peshkov

Introduction

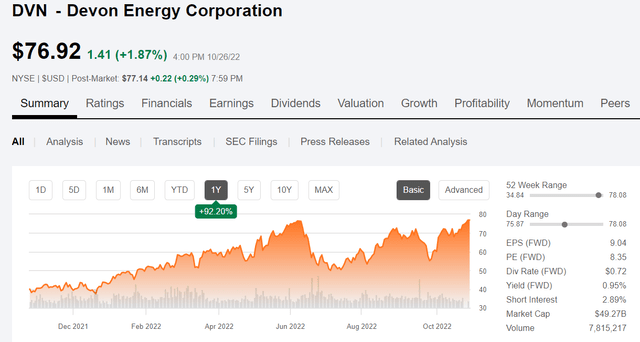

Devon Energy Corporation (NYSE:DVN) has been one of our best-performing investments over the last couple of years. It is currently sitting just above its June 2022 high, with premarket indications that it will continue this push in today’s trading.

Devon Energy price chart (Seeking Alpha)

This is at a point where investors could be justified in trimming their positions and playing with the “House’s Money.” We are not suggesting they shouldn’t do just that, as the decision to buy or sell rests solely with the individual investor. That said, DVN is just now reaching the level we suggested for the year-end 2022 in a recent article (past research on DVN is available here). We find reasons for continued optimism, and remain bullish on the stock. Recent market moves have enhanced the case for higher oil prices from the point we took our original estimates.

We are going to stick around. Here’s why.

The thesis for staying with DVN

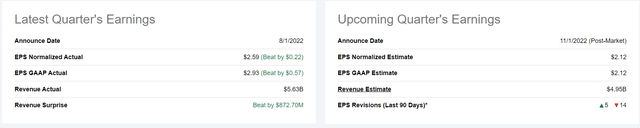

Devon Energy will report earnings on November 1, 2022. We’re coming off a strong beat in Q-2, thanks to realizations in the $100/bbl range for that quarter. Analysts are a little more circumspect for Q-3, with EPS expectations down about 20% from the prior quarter. They surprised to the upside last quarter and I expect they will again. Devon is a low-cost producer with a lot of natural and logistical drivers that help it lower its expenses.

DVN earnings forecast (Seeking Alpha)

I think energy stocks are going to make an extended run higher in 2023 that will be supported by strong prices for oil and gas, in the $90-$100 BOE range, and other factors we will discuss. Oil companies are still making land-office profits in that range, as evidenced by the recent Shell plc (SHEL) results. EBITDA was 7% lower than Q-2, 2022-driven by working capital adjustments for European gas inventories, but the net effect of operations in the quarter was a thunderstorm of cash. Comparisons between Shell and Devon break down pretty quickly, as the former company has many more levers to pull, but net effect of prices in the quarter will be the same for Devon as it was for Shell. Cash will rain!

That’s the base case for DVN. Let’s look at the macro environment in which the company operates.

The big picture

We know more about the shape of things to come in the oil market, than we did a few months ago. One thing in particular we have learned is that OPEC+ is committed to supporting oil in an $80-$90 a barrel range. The recently announced 2 mm BOPD cut is symbolic of that commitment. There could be more, if needed.

Something I’ve been harping on in my articles the last year or so is that supplies of oil are tight. The big oil releases from the Strategic Petroleum Reserve (“SPR”), intended to reduce gasoline prices in advance of the midterm elections, have at least to an extent done their job, but are coming to an end…I guess, who knows? There is a finite amount of the stuff in the SPR, as our elected leaders may one day discover. Oil doesn’t grow on trees, imagine that!

One point on which we are confident, crude builds as compiled by the EIA-WPSR have largely been the result of these SPR releases, without which inventories would be at least 100 mm bbls below current levels. Of some importance, these efforts have not gone unnoticed by concerned parties around the world.

The other day, the Saudi oil minister, Abdulaziz bin Salman, cautioned against over-tapping emergency reserves. This was a pointed reminder of past comments about their ability to expand production above current levels. I won’t get into the advisability of this action by our political leadership. What’s done is done. I discussed these dynamics in my last strategic article, linked here for your reference. I will point out that the administration’s expectations of refilling the reserve at $72, are somewhat out of step with what the market expects for pricing in the coming year. But, then what do markets know, anyway! I am sure Amos Hochstein has it all figured out.

Another contributing factor to oil weakness has been dollar strength. Peaking earlier this month at multiyear highs, recently it’s backed off about 15%. This tracks oil’s move higher and we could see more of this as the inevitable FED pivot nears. Some of this dollar weakness is associated with the anticipation of that pivot, coming probably in Q-2, 2023.

Finally, we have another pivotal factor that is only just starting to emerge. In an anticipation of a deep recession next year – I am not arguing pro or con here, just documenting the market sentiment – money has been coming out of tech funds and stocks. Some of the big tech plays – Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG, GOOGL), and Meta Platforms (META) – are all down 20, 30, 40, 50% or more this year. The Invesco QQQ ETF (QQQ) that tracks tech is down about 30% this year as well. Finally, BlackRock (BLK), the maven of all things ESG, is down about 30% from year-ago peaks. Notably, this trend has reversed recently and could signify a bottom…or could be the proverbial “dead cat bounce.”

It’s way above my pay grade to make that call, but what is worth pointing out is that money has had to go somewhere. With the record cash and distributions that oil companies like Devon have been throwing off this year, there is a reasonable probability that a good bit of that money has been going into oil and gas companies. Energy fund manager, Vivek Ramaswamy, CEO of Strive Asset Management, recently penned an essay carried in the WSJ, that presented this thesis-

If other market participants defect from the ESG-driven consensus, that will drive energy-sector outperformance. Trends already point in that direction: May 2022 marked the first month in three years that ESG funds saw their inflows decline. As Mr. Buffett wrote during the early stages of U.S. stock-price recovery after the 2008 crisis, “if you wait for the robins, spring will be over.”

As the season of the tech giants fades to winter, the resurgence of energy may bound into spring—especially if investors sow the seeds by delivering a new shareholder mandate to the sector.

Risks

Could our thesis be wrong? Of course, it could. There is also the possibility that DVN could sell off 5-10% post earnings, which we have stipulated will likely not match Q-2’s blow out performance. We are prepared for that in our risk assessment with a call option contingency through what we view as the critical period, risking a small portion of capital to preserve the bulk of it if things go sideways.

Wrapping it up

As I have noted in past articles, DVN is positioned with some of the best acreage in the Permian basin, and has made strategic moves in other areas to enhance its long-term viability and profitability. These moves have been chronicled in my recent articles. Here and here.

The same bunch of analysts have an overweight rating on the stock with price targets ranging from $60-$109, the median is $80, the higher figure which we are endorsing, implying a ~31% upside from the current price of ~$76. DVN is trading at 4.5X EV/OCF. A stock price of $109 would mean a cash flow multiple of 7X on a forward basis, not out of reach as our thesis begins to take shape in the coming year. I think that $80 is a good possibility before the year closes out. Update-Obviously we are very near that now, the $80 was a safe call made a couple of weeks ago when the core of this article appeared in the Daily Drilling Report.

For those interested in DVN, keep in mind the Ex-div date (hasn’t been officially announced yet) will likely be announced Oct, 29th or 30th, with an EX-D of Nov 8th or 9th. Last quarter it was $1.37 per share. This time it should be in the high $1.20’s for the quarter based on their 50% return of capital commitment.

To summarize, I think DVN has farther to run and am maintaining a buy at current levels. Investors looking for growth and income may find the company attractive at current levels.

Be the first to comment