatformDIGITAL in order to access 2 leading cloud providers easily.

- A Global 100 top insurance company is rationalizing its data centers and moving to PlatformDIGITAL to gain strong access to 2 leading cloud service providers.

Digital Realty has reported tremendous traction across those enterprises that wish to operate in a “Hybrid Cloud” environment. In general, organizations have a few options when moving to the cloud. Firstly, they can keep all their IT on-premises which is the traditional structure. Second, they can move all their IT applications to a major cloud provider such as Amazon Web Services [AWS], Microsoft Azure or Google Cloud. Third, they can adopt a Hybrid approach which enables the companies to use multiple cloud providers and even keep some IT services “On-Prem”.

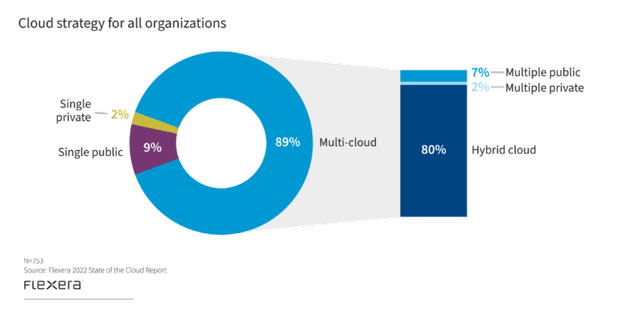

According to one study, 89% of companies are taking a multi-cloud approach with 80% taking a hybrid cloud approach. Now it should be noted the sample size was quite small for this survey (753 people), but it is still an interesting data point and tailwind for Digital Realty. The Hybrid Cloud approach can be slightly more complex but it does give companies greater leverage against cloud providers as well as enabling the businesses to benefit from the strong features of each provider.

Hybrid Cloud Survey (State of Cloud Report)

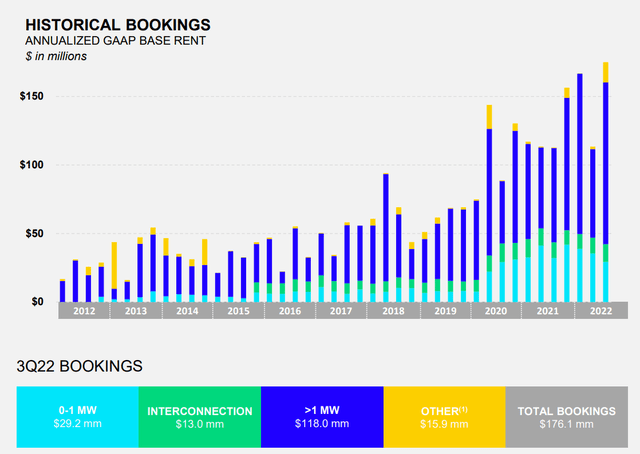

The company signed record bookings of $176 million in the quarter. This growth was driven mostly by the North American region with large deals in Portland and Dallas areas. Strong growth in San Palo, led the Latin American region, and Osaka led APAC growth. These large number of deals drove strong development pipeline of over 400 megawatts, with 60% of its developments already pre-leased to customers. This offers solid consistency and lower risk for investors, which is a positive sign. In my previous post on Digital Realty, I discussed its business model in more detail, for those interested.

Digital Realty has a beautiful rental system for its data centers in that it embeds CPI-Based escalators for its new leases. The Consumer Price Index [CPI] is a popular measure of inflation and this means the company is naturally hedged against the effects of inflation. Approximately 95% of its portfolio includes some type of rent escalation clause which is a positive.

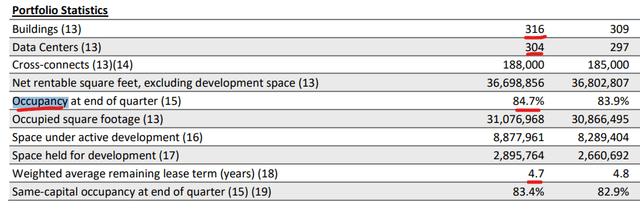

Across Digital Realty’s 304 Data Centers and 316 buildings, the company has a strong occupancy rate of 84.7%, which rebounded by 80 basis points quarter over quarter. This growth has come despite the company rapidly expanding its global colocation inventory which will be a slight headwind against occupancy rates in the short term. The weighted average remaining lease term is 4.7 years, which helps to give investors an idea of the cash flow situation and security.

Occupancy (Q3 supplement Data)

Digital Realty has a solid backlog of signed but not yet commenced leases equating to $466 million. The time period between when a lease is “signed” and commenced is ~17 months, for its large multisite enterprise clients with customer requirements. However, excluding the recent enterprise deals, the sign-to-commencement time period is less than 8 months which is aligned with its historic average.

FFO and NOI Metrics

Two common metrics used to analyze REITs are NOI (net operating Income) and FFO (Funds from Operations). NOI is the “net income” after all operating expenses are misused for the properties. In this case, the same capital cash NOI growth fell by 7.3%, which was mainly driven by a 480 basis point FX headwind.

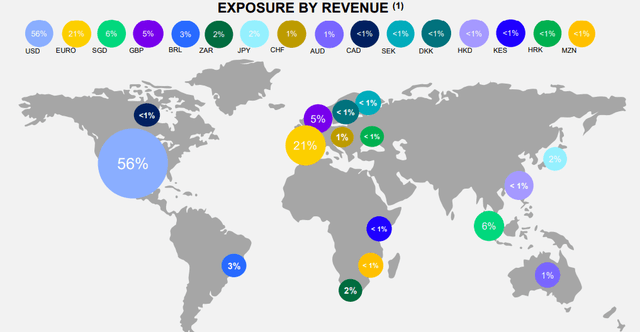

A strong dollar relative to most other global currencies has been a headwind for many organizations especially those with strong exposure to foreign currencies via international revenue. In Digital Realty’s case, 56% of its third quarter operating income is in U.S dollars. This is followed by 21% in euros, 6% in Singapore dollars, 5% in British pounds, and 2% in Japanese yen.

The good news is the business invests its foreign currency gains locally and thus doesn’t actually lose out on unfavorable exchange rates. The company also has a hedging strategy in place which executes a variety of “swaps” in order to mitigate the FX volatility and headwinds.

Currency exposure (Digital Realty)

The company generated core FFO (funds from operations) per share of $1.67 which was 1% higher year over year. However, this did decline by 3% sequentially due to the negative FX exposure. Moving forward management is forecasting FFO per share to remain under pressure from strong FX headwinds.

Acquisitions and Expansion

Digital Realty has accelerated the expansion of its operations through a series of acquisitions. During the third quarter of 2022, the company purchased a majority interest stake in Teraco, a leading carrier and cloud-neutral data center provider in South Africa. This company has 7 data centers, 22,000 cross connects and 7 submarine cables, thus it gives Digital Realty strong exposure to the region. Teraco also complements the company’s existing operations through iColo in East Africa and Medallion in West Africa.

Digital Realty also acquired land on the beautiful Greek island of Crete a popular vacation destination but also a strategic hub for connectivity. The company is also developing hubs in Barcelona and Israel.

Balance Sheet

The company reported a leverage ratio of 6.7x, which is slightly above its historical average. However, the company has increased its liquidity position to ~$3 billion, thus the company is in a solid position.

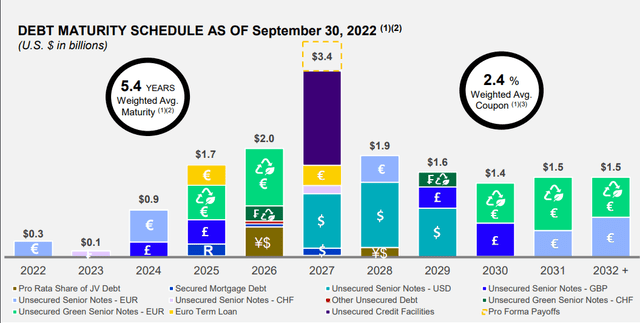

Its weighted average debt maturity is ~5.5 years with approximately three quarters of its debt in non-U.S currencies, thus this will benefit from the devaluing of foreign currencies. 80% of Digital Realty’s net debt is also at a fixed rate, which helps to mitigate major issues with rising interest rates.

Valuation?

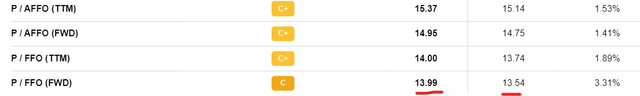

In order to value Digital Realty, I will compare the Price to Funds from operations across a few data center REITs in the industry. Digital Realty (DLR) is the cheapest data center REIT the peers I have looked at with a P/FFO [fwd] = 13.99. By comparison, Equinix (EQIX) has a P/FFO [fwd] = 27.2 and CyrusOne (CONE) (pre-acquisition by KKR) had a P/FFO [fwd] = 20.1. As an extra data point, American Tower (AMT) which is focused more on the telecoms tower industry, has a Price to FFO of 16.5, which is also more expensive than Digital Realty.

As an extra data point, Digital Realty trades at an average (C+) valuation relative to the real estate sector. However, keep in mind this includes all types of real estate, including commercial offices that are trading lower than the historic average, due to uncertainty about use cases in the future. Data Centers have much more growth and certainty, thus tend to trade at a higher multiple.

FFO vs Real Estate Sector (Seeking Alpha)

Final Thoughts

Digital Realty is a tremendous company that is poised to benefit from the tailwinds of digital transformation and the hybrid cloud. The company has generated solid financial results in the third quarter, despite foreign exchange headwinds. Management is proactive and implementing a series of strategies from investing international revenue locally to executing a series of acquisitions. The stock is undervalued relative to historic metrics and industry peers, therefore the company could be a great long-term investment.

Be the first to comment